Closing Bell: ASX posts sixth loss in seven days, as earnings misses raise concerns

The ASX has now lost six times in seven days. Picture via Getty Images

- ASX down, hits six losses in seven days

- Johns Lyng, Domino’s and Viva Energy hit hard

- Zip shines bright, while gold flirts with record highs

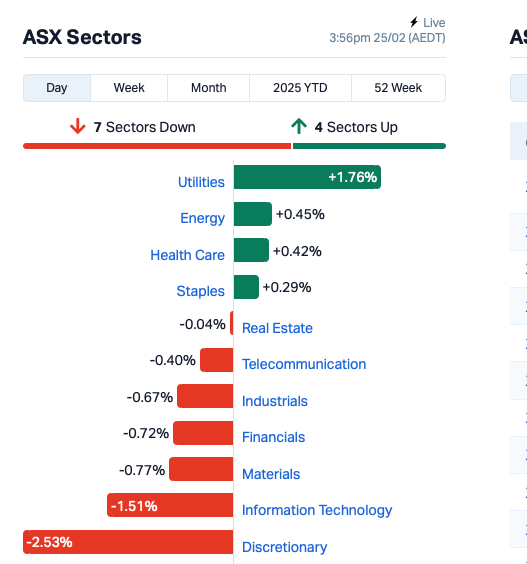

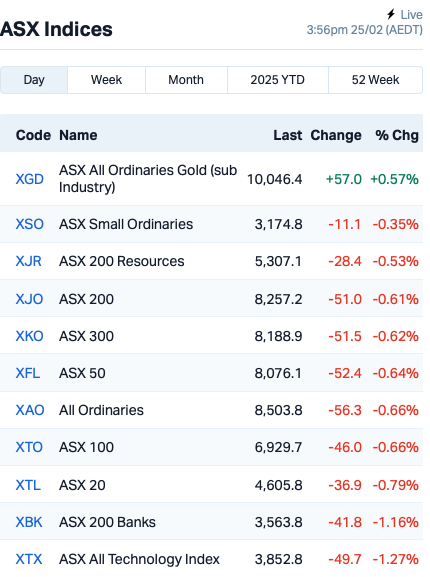

The ASX200 closed 0.7% lower on Tuesday, bringing its record to six losses in seven days.

Today’s slump comes after a tough night on Wall Street, where big tech stocks stumbled as everyone waited on Nvidia’s earnings report due on Wednesday US time.

Investors were also jittery after US President Trump said that tariffs on Mexico and Canada will go ahead – something almost no one seemed thrilled about.

Back home, local earnings season on the ASX isn’t exactly hitting it out of the park, either.

Headlining today’s earnings misses, building services provider Johns Lyng Group (ASX:JLG) plunged 32%, hitting its lowest point since October 2020.

This followed a softer-than-expected 1H 2025 net profit of $20.8 million, down from $31 million the previous year, and a revision of its full-year guidance due to fewer weather-related insurance claims.

Domino’s Pizza Enterprises (ASX:DMP) wasn’t having a slice of success either, falling 11% and dragging down the discretionary sector today. The fast food retailer reported a $22.2 million loss for 1H 2025, with restructuring costs, write-downs, and impairments adding extra grease to the decline.

Viva Energy’s (ASX:VEA) plunged 26% after revealing a 20% profit drop for FY24, and describing the outlook as “very underwhelming”.

On the brighter side, Zip Co (ASX:ZIP) shot up 17% after a stellar 117% jump in EBITDA for the half.

This is how things looked leading up to Tuesday’s close:

Across Asia, stocks were mostly dumped after Trump pushed for tighter curbs on Chinese investments. Alibaba saw a 10% dip as worries over these restrictions on Chinese tech simmered.

