Closing Bell: ASX investors abandon ship after eight straight days on a sea of green

Via Getty

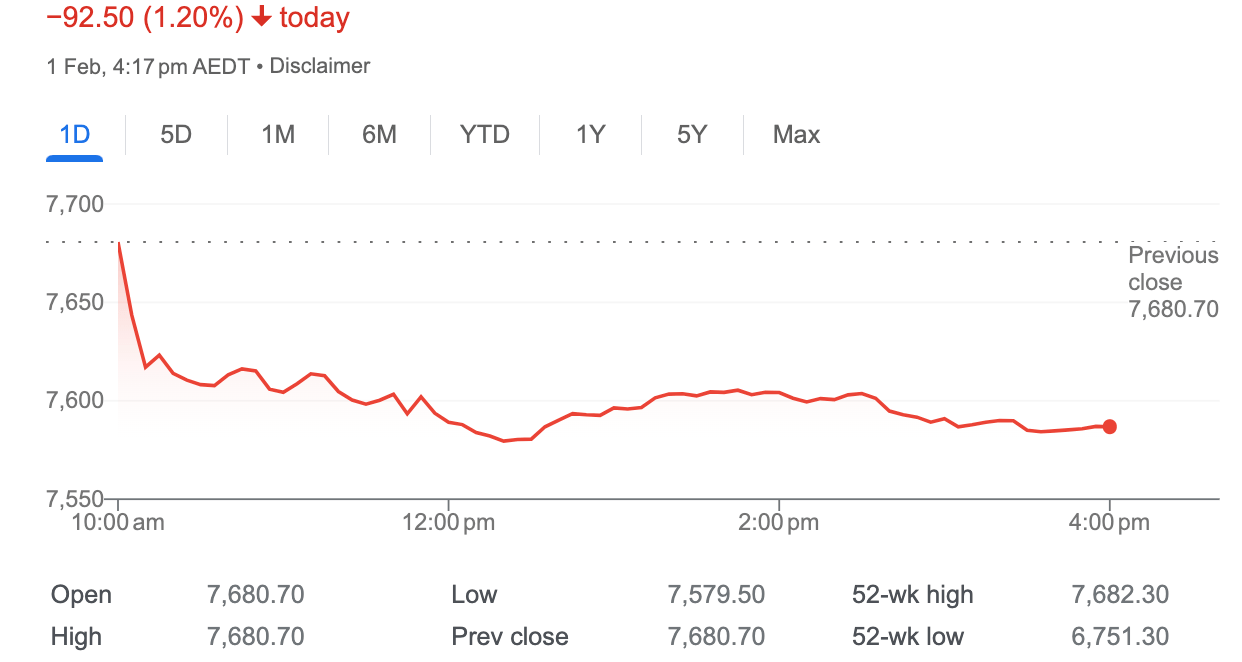

- ASX down more than 1.2pc

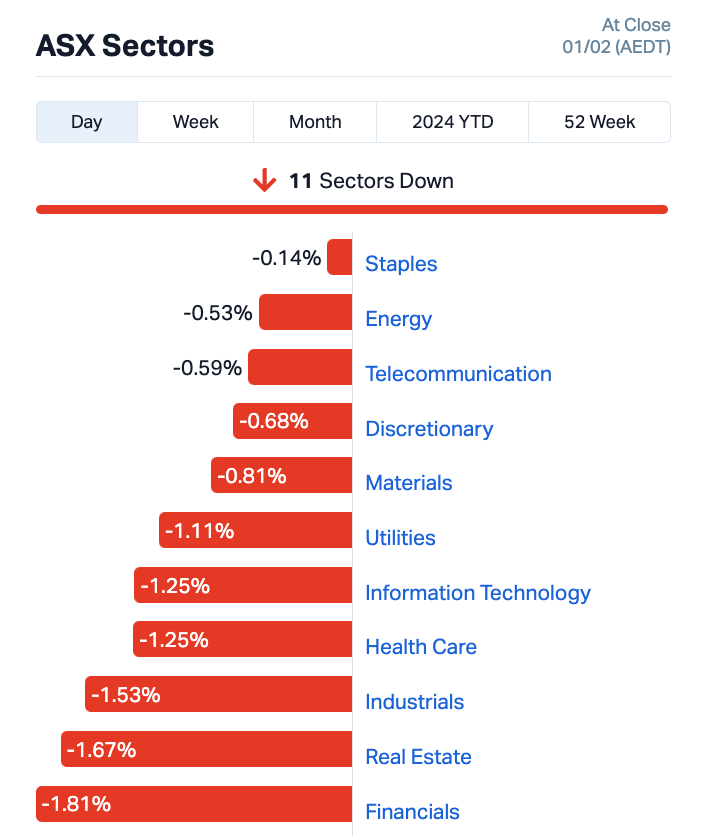

- All sectors in the red

- Mineral Commodities leads strong day across small cap winners

Local markets have ended their quietly astonishing eight-day merry-go-lucky streak, failing on the ninth attempt at a positive close on Thursday.

At 4.15pm on February 1, the S&P/ASX200 was down 92.50 points or 1.2% to 7,588.20

Just a day after making a fresh record high at 7682.3, the benchmark has reminded us of what a terrific slumper it can be, slumping almost 100 points and giving back all of Wednesday’s gains and some more, showing the same ashen faced cowardice with which yesterday’s bulls went about their business on Wall Street overnight.

By lunchtime in Sydney, it was apparent that no one was feeling chipper, so losses were kicked off by the blue chip members of the local bourse who were determined to not come out and play on Day 9 of what’s admittedly been a pretty impressive streak.

The end of the month aligned with the end of a cracking quarter for the ASX200, gaining about 11%.

