Closing Bell: ASX navigates uncharted territory, surging on RBA rate cut

The ASX is in uncharted territory once again, setting its fourth new record closing high in two weeks. Pic: Getty Images

- RBA cuts interest rates by 25 basis points

- ASX notches new all-time intraday and closing highs

- Broad market strength with 8 of 11 sectors green

ASX breaks through 8870 points

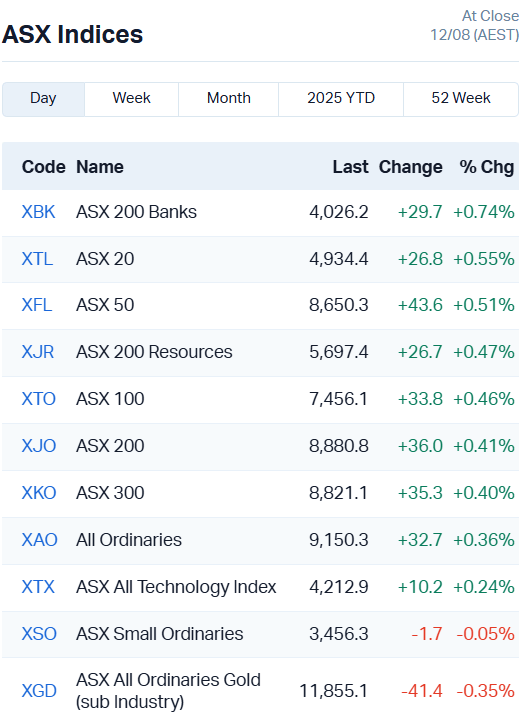

The ASX 200 set both a new intraday high (8885) and a new record closing high today, muscling higher on interest rate cut momentum to finish up 0.41% at 8880 points.

The market had been fairly steady at about +0.2% for most of the day before making a strong climb as soon as the RBA decision came through. More on that in a moment.

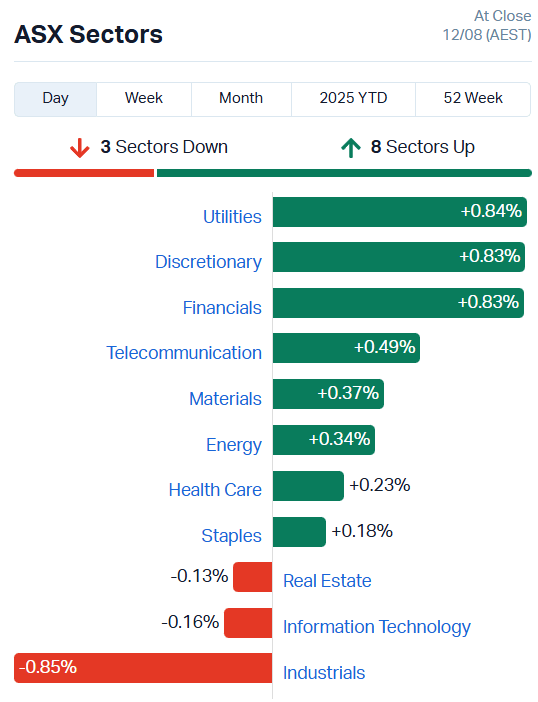

Of our 11 sectors, eight moved higher. Only real estate, info tech and industrials missed out.

Utilities, consumer discretionary and financials led gains, adding about 0.83% each.

Cash rate lowered to 3.6%

The RBA cut interest rates by 25 basis points this month, as just about everyone was betting the central bank would.

The market reacted with a quick spike that turned into some solid gains through the latter half of the day.

“Because we didn’t take rates as high as some other countries, it may be that we don’t need to reduce rates as much either, as demand and potential supply in the economy get closer to balance and inflationary pressures ease,” RBA Governor Michele Bullock said.

The term “neutral rate” has been flying around today, as the market wonders where the RBA will settle in its monetary policy tweaking.

It means a cash rate which would neither restrict nor encourage inflation, a sweet spot that would offer stable economic growth without risking uncontrolled price hikes.

While we’d all love a hard and fast number for that, it’s just not that simple.

Bullock responded to the ABC’s David Chau’s question on the topic with a wide range of between 1% and 4%.

“The neutral rate is something that is a long run concept,” she explained, “In the absence of shocks. And we are very often not in the absence of shocks.