Meanwhile, gold is flirting with record highs, trading at $2,938 an ounce. Silver also continues its winning streak, marking its fifth consecutive week of gains last Friday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| WOA | Wide Open Agricultur | 0.013 | 160% | 123,367,372 | $2,668,433 |

| 88E | 88 Energy Ltd | 0.002 | 100% | 4,081,941 | $28,933,812 |

| EVS | Envirosuite Ltd | 0.082 | 91% | 8,560,797 | $61,949,498 |

| LNR | Lanthanein Resources | 0.003 | 50% | 466,683 | $4,887,272 |

| WEL | Winchester Energy | 0.002 | 50% | 111,111 | $1,363,019 |

| M2R | Miramar | 0.004 | 33% | 56,500 | $1,369,040 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 470,491 | $3,632,709 |

| OB1 | Orbminco Limited | 0.002 | 33% | 250,000 | $3,249,885 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 1,370,475 | $7,254,899 |

| TIG | Tigers Realm Coal | 0.004 | 33% | 1,119,039 | $39,200,107 |

| CMB | Cambium Bio Limited | 0.520 | 33% | 350,147 | $5,515,776 |

| 3DP | Pointerra Limited | 0.091 | 28% | 18,907,856 | $57,160,453 |

| CSX | Cleanspace Holdings | 0.490 | 26% | 384,670 | $30,475,938 |

| FAU | First Au Ltd | 0.003 | 25% | 1,000,000 | $4,143,987 |

| HFY | Hubify Ltd | 0.010 | 25% | 293,310 | $4,089,090 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 12,178,319 | $6,350,111 |

| QXR | Qx Resources Limited | 0.005 | 25% | 536,781 | $5,240,311 |

| HMD | Heramed Limited | 0.021 | 24% | 21,968,065 | $14,885,247 |

| BTE | Botalaenergyltd | 0.068 | 21% | 397,202 | $13,896,737 |

| ALR | Altairminerals | 0.003 | 20% | 721,360 | $10,741,860 |

| AMS | Atomos | 0.006 | 20% | 644,005 | $6,075,092 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 2,684,719 | $5,932,817 |

| CUL | Cullen Resources | 0.006 | 20% | 500,000 | $3,467,009 |

| GLL | Galilee Energy Ltd | 0.006 | 20% | 1,206,015 | $2,785,964 |

| HCD | Hydrocarbon Dynamics | 0.003 | 20% | 151,000 | $2,695,273 |

Wide Open Agriculture (ASX:WOA) skyrocketed after receiving approval to export its high-protein lupin protein isolate to China. The Chinese plant-based protein market is growing fast and is expected to reach $12.1 billion by 2030. WOA’s lupin protein is a non-GMO, sustainable alternative to soy protein, and is used in products like protein powders, plant-based milks, and yogurts. The company is working with a local distributor to enter the Chinese market and expand into protein powder and dairy alternatives.

Envirosuite (ASX:EVS) has received an unsolicited, non-binding offer from Ideagen to buy the company for $0.10 per share. This offer is a 133% premium to Envirosuite’s current share price. The deal is still conditional on due diligence, shareholder approval, and the company plans to engage with Ideagen further. The Envirosuite board believes it’s in the best interest of shareholders to explore this opportunity.

Cambium Bio (ASX:CMB) has received FDA approval for the phase 3 clinical trial protocol of its Elate Ocular treatment for moderate to severe dry eye disease. The trials, which will take place in the US, Australia, and other countries, will involve 800 patients. The goal is to evaluate Elate Ocular’s safety and efficacy compared to a placebo, with a focus on improving corneal staining and eye discomfort. The approval follows the FDA’s Fast Track designation for the treatment.

Cleanspace (ASX:CSX) saw strong growth in H1 FY25, with revenue rising 26% to $9.2 million, driven by its industrial-led strategy. Gross margin improved to 74%, and the company controlled costs, reducing expenses by 6%. The company has healthy cash reserves of $8.3 million and expects a $1 million R&D tax refund in H2.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JLG | Johns Lyng Group | 2.590 | -32% | 24,159,879 | $1,069,333,045 |

| RCR | Rincon | 0.013 | -32% | 11,743,381 | $5,558,686 |

| VEA | Viva Energy Group | 1.780 | -26% | 30,864,209 | $3,827,538,492 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 13,393,148 | $13,149,361 |