The US Fed surprised no-one when it held the note for a fourth straight month, keeping US interest rates steady at the highest level since 2001 and making it clear it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward” its goal of 2%.

All stocks, everywhere fell in Sydney all at once, ending the brief giddy highs from the previous session’s 7680.70 points splurge, driven hopelessly by dreams of interest rate cuts.

“We’re not declaring victory at all,” Fed chair J Powell said post-match, adding it was unlikely the US central bank would get to that level of comfort by its next rate meeting in March.

All these dashed hopes fell upon the soft earnings misses from Mega Tech companies, Microsoft, Alphabet and AMD. And so the ship was abandoned.

All 11 ASX sectors ended lower, with the Banks, Real Estate, Industrials and the IT sector, shaming to the greatest degree.

South32 (ASX:S32) BHP (ASX:BHP) , CSL (ASX:CSL) . Novonix (ASX:NVX) Appen (ASX:APX) and Zip Co (ASX:ZIP), out front of the many underperformers.

On the upside, Materials and Energy weren’t totally routed, despite the RBA’s Index of Commodity Prices tumbling by 10.4% year-on-year in January 2024, slowing from an upwardly revised 11.2% drop during December.

It was the 11th straight month of contraction but the softest pace since March, led by lower thermal coal and liquified natural gas prices.

The index fell 7.1% in Aussie dollar terms.

