Closing Bell: ASX rebounds, fuelled by utilities gains

The ASX is within touching distance of another slam dunk, rebounding from yesterday’s losses to set a new intraday high. Pic: Getty Images

- ASX rebounds to set new intraday high, up 0.53pc

- Origin Energy leads gains alongside utilities sector

- Unemployment rate falls, lowering interest rate cut chances

ASX sets new intraday high

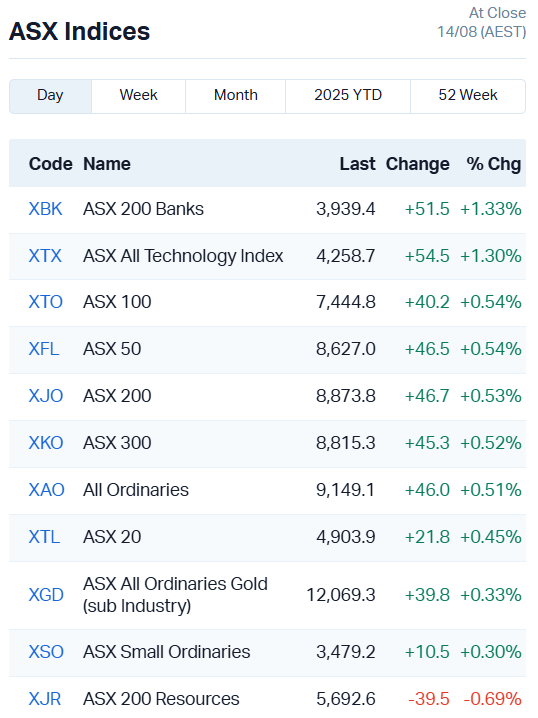

The ASX rebounded powerfully from yesterday’s profit taking, adding 0.53% or 46.7 points by the end of the day.

The market briefly touched a new intraday high of 8899 points, but couldn’t hold the gains to mark off a new record close as well. We’re currently sitting 0.28% off that intraday high.

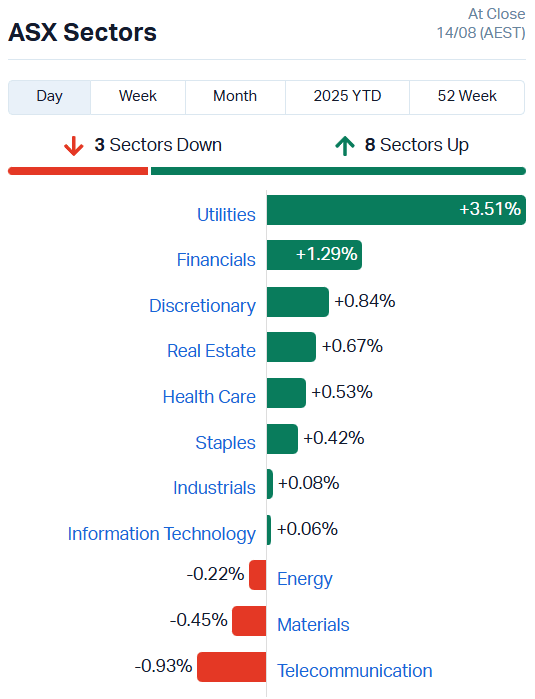

Today’s hero was the utilities sectors, riding high on a surge in Origin Energy (ASX:ORG) shares (+6.3%) alongside some other solid performances among its brethren.

The gas and electricity provider lifted underlying profits by $307m year-on-year and offered up a second 30c dividend to bring the financial year’s full offering to 60c a share.

AGL Energy (ASX:AGL) also climbed 2.5%, while Genesis Energy (ASX:GNE) lifted 2.8% and Energy World Corp (ASX:EWC) 1.7%.

Overall, eight of 11 sectors finished higher and the Banks (+1.3%), Tech (+1.3%) and Gold indices (+0.33%) lent their momentum to boot.

Looking for coverage of today’s earnings reports? Check out our midday Lunch Wrap courtesy of the preeminent Eddy Sunarto for deets on Westpac (ASX:WBC), Suncorp Group (ASX:SUN), Pro Medicus (ASX:PME), Temple & Webster (ASX:TPW) and South32’s (ASX:S32) earnings performances today.

More Australians employed more efficiently

The ABS released its employment stats today, which fell overall in line with expectations at 4.2%, with 25,000 jobs created in the past month.

The numbers tell a story of a more efficiently employed workforce, too – part-time workers fell by 36,000 while full employment lifted by 60,000 positions.

Our underutilisation rate – which combines unemployment and underemployment rates – fell by 0.2% to 10.1%, maintaining an ongoing downward trend.

Women’s participation in the work force hit a record high this month, with the participation rate reaching 63.5%.

“Trend annual employment growth has been faster than population growth for most of the past year, but has slowed in recent months to be in line with annual population growth in July,” ABS head of labour statistics Sean Crick said.

The numbers were exactly in line with both the market’s and the RBA’s expectations, lowering the expectations for a September interest rate cut to 35% according to the ABC’s business blog.

