Closing Bell: ASX sets 17th record high for 2025 as market continues to show broad strength

The ASX is flexing its muscles once again, notching a 17th record high for the year. Pic: Getty Images

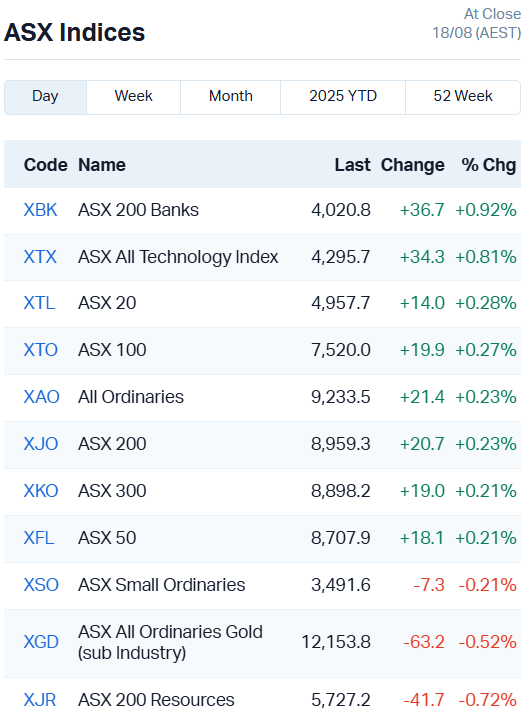

- ASX sets 17th intraday high for the year at 8963

- Closes out trade at record 8959.3 points

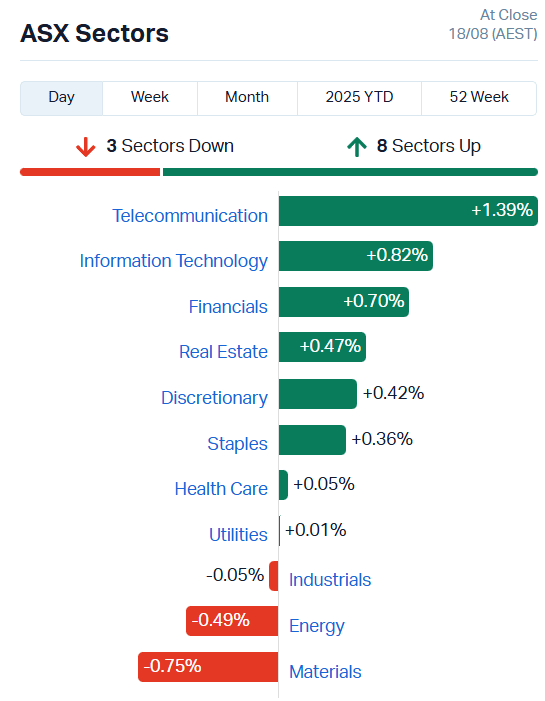

- Broad sector gains continue with eight of 11 higher

Bulls set the tone for fresh week of trade

It wasn’t looking this way as we chowed down for lunch in the east, but it’s been an ultimately tidy open to this week’s trade for the ASX 200. The benchmark finished up 0.23% or 20 points to give us a double whammy of new intraday and record highs once again.

The ASX has been on a tear in recent weeks, offering up 17 new all-time highs this year.

In a good sign for market stability, the gains haven’t come from any one place, although mining and banking stocks have maintained their dominate position as trend setters.

Today, telecoms and info tech led the pack, with some support from financials and the Banks index.

Real Estate digital advertising giant REA Group (ASX:REA) led the telecoms sector higher, climbing 4.4%.

The company is bringing Cameron McIntyre on as its newest CEO, effective November 3. He oversaw a six-fold increase in the value of CAR Group Limited in his nine years as CEO. McIntyre will be taking over for outgoing CEO Owen Wilson, who’s looking to make a retirement from full time executive roles.