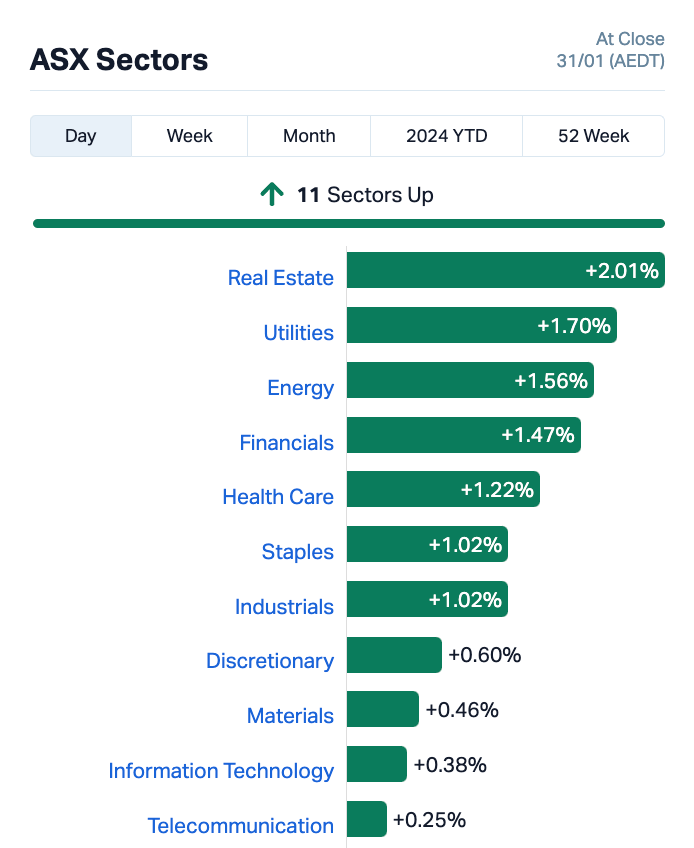

Anyway, I’ve left yesterday’s sectors further below, just because of the rare and pretty symmetry the two charts provide, back to back

In the States…

The Federal Reserve kept the fund’s rate unchanged at a 23-year high of 5.25%-5.5% on Wednesday and discarded the formal guidance that had maintained the possibility of rate hikes.

Still, during the press conference, everyone’s man, Chairman J. Powell stated that the Fed just didn’t have enough confidence in the inflation trajectory to even think about cutting interest rates in March.

So here’s a pin for your hope balloon.

US Futures were higher in Sydney at 4pm on Thursday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| MRC | Mineral Commodities | 0.028 | 87% | 416,193 | $14,767,089 |

| SHG | Singular Health | 0.15 | 60% | 5,943,163 | $13,283,165 |

| BPM | BPM Minerals | 0.12 | 50% | 2,097,437 | $5,369,777 |

| GES | Genesis Resources | 0.006 | 50% | 85,650 | $3,131,365 |

| M4M | Macro Metals Limited | 0.003 | 50% | 500,000 | $4,934,156 |

| CPO | Culpeominerals | 0.072 | 47% | 28,271,880 | $6,653,746 |

| RDM | Red Metal Limited | 0.13 | 35% | 7,387,398 | $28,639,040 |

| POD | Podium Minerals | 0.031 | 29% | 4,111,249 | $10,913,923 |

| OSL | Oncosil Medical | 0.009 | 29% | 12,438,445 | $13,821,788 |

| TMG | Trigg Minerals Ltd | 0.009 | 29% | 41,671 | $2,623,293 |

| CTN | Catalina Resources | 0.005 | 25% | 50,000 | $4,953,948 |

| GBZ | GBM Rsources Ltd | 0.01 | 25% | 4,797,451 | $5,851,463 |

| HCD | Hydrocarbon Dynamic | 0.005 | 25% | 200,000 | $3,078,664 |

| ROG | Red Sky Energy. | 0.005 | 25% | 38,001 | $21,208,909 |

| TML | Timah Resources Ltd | 0.045 | 25% | 873 | $3,195,351 |

| COB | Cobalt Blue Ltd | 0.175 | 21% | 765,556 | $54,492,017 |

| DGR | DGR Global Ltd | 0.018 | 20% | 128,699 | $15,655,402 |

| GCX | GCX Metals Limited | 0.042 | 20% | 795,893 | $8,252,254 |

| SPX | Spenda Limited | 0.018 | 20% | 19,452,063 | $64,686,867 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 2,957,549 | $8,182,479 |

| IBG | Ironbark Zinc Ltd | 0.006 | 20% | 1,207,148 | $7,969,363 |

| NET | Netlinkz Limited | 0.006 | 20% | 485,372 | $19,392,242 |

| NSM | Northstaw | 0.048 | 20% | 65,417 | $5,595,031 |

| GSM | Golden State Mining | 0.013 | 18% | 352,003 | $3,073,077 |

| HIQ | Hitiq Limited | 0.02 | 18% | 1,521,553 | $5,981,364 |

Mineral Commodities (ASX:MRC) has smacked Thursday out of the park with a sweetly struck upbeat quarterly late yesterday which soared through the world of Aussie graphite mining and landed MRC stock a near 85% boost.

