Closing Bell: ASX nudges up as Trump demands lower rates; Kogan crashes 15pc

ASX edges up as Trump stirs markets. Pic: Getty Images

- ASX edges up as Trump stirs markets

- Wesfarmers jumps, oil stocks slide after Trump Davos speech

- BoJ hikes rates, Yen fluctuates

The ASX crept up 0.3% on Friday and for the week the S&P/ASX 200 benchmark was up over 1%.

Overnight, Trump gave the markets a boost after calling for lower interest rates and cheaper oil to lower inflation in his speech at the World Economic Forum in Davos.

“With oil prices going down, I’ll demand that interest rates drop immediately, and likewise they should be dropping all over the world,” he told the WEF audience.

And in a surprising interview with Fox News afterwards, Trump said he’d prefer not to have to impose tariffs on China.

“I’d rather not have to use it. But it’s a tremendous power over China.”

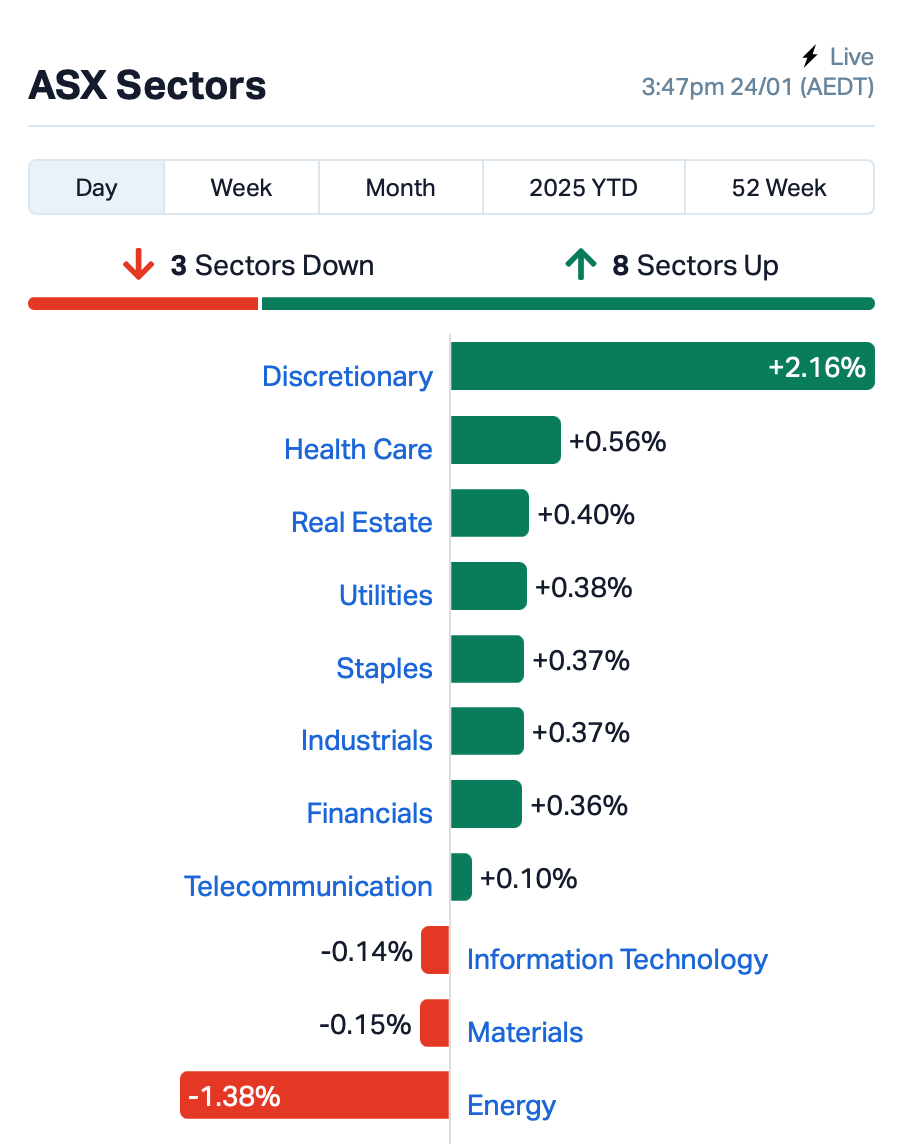

Rates-sensitive real estate and discretionary stocks on the ASX gained momentum after his comments; while oil stocks slipped.

Over in Asia, the Bank of Japan has just raised its interest rates for the first time in 17 years, hiking them by 0.25% to 0.5%. The yen fluctuated after the decision.

And, looking ahead to next week, all eyes will be on the local CPI report dropping Wednesday.

“While we’re not likely to see any surprises in next week’s CPI print, it will certainly set the tone for the next few months, both economically and politically,” said Webull’s Rob Talevski.

This is where things stood leading to Friday’s close:

In large caps news, IGO (ASX:IGO) announced that its joint venture partner Tianqi Lithium had decided to suspend the expansion of the Kwinana lithium refinery.

