Closing Bell: ASX leaps on bank, tech stocks rally; Novonix, Bitcoin on fire

Bitcoin hits $107K, eyes $150K target. Picture via Getty Images

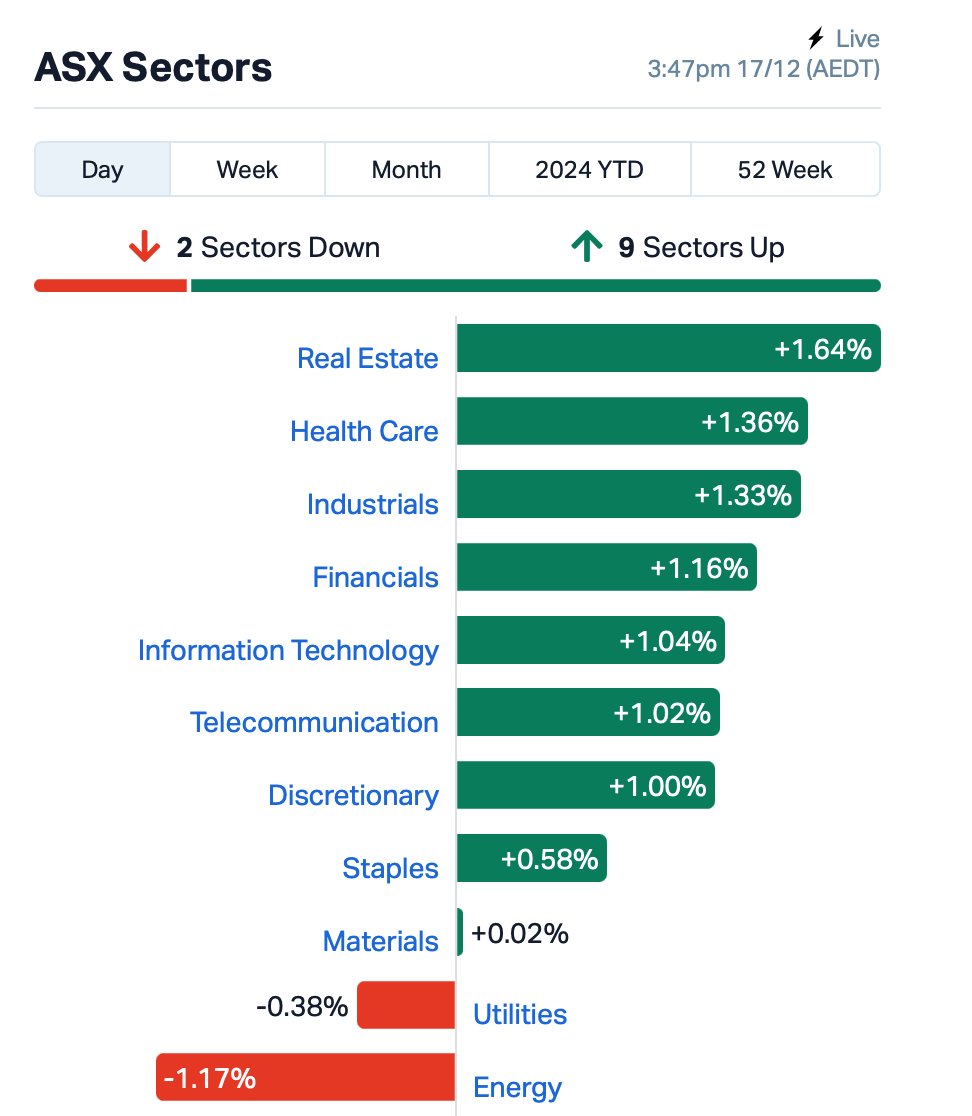

- ASX rises as banks lead, energy lags

- Bitcoin hits $107k… $150k target murmurings grow louder

- Orica CEO to retire, Data#3 tumbles on Microsoft news

The ASX edged higher by 0.78% on Tuesday, with the big banks keeping the mood upbeat through the afternoon session.

Commonwealth Bank (ASX:CBA) led the pack, jumping by over 1.5%.

The energy sector, however, was the main drag today after Brent crude slipped on weaker demand from China.

Bitcoin has been on fire this week, hitting a fresh record of $107,790 on Tuesday before retreating, supercharged by Donald Trump’s plans for a US Bitcoin reserve.

Investors are already eyeing US$150,000 as the next big target, with a ton of bullish bets on the table.

