Closing Bell: ASX rises in broad rally, but Trump’s return keeps markets on edge

The ASX edged up on Monday. Picture via Getty Images

- ASX edges up, Trump’s return on the radar

- Bitcoin dips after hitting $106k, Star Entertainment Group tanks

- Banks push ASX higher, Karoon Energy struggles

The ASX saw a small but steady rise on Monday, up 0.45% as traders nervously eyed Trump’s upcoming return to the White House and what that could mean for the global markets.

With Trump being sworn in as the 47th US president on Tuesday morning AEDT, investors are wondering if his next set of policies will send the market flying or crashing.

“Trump’s proposed tariffs are likely to make exports more expensive to import into the US,” said Josh Gilbert at eToro.

“Sectors such as energy and healthcare are expected to experience some volatility,” he added.

In Washington D.C., Trump held his final rally before the inauguration, telling the crowd that the “American decline” was over and that his second term would usher in a “new day of American strength and prosperity”.

He made it clear that he would hit the ground running with a series of executive orders, including some aimed at trade and tariffs that could rock global markets.

The rally was attended by a who’s who of business moguls, with Elon Musk and Jeff Bezos rubbing shoulders with politicians and other celebrities alike.

Elon Musk and his son, Lil X at President Donald J. Trump’s Inauguration Eve Rally in Washington D.C

America is so back! pic.twitter.com/tAov5hRMKw

— SMX (@iam_smx) January 19, 2025

But with the US still on holiday for Martin Luther King Day, many traders were sitting on the sidelines, staying cautious.

Over in crypto world, Bitcoin had a mixed day.

After a strong rally that saw it break through the $US106,000 mark overnight, BTC started to retreat by midday, but still managed to kick back above $US102,000 at the time of writing.

