Closing Bell: ASX rallies as Trump softens up on tariffs; Capricorn CEO faces charge

Trump backs off tariffs and markets breathe easier. Pic: Getty Images

- Trump backs off tariffs and markets breathe easier

- Musk will spend more time at Tesla after a shocker quarter

- Gold miners smashed as traders cash in on record highs

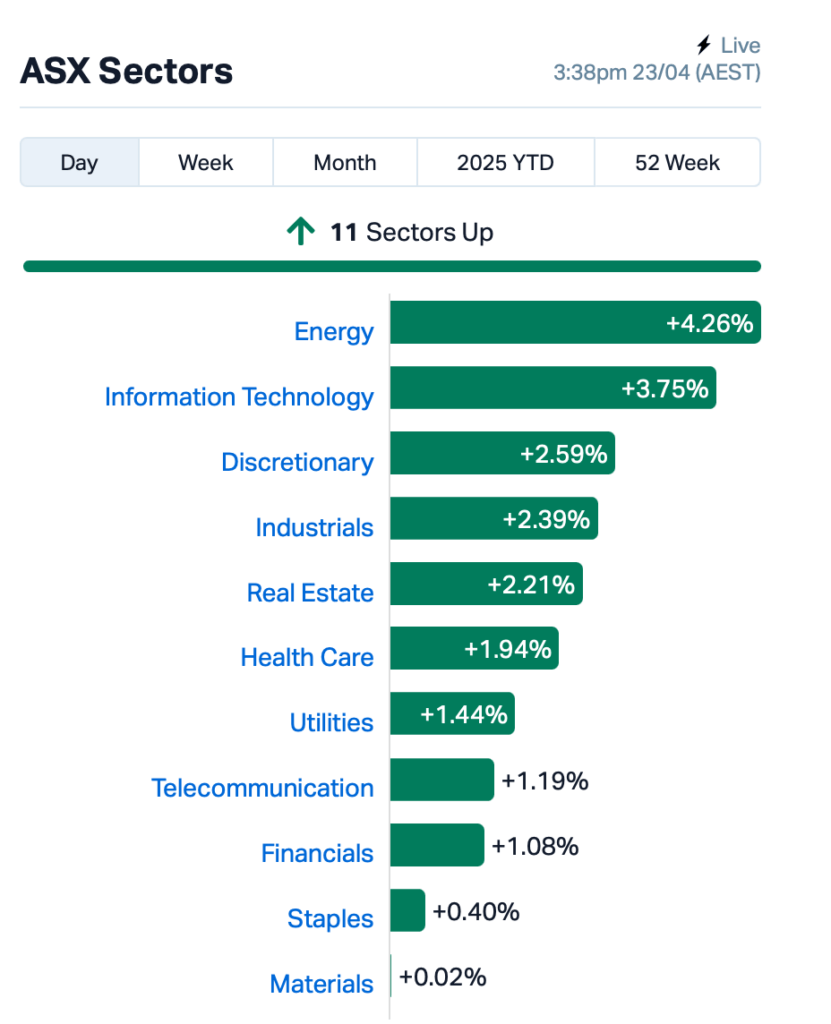

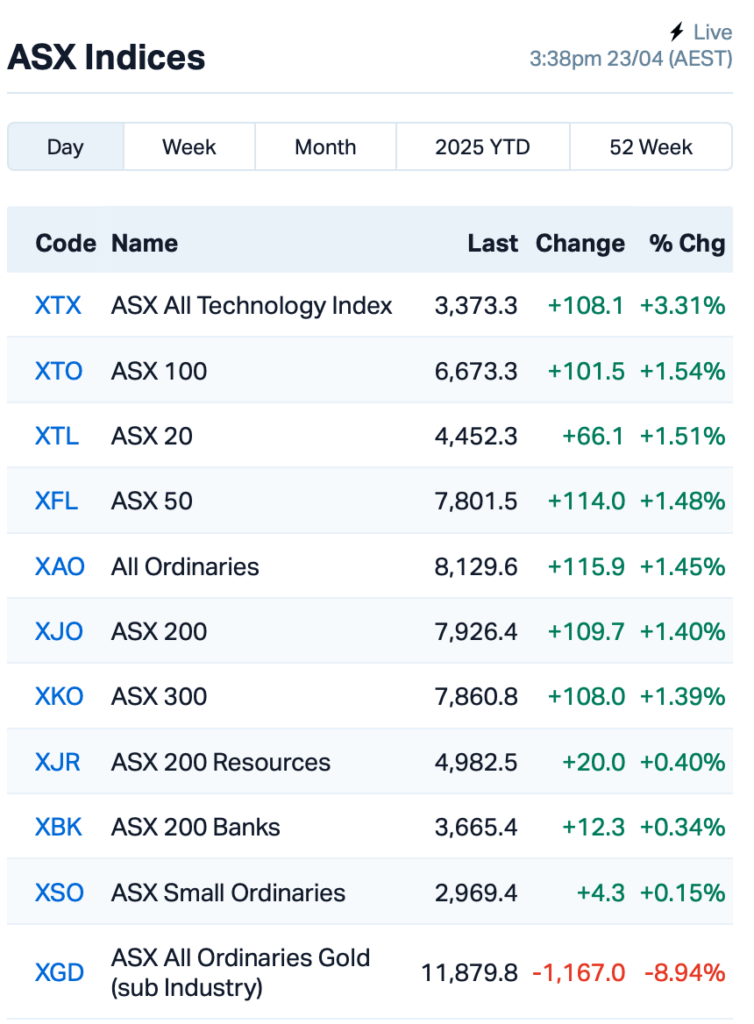

The ASX rallied by about 1.5% on Wednesday, riding a wave of optimism from Wall Street, which surged over 2% last night.

