Closing Bell: ASX plays catch up crash, wins

A victory from the right angle, Via Getty

- Benchmark collapses

- Small caps down 6%

- Hamelin brings hope

After a really terrific Queen’s Birthday long weekend, local markets already had a session of losses to catch up on at the open. Needless to say, they have.

The benchmark took a 5% dive in early trade and hasn’t really looked back.

All sectors doing their bit, but Info Tech (-7.3%) materials and miners (both down -6%) really helping to bring the Australian market in line with Monday losses and out ahead of the pack today.

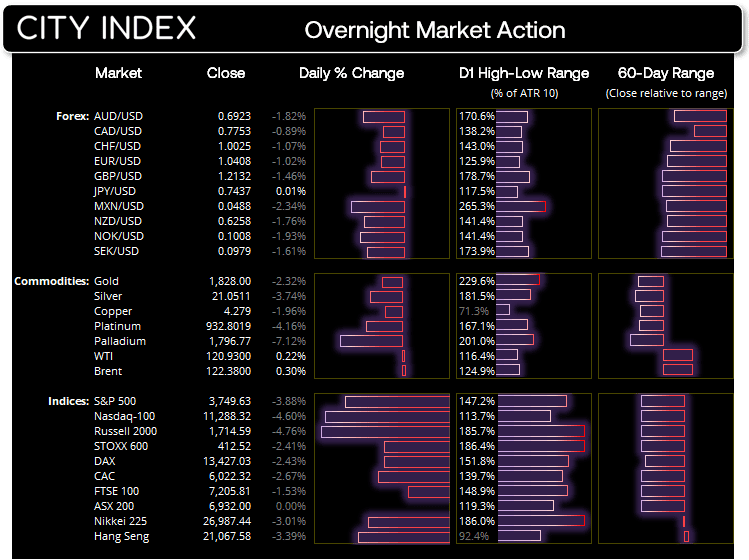

Around the traps, Japan’s Nikkei was down 1.6%.

There’s less fear than loathing on Chinese markets. The Hang Seng Index down 0.9%, Shanghai Composite down 1.5% and China’s CSI300 Index was down nearly 1%.

After US inflation in the year to May delivered a fiercer than expected 8.6% and Goldman Sachs forecast a 75 basis point interest rate hike at the Feds next policy meet on Wednesday, global markets just haven’t coped. At all.

“The US will see rate rises faster and higher than Wall Street has been expecting,” James Rosenberg, Ord Minnett adviser in Sydney told Reuters.

“There will likely be the double impact of earnings forecasts being trimmed and further price to earnings derating.”

While there’s a lot of doom-filled commentary on the bleak run we’re about to get stuck into, I liked this from Matt Simpson, Market Analyst at City Index, says this is volatility emerging as hysteria.

“There are various degrees of risk-off, and markets have just entered one of the worst kinds. An example of a less severe form of risk off would be when equities tumble due to a slew of weak earnings, and currencies or bonds take little to no notice. A sure sign of a classic ‘risk-off’ environment would be when equities, commodities and bond yields fall yet bond prices (which move inversely to yields) and gold rise as they’re considered to be ‘safe-haven’ assets. But that’s not what we’re currently seeing.”

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| T3D | 333D Limited | 0.002 | 100% | 415,066 |

| RAP | Resapp Health Ltd | 0.165 | 50% | 5,516,196 |

| SIT | Site Group Int Ltd | 0.004 | 33% | 11,640,157 |

| MBK | Metal Bank Ltd | 0.005 | 25% | 4,804,404 |

| SIX | Sprintex Ltd | 0.058 | 23% | 30,000 |

| AHN | Athena Resources | 0.028 | 22% | 41,921,109 |

| AXP | AXP Energy Ltd | 0.006 | 20% | 19,918,928 |

| ADX | ADX Energy Ltd | 0.008 | 14% | 9,741,548 |

| GED | Golden Deeps | 0.016 | 14% | 15,608,726 |

| LKE | Lake Resources | 1.59 | 14% | 46,367,790 |

| IPT | Impact Minerals | 0.009 | 13% | 18,889,315 |

| RML | Resolution Minerals | 0.009 | 13% | 4,632,755 |

| RAS | Ragusa Minerals Ltd | 0.099 | 13% | 4,733,007 |

| OZM | Ozaurum Resources | 0.185 | 12% | 488,063 |

| TMR | Tempus Resources Ltd | 0.068 | 11% | 898,539 |

| PNX | PNX Metals Limited | 0.005 | 11% | 250,000 |

| MRD | Mount Ridley Mines | 0.0055 | 10% | 6,871,835 |

| OAU | Ora Gold Limited | 0.011 | 10% | 142,300 |

| SUH | Southern Hem Min | 0.022 | 10% | 80,000 |

| ALB | Albion Resources | 0.11 | 10% | 118,094 |

| SFM | Santa Fe Minerals | 0.11 | 10% | 5,187 |

| DAL | Dalaroometalsltd | 0.09 | 10% | 48,758 |

| NFL | Norfolkmetalslimited | 0.175 | 9% | 66,658 |

| HMG | Hamelingoldlimited | 0.12 | 9% | 54,035 |

| AEV | Avenira Limited | 0.013 | 8% | 2,315,000 |

The brave little explorer Hamelin Gold (ASX:HMG) listed late 2021 as a spin-out of Encounter Resources (ASX:ENR) with a focus on the remote, mineral rich Tanami Desert.

Majors Gold Fields and Silver Lake Resources (ASX:SLR) each snatched up a 10% stake on listing, which they’ve stuck to with patience.