Materials – in particular resources and gold stocks – weighed on the other side of the balance sheet alongside energy and a small dip in industrials, but the damage was limited.

BHP (ASX:BHP) and Rio Tinto (ASX:RIO) fell more than 1% each, while Fortescue (ASX:FMG) slid 0.6%.

Critical mineral stocks were having a much better time of it.

Rare earths miner Lynas (ASX:LYC) added 1.9%, while lithium stock Pilbara Minerals (ASX:PLS) jumped 3.2% and Mineral Resources (ASX:MIN) added 1.3%

Overall, despite some midday hiccups, it’s been a day of steady upward progress for the ASX. Let’s see who’s been able to capitalise on that momentum.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 1.08 | 2900% | 1882040 | $5,306,413 |

| AOA | Ausmon Resorces | 0.0045 | 125% | 31270577 | $2,622,427 |

| MTB | Mount Burgess Mining | 0.012 | 100% | 48362991 | $2,553,830 |

| AHX | Apiam Animal Health | 0.795 | 49% | 2151677 | $98,409,250 |

| BCN | Beacon Minerals | 2.3 | 35% | 706852 | $180,680,630 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 136568 | $9,763,676 |

| VKA | Viking Mines Ltd | 0.008 | 33% | 4777420 | $8,063,692 |

| IFG | Infocusgroup Hldltd | 0.025 | 32% | 11232127 | $5,546,844 |

| LNR | Lanthanein Resources | 0.052 | 30% | 850553 | $7,493,763 |

| OVT | Ovanti Limited | 0.009 | 29% | 75675099 | $29,920,265 |

| VML | Vital Metals Limited | 0.14 | 27% | 1850545 | $12,968,919 |

| ADN | Andromeda Metals Ltd | 0.014 | 27% | 34598528 | $41,983,440 |

| IXC | Invex Ther | 0.095 | 27% | 98193 | $5,636,539 |

| JNO | Juno | 0.03 | 25% | 195114 | $5,021,689 |

| AOK | Australian Oil. | 0.0025 | 25% | 700825 | $2,075,566 |

| ERA | Energy Resources | 0.0025 | 25% | 1321373 | $810,792,482 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 1982 | $6,735,721 |

| LMG | Latrobe Magnesium | 0.021 | 24% | 15469989 | $44,786,485 |

| RWL | Rubicon Water | 0.21 | 24% | 33381 | $40,918,167 |

| SRL | Sunrise | 1.625 | 23% | 1656512 | $155,356,259 |

| IS3 | I Synergy Group Ltd | 0.011 | 22% | 893410 | $15,356,699 |

| GTE | Great Western Exp. | 0.017 | 21% | 11694014 | $7,948,611 |

| UNT | Unith Ltd | 0.0085 | 21% | 4495211 | $10,351,498 |

| 1AD | Adalta Limited | 0.003 | 20% | 1189832 | $2,886,625 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 924978 | $2,302,583 |