Behind the rally was a bit of sweet talk from President Trump, who, after rattling nerves with that massive tariff hike earlier this month, suddenly changed his tune.

He told reporters he planned to be “very nice” to China and hinted the final tariff figure would come down “substantially”, just not all the way to zero.

Treasury Secretary Scott Bessent chimed in too, calling the current tariff standoff with China “unsustainable,” which only fuelled the idea that a climbdown is coming.

Meanwhile, Elon Musk told investors at a Tesla earnings call that he was finally ready to pull back from his DOGE gig in Washington.

Musk said the heavy lifting at DOGE is “mostly done”, and he’ll now spend “far more” time back at the Tesla wheel.

That helped settle a few nerves, especially after Tesla just dropped a shocker of a quarterly report, with revenue coming in at US$19.34 billion, way under the US$21.43 billion forecast.

Tesla’s profits also missed targets, with adjusted earnings per share at just US 27 cents, way off the US 44-cent estimate.

Even then, Tesla’s shares still leapt 5% in after-hours trading.

In the crypto corner, Bitcoin kept pushing higher, popping by 6% to US$93,553 after Trump said he wasn’t planning to sack Fed boss Jerome Powell.

Back on home turf, ASX energy stocks were the best performers today, thanks to the US hitting Iran with fresh export sanctions.

Tech stocks also caught the tailwind, but gold miners received an absolute hammering.

After spot gold briefly kissed a record $US3500 an ounce on Tuesday, it dropped back to around $US3338 by this afternoon.

Traders took the cue to cash out, and the sell-off on gold stocks was brutal. All Ords gold crumbled close to 9%.

In large caps news, BHP (ASX:BHP) rose over 3% as rumours swirled about CEO Mike Henry possibly heading for the exit, although no announcement has been made by BHP.

Capricorn Metals (ASX:CMM) crashed 11% after it finally told shareholders that CEO Paul Criddle’s been charged with aggravated assault over an incident in North Freo back in March. He’s pleaded not guilty, and has stepped aside as CEO while the case heads to trial in November. The broader gold sell off didn’t help either.

Uranium play Paladin Energy (ASX:PDN), meanwhile, lit things up, soaring by 26% after its Langer Heinrich mine hit record output despite some dodgy weather.

Still in the large end of town, Telix Pharmaceuticals (ASX:TLX) jumped nearly 11% after a huge lift in revenue in Q1 following a strong demand for its prostate cancer imaging agent.

And, Insignia Financial (ASX:IFL) lifted 4.3% despite reporting $1.8 billion in net outflows for the March quarter, mostly due to a big institutional client pulling money.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap M2R Miramar 0.004 100% 14,951,172 $1,993,647 RDS Redstone Resources 0.006 100% 8,829,890 $2,776,135 CR9 Corellares 0.003 50% 190,016 $1,269,815 EEL Enrg Elements Ltd 0.002 50% 1,500,000 $3,253,779 PAB Patrys Limited 0.003 50% 300,000 $4,114,895 RAN Range International 0.003 50% 333,334 $1,878,581 PPY Papyrus Australia 0.011 38% 336,798 $4,565,454 ACS Accent Resources NL 0.008 33% 60,000 $2,838,764 GCM Green Critical Min 0.012 33% 53,609,519 $17,655,105 CUS Coppersearchlimited 0.022 29% 189,295 $2,017,456 PDN Paladin Energy Ltd 5.000 26% 8,902,708 $1,587,861,950 C7A Clara Resources 0.005 25% 57,500 $2,046,417 MTB Mount Burgess Mining 0.005 25% 100,000 $1,358,150 SKN Skin Elements Ltd 0.003 25% 213,786 $2,150,428 AKM Aspire Mining Ltd 0.285 24% 249,175 $116,756,507 RMY RMA Global 0.032 23% 142,151 $17,272,623 TAR Taruga Minerals 0.011 22% 1,330,000 $6,354,241 AQC Auspaccoal Ltd 0.075 21% 604,720 $43,428,991 ASP Aspermont Limited 0.006 20% 250,000 $12,350,058 BMG BMG Resources Ltd 0.012 20% 1,298,293 $8,383,972 IPT Impact Minerals 0.006 20% 9,789,400 $18,513,316 ABE Ausbondexchange 0.039 18% 218,181 $3,718,048 NUZ Neurizon Therapeutic 0.130 18% 364,561 $54,153,634 KNI Kunikolimited 0.165 18% 232,325 $12,169,398

Redstone Resources (ASX:RDS) has kicked off diamond drilling at its Tollu copper deposit in WA’s West Musgrave. It’s punching down a 1200m hole under the high-grade Tollu copper zone, hoping to hit a Voisey’s Bay-style copper-nickel jackpot hiding beneath. Previous drilling has already pulled up some promising copper hits, one even hit 18% copper over a metre.