Drilling is ongoing across multiple prospects at the flagship West Tanami project, the company said today.

“Hamelin currently have two drill rigs operating in the West Tanami and in this current program we will see initial RC and/or diamond drilling at seven large scale gold prospects,” managing director Peter Berwick says.

Diamond drilling was completed (892m) at Bandicoot and Quenda prospects, while RC drilling is done also at Camel with diamond drilling in progress.

Quartz veining with sulphides observed at first diamond drill hole at Camel (TSD0005) similar to that seen in CMDD002 that contained: 7.25m @ 3.09g/t Au from 94.75m

“We expect to receive first assays from this program in July/August 2022.”

The $14m market cap stock has bounced back from recent lows but remains down 11% year-to-date. It had $8m in the bank at the end of March.

At Eclipse Metals (ASX:EPM) satellite imagery has uncovered new targets at the ‘Ivittuut’ multi-commodity project in Greenland.

Two large mineral anomalies were identified that have never been sampled or drill tested at Ivittuut, which comprises a historic cryolite mine, prospective for high-purity quartz, fluorite, base metals and REE, and the Grønnedal-Ika syenite carbonatite complex, prospective for rare earths.

“We are delighted that Sentinel-2 satellite imagery analysis, which is a proven and cost-effective technology for screening large areas of exposed rock, has delivered new high-priority targets for REE and base metal mineralisation,” exec chairman Carl Popal says.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Last | % | Volume |

|---|---|---|---|---|

| ARE | Argonaut Resources | 0.002 | -33% | 6,676,909 |

| AYM | Australia United Min | 0.004 | -33% | 298,920 |

| EVE | EVE Health Group Ltd | 0.001 | -33% | 22,232,332 |

| PRM | Prominence Energy | 0.002 | -33% | 261,002,249 |

| ABV | Adv Braking Tech Ltd | 0.021 | -32% | 476,419 |

| IVO | Invigor Group Ltd | 0.029 | -29% | 367,262 |

| PXX | Polarx Limited | 0.013 | -28% | 9,558,001 |

| RIE | Riedel Resources Ltd | 0.008 | -27% | 7,554,680 |

| MTM | Mtmongerresources | 0.11 | -27% | 363,968 |

| PRS | Prospech Limited | 0.033 | -25% | 37,500 |

| MCT | Metalicity Limited | 0.003 | -25% | 6,719,111 |

| MRQ | Mrg Metals Limited | 0.006 | -25% | 2,167,281 |

| NAE | New Age Exploration | 0.006 | -25% | 13,387,444 |

| OEX | Oilex Ltd | 0.003 | -25% | 1,020,118 |

| KNG | Kingsland Minerals | 0.15 | -25% | 781,229 |

| WA1 | Wa1Resourcesltd | 0.12 | -25% | 128,514 |

| AWV | Anova Metals Ltd | 0.009 | -25% | 1,283,744 |

| FGL | Frugl Group Limited | 0.009 | -25% | 410,555 |

| IEC | Intra Energy Corp | 0.009 | -25% | 958,008 |

| WEC | White Energy Company | 0.009 | -25% | 1,844,458 |

| DEL | Delorean Corporation | 0.095 | -24% | 3,868,423 |

| GCR | Golden Cross | 0.07 | -24% | 72,153 |

| AGD | Austral Gold | 0.048 | -24% | 567,010 |

| WR1 | Winsome Resources | 0.24 | -24% | 7,264,070 |

| S3N | Sensore Ltd | 0.38 | -23% | 48,699 |

ANNOUNCEMENTS YOU MAY’VE MISSED

Plenty of action on the markets today, so you might have missed the news that Metalicity (ASX:MCT) has launched a Supreme Court action against Nex Metals Exploration (ASX:NME) in pursuit of money it claims the company is owed, totalling a satisfylingly round $1,279,794.26. Nex naturally says a hearty “yeah… nah.” to the claim, and it looks set to land in the lap of the legal system, much to the joy of lawyers for both sides.

The team at Tempus Resources (ASX:TMR) say they’ve found visible gold after drilling the Elizabeth Blue Vein in Canada. Tempus says that the Blue Vein structure and gold mineralisation extends along strike to the south of last year’s discovery drill hole, and that samples are being prepared for examination in labs to provide further clarity on the size of the find.

And also flying under the radar a little today was airway health tech Oventus (ASX:OVN), where the board has voted to go into voluntary administration. Michael McCann and Graham Killer of Grant Thornton have been appointed to handle the process for Oventus, by (we assume) finding and eliminating everyone called Graham who works there.

TRADING HALTS

Sovereign Metals Limited (ASX: SVM) – pending a release regarding an expanded scoping study at Kasiya.

Chase Mining Corporation ASX: CML) – pending an announcement regarding details of a material acquisition.

Celsius Resources Limited (ASX:CLA) – pending an announcement regarding c-suite shuffling

Dreadnought Resources (ASX:DRE) – pending a release regarding exploration results

Tombola Gold (ASX:TBA) – pending the release of an announcement regarding a potential material acquisition transaction.

Medibio Limited (ASX: MEB) – announcement regarding a capital raise.

Resource Mining (ASX: RMI) – pending announcement regarding a capital raise

Blue Star Helium Limited (ASX: BNL) – pending the release of an announcement about its Enterprise 16-1 well.

Critical Resources Limited (ASX: CRR) – pending an announcement regarding results from its Mavis Lake drilling program.

Equity Story Group Ltd (ASX: EQS) – pending an announcement in relation to receipt of a new regulatory registration.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.