The company recently completed a Rights Issue, raising $8.8 million to help fund its core activities, which currently revolve around recommencement of operations at the Skaland Graphite mine, and meeting payment obligations as the company works towards 100% ownership of the project.

Meanwhile, we cross to the wee cap healthcare end of the bourse, where Singular Health Group (ASX:SHG) added a 48% jump to its bag of tricks this morning, coming out of a trading halt with the announcement that it has locked in a purchase order for 50 3Dicom R&D licences and 5,000 3Dicom Patient licences, for total value of approximately $152,000, via the Roseman University of Health Sciences in Las Vegas, Nevada.

“While the $152k contract is not huge, the purchase means that Roseman University has become the first US College to adopt Singular’s 3Dicom R&D software as a medical education tool, in a market forecast to be worth USD$17.6 billion by 2027,” Eddy reported this morning.

Another outlier on Thursday is Culpeo Minerals (ASX:CPO), the Aussie-based copper exploration and development upstart digging across its assets in Chile.

The ASX called CPO out for a Visual Estimate of Mineralisation Query, and on Monday CPO was fairly adamant in its confirmation.

Up almost 50% on Thursday, it almost seems like someone else visually confirmed the visual confirmation very recently as well.

BPM Minerals is also making some healthy strides at the end of the day, following a cheerful quarterly on Wednesday as well as news that the company has kicked off a 10,000m drilling program along strike of Capricorn Metals’ (ASX:CMM) 3.24Moz Mt Gibson Gold Project, just 500m from Capricorn’s recent intersection of 16m @ 17.16g/t from 32m.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -50% | 3,484,622 | $5,546,680 |

| VPR | Volt Power Group | 0.001 | -50% | 535,709 | $21,432,416 |

| IBX | Imagion Biosys Ltd | 0.11 | -35% | 642,325 | $5,549,914 |

| KGD | Kula Gold Limited | 0.006 | -33% | 27,453,467 | $3,808,907 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 5,883,892 | $9,630,891 |

| AUK | Aumake Limited | 0.003 | -25% | 6,259 | $7,657,627 |

| JTL | Jayex Technology Ltd | 0.006 | -25% | 2,921,691 | $2,250,228 |

| KPO | Kalina Power Limited | 0.003 | -25% | 29,652 | $8,840,512 |

| PKO | Peako Limited | 0.003 | -25% | 224,000 | $2,108,339 |

| TSI | Top Shelf | 0.21 | -24% | 163,551 | $57,179,612 |

| AUR | Auris Minerals Ltd | 0.007 | -22% | 600,000 | $4,289,634 |

| ARD | Argent Minerals | 0.008 | -20% | 4,651,423 | $12,917,590 |

| BFC | Beston Global Ltd | 0.008 | -20% | 16,920,839 | $19,970,469 |

| LSR | Lodestar Minerals | 0.002 | -20% | 1,267,500 | $5,058,493 |

| NAE | New Age Exploration | 0.004 | -20% | 119,628 | $8,969,495 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20% | 41,570 | $3,097,704 |

| VML | Vital Metals Limited | 0.004 | -20% | 22,124,047 | $29,475,335 |

| WEL | Winchester Energy | 0.002 | -20% | 100,000 | $2,551,055 |

| IR1 | Irismetals | 0.565 | -19% | 536,579 | $90,639,487 |

| NGS | NGS Ltd | 0.013 | -19% | 1,288,993 | $4,019,638 |

| RSH | Respiri Limited | 0.022 | -19% | 188,615 | $28,616,461 |

| EXL | Elixinol Wellness | 0.009 | -18% | 1,518,365 | $6,961,588 |

| STN | Saturn Metals | 0.135 | -18% | 690,079 | $36,852,784 |

| AXN | Alliance Nickel Ltd | 0.032 | -18% | 92,095 | $28,307,745 |

| CAZ | Cazaly Resources | 0.019 | -17% | 1,351,507 | $10,456,635 |

In Case You Missed It

Austral Resources (ASX:AR1) has signed a new haulage deal with REGROUP for its Anthill copper mine, with the additon of five new trucks expected to help address a road haulage shortfall allowing Austral to press ahead with its copper operations, aided by a new haulage contractor.