“Sentiment is indeed bullish, perhaps overwhelmingly positive,” said momoo’s Jessica Amir.

Back on the ASX, this is where things stood at around 15:45 AEDT:

In the large end of town, Orica (ASX:ORI)’s chairman Malcolm Broomhead is calling it a day, with plans to retire in December 2025 after 10 years at the explosives maker.

Data#3 (ASX:DTL) dropped by 9% after the IT solutions provider revealed major changes to its partnership with Microsoft. The company, which distributes Microsoft products in Australia, told investors that the changes would significantly reduce the incentives it can earn on its Microsoft Enterprise Agreements.

Pexa (ASX:PXA), a company that facilitates property transactions, has appointed Russell Cohen as its new CEO, effective March 31, 2025. Cohen, currently the Group Managing Director of Operations at Grab, brings extensive experience in scaling platform businesses across Asia Pacific. Shares rose 9%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| AXP | AXP Energy Ltd | 0.002 | 50% | 4,734 | $5,824,681 |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 50% | 11,965 | $5,824,681 |

| GGE | Grand Gulf Energy | 0.003 | 25% | 350,000 | $4,900,774 |

| HHR | Hartshead Resources | 0.006 | 20% | 935,864 | $14,043,411 |

| EPM | Eclipse Metals | 0.007 | 17% | 13,049,653 | $13,727,133 |

| JPR | Jupiter Energy | 0.032 | 14% | 125,302 | $35,710,795 |

| BTM | Breakthrough Minsltd | 0.075 | 14% | 2,589 | $2,527,580 |

| TOE | Toro Energy Limited | 0.245 | 11% | 429,206 | $26,462,007 |

| BRU | Buru Energy | 0.039 | 10% | 414,137 | $27,279,336 |

| BSN | Basinenergylimited | 0.017 | 10% | 137,645 | $1,565,244 |

| CXU | Cauldron Energy Ltd | 0.013 | 8% | 772,221 | $17,536,855 |

| TBN | Tamboran | 0.140 | 8% | 6,450,772 | $226,181,072 |

| KKO | Kinetiko Energy Ltd | 0.073 | 7% | 12,108 | $97,415,787 |

| LIO | Lion Energy Limited | 0.018 | 6% | 103,798 | $7,686,851 |

| NGY | Nuenergy Gas Ltd | 0.018 | 6% | 42,373 | $30,271,993 |

| BTE | Botalaenergyltd | 0.061 | 5% | 11,557 | $14,393,049 |

| FDR | Finder | 0.044 | 5% | 346,065 | $11,940,109 |

| BKY | Berkeley Energia Ltd | 0.330 | 3% | 48,619 | $142,654,949 |

| FAR | FAR Ltd | 0.515 | 3% | 662,150 | $46,204,824 |

| TER | Terracom Ltd | 0.185 | 3% | 409,867 | $144,173,922 |

| EEG | Empire Energy Ltd | 0.200 | 3% | 472,653 | $198,374,128 |

| NHE | Nobleheliumlimited | 0.046 | 2% | 200,569 | $25,509,086 |

Novonix (ASX:NVX) jumped after securing a $755 million loan from the US Department of Energy to build a new plant in Tennessee. The funding is a big deal for the synthetic graphite maker, which will supply materials for EV batteries.

Environmental Clean Technologies (ASX:ECT) and ESG Agriculture have launched a joint venture, Zero Quest, to develop sustainable soil health solutions, including the COLDry Fertiliser, a low-emission alternative to traditional fertilisers. The venture has secured $300,000 in seed funding and will begin field trials across Australia and the Philippines to test the product’s effectiveness.

BPM Minerals (ASX:BPM) has completed its phase III reverse circulation drilling program at the Louie Prospect within the Claw Gold Project in Western Australia. A total of 11 holes were drilled, covering 1995 metres, targeting high-grade mineralisation at depth. The samples are now being assayed, with results expected early next year.

