Closing Bell: ASX jumps higher again, 4DMedical wins US FDA approval

ASX climbs again. Picture via Getty Images

- ASX 200 lifts on tech rally, miners struggle

- Barrick Gold threatens Mali shutdown over shipping restrictions

- Bitcoin bounces back after recent slump

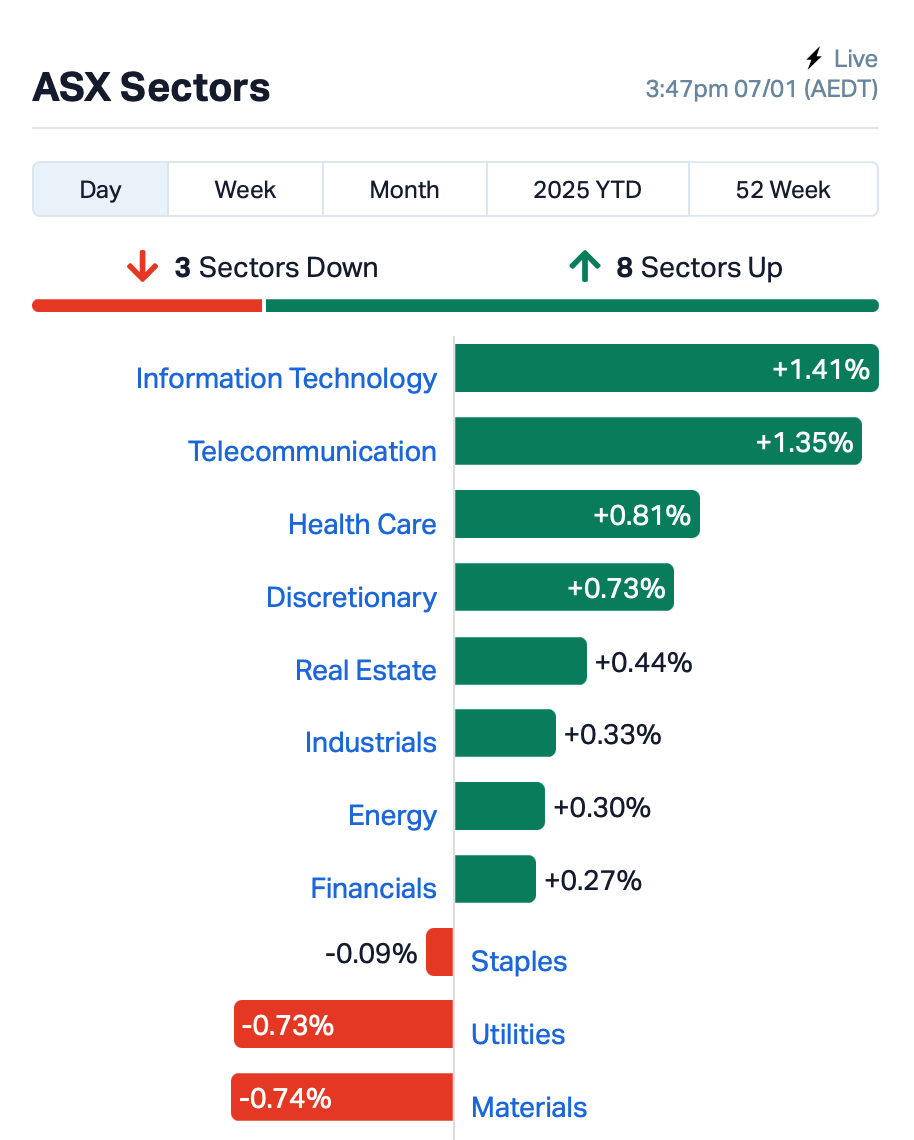

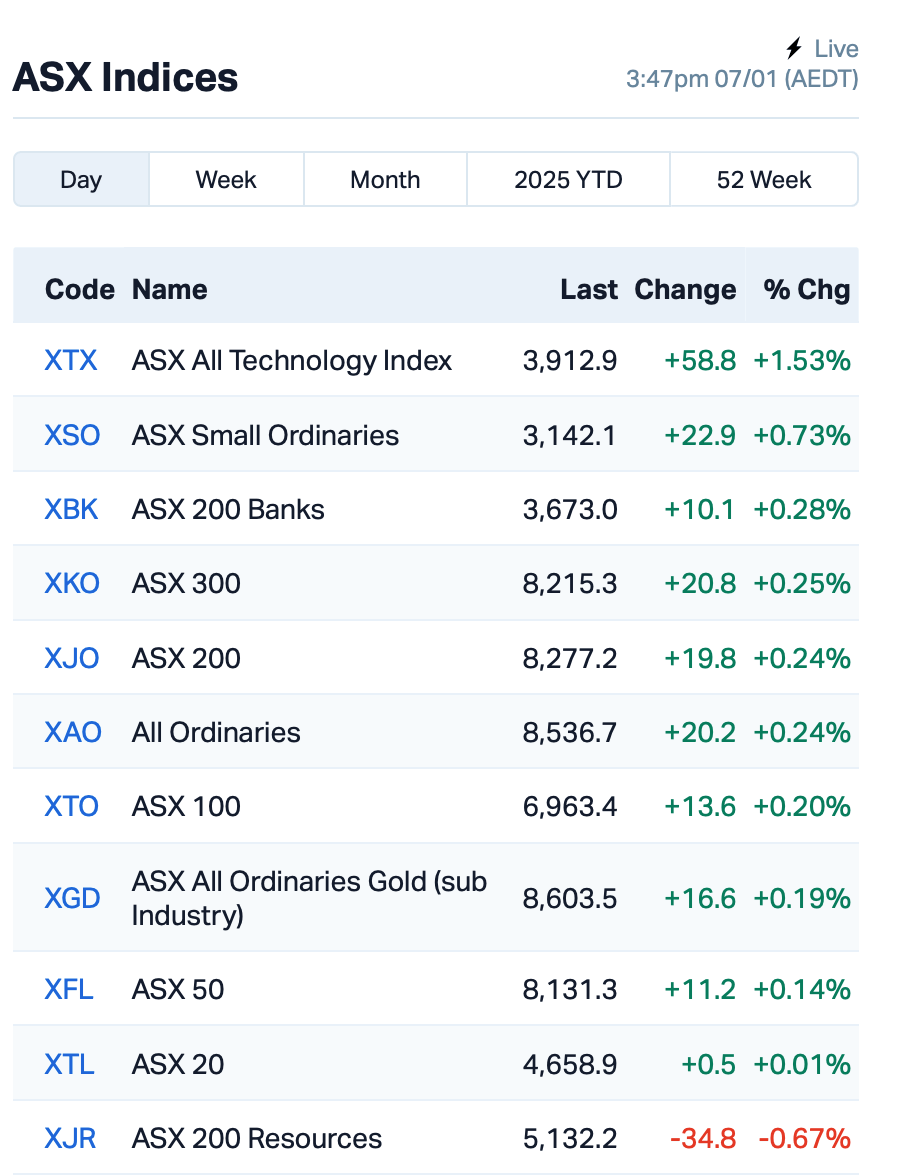

The ASX 200 index crept up 0.34% on Tuesday, thanks to a rally in tech following the Nasdaq’s overnight bounce.

But miners aren’t having the best time. Iron ore futures have dipped further, trading below US$98 a tonne today.

Fortescue (ASX:FMG) lost 4.5%, BHP (ASX:BHP) and Rio Tinto (ASX:RIO) dipped by over 1%.

Utilities weren’t doing any better, either, with AGL Energy (ASX:AGL) slipping 1.5%.

But some good news, Capricorn Metals (ASX:CMM) rose 3% after reporting record gold production for the December quarter, producing 28,702 ounces of gold, up from 25,559 the previous quarter.

This is where things stood at 15:45 AEDT:

Elsewhere, there’s big drama out of West Africa. Canadian giant Barrick Gold has threatened to suspend operations in Mali if the country doesn’t lift restrictions on its gold shipments. Tensions are rising across the region as military governments renegotiate mining contracts.

