Closing Bell: ASX inches into positive territory on diminished tariffs fears

The ASX 200 made some hard yards on Monday. Pic: Getty Images

- The ASX 200 pushed into the green on a choppy Monday

- Fears around Trump’s tariffs trade war somewhat quelled

- The index was propped up by discretionary and financials sectors, as well as a couple of big miners

After a slow start, the ASX 200 made some hard yards up the middle today and inched its way just ahead for a tough win. If you count a 0.072% gain as a win, that is.

It’s a pretty fair recovery from where it was all heading earlier in the day, so we’ll take it.

The move back into the green can likely be put down to the fact US stock index futures gained on a Bloomberg report indicating that US tariff announcements on April 2 will likely be narrower in scope than US President Trump has threatened.

Per Bloomberg:

Donald Trump’s planned “reciprocal tariffs” expected April 2 are set to be more focused than the barrage he has occasionally threatened, officials familiar with the matter said. Some countries will be exempt, and existing levies on steel and other metals may not be cumulative. Meanwhile, China is prepared for “shocks that exceed expectations,” Premier Li Qiang told a gathering of global business leaders.

S&P 500 futures were up about 0.6 per cent with Nasdaq 100 futures up 0.8 per cent on the back of slightly less negative sentiment about the tariff war.

ASX market news

The biggest stories of the day on the ASX involved (individually) Gold Road, James Hardie, Opthea, Helia, MinRes and Fortescue.

To quickly recap, then:

Gold Road Resources (ASX:GOR) investors will be on high alert tomorrow after South Africa’s Gold Fields, its partner in the ~300,000ozpa Gruyere gold mine in WA, lobbed a $3.3 billion cash bid. Comprising $2.27 in cash plus an additional cash payment pegged to the value of Gold Road’s investment in De Grey Mining (ASX:DEG), the offer has been rejected by the Gold Road board, which instead played the Uno reverse card and suggested buying the Joburg-based miner’s half of Gruyere.

No prizes for guessing how that went down. Gold Fields, by the way, says it does not intend to compete with Northern Star Resources (ASX:NST) for De Grey and would vote up the big Australian goldie’s takeover of the Hemi owner if it can successfully buy out GOR. That vote is set to take place on April 16.

James Hardie (ASX:JHX) took a 14.5% hit today as it makes a bet on attaching itself to a new growth business in the US. In what would be the biggest buyout in Australia since 2022, the $20bn Aussie building products giant is moving to buy US rival Azek, an outdoor living products company, for $US8.75bn ($14bn).

It’s believed the company’s shareholders have punished JHX thanks to what market experts are describing as an overpriced acquisition.

Per Bridget Carter at The Australian:

The cash and scrip deal at a 37.4 per cent premium to Azek’s last closing share price of $US41.39 (representing a market value of $US5.9bn) comes as investors lose patience with Australian listed companies after a number of groups have embarked on transformational deals, only for their performance to go backwards, with acquisitions by Ampol, Reece, Perenti, Orora and Viva Energy some of the latest examples.

Opthea (ASX:OPT) trading has been suspended on the ASX and the Nasdaq at the time of writing. Stockhead’s Tim Boreham noted earlier that the company’s solvency is in question after a “monumental phase III eye disease trial failure“.

The company this morning said the trial did not meet its primary endpoint of a “mean change in best-corrected visual acuity from baseline to week 52”.

Actively-treated patients treated for four weeks were able to read 13.5 more letters on an eye chart, while those treated for eight weeks showed a 12.8 letter improvement.

But the control patients on aflibercept alone showed a 13.7 letter improvement.

In other words, as Tim put it: “the existing drug was better”.

On the back of the Opthea news, specialist investment manager Regal Partners took a hammering in afternoon trading, down 14.84 per cent at close. Regal has a 30% stake in Opthea.

Helia Group (ASX:HLI), a lenders mortgage insurance provider, saw its shares tank by about 25 per cent to $3.48 after the group signalled it’s not looking great for the continuation of its contract with CBA – a contract that’s underpinned the company’s gross written premium business for the past 50 years.

The big four bank/lender has entered into exclusive negotiations with an alternative provider.

Mineral Resources (ASX:MIN) closed the day up 6.9% after resuming haulage operations along the Onslow Iron dedicated haul road following a temporary safety-related pause.