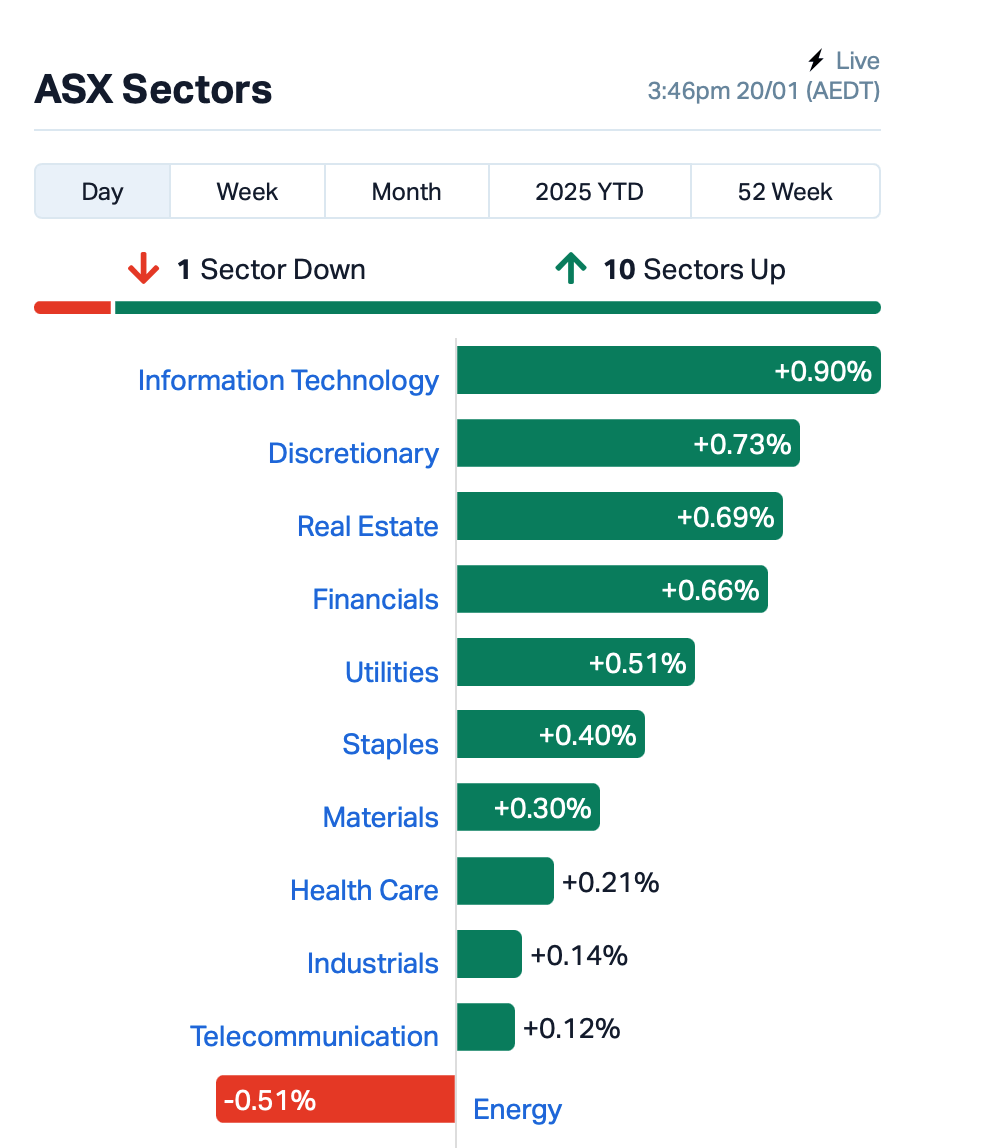

Meanwhile, the ASX had a broad rally, but tech and retail stocks were really doing the heavy lifting to drive the index higher.

Star Entertainment Group (ASX:SGR), however, copped a massive hit, falling 11%. This comes amid concerns that the casino giant might not be able to stay afloat with its mounting financial problems.

Over in energy, Karoon Energy (ASX:KAR) also had a rough day, dropping 4% after it reported no major hydrocarbon discoveries from its Mississippi exploration well. A dud result that didn’t exactly inspire confidence.

This is where things stood leading up to Monday’s close:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap 3DP Pointerra Limited 0.070 40% 32,342,736 $40,253,840 ASE Astute Metals NL 0.032 33% 1,115,330 $12,823,525 NIM Nimy Resources 0.125 30% 1,063,585 $17,877,001 TZL TZ Limited 0.051 28% 114,848 $10,611,231 GMN Gold Mountain Ltd 0.003 25% 1,012,466 $9,158,446 MEL Metgasco Ltd 0.005 25% 107,851 $5,830,347 MSG Mcs Services Limited 0.005 25% 899,720 $792,399 SP8 Streamplay Studio 0.010 25% 13,743,751 $9,204,990 TEM Tempest Minerals 0.005 25% 2,792,447 $2,538,119 TSL Titanium Sands Ltd 0.005 25% 2,176,658 $8,846,989 XRG Xreality Group Ltd 0.042 24% 2,886,130 $19,349,415 AMN Agrimin Ltd 0.165 22% 310,466 $46,279,725 FND Findi Limited 4.560 21% 427,137 $184,620,591 ALM Alma Metals Ltd 0.006 20% 83,333 $7,931,727 AOK Australian Oil. 0.003 20% 450,000 $2,504,457 WHK Whitehawk Limited 0.012 20% 7,363,402 $6,415,293 SUH Southern Hem Min 0.031 19% 1,190,677 $19,142,241 INR Ioneer Ltd 0.203 19% 11,964,370 $400,464,328 PUA Peak Minerals Ltd 0.013 18% 23,892,894 $28,073,213 VR8 Vanadium Resources 0.033 18% 799,800 $15,753,506

Ioneer (ASX:INR) rocketed 17% after it secured a record-breaking $US996 million loan from the US Department of Energy for its lithium-boron project in Nevada. That loan could be a “game changer” for Ioneer, the company said, with the US looking to get serious about its lithium mining operations in a bid to compete with China. It’s also the first new lithium mine to be approved in the US in nearly 100 years.

Astute Metals (ASX:ASE) has just hit a major milestone at its Red Mountain lithium project in Nevada, with a standout drill hole (RMDD002) showing 86.9 metres of solid lithium mineralisation, including 32.1 metres at a high-grade 2,050ppm Li. This marks the thickest intersection so far at the site, extending the lithium deposit a further 375 metres north of previous drilling.