The timing is weet as Fitch reckons the red metal will soar more than 75% over the next two years due to supply disruptions and higher demand, potentially pushing copper prices to US$15,000/t in 2025, significantly higher than the record peak of US$10,730/t in March 2023.

Meanwhile, reconnaissance drilling outside the current 1.8Bt resource at its Kaysia deposit in central Malawi has defined several mineralisation zones, for Sovereign Metals (ASX:SVM) ranging from 400m to 2km wide, boosting the strike length to over 37km.

Kaysia project is already the biggest natural rutile deposit and second largest flake graphite deposit in the world with a current resource of 1.8Bt @ 1% rutile and 1.4% graphite.

A resampling campaign is showing up high-grade gold hits at Burbanks for Greenstone Resources (ASX:GSR) , as the digger continues discussions with potential open-pit mining and milling partners

Greenstone says 18 holes resampled so far with hits of up to 33.2g/t gold.

Viridis Mining and Minerals (ASX:VMM) has reported its highest-grade REE intersection of 23,556ppm TREO at the Poços de Caldas Alkaline Complex to date, with the intercept also including the highest levels of valuable dysprosium and terbium. This area of the Fazenda mining licence is now a significant area of interest for the Brazil-focused Aussie digger.

Metalicity (ASX:MCT) is set to begin exploration at Yundamindra following the receipt of a decision from the Wardens Court, allowing the historical gold project near Leonora to be retained by the company and its joint venture partner, Nex Metals Exploration.

Finally, greater certainty is coming to Area A at the Makuutu project in Uganda with Ionic Rare Earths (ASX:IXR) reporting the assays from all 20 infill core holes received to date returning mineralised intersections.

Makuutu is the most advanced Ionic Adsorption Clay-hosted (IAC) project currently in development with product not committed to China. The operation has a resource of 532Mt grading 640ppm total rare earth oxides (TREO) which is due for an update.

TRADING HALTS

EP&T Global (ASX:EPX) – pending a proposed capital raising.

Metcash (ASX:MTS) – pending an announcement relating to the potential acquisition of Superior Food Group, and is required to ensure that Metcash securities are not trading on a misinformed basis.

Linius Technologies (ASX:LNU) – pending the release of an announcement to the market regarding a capital raising initiative.

RocketBoots (ASX:ROC) – pending an announcement regarding a capital raising.

Viridis Mining and Minerals (ASX:VMM) – pending the release of an announcement regarding a capital raising.

BCI Minerals (ASX:BCI) – pending an announcement about a proposed equity raising.

Legacy Iron Ore (ASX:LCY) – an announcement regarding a capital raising.

Basin Energy (ASX:BSN) – pending an announcement regarding a material capital raising.

Silver Mines (ASX:SVL) – pending an announcement in relation to a capital raising.

IODM (ASX:IOD) – ending an announcement regarding a material revenue event.

Bluechiip (ASX:BCT) – pending an announcement to the market in connection with a capital raising program.

Yandal Resources (ASX:YRL) – pending an announcement by the Company regarding a capital raising.

Moab Minerals (ASX:MOM) – pending an announcement in connection with a proposed acquisition by MOM.

Unith (ASX:UNT) – pending an announcement regarding a capital raising.

Jayride (ASX:JAY) – pending the completion of a capital raising.

NeuRizer (ASX:NRZ) – pending release to the market of an update regarding amounts owing to DL E&C and negotiations to extend the payment date.

Regis Resources (ASX:RRL) – pending an announcement regarding the commencement of proceedings claiming a royalty applies in relation to the Tropicana Gold Project.

Advanced Health Intelligence (ASX:AHI) – pending the release of an announcement in relation to various potential funding solutions referred to in the AHI’s quarterly.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.