And finally, Bitcoin’s making moves again, breaking US$100k and earlier touching US$102k after a choppy stretch in the nervous ’90s over the past few weeks.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap 88E 88 Energy Ltd 0.002 100% 901,495 $28,933,812 RGT Argent Biopharma Ltd 0.250 47% 163,485 $9,226,286 ICG Inca Minerals Ltd 0.008 33% 8,676,176 $6,160,335 PPY Papyrus Australia 0.015 25% 1,322,797 $6,624,544 ADD Adavale Resource Ltd 0.003 25% 3,938,486 $3,081,664 CUL Cullen Resources 0.005 25% 1,519,725 $2,773,607 MOH Moho Resources 0.005 25% 873,000 $2,865,898 DXB Dimerix Ltd 0.440 24% 6,584,843 $198,042,756 PIM Pinnacleminerals 0.058 21% 40,000 $2,182,239 KKO Kinetiko Energy Ltd 0.073 20% 83,004 $87,387,691 JAV Javelin Minerals Ltd 0.004 17% 11,980 $18,065,874 VRC Volt Resources Ltd 0.004 17% 484,750 $12,639,719 FGH Foresta Group 0.008 14% 100,000 $18,403,831 PVT Pivotal Metals Ltd 0.008 14% 30,006 $6,350,581 SKK Stakk Limited 0.008 14% 463,000 $14,525,558 KZR Kalamazoo Resources 0.083 14% 145,774 $14,839,700 SCN Scorpion Minerals 0.017 13% 4,690 $6,141,843 SBW Shekel Brainweigh 0.026 13% 54,822 $5,245,408 BML Boab Metals Ltd 0.180 13% 1,439,820 $37,343,217 AEV Avenira Limited 0.009 13% 150,000 $25,352,272

4DMedical (ASX:4DX) has just scored a big win, getting US FDA approval for its AI-powered IQ-UIP diagnostic tool. The tech helps pinpoint Usual Interstitial Pneumonia (UIP), a key marker for Interstitial Pulmonary Fibrosis (IPF), a serious lung condition. The IPF treatment market is set to grow from US$4 billion to nearly US$8 billion in the next decade, said 4DX. Shares rose 19%.

Meanwhile, clinical-stage biotech Dimerix (ASX:DXB) has partnered with Japan’s Fuso Pharmaceutical Industries to develop and commercialise DMX-200 for the treatment of FSGS kidney disease. The deal, valued at over $100 million, will see Fuso lead development costs, regulatory approval, and sales and marketing efforts in Japan.

Argent Biopharma (ASX:RGT) has successfully raised US$4.5 million by issuing 11.25 million shares at US$0.40 each, with one free warrant for every two shares. The funds will support the development of CannEpil and other treatments, while the company plans a US listing after its LSE delisting.

Smart sensors tech company Shekel Brainweigh (ASX:SBW) ended 2024 with a bang, reporting a record Q4 revenue of US$7.65m – up 27% from the previous year. Retail tech sales soared 106%, and local Israeli market revenue jumped 75%. Entering 2025, the company said it has a US$6.11m order backlog, up 19%.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap SIS Simble Solutions 0.004 -33% 434,166 $5,017,982 GMN Gold Mountain Ltd 0.003 -25% 769,608 $18,269,893 NAE New Age Exploration 0.003 -25% 195,666 $8,575,596 TMX Terrain Minerals 0.003 -25% 162,805 $7,242,782 TTI Traffic Technologies 0.003 -25% 810,157 $4,614,933 SGQ St George Min Ltd 0.020 -20% 11,952,557 $30,963,511 MEL Metgasco Ltd 0.004 -20% 49,998 $7,287,934 RLG Roolife Group Ltd 0.004 -20% 25,000 $5,980,156 TYX Tyranna Res Ltd 0.004 -20% 317,798 $16,439,627 ERA Energy Resources 0.003 -17% 540,000 $1,216,188,722 PWN Parkway Corp Ltd 0.011 -15% 35,918 $35,972,480 BRN Brainchip Ltd 0.320 -15% 24,826,278 $739,675,491 CCO The Calmer Co Int 0.006 -14% 181,097 $17,785,969 GTR Gti Energy Ltd 0.003 -14% 190,827 $10,370,324 KRR King River Resources 0.012 -14% 149,000 $21,395,091 SER Strategic Energy 0.007 -13% 25,000 $5,368,267 1AD Adalta Limited 0.015 -12% 55,000 $10,734,787 KNB Koonenberrygold 0.015 -12% 4,061,893 $14,862,887 BIT Biotron Limited 0.016 -11% 100,000 $16,242,890 PUA Peak Minerals Ltd 0.008 -11% 178,490 $22,968,992 RC1 Redcastle Resources 0.008 -11% 85,000 $6,692,102 TOY Toys R Us 0.051 -11% 1,122,435 $8,621,943

Syrah Resources (ASX:SYR) fell 2% despite securing a loan waiver from the US government’s development bank. The waiver, valued at US$53 million, comes after civil unrest in Mozambique halted production at its graphite mine.

IN CASE YOU MISSED IT

Aroa Biosurgery’s (ASX:ARX) latest study has highlighted the potential of its Myriad treatment range in lower limb reconstruction, showing both its effectiveness and cost-saving benefits. The initial results from the Myriad Augmented Soft Tissue Reconstruction Registry (MASTRR) point to an opportunity that could see Aroa capitalise on a $225 million market.

Koonenberry Gold (ASX:KNB) has uncovered a 6km trend of copper-gold mineralisation through initial fieldwork at its Breakfast Creek project in NSW’s Lachlan Fold Belt. Rock chip sampling returned results up to 7.02g/t gold and 1.96% copper, confirming previous findings, with the company now working to advance several targets to drill-ready status.

St George Mining (ASX:SGQ) has secured $20 million through a placement to fund the acquisition of the high-grade Araxá niobium-rare earth element (REE) project in Brazil. Residing next to the world’s largest niobium mine, the company aims to begin a 5,000m diamond drilling campaign shortly.

At Stockhead, we tell it like it is. While Aroa Biosurgery, Koonenberry Gold, St George Mining and Dimerix are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.