That said, expectations for a rate cut before November are still high at 78%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATV | Activeport Group Ltd | 0.023 | 142% | 1.52E+08 | $6,526,282 |

| GGE | Grand Gulf Energy | 0.002 | 100% | 804209 | $2,820,425 |

| MRD | Mount Ridley Mines | 0.004 | 60% | 46808312 | $1,946,223 |

| CRB | Carbine Resources | 0.006 | 50% | 2879525 | $4,000,652 |

| MEL | Metgasco Ltd | 0.003 | 50% | 100000 | $3,674,173 |

| PRM | Prominence Energy | 0.003 | 50% | 15207265 | $972,941 |

| TMX | Terrain Minerals | 0.003 | 50% | 331104 | $5,063,629 |

| OLY | Olympio Metals Ltd | 0.13 | 44% | 593543 | $9,276,057 |

| BPP | Babylon Pump & Power | 0.007 | 40% | 8348639 | $19,034,455 |

| MMR | Mec Resources | 0.007 | 40% | 9922730 | $9,248,829 |

| CR9 | Corellares | 0.004 | 33% | 750000 | $3,021,809 |

| DTI | DTI Group Ltd | 0.008 | 33% | 66887 | $5,382,617 |

| BPH | BPH Energy Ltd | 0.012 | 33% | 21504358 | $10,964,095 |

| FUL | Fulcrum Lithium | 0.078 | 26% | 460054 | $4,681,000 |

| FRB | Firebird Metals | 0.175 | 25% | 4568697 | $19,930,596 |

| BLU | Blue Energy Limited | 0.01 | 25% | 3181706 | $14,807,789 |

| DBO | Diabloresources | 0.02 | 25% | 1983870 | $2,689,854 |

| DTM | Dart Mining NL | 0.0025 | 25% | 10091666 | $2,396,111 |

| CAN | Cann Group Ltd | 0.016 | 23% | 1108697 | $8,466,991 |

| IS3 | I Synergy Group Ltd | 0.011 | 22% | 4113289 | $15,356,699 |

| WTM | Waratah Minerals Ltd | 0.75 | 22% | 4837566 | $143,610,044 |

| DTR | Dateline Resources | 0.2 | 21% | 57147520 | $527,867,058 |

| BB1 | Blinklab Limited | 0.53 | 20% | 862076 | $38,394,908 |

| SOR | Strategic Elements | 0.042 | 20% | 2378280 | $16,586,467 |

| FBR | FBR Ltd | 0.006 | 20% | 4066783 | $28,447,261 |

In the news…

Activeport (ASX:ATV) has launched Australia’s first “private cloud networking superhighway”, Private-Cloud Connect, swiftly bringing three new customers on board.

The networking infrastructure product offers high speed data communication ports, connecting branch offices to private cloud services hosted in colocation data centres.

With AI and data-heavy cloud computing gaining rapidly in property, ATV reckons there’s a solid market to corner in connecting private business with high-powered data centres.

Health and wellness food company OMG Group’s (ASX:OMG) Blue Dinosaur snack products are set to be stocked in 750 7-Eleven stores across Australia as part of a ranging deal. OMG has been building strong sales momentum in recent months, increasing cash receipts by 42% to more than $1.6m quarter-on-quarter.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.001 | -50% | 31455 | $5,640,850 |

| BEL | Bentley Capital Ltd | 0.015 | -42% | 4318593 | $1,979,326 |

| DTM | Dart Mining NL | 0.002 | -33% | 21263802 | $3,594,167 |

| PRM | Prominence Energy | 0.002 | -33% | 255120 | $1,459,411 |

| SKK | Stakk Limited | 0.005 | -29% | 8192 | $14,525,558 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 151531 | $5,538,785 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 4674800 | $6,336,765 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 691143 | $10,906,075 |

| AQC | Auspaccoal Ltd | 0.008 | -20% | 7558757 | $7,004,676 |

| ARV | Artemis Resources | 0.004 | -20% | 350432 | $14,328,361 |

| OSX | Osteopore Limited | 0.008 | -20% | 8341781 | $2,372,600 |

| TMX | Terrain Minerals | 0.002 | -20% | 1446699 | $6,329,536 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 27625 | $23,424,247 |

| OZM | Ozaurum Resources | 0.062 | -17% | 2193670 | $17,182,640 |

| SRK | Strike Resources | 0.029 | -17% | 150000 | $9,931,250 |

| EVE | EVE Health Group Ltd | 0.03 | -17% | 115684 | $8,863,557 |

| IXC | Invex Ther | 0.075 | -17% | 1332 | $6,763,846 |

| 1AD | Adalta Limited | 0.0025 | -17% | 2078341 | $3,463,949 |

| FBR | FBR Ltd | 0.005 | -17% | 2494829 | $34,136,713 |

| GLL | Galilee Energy Ltd | 0.01 | -17% | 300000 | $8,486,315 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 323599 | $2,335,467 |

| SPQ | Superior Resources | 0.005 | -17% | 7554456 | $14,225,896 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 12258062 | $30,667,149 |

| BVS | Bravura Solution Ltd | 2.02 | -17% | 13434796 | $1,085,016,685 |

| FNX | Finexia Financialgrp | 0.17 | -15% | 145035 | $12,460,793 |

In Case You Missed It

Legacy Minerals Holdings (ASX:LGM) has reported promising early diamond drilling results from the Thomson project in western New South Wales.

DY6 Metals’ (ASX:DY6) preliminary metallurgical testing of ore from the Tundulu rare earths and phosphate project in Malawi has identified the opportunity to produce a phosphoric acid grade flotation concentrate co-product.

Sipa Resources (ASX:SRI) has wrapped up RC drilling and is preparing to get an aircore program underway at the Tunkillia North and Nuckulla Hill gold projects.

Argenica Therapeutics (ASX:AGN) now has a clear path forward to clear the clinical hold currently in place on its investigational new drug application that will enable clinical trials for its lead drug ARG-007.

Trading Halts

Adelong Gold (ASX:ADG) – Challenger Gold Mine JV dispute

Bayan Mining and Minerals – price query

EPX Limited (ASX:EPX) – cap raise

Falcon Metals (ASX:FAL) – cap raise

Siren Gold (ASX:SNG) – cap raise

Somerset Minerals (ASX:SMM) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.