In the news…

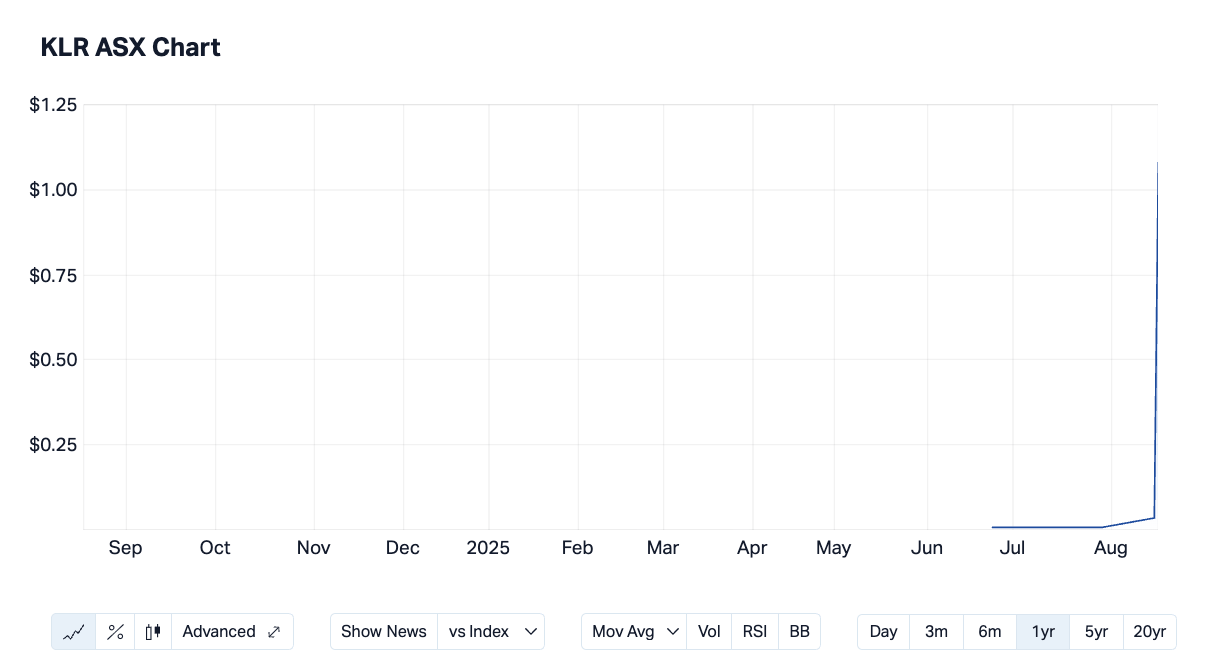

Kaili Resources (ASX:KLR) fended off a price query from the ASX after its share price surged an eye-watering 2900% today, pointing to Friday’s drilling approval news that saw them topping our ASX Leaders chart last week, too.

KLR is preparing to drill for rare earths on three tenements in South Australia. Previous results from a maiden drilling program on Lameroo, one of the three areas in question, peaked at 356 parts per million total rare earths.

How about this chart… that’s pretty insane and untoward action to say the least. Read today’s Resources Top 5 for more.

Mount Burgess Mining (ASX:MTB) is poised to snap up two advanced gold projects from fellow ASX listers Metal Hawk (ASX:MHK) and Falcon Metals (ASX:FAL).

MTB is looking to acquire the Viking gold project and the Blair North project, which have both produced high-grade gold grades up to 6m at 64 g/t gold from 50m and 5.9m at 6.7 g/t gold from 244.4m, respectively.

Apiam Animal Health (ASX:AHX) is climbing after fielding a non-binding takeover offer from Adamantem Capital Management. The investment firm is offering to acquire AHX via a scheme of arrangement at $0.88 cash per share.

I’ll hand over to Stockhead’s own Tim Boreham to give you the full run down.

Beacon Minerals (ASX:BCN) hit bonanza grade gold in drilling at the Iguana deposit, part of the Lady Ida project in WA. The stand out result among some solid gold hits was a 10-metre intersection grading at 69.9 g/t gold from 40m of depth.

Within that gold hit, BCN encountered a metre-wide mineralised section grading at a startling 593 g/t gold, alongside a total of 17 results above 20 g/t gold.

Management says the assays are a “fantastic” result that provides greater confidence as the company prepares for first production early next year.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HFR | Highfield Res Ltd | 0.13 | -47% | 2655017 | $116,148,876 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 58975 | $2,811,999 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 50000 | $7,254,899 |