| CLA | Celsius Resource Ltd | 0.012 | -23% | 28,156,106 | $40,038,577 |

| ODE | Odessa Minerals Ltd | 0.005 | -23% | 6,130,807 | $10,396,961 |

| CYC | Cyclopharm Limited | 1.520 | -20% | 781,146 | $211,160,015 |

| 1TT | Thrive Tribe Tech | 0.002 | -20% | 4,503,502 | $5,079,308 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 2,217,972 | $9,476,880 |

| AJX | Alexium Int Group | 0.008 | -20% | 458,000 | $15,765,114 |

| BMO | Bastion Minerals | 0.004 | -20% | 100,001 | $4,223,623 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 3,558,913 | $15,000,000 |

| FRX | Flexiroam Limited | 0.005 | -17% | 7,846 | $9,104,392 |

| LML | Lincoln Minerals | 0.005 | -17% | 556,483 | $12,337,557 |

| SER | Strategic Energy | 0.005 | -17% | 28,003 | $4,026,200 |

| WBE | Whitebark Energy | 0.005 | -17% | 3,410,015 | $1,849,255 |

| PNV | Polynovo Limited | 1.495 | -16% | 6,853,285 | $1,233,154,739 |

| AMO | Ambertech Limited | 0.140 | -15% | 190,260 | $15,741,789 |

| DDB | Dynamic Group | 0.200 | -15% | 28,500 | $33,643,018 |

| 1AI | Algorae Pharma | 0.006 | -14% | 340,709 | $11,811,763 |

| CTN | Catalina Resources | 0.003 | -14% | 450,980 | $4,606,917 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 1,390,777 | $36,668,998 |

| RLL | Rapid Lithium Ltd | 0.003 | -14% | 100,000 | $3,613,556 |

| RVT | Richmond Vanadium | 0.120 | -14% | 7,190 | $31,056,666 |

Rincon Resources’ (ASX:RCR) shares dropped despite a positive update. The company’s Telfer South gold project is looking promising with a new mineral resource estimate (MRE) at the Hasties gold-copper deposits. The Hasties prospects show strong potential, with gold and copper mineralisation starting near the surface and open in multiple directions.

The project is only 10km from Greatland Gold’s Telfer gold mine, which makes it an attractive target for further exploration. The company has identified priority drill spots and is well-funded with $3.3 million in cash as of December 2024.

IN CASE YOU MISSED IT

Top End Energy (ASX:TEE) has grown its hydrogen and helium exploration acreage in Kansas by 25% to 25,000 acres, strengthening its position in a competitive land rush. With plans to secure another 5000 acres and advance drilling prep, TEE is quickly building momentum in the natural hydrogen sector.

Magnetic Resources (ASX:MAU) has improved gold recovery at its Lady Julie North 4 deposit to 93% through flotation and fine grinding, up from 88% with conventional processing. The company sees strong economic potential in these improvements, with feasibility studies underway to incorporate them into the planned plant using proven modular technology.

Koonenberry Gold (ASX:KNB) has expanded its Enmore project in NSW by securing a new exploration licence, increasing its total landholding to 302km². With historic high-grade gold and antimony results, the company aims to kick off sampling and mapping programs.

Victory Metals (ASX:VTM) has outlined a rare earth and scandium exploration target of up to 230Mt at its North Stanmore project, complementing its existing 247.5Mt resource. With a 6600m drill program underway and a scoping study due this quarter, the company is also advancing strategic partnerships and offtake discussions.

Elevate Uranium (ASX:EL8) joint venture partner, Energy Metals, has reported a 12% lift in the mineral resource estimate for the Bigrlyi uranium project in the Northern Territory. Managing Director Shubiao Tao said the expansion to 10.9kt U₃O₈ highlights Bigrlyi’s growth potential and reaffirmed the company’s commitment to further drilling in 2025 to test high-priority zones.

At Stockhead, we tell it like it is. While Top End Energy, Magnetic Resources, Koonenberry Gold, Victory Metals and Elevate Uranium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.