Meanwhile fellow mining big dog Fortescue (ASX:FMG) also had a good day, ending +3.23% after UBS analyst Lachlan Shaw upgraded FMG to ‘Neutral’ from ‘Sell’ while trimming his target price to $16.70. The selloff in Fortescue shares is “overdone”, he noted, adding: “Concerns on the iron ore price outlook we believe are overdone thanks to our expectation for prices to hold US$90-100 tonne for the next five years.”

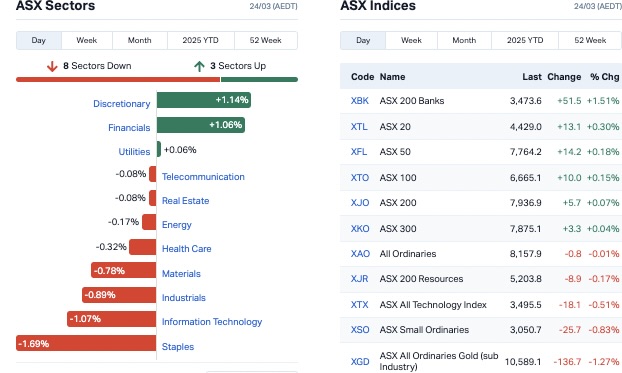

Here’s how the ASX sectors fared today…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ERW | Errawarra Resources | 0.053 | 104% | 4,414,459 | $2,493,937 |

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 20,442 | $2,031,723 |

| GGE | Grand Gulf Energy | 0.0015 | 50% | 47,000 | $2,450,387 |

| MEM | Memphasys Ltd | 0.01 | 43% | 51,212,484 | $12,397,103 |

| AOK | Australian Oil | 0.002 | 33% | 709,814 | $1,502,674 |

| FHE | Frontier Energy Ltd | 0.13 | 33% | 6,798,904 | $50,476,619 |

| HT8 | Harris Technology Gl | 0.014 | 27% | 568,109 | $3,618,617 |

| AUA | Audeara | 0.038 | 27% | 122,216 | $5,398,031 |

| JGH | Jade Gas Holdings | 0.035 | 25% | 220,000 | $47,231,357 |

| CDT | Castle Minerals | 0.0025 | 25% | 3,000,000 | $3,855,646 |

| ERA | Energy Resources | 0.0025 | 25% | 693,038 | $810,792,482 |

| YAR | Yari Minerals Ltd | 0.005 | 25% | 626,416 | $1,929,431 |

| BDG | Black Dragon Gold | 0.062 | 22% | 866,933 | $15,489,519 |

| ARV | Artemis Resources | 0.0085 | 21% | 1,289,369 | $17,699,705 |

| AZI | Altamin Limited | 0.035 | 21% | 38,001 | $16,660,584 |

| NAG | Nagambie Resources | 0.018 | 20% | 524,646 | $12,049,535 |

| TRM | Truscott Mining Corp | 0.072 | 20% | 111,000 | $11,486,914 |

| VRL | Verity Resources | 0.018 | 20% | 2,189,474 | $2,765,108 |

| CCO | The Calmer Co | 0.006 | 20% | 3,432,245 | $12,750,346 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 430,708 | $3,532,015 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 623,000 | $15,115,373 |

| LYK | Lykos Metals | 0.012 | 20% | 5,000 | $1,883,556 |

| NTD | NTAW Holdings Ltd | 0.245 | 20% | 179,745 | $34,380,060 |

| AXN | Alliance Nickel Ltd | 0.033 | 18% | 279,134 | $20,323,509 |

| BDX | Bcal Diagnostics | 0.115 | 17% | 1,514,229 | $35,864,853 |

Errawarra Resources (ASX:ERW) led the small caps gainers today with a 104% blast up the charts. See today’s Resources Top 5 for the deets.

Memphasys (ASX:MEM), a company specialising in reproductive biotechnology for commercial applications, has announced the successful unblinding and data analysis of its pivotal clinical trial for the Felix system. The company says this confirms its “best-in-class performance in sperm selection for Assisted Reproductive Technology (ART)”. The study was conducted in clinical partnership through Monash IVF.

Frontier Energy (ASX:FHE) has announced that its Waