Closing Bell: ASX plays sweet music in symphony of gains, hits new high

It was a cacophony of wins on the ASX today, climbing 0.9pc to a new all-time closing high. Pic: Getty Images

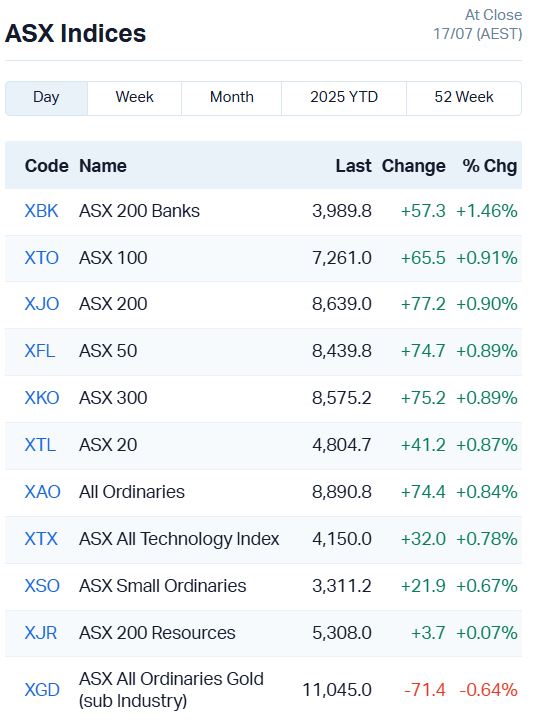

- ASX crescendos, adding 0.9pc to close at new all-time high of 8639 points

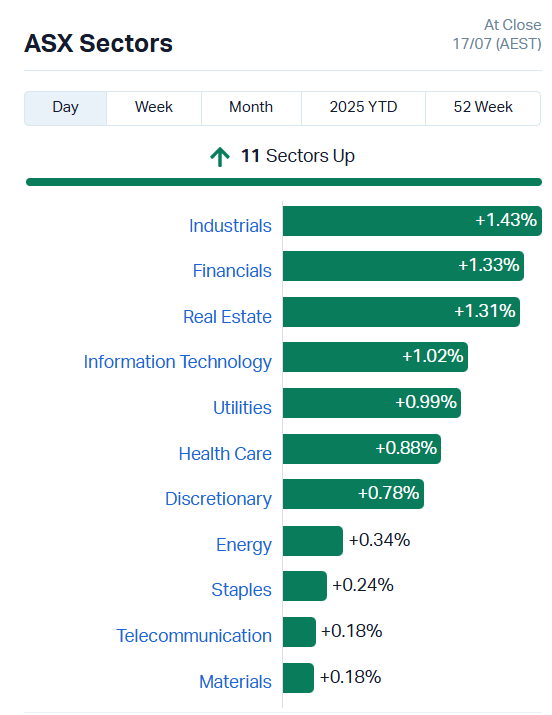

- Powerful gains across every sector, with all 11 closing higher

- Financials leads wins, with major banks at the vanguard

A fanfare of triumphs

The ASX was singing today, up right out of the gate and moving with plenty of pep in its step all through trade to add 0.9%.

We also set a new closing high after nudging that bar higher just 48 hours ago, closing at 8639 points with every single sector flashing green from industrials (+1.43%) to a more subdued but still buoyant materials sector (+0.18%).

The key data was a much lower than expected number of new jobs added in June (2000 vs 20,000 forecasts). That has rate cuts in full focus for August’s RBA meeting.

The top banks were leading the chorus, pumping the ASX 200 Banks index up by 1.46% and making some tidy individual gains.

Commonwealth Bank (ASX:CBA) jumped more than $3 a share, adding 1.82%, while NAB (ASX:NAB), Westpac (ASX:WBC) and ANZ (ASX:ANZ) all climbed about 1%.

The All Tech joined the orchestra, climbing 0.78%.

Weebit Nano (ASX:WBT) continued its bull run, adding another 7.4% today. The semiconductor stock has shot up 22% in the last five days.

The Philadelphia Semiconductor Sector – tracking the 30 largest US semiconductor companies – jumped 8% over the last month as traders shrugged off more semiconductor tariff threats from Trump.

Check out our Stock Insiders podcast episode with Weebit CEO Coby Hanoch to explore the company’s ReRAM and neuromorphic computing platform.

Rounding out our midcap tech gains, Fineos (ASX:FCL) added 6.4% and NUIX (ASX:NXL) 4.8%.

Gold miners under the microscope

Taking a closer look at our resources sector, there were production reports out of two key mid-tier gold miners Genesis Minerals (ASX:GMD) and Gold Road Resources (ASX:GOR).

Thankfully, broker reports from Argonaut are helping us make sense of it all today.

Gold production numbers at the Gruyere gold mine came in 11% below Argonaut expectations at ~73,000oz but the broker reckons mining physicals were steady quarter on quarter, and milling grades increased from 1.05g/t to 1.11g/t.

All largely immaterial for the miner’s share price, given it’s already acquiesced to a $3.7bn takeover from 50-50 JV partner Gold Fields.

GOR is currently under a Scheme of Arrangement with Gold Fields, whereby the South African company will acquire 100% of Gold Road shares – Argonaut reiterates its hold recommendation, predicting the transaction will be voted through in a September shareholder meeting.

Raleigh Finlayson’s Leonora gold miner Genesis Minerals managed to tip just over expectations for both gold produced (61.5koz) and reported cash and bullion (A$263m), although ASIC was a touch higher (6%) than expected.

At 214,311oz, it also cleared full year guidance of 190-210,000oz.

Argonaut is maintaining its buy recommendation on GMD, alongside a price target of $6.70 compared to today’s close of $3.95.

Dollar dives and market climbs as unemployment rises

Unemployment numbers took pundits by surprise today, rising 4.3% compared to expectations of 4.1% with only 2000 people finding new jobs this month.

AUD slipped from US$0.6516 to US$0.6492 within the hour, coming to a rest near US$0.6465 at market close.

Unemployment hasn’t been this high since the covid days of November 2021. There’s a good chance it’ll be enough to move the RBA’s rate cut dial – the market is pricing in an 84% chance of a rate cut in August.

That expectation meant little last month, but there’s a lot more negative data for the RBA to respond to this time.

“In terms of policy implications, we continue to expect the RBA to cut 25 basis points at its next meeting August after its surprisingly hawkish ‘on hold’ decision last week,” Goldman Sachs economist Andrew Boak said.

“The data also supports our view that Australia’s labour market is no longer ‘tight’ and should not be a barrier for further cuts.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RPG | Raptis Group Limited | 0.23 | 77% | 652321 | $45,589,031 |

| HLX | Helix Resources | 0.0015 | 50% | 1498601 | $3,364,194 |

| PRM | Prominence Energy | 0.003 | 50% | 1071469 | $972,941 |

| SIS | Simble Solutions | 0.006 | 50% | 1541312 | $4,329,321 |

| SLZ | Sultan Resources Ltd | 0.006 | 50% | 1617803 | $925,880 |

| G50 | G50Corp Ltd | 0.27 | 42% | 3173630 | $30,513,555 |

| CPV | Clearvue Technologie | 0.255 | 34% | 2189794 | $52,938,782 |

| CCO | The Calmer Co Int | 0.004 | 33% | 174068 | $9,034,060 |

| EMT | Emetals Limited | 0.004 | 33% | 481419 | $2,550,000 |

| ICG | Inca Minerals Ltd | 0.016 | 33% | 35712735 | $19,618,334 |

| RLF | Rlfagtechltd | 0.06 | 33% | 3625840 | $16,735,716 |

| BMR | Ballymore Resources | 0.2 | 25% | 104227 | $28,276,894 |

| D3E | D3 Energy Limited | 0.25 | 25% | 250362 | $15,895,001 |

| LEX | Lefroy Exploration | 0.125 | 25% | 1541908 | $24,842,014 |

| BUY | Bounty Oil & Gas NL | 0.0025 | 25% | 105200 | $3,122,944 |

| MSI | Multistack Internat. | 0.005 | 25% | 139160 | $545,216 |

| RGL | Riversgold | 0.005 | 25% | 3469248 | $6,734,850 |

| VEN | Vintage Energy | 0.005 | 25% | 16472595 | $8,347,655 |

| TNY | Tinybeans Group Ltd | 0.14 | 22% | 1002687 | $17,009,700 |

| GNM | Great Northern | 0.017 | 21% | 224271 | $2,164,807 |

| MDR | Medadvisor Limited | 0.07 | 21% | 2743540 | $36,264,738 |

| NSB | Neuroscientific | 0.18 | 20% | 910625 | $49,886,356 |

| ADD | Adavale Resource Ltd | 0.024 | 20% | 4313414 | $3,655,626 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 2719501 | $11,243,383 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 3781298 | $3,440,582 |

Making news…

Gold coast property developer Raptis Group’s (ASX:RPG) share surged in trade today as long serving director James Raptis resigned from the board alongside his son Evan.

Earlier this year the ATO dropped a $110m case against Mr Raptis after striking a payment deal. Court documents alleged apparent “tax avoidance arrangement” related to Raptis and 11 companies allegedly linked to him.

Incoming CEO Russell Garnett says the company will be re-strategising, moving away from property development, hinting the new direction will be related to management rights in a similar vein to his co-living property company Vuvale.

RLF AgTech (ASX:RLF) is turning heads after closing out a strong 2024FY with big increases in customer cash receipts, up 74% compared to last year and set to grow even more in June.

The plant nutrition company has inked deals with a slew of distributors, expanding its Australian footprint to more than 520 stores. In parallel, pre-orders out of China for the month of June have shot up 73% compared to the same time last year.

Photo-sharing subscription company TinyBeans (ASX:TNY) is also rising on a solid financial report tide, delivering positive operating cash flows for a second consecutive quarter after raking in US$141,000.

The all-important annual subscription numbers jumped 12% on last year, generating $5.08m in revenue and bringing TNY’s cash balance to $2.62m.

Vintage Energy (ASX:VEN) has launched a suite of production improvement measures at the Odin and Vali gas field. If all goes as planned over the next month or two, the work could increase flows by up to 5.6 MMscf/day and pay itself off within three months.

VEN has also offloaded its interest in PEP 171 to Beach Energy (ASX:BPT) in return for $1.25m.

Adelong Gold (ASX:ADG) has officially transitioned into gold producer status after achieving first gold pour at the Challenger gold mine in NSW.

ADG is now focused on realising the value of Challenger’s 188,000oz gold bounty alongside project operator and JV partner Great Divide Mining (ASX:GDM).

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FTC | Fintech Chain Ltd | 0.003 | -25% | 92445 | $2,603,078 |

| SHP | South Harz Potash | 0.003 | -25% | 1195668 | $5,132,248 |

| KAI | Kairos Minerals Ltd | 0.024 | -20% | 18497447 | $78,927,366 |

| CUL | Cullen Resources | 0.004 | -20% | 2214433 | $3,467,009 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 200000 | $17,069,268 |

| ROG | Red Sky Energy. | 0.004 | -20% | 439799 | $27,111,136 |

| DTZ | Dotz Nano Ltd | 0.03 | -19% | 544718 | $21,906,379 |

| M24 | Mamba Exploration | 0.013 | -19% | 2509739 | $4,722,650 |

| BEL | Bentley Capital Ltd | 0.009 | -18% | 24773 | $837,407 |

| KNG | Kingsland Minerals | 0.12 | -17% | 227163 | $10,521,332 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 2531037 | $20,261,346 |

| ERL | Empire Resources | 0.005 | -17% | 1169775 | $8,903,479 |

| FBR | FBR Ltd | 0.005 | -17% | 3362307 | $34,136,713 |

| TFL | Tasfoods Ltd | 0.005 | -17% | 350 | $2,622,573 |

| SWP | Swoop Holdings Ltd | 0.11 | -15% | 20156 | $27,882,220 |

| HIO | Hawsons Iron Ltd | 0.017 | -15% | 12313365 | $20,330,027 |

| IRI | Integrated Research | 0.42 | -14% | 1719541 | $86,902,827 |

| ADR | Adherium Ltd | 0.006 | -14% | 1035754 | $9,708,707 |

| ALR | Altairminerals | 0.003 | -14% | 2184510 | $15,038,605 |

| ANR | Anatara Ls Ltd | 0.006 | -14% | 13149 | $1,493,686 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 1185451 | $36,892,201 |

| DGR | DGR Global Ltd | 0.006 | -14% | 1994009 | $7,305,872 |

| EMU | EMU NL | 0.024 | -14% | 20459 | $5,914,957 |

| FRS | Forrestaniaresources | 0.12 | -14% | 1371044 | $43,543,140 |

| HHR | Hartshead Resources | 0.006 | -14% | 15550610 | $19,660,775 |

IN CASE YOU MISSED IT

CuFe (ASX:CUF) has updated the indicated resources at its Tennant Creek copper-gold project as it looks to release a scoping study in the near-term.

StockTake: Heavy Rare Earths (ASX:HRE) makes progress at Radium Hill in South Australia, looking to unlock the project’s uranium, scandium and rare earths.

Brightstar Resources (ASX:BTR) has started mining the Fish underground gold mine at its Laverton Hub operations and is looking for in-mine upside at Second Fortune.

Confirmation of mineralised trends at Locksley Resources’ (ASX:LKY / OTCQB: LKYRF) Mojave project in the US is guiding targeting efforts and refining modelling to define exploration targets.

TRADING HALTS

Artemis Resources (ASX:ARV) – cap raise

Horizon Gold (ASX:HRN) – cap raise

Ordell Minerals (ASX:ORD) – cap raise

RareX (ASX:REE) – cap raise

Renegade Exploration (ASX:RNX) – cap raise

Solara Minerals (ASX:SLA) – proposed acquisition

At Stockhead, we tell it like it is. While Weetbit Nano is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.