| UBI | Universal Biosensors | 0.013 | -32% | 3931599 | $5,663,281 |

| SKK | Stakk Limited | 0.005 | -29% | 291299 | $14,525,558 |

| M2R | Miramar | 0.003 | -25% | 7897727 | $3,987,293 |

| PLC | Premier1 Lithium Ltd | 0.009 | -25% | 136601 | $4,416,727 |

| GTRDA | Gti Energy Ltd | 0.125 | -22% | 305646 | $14,835,762 |

| PET | Phoslock Env Tec Ltd | 0.011 | -21% | 12848562 | $8,741,467 |

| AD8 | Audinate Group Ltd | 4.83 | -20% | 2893393 | $511,289,266 |

| TMK | TMK Energy Limited | 0.002 | -20% | 290555 | $25,555,958 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2470000 | $23,424,247 |

| BCK | Brockman Mining Ltd | 0.018 | -18% | 22750 | $204,165,107 |

| 1CG | One Click Group Ltd | 0.01 | -17% | 988767 | $14,187,434 |

| AJL | AJ Lucas Group | 0.01 | -17% | 3194034 | $16,508,756 |

| ALR | Altairminerals | 0.01 | -17% | 12603476 | $54,560,930 |

| BEL | Bentley Capital Ltd | 0.01 | -17% | 834640 | $913,535 |

| CRB | Carbine Resources | 0.005 | -17% | 693700 | $6,000,978 |

| FBR | FBR Ltd | 0.005 | -17% | 7071488 | $34,136,713 |

| LU7 | Lithium Universe Ltd | 0.01 | -17% | 11540403 | $17,231,755 |

| PPY | Papyrus Australia | 0.01 | -17% | 16040 | $7,234,581 |

| SLZ | Sultan Resources Ltd | 0.005 | -17% | 200000 | $1,566,501 |

| TMX | Terrain Minerals | 0.0025 | -17% | 2000000 | $7,595,443 |

| NHE | Nobleheliumlimited | 0.042 | -16% | 1180203 | $29,976,250 |

| RML | Resolution Minerals | 0.048 | -16% | 20555425 | $70,441,162 |

In Case You Missed It

ReNerve (ASX:RNV) has completed the first sale and clinical use of its new deep dermal tissue product line.

HyTerra (ASX:HYT) has found hydrogen and helium while drilling its third well at the Nemaha project in Kansas, USA.

Albion Resources (ASX:ALB) has identified 17 new Yandal West targets including seven high-priority drill targets with strong geological similarities to the Collavilla prospect.

Artemis Resources (ASX:ARV) inks approval for Exploration Licence E69/4266, covering the Cassowary Intrusion and three nearby targets with copper-gold potential.

Power Minerals’ (ASX:PNN) second-phase auger drilling at the Santa Anna project has intersected high-grade niobium and rare earths, reinforcing confidence in outlining a future resource.

Chariot Corporation (ASX:CC9) has appointed Leo Lithium (ASX:LLL) director Brendan Borg as an independent non-executive director.

Metallium (ASX:MTM) has made significant infrastructure advancements following the May acquisition of its Chambers County site in Texas.

CuFe (ASX:CUF) now has the option to include gold, bismuth and silver as additional revenue streams at the Tennant Creek project after a 400% increase to the Gecko Trend resource estimate.

ADX Energy (ASX:ASX) is celebrating the award of a much-anticipated exploration permit in the Sicily Channel, close to existing third-party gas finds that feature stacked gas plays.

Lode Resources (ASX: LDR) has bulk-tonnage potential in view at its Montezuma project in Tasmania after confirming multiple stacked mineralised structures.

Trading halts

Arafura Rare Earths (ASX:ARU) – cap raise

European Metals (ASX:EMH) – cap raise

Felix Group Holdings (ASX:FLX) – strategic acquisition and cap raise

Frontier Digital Ventures (ASX:FDV) – investigating misappropriation of funds

Lindian Resources (ASX:LIN) – cap raise

Magnetic Resources (ASX:MAU) – cap raise

Marquee Resources (ASX:MQR) – cap raise

Rokeby Resources (ASX:RKB) – cap raise

Unico Silver (ASX:USL) – cap raise

West Cobar Metals (ASX:WC1) – cap raise

WIA Gold (ASX:WIA) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.