Papyrus Australia (ASX:PPY) reported a solid quarter, kicking big goals both in Vietnam and back home. It teamed up with local partner Thung Dung to push ahead with its banana waste-to-product tech, and a recent site visit confirmed the joint venture’s in good nick. Back in Australia, it’s powering through setup of its R&D hub in Adelaide, with early product tests looking promising. It’s also raised $200k to keep the commercialisation engine ticking over.

Green Critical Minerals (ASX:GCM) has inked a collaboration agreement with leading data centre operator GreenSquareDC to develop next-gen thermal management products using its very high density graphite technology. The deal confirms strong commercial interest in GCM’s ultra-dense graphite tech, known for outperforming traditional materials like aluminium and copper in heat diffusion.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CYQ | Cycliq Group Ltd | 0.002 | -33% | 1,509,489 | $1,381,550 |

| FTC | Fintech Chain Ltd | 0.004 | -33% | 1,383,290 | $3,904,618 |

| SRN | Surefire Rescs NL | 0.003 | -25% | 673,333 | $9,665,231 |

| CTT | Cettire | 0.500 | -24% | 11,376,751 | $249,711,034 |

| NGX | Ngxlimited | 0.100 | -20% | 73,985 | $11,326,480 |

| CTN | Catalina Resources | 0.002 | -20% | 776,798 | $4,159,399 |

| FAU | First Au Ltd | 0.002 | -20% | 58,227 | $5,179,983 |

| LML | Lincoln Minerals | 0.004 | -20% | 2,665 | $10,512,849 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 5,000,000 | $8,419,651 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 177,665 | $23,423,890 |

| REE | Rarex Limited | 0.031 | -18% | 19,060,840 | $30,432,142 |

| AGD | Austral Gold | 0.058 | -17% | 278,954 | $42,861,795 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 2,500 | $6,881,340 |

| KPO | Kalina Power Limited | 0.005 | -17% | 9,478,713 | $17,365,318 |

| ROG | Red Sky Energy. | 0.005 | -17% | 1,871,001 | $32,533,363 |

| SHP | South Harz Potash | 0.005 | -17% | 72,000 | $6,495,472 |

| VHM | Vhmlimited | 0.270 | -16% | 228,500 | $69,487,985 |

| 8CO | 8Common Limited | 0.017 | -15% | 256,695 | $4,481,898 |

| QEM | QEM Limited | 0.047 | -15% | 165,457 | $10,495,853 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 12,345,093 | $31,932,702 |

| FFF | Forbidden Foods | 0.006 | -14% | 6,676,524 | $4,984,714 |

| HHR | Hartshead Resources | 0.006 | -14% | 4,468,779 | $19,660,775 |

| NWM | Norwest Minerals | 0.012 | -14% | 2,637,999 | $6,791,673 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 18,072 | $11,196,728 |

Online fashion retailer Cettire (ASX:CTT) slumped by 15% after reporting a bit of a mixed bag this quarter. It pulled in $260 million in sales, up just 1% on pcp, but it took a $4.7 million EBITDA hit, thanks in part to currency losses and heavy discounting. The company said demand’s been patchy across the luxury market, especially in the US, but it still grew its active customer base to around 696,000.

IN CASE YOU MISSED IT

Koonenberry Gold (ASX:KNB) has struck multiple zones of visible gold in the fifth straight diamond drill hole at its Enmore project in NSW, extending gold mineralisation to ~300m depth. Drilling is ongoing and further assays are expected shortly.

RareX (ASX:REE) has joined forces with major Iluka Resources in a consortium targeting the development of the Mrima Hill rare earths project in Kenya. RareX plans to process the Kenyan REEs at Iluka’s Eneabba facility in WA, positioning itself as the future operator of the project.

Riversgold (ASX:RGL) has expanded the mineralised footprint at its Kalgoorlie East – Northern Zone project, uncovering a new high-grade zone with standout drilling results including 10 metres at 8.89g/t gold. Assays from additional holes are pending, with a maiden resource estimate on the horizon.

Blue Star Helium (ASX:BNL) has successfully drilled its Jackson 27 development well to total depth within the company’s broader Galactica helium project in Las Animas County, Colorado. The company confirmed gas presence, with the well flowing naturally both during drilling and at total depth, verified by wireline logs. Gas samples have been sent to the laboratory for analysis of helium and CO2 concentrations.

TRADING HALTS

- Nutritional Growth Solutions (ASX:NGS) – cap raise

- Infinity Lithium (ASX:INF) – a potential acquisition

- Greenwing Resources (ASX:GW1) – cap raise

- Dart Mining (ASX:DTM) – divestment of tenements

- BPH Global (ASX:BP8) – cap raise

At Stockhead, we tell it like it is. While Green Critical Minerals, Koonenberry Gold, RareX, Riversgold and Blue Star Helium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.