Dorsavi (ASX:DVL) has partnered with Secret Network to integrate privacy-focused blockchain technology with its wearable movement analysis devices. The collaboration will test how Secret Network’s encrypted smart contracts can secure data from dorsaVi’s devices. The project will also explore using Non-Fungible Tokens (NFTs) to protect and control access to movement data.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.002 | -25% | 252,454 | $8,219,752 |

| MMR | Mec Resources | 0.004 | -20% | 1,330,443 | $9,159,035 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 271,608 | $9,399,133 |

| ERA | Energy Resources | 0.003 | -17% | 2,126,530 | $1,216,188,722 |

| WBE | Whitebark Energy | 0.006 | -14% | 82,400 | $1,766,334 |

| AEE | Aura Energy | 0.135 | -13% | 1,832,214 | $128,101,676 |

| ATS | Australis Oil & Gas | 0.008 | -11% | 225,963 | $11,601,088 |

| TOU | Tlou Energy Ltd | 0.015 | -9% | 390,338 | $20,777,349 |

| KAR | Karoon Energy Ltd | 1.273 | -9% | 9,036,768 | $1,081,267,321 |

| HYT | Hyterra Ltd | 0.035 | -8% | 6,807,764 | $61,786,438 |

| EL8 | Elevate Uranium Ltd | 0.260 | -7% | 1,277,241 | $95,449,636 |

| PV1 | Provaris Energy Ltd | 0.017 | -6% | 1,060,069 | $12,363,906 |

| PEN | Peninsula Energy Ltd | 1.040 | -5% | 736,338 | $175,598,080 |

| CND | Condor Energy Ltd | 0.019 | -5% | 58,421 | $11,726,674 |

| EXR | Elixir Energy Ltd | 0.043 | -4% | 703,538 | $53,856,486 |

| DYL | Deep Yellow Limited | 1.178 | -4% | 2,718,354 | $1,192,782,569 |

| AGE | Alligator Energy | 0.036 | -4% | 4,842,621 | $143,323,176 |

| CTP | Central Petroleum | 0.050 | -4% | 137,000 | $38,753,432 |

| FZR | Fitzroy River Corp | 0.125 | -4% | 190,000 | $14,034,053 |

| LOT | Lotus Resources Ltd | 0.185 | -5% | 12,547,476 | $460,717,129 |

| CVN | Carnarvon Energy Ltd | 0.150 | -3% | 314,592 | $277,308,467 |

| SRJ | SRJ Technologies | 0.032 | -3% | 30,542 | $19,856,713 |

| WHC | Whitehaven Coal | 6.355 | -3% | 3,834,403 | $5,454,637,112 |

Shares in Karoon Energy (ASX:KAR) fell over 9% after the junior oil and gas producer revised its production guidance downward. The company said it has shut down its Brazilian oil field, Bauna, after an “incident” involving its mooring system.

IN CASE YOU MISSED IT

James Bay Minerals’ (ASX:JBY) review of historic core at its newly acquired Independence gold project in Nevada has shown potentially missed mineralised lodes between skarn and oxide resources. Once logging and sampling of the core are complete, the company will start planning a diamond drill program targeting polymetallic mineralisation within the Pumpernickel formation and deeper gold-silver skarn mineralisation between the Battle formation.

Indiana Resources’ (ASX:IDA) has uncovered potential for gold beyond the known mineralised footprint at its Minos prospect within the Central Gawler Craton exploration project in South Australia. Drill hole 24LLRC008 intersected 8m at 8.90g/t gold from 208m to end of hole, with further drilling planned into early 2025.

Astral Resources (ASX:AAR) has reported encouraging infill drilling results at the Iris deposit within its Mandilla project in WA, which will be included into a PFS scheduled for release in Q2 2025. Highlights included 5m at 10.3g/t gold and 28m at 1.54g/t gold, expected to upgrade the resource to the indicated category.

Victory Metals (ASX:VTM) has signed an MoU with Sumitomo for a 30% share of annual mixed rare earth carbonate production from its North Stanmore project over an initial five-year period. Both parties aim to finalise a binding term sheet by October 31, 2025, further positioning the project as a significant global supplier of rare earths.

Tungsten Mining (ASX:TGN) is now the sole owner of the Northern Territory-based Hatches Creek project, having acquired the remaining 80% interest from GWR Group (ASX:GWR). TGN has issued 107.5 million shares to GWR Group, increasing GWR’s voting power in TGN to ~19.86%. TGN believes the project holds several high-grade polymetallic tungsten prospects and the potential for a significant high-grade tungsten deposit in an area that is largely underexplored, offering a chance to grow the resource.

Race Oncology (ASX:RAC) has received a $5.25 million R&D tax refund for FY24 through the Australian government’s R&D Tax Incentive program, which will be reinvested into driving the clinical development of its lead asset, RC220. It adds to the company also recently securing a binding guarantee for up to $20.08 million in overseas R&D activities over the next three years.

At Stockhead, we tell it like it is. While James Bay Minerals, Indiana Resources, Astral Resources, Victory Metals, Tungsten Mining and Race Oncology are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.