“Our estimates are somewhere between 1 and 4. It’s a very wide range. We don’t put a lot of emphasis on the neutral rate in terms of thinking.”

Westpac (ASX:WBC) and Commonwealth Bank (ASX:CBA) responded with instant cuts to their variable loan rates, while Macquarie (ASX:MGQ) had already signalled its intention to pass on any reductions in full.

The ASX 200 Banks index added 0.74%. The banks themselves were mixed, with CBA and Macquarie lifting only marginally.

ANZ (ASX:ANZ) shot up about 2%, joined by Suncorp (ASX:SUN) and QBE (ASX:QBE) while Westpac and NAB (ASX:NAB) added about 0.9% each.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AJL | AJ Lucas Group | 0.013 | 117% | 37668546 | $8,254,378 |

| BEL | Bentley Capital Ltd | 0.025 | 56% | 2524992 | $1,218,047 |

| LNU | Linius Tech Limited | 0.0015 | 50% | 6247950 | $6,501,216 |

| LIN | Lindian Resources | 0.185 | 37% | 22162189 | $159,762,002 |

| AM5 | Antares Metals | 0.008 | 33% | 3492140 | $3,089,117 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 4592596 | $4,154,089 |

| PKO | Peako Limited | 0.004 | 33% | 1579365 | $4,463,226 |

| ROG | Red Sky Energy. | 0.004 | 33% | 1281137 | $16,266,682 |

| ANR | Anatara Ls Ltd | 0.009 | 29% | 3685995 | $1,495,132 |

| SRJ | SRJ Technologies | 0.009 | 29% | 2317321 | $7,286,318 |

| ZEU | Zeus Resources Ltd | 0.018 | 29% | 12747199 | $10,044,113 |

| TUA | Tuas Limited | 7.08 | 28% | 25147473 | $2,577,974,009 |

| GRL | Godolphin Resources | 0.014 | 27% | 11757645 | $4,937,606 |

| SMS | Starmineralslimited | 0.038 | 27% | 2259980 | $5,613,200 |

| SGR | The Star Ent Grp | 0.1125 | 26% | 36484249 | $255,312,598 |

| AUA | Audeara | 0.024 | 26% | 2473477 | $3,418,753 |

| MTC | Metalstech Ltd | 0.175 | 25% | 717440 | $31,087,694 |

| CAV | Carnavale Resources | 0.005 | 25% | 1067633 | $16,360,874 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 5420000 | $12,000,000 |

| ERA | Energy Resources | 0.0025 | 25% | 207608 | $810,792,482 |

| FRX | Flexiroam Limited | 0.005 | 25% | 23901 | $6,069,594 |

| PIL | Peppermint Inv Ltd | 0.0025 | 25% | 2499992 | $4,662,820 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 2001571 | $13,483,725 |

| QXR | Qx Resources Limited | 0.005 | 25% | 2739496 | $5,241,315 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 304877 | $18,739,398 |

In the news…

AJ Lucas Group (ASX:AJL) has settled a dispute over a carry agreement relating to UK shale gas exploration licences through subsidiary Cuadrilla Resources Limited, receiving a cash sum of £12.5m (about A$26m) and terminating the agreement.

Antares Metals (ASX:AM5) has unearthed some promising rock chip results at the Conglomerate Creek prospect of the Mt Isa North copper and uranium project, grading up to 22% copper, 394g/t silver and 7.4 g/t gold.

Mobile network firm Tuas (ASX:TUA) shares surged after raising $385m to acquire M1 Limited in a $1.43 billion deal. M1 is a digital network operator based in Singapore with offerings in mobile services, fixed services and handset and equipment sales.

Audeara (ASX:AUA) is moving into the Chinese e-commerce space with a licensing agreement through Eastech Holding Limited, a Taiwan-listed company valued at about $350m.

AUA will market its hearing technology under a third-party brand to be distributed via a Chinese e-commerce hearing aid provider with a strong online presence across major platforms, offering exposure to millions of potential customers.

Godolphin Resources (ASX:GRL) has materially upgraded the Lewis Pond project’s mineral resource, increasing gold 18% to 470koz and silver 31% to 21Moz.

GRL reckons there’s more room for growth in fresh lodes that haven’t been incorporated into the estimate yet, and plans to do more drilling alongside metallurgical testing and a mining scoping study already underway.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MEL | Metgasco Ltd | 0.002 | -33% | 134516 | $5,511,260 |

| NTM | Nt Minerals Limited | 0.001 | -33% | 8000 | $1,816,354 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 1999998 | $2,330,120 |

| SHE | Stonehorse Energy Lt | 0.005 | -29% | 4064735 | $4,791,046 |

| FNX | Finexia Financialgrp | 0.2 | -27% | 24487 | $17,133,591 |

| C7A | Clara Resources | 0.003 | -25% | 800 | $2,353,084 |

| LMLR | Lincoln Minerals | 0.003 | -25% | 2582442 | $1,249,468 |

| SRN | Surefire Rescs NL | 0.0015 | -25% | 8400000 | $6,457,219 |

| NAG | Nagambie Resources | 0.013 | -24% | 11895558 | $13,656,140 |

| EQS | Equitystorygroupltd | 0.02 | -20% | 1000000 | $4,170,510 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 101964 | $3,903,680 |

| MOH | Moho Resources | 0.004 | -20% | 284500 | $3,727,070 |

| RAN | Range International | 0.002 | -20% | 17123 | $2,348,226 |

| TMK | TMK Energy Limited | 0.002 | -20% | 1800000 | $25,555,958 |

| VEN | Vintage Energy | 0.004 | -20% | 608071 | $10,434,568 |

| EDE | Eden Inv Ltd | 0.038 | -17% | 541218 | $9,452,787 |

| GLL | Galilee Energy Ltd | 0.01 | -17% | 193760 | $8,486,315 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 2299 | $18,756,675 |

| KPO | Kalina Power Limited | 0.01 | -17% | 7071664 | $35,195,948 |

| RR1 | Reach Resources Ltd | 0.01 | -17% | 196086 | $10,493,176 |

| TFL | Tasfoods Ltd | 0.005 | -17% | 10000 | $2,622,573 |

| 1AI | Algorae Pharma | 0.006 | -14% | 5523247 | $11,811,763 |

| RGL | Riversgold | 0.003 | -14% | 1 | $5,892,994 |

| RNX | Renegade Exploration | 0.003 | -14% | 4340000 | $5,608,272 |

| D3E | D3 Energy Limited | 0.315 | -14% | 163132 | $29,008,377 |

In Case You Missed It

Neurizon Therapeutics (ASX:NUZ) has begun manufacturing an initial registration batch of NUZ-001 tablets to potentially treat ALS and related neurodegenerative diseases.

New data shows Recce Pharmaceuticals’ (ASX:RCE) topical gel is highly effective against two challenging antibiotic-resistant bacteria affecting burns.

AnteoTech (ASX:ADO) is breaking into the South Korean market with a distribution agreement with Kangshin Industrial Co.

White Cliff Minerals’ (ASX:WCN) regional drilling at the Danvers copper project in Nunavut, Canada, has extended known mineralisation and identified further sulphide mineralisation along strike.

Green Critical Minerals (ASX:GCM) has transitioned into manufacturing VHD blocks, with Module 1 now commissioned at its VHD production plant.

Everest Metals Corporation (ASX:EMC) has raised $4 million to advance its key trio of gold and critical minerals projects in Western Australia.

QMines’ (ASX:QML) confidence in resource continuity at the Sulphide City deposit within its Develin Creek project in Queensland continues to build after drilling delivered more high-grade copper and zinc intersections.

Small language models promise faster, cheaper and more accurate AI translation, notes ASX-listed language tech company Straker (ASX:STG).

Last Orders

Tryptamine Therapeutics (ASX:TYP) has locked in a $2.6m credit line with Rockford Equity, secured against TYP’s projected FY2026 R&D tax refund.

The facility can be drawn down in $500k tranches, accruing interest at 16% per year on the outstanding balance. TYP also expects to receive an $800k R&D tax rebate from the ATO in the coming months.

The fresh funding will go to fast tracking key development milestones for Tryptamine’s binge eating disorder trial with Swinburne University.

Trading Halts

Bayan Mining and Minerals (ASX:BMM) – price query

Centaurus Metals (ASX:CTM) – cap raise

G11 Resources (ASX:G11) – new project acquisition

Trigg Minerals (ASX:TMG) – assay results and new mineralisation discovery

At Stockhead, we tell it like it is. While Tryptamine Therapeutics and Audeara are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.