This decision has led to a reassessment of the project’s future, with IGO saying it will recognise a substantial impairment in its half-year results. IGO’s shares still rose 2%, with investors cheering its capital discipline as the first train continues to consume cash in a protracted ramp-up.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap AQN Aquirian 0.275 53% 756,419 $14,535,715 LYN Lycaon Resources 0.245 48% 773,685 $8,742,496 MMR Mec Resources 0.005 43% 7,057,714 $6,411,325 CTQ Careteq Limited 0.015 36% 170,033 $2,608,306 OB1 Orbminco Limited 0.002 33% 257,166 $3,249,885 SFG Seafarms Group Ltd 0.002 33% 5,529,919 $7,254,899 CLU Cluey Ltd 0.050 32% 460,171 $13,407,302 AQD Ausquest Limited 0.031 29% 82,343,777 $27,118,433 SM1 Synlait Milk Ltd 0.460 28% 667,189 $217,151,315 GGE Grand Gulf Energy 0.003 25% 500,000 $4,900,774 VAR Variscan Mines Ltd 0.010 25% 1,681,244 $6,262,862 CPO Culpeominerals 0.021 24% 66,157 $3,739,358 AMD Arrow Minerals 0.054 23% 4,770,815 $29,091,953 FRE Firebrickpharma 0.079 22% 1,030,384 $13,657,053 AOK Australian Oil. 0.003 20% 2,590,798 $2,504,457 MRD Mount Ridley Mines 0.003 20% 3,017,890 $1,946,223 XPN Xpon Technologies 0.012 20% 34,966 $3,624,415 PXX Polarx Limited 0.010 19% 7,856,218 $19,004,008 3DP Pointerra Limited 0.096 17% 17,810,027 $66,016,297 FHS Freehill Mining Ltd. 0.004 17% 831,673 $9,235,583

Western Energetics (WE), the subsidiary of mining services company Aquirian (ASX:AQN), has just landed a juicy three-year, $20 million supply deal with Aurenne’s Mt Ida gold mine in WA. The agreement will see WE deliver a tailored energetics and tech package, including its innovative Collar Keeper drill tech, helping to cut costs and boost efficiency.

Lycaon Resources (ASX:LYN) surged 48% before a voluntary trading halt was called, with the company citing pending exploration results.

Synlait Milk (ASX:SM1) skyrocketed 22% after the company bumped up its H2 guidance, and said it’s expecting a return to profitability this year, with an EBITDA forecast of $58-63 million.

Drilling is now underway at Noronex (ASX:NRX)’s Damara Copper Project in Namibia to test some high-potential targets in unexplored territory. Funded by South32 (ASX:S32) under an earn-in agreement, the project is set to explore the Kalahari Copper Belt’s gravity-magnetic bullseye features.

AusQuest (ASX:AQD) shares continue to climb after announcing the discovery of a copper-rich porphyry in Peru on Thursday. Read our interview with managing director Graeme Drew here.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap VML Vital Metals Limited 0.002 -33% 509,221 $17,685,201 CTO Citigold Corp Ltd 0.003 -25% 3,287,984 $12,000,000 HLX Helix Resources 0.003 -25% 3,150,000 $13,456,775 LNU Linius Tech Limited 0.002 -25% 645,024 $12,302,431 OB1 Orbminco Limited 0.002 -25% 1 $4,333,180 TX3 Trinex Minerals Ltd 0.002 -25% 2,315,189 $3,757,305 PRS Prospech Limited 0.021 -22% 148,549 $8,878,299 BNL Blue Star Helium Ltd 0.004 -20% 782,802 $13,474,426 EVR Ev Resources Ltd 0.002 -20% 48,000 $4,531,258 GMN Gold Mountain Ltd 0.002 -20% 184,026 $11,448,058 MOM Moab Minerals Ltd 0.002 -20% 5,750,499 $3,917,498 OCT Octava Minerals 0.105 -19% 1,409,952 $7,931,210 ADD Adavale Resource Ltd 0.003 -17% 242,689 $4,622,496 AOK Australian Oil. 0.003 -17% 532,000 $3,005,349 NHE Nobleheliumlimited 0.040 -17% 4,289,283 $27,689,692 CPO Culpeominerals 0.017 -15% 308,724 $4,399,244 E25 Element 25 Ltd 0.290 -15% 1,183,629 $74,770,216 BUY Bounty Oil & Gas NL 0.003 -14% 103,258 $5,244,753 SKK Stakk Limited 0.006 -14% 2,320,423 $14,525,558 PL3 Patagonia Lithium 0.085 -13% 816,927 $6,409,274 EQR Eq Resources Limited 0.033 -13% 13,558,990 $88,731,233 AUQ Alara Resources Ltd 0.034 -13% 875,193 $28,005,414

Kogan (ASX:KGN) crashed by 15% despite reporting solid revenue growth of 9.9% for the first half of FY25. The retailer’s gross sales rose by 10.3%, but investors weren’t too thrilled with its outlook and the challenges faced with its digital transformation of the Mighty Ape brand.

IN CASE YOU MISSED IT

Drug developer Paradigm Biopharmaceuticals (ASX:PAR) has received $6.3m from a R&D tax incentive refund for last financial year – bringing the company’s current cash balance to roughly $31m.

PAR’s cash on hand means the company is well positioned to continue its current Phase 3 clinical trial for an injectable therapy to treat osteoarthritis.

Adisyn (ASX:AI1) has completed a heavily oversubscribed $10m placement priced at 9.5c per share, backed by semiconductor industry figure and incoming non-executive director Kevin Crofton.

The placement was jointly led by Sandton Capital Advisory, Alpine Capital and Peloton Capital. AI1 CEO Blake Burton says the money from the placement will contribute to further developing the company’s graphene semiconductor technology.

Battery technology developer Altech Batteries (ASX:ATC) today received the highest possible green rating category – “Dark Green” – from the independent Centre of International Climate and Environmental Research for its CERENERGY battery technology.

The Centre is owned by Standard and Poor’s Global Ratings and is based out of Oslo in Norway. Altech says its CERENERGY technology is primed act as a greener alternative to lithium-ion batteries, expected to emit just one third of its peer technology’s emissions.

At Stockhead, we tell it like it is. While Paradigm Biopharmaceuticals, Adisyn and Altech Batteries are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.