Agrimin (ASX:AMN) has received Western Australia’s environmental approval for its Mackay potash project after thorough assessments and public reviews. The approval follows years of environmental and heritage surveys, with conditions set by the WA Environmental Protection Authority. Agrimin now aims to secure Commonwealth approval and continue progressing the project.

Findi (ASX:FND) has agreed to acquire BankIT Services for $30 million, marking a major step towards becoming a fully fledged payments bank in India. BankIT, a digital financial products distributor, will help accelerate Findi’s growth with its extensive merchant network and tech solutions. The acquisition brings Findi closer to its goal of reaching 200,000 merchant locations by March.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap EDE Eden Inv Ltd 0.001 -50% 719,873 $8,219,752 MMR Mec Resources 0.003 -40% 5,565,750 $9,159,035 MOM Moab Minerals Ltd 0.002 -33% 13,477,718 $4,700,998 RLC Reedy Lagoon Corp. 0.002 -33% 26,309 $2,330,120 SFG Seafarms Group Ltd 0.001 -33% 5,497 $7,254,899 VML Vital Metals Limited 0.002 -33% 3,800,122 $17,685,201 88E 88 Energy Ltd 0.002 -25% 2,993,085 $57,867,624 ERL Empire Resources 0.003 -25% 1,019,307 $5,935,653 LNU Linius Tech Limited 0.002 -25% 7,633,881 $12,302,431 OB1 Orbminco Limited 0.002 -25% 3,171,787 $4,333,180 PHL Propell Holdings Ltd 0.015 -21% 15,000 $5,288,424 AAU Antilles Gold Ltd 0.004 -20% 1,204,327 $9,289,380 AHN Athena Resources 0.004 -20% 265,000 $10,016,007 TMK TMK Energy Limited 0.002 -20% 129,380 $23,313,913 AXN Alliance Nickel Ltd 0.028 -18% 1,429,361 $24,678,547 8IH 8I Holdings Ltd 0.010 -17% 982 $4,177,930 ERA Energy Resources 0.003 -17% 165,191 $1,216,188,722 RNX Renegade Exploration 0.005 -17% 166,000 $7,704,021 EQN Equinoxresources 0.105 -16% 293,031 $15,481,250 APC APC Minerals 0.011 -15% 121,326 $1,328,250 SNS Sensen Networks Ltd 0.041 -15% 298,649 $38,065,799 ERG Eneco Refresh Ltd 0.018 -14% 246,666 $5,719,525

IN CASE YOU MISSED IT

CuFe (ASX:CUF) has appointed David Palmer to its board as a non-executive director. Palmer is a geologist by trade and has nearly 40 years’ experience in the global exploration industry, having spent the majority of his career with Rio Tinto Exploration searching for copper, gold, base metals, industrial minerals, uranium, iron ore and diamonds.

Palmer’s work with Rio Tinto has taken him across Australia and the Asia/Pacific regions, including working in the management team that discovered the world-class Winu copper-gold deposit in the Pilbara.

Regenerative medicine company Orthocell (ASX:OCC) has received a $3.18m R&D tax incentive refund from the Australian Government. Following today’s rebate, Orthocell now holds roughly $33m cash in the bank, putting it in a favourable position to continue the commercialisation strategy of its Remplir product – designed to assist in peripheral nerve repair.

Orthocell is expecting US FDA clearance for sales of Remplir by late March or early April this year, allowing it to tap into a US$1.6bn market.

Explorer Belararox (ASX:BRX) has kicked off maiden drilling at its Toro-Malambo-Tambo project in Argentina’s San Juan province, testing a large porphyry copper-gold target identified by 3D modelling. The first hole is planned to burrow roughly 1,300m deep as part of a total 6,000m drill program expected to finish by the end of April this year.

The Belararox team say fieldworks at the Tambo South target have identified encouraging signs of porphyry-style veining within zoned hydrothermal alteration – coincident with “classic porphyry-style geochemical anomalies”.

At Stockhead, we tell it like it is. While CuFe, Orthocell and Belararox are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.