Closing Bell: ASX loses fizz as ANZ dips, but Gold Road shows the way

Pic via Getty Images

- In the arvo session the ASX 200 gave back much of its early strong gains

- ANZ’s hefty dip had a lot to do with that, although the staples, materials and utilities sectors also let the side down

- But… big gold producer Gold Road, along with IT and healthcare stocks, propped things up

The local benchmark ran out of steam this afternoon, giving up some of the strong gains it made earlier in the day. That said, it still gets a C- for posting a passable +0.071% score at close, after earlier hitting a two-week high of 7994 points.

Report card: Shows promise. Has tendency to lose focus. Must try harder for longer periods next time.

Why the arvo slump? Maybe ask someone at ANZ (ASX:ANZ). The big bank’s shares fell as much as 3.9 per cent to $28.38. That’s after hitting a three-week high of $29.90 in early trading.

ASX market news

Big gun gold producer Gold Road Resources was a standout performer all day, finishing with a PB of $2.83 a share and a stonking 15.51% gain.

Why? Here’s something, still fresh enough, that we prepared a little earlier…

Gold Road investors were frothing today, watching their beloved GOR share price surge +15%. That’s a pretty significant gain for a $3bn stock.

A standoff of sorts has taken place between the miner and its WA project partner, South Africa’s Gold Fields.

Late yesterday, Gold Road confirmed it had rejected a $3.3bn takeover bid by Gold Fields, its 50 per cent partner in the Gruyere gold mine in WA. “Opportunistic,” it exclaimed in the classic parlance of a takeover target.

The South African entity wants all the cheese, essentially – it has been gunning to own 100 per cent of Gruyere and will also assume Gold Road’s other major asset – a 17 per cent stake in De Grey Mining, which is the target of a $5bn takeover play from Northern Star. Gold Fields doesn’t plan to interlope on NST’s De Grey play ahead of an April 16 shareholder vote though.

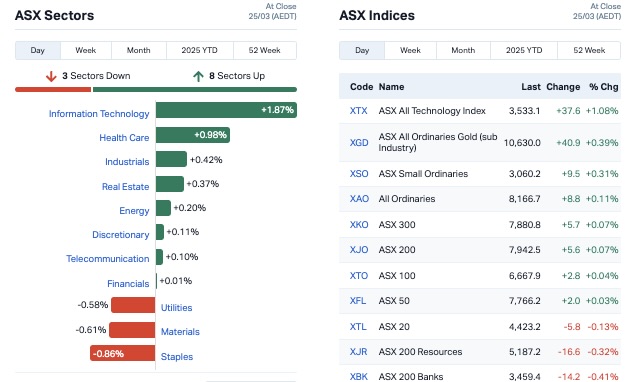

Sectors wise on the ASX, local tech and healthcare stocks led the day, while staples and materials (on the whole) didn’t.

It all looked like this at day’s end…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SRH | Saferoads Holdings | 0.19 | 363% | 274,353 | $1,791,922 |

| REE | Rarex Limited | 0.024 | 200% | 107,684,590 | $6,406,767 |

| BRX | Belararox | 0.27 | 116% | 9,915,400 | $17,995,514 |

| LNR | Lanthanein Resources | 0.003 | 50% | 201,261 | $4,887,272 |

| ERW | Errawarra Resources | 0.079 | 46% | 4,309,727 | $5,179,716 |

| BTC | BTC Health Ltd | 0.065 | 35% | 83,686 | $15,615,519 |

| ASR | Asra Minerals Ltd | 0.004 | 33% | 1,825,494 | $7,119,380 |

| BP8 | BPH Global Ltd | 0.004 | 33% | 869,250 | $1,824,924 |

| EMT | Emetals Limited | 0.004 | 33% | 1,925,013 | $2,550,000 |

| HAR | Haranga Resources | 0.073 | 30% | 13,951,005 | $5,111,645 |

| A1G | African Gold Ltd. | 0.1 | 30% | 1,492,638 | $29,390,671 |

| RRR | Revolver Resources | 0.038 | 27% | 451,142 | $8,193,728 |

| ASQ | Australian Silica | 0.025 | 25% | 6,460 | $5,637,208 |

| CUL | Cullen Resources | 0.005 | 25% | 500,000 | $2,773,607 |

| RMI | Resource Mining Corp | 0.005 | 25% | 1,810,929 | $2,609,391 |

| RPG | Raptis Group Limited | 0.01 | 25% | 1,000,000 | $507,891 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 397,433 | $3,220,998 |

| TEM | Tempest Minerals | 0.005 | 25% | 510,000 | $2,538,119 |

| CAZ | Cazaly Resources | 0.016 | 23% | 4,409,784 | $5,996,939 |

| EV1 | Evolution Energy | 0.016 | 23% | 155,008 | $4,714,456 |

| IME | Imexhs Limited | 0.44 | 22% | 85,377 | $16,520,770 |

| LOM | Lucapa Diamond Ltd | 0.018 | 20% | 272,216 | $6,905,580 |

| EM2 | Eagle Mountain | 0.006 | 20% | 242,500 | $5,675,186 |

| EPM | Eclipse Metals | 0.006 | 20% | 10,422,465 | $14,299,095 |

| HLX | Helix Resources | 0.003 | 20% | 260,000 | $8,410,484 |

RareX (ASX:REE) closed at +175% today, after the company discovered high-grade gallium at the Cummins Range carbonatite pipe, with assays confirming its presence in the upper 80m alongside high-grade rare earths, phosphate, and scandium. RAR said the rare earth deposit features multiple wide, high-grade intercepts above the Rare and Phos carbonatite dykes, while deeper gallium mineralisation is yet to be tested.

Belararox (ASX: BRX) had a beaut +124% kind of day, after visible copper was observed in the second hole at the Tambo South prospect within its Toro-Malambo-Tambo project in Argentina. This, and the intersection of hundreds of metres of continuous copper sulphides in the hole, indicates that Tambo South is an extensive copper porphyry system which has been overprinted by a high sulfidation event. “The mineralisation and alteration vectors are suggesting a strong copper system, and we eagerly await the continuation of this hole to the planned depth of >1300m,” noted the company’s exploration manager Jason Ward.

BPH Global Ltd (ASX: BP8) finished 33% up after announcing significant progress regarding its Indonesian-based seaweed operations following its acquisition of the Indonesian-based seaweed assets from joint venture partners in January to start joint development of the business. The company said its wholly owned subsidiary PT BPH Global Indonesia was now fully registered and operational with a focus on expansion of operations in the world’s largest seaweed-producing market.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.001 | -33% | 1,270 | $2,817,978 |

| VML | Vital Metals Limited | 0.002 | -33% | 959,015 | $17,685,201 |

| EQS | Equity Story Group | 0.025 | -31% | 459,441 | $5,969,534 |

| IRX | Inhalerx Limited | 0.025 | -29% | 959,194 | $7,470,688 |

| GUL | Gullewa Limited | 0.04 | -27% | 825,449 | $11,991,219 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 1,708,437 | $57,867,624 |

| ERL | Empire Resources | 0.003 | -25% | 274,399 | $5,935,653 |

| RAG | Ragnar Metals Ltd | 0.016 | -24% | 13,023 | $9,953,706 |

| ASP | Aspermont Limited | 0.004 | -20% | 818 | $12,350,058 |

| RFA | Rare Foods Australia | 0.008 | -20% | 1,383,972 | $2,719,832 |

| FUL | Fulcrum Lithium | 0.135 | -18% | 10,949 | $12,457,500 |

| WNX | Wellnex Life Ltd | 0.4 | -17% | 212,148 | $31,792,288 |

| AMS | Atomos | 0.005 | -17% | 38,650 | $7,290,111 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 14,816 | $3,895,612 |

| MGU | Magnum Mining & Exp | 0.005 | -17% | 368,851 | $4,856,168 |

| CAE | Cannindah Resources | 0.078 | -16% | 4,793,119 | $67,711,436 |

| GRV | Greenvale Energy Ltd | 0.052 | -15% | 839,093 | $29,699,273 |

| KZR | Kalamazoo Resources | 0.077 | -14% | 626,992 | $18,845,417 |

| AAJ | Aruma Resources Ltd | 0.012 | -14% | 2,112,443 | $3,108,814 |

| PLC | Premier1 Lithium Ltd | 0.013 | -13% | 5,966,893 | $5,520,909 |

| CKA | Cokal Ltd | 0.033 | -13% | 1,793,334 | $41,000,061 |

| BDX | Bcal Diagnostics | 0.1 | -13% | 597,939 | $42,086,307 |

| RNT | Rent.Com.Au Limited | 0.018 | -13% | 110,504 | $15,668,286 |

| BLU | Blue Energy Limited | 0.007 | -13% | 916,645 | $14,807,789 |

| CAV | Carnavale Resources | 0.0035 | -13% | 200,000 | $16,360,874 |

IN CASE YOU MISSED IT

Altech Batteries (ASX:ATC) has secured a €2.5m funding agreement with major shareholder Deutsche Balaton AG through interest-bearing Bearer Bonds. The company plans to repay the bonds from the sale of Altech’s Malaysian land, with shareholder approval expected in April 2025.

Alice Queen’s (ASX:AQX) latest drilling at the Dakuniba prospect in Fiji has confirmed a high-grade epithermal gold zone runs continuously from surface down to 175m, with the second hole returning a top assay of 4.14m at 6.13g/t gold and 9.42g/t silver. A third hole is now underway to test even deeper, aiming to extend the high-grade gold zone to around 275m.

Resolution Minerals’ (ASX:RML) interim LiDAR results at Drake East have identified over 500 historical mine workings, highlighting the project’s brownfields potential. The company is moving forward to conduct map[ing and sampling of these targets to confirm mineralisation, with final LiDAR results expected soon.

Cannindah Resources (ASX:CAE) has hit a thick, high-grade intersection of 71m at 0.95% copper equivalent at Mt Cannindah, extending mineralisation beyond the current 14.5Mt resource. The company is planning more drilling to test nearby IP anomalies, seeing strong potential for further resource growth.

At Stockhead, we tell it like it is. While Altech Batteries, Alice Queen, Resolution Minerals, Cannindah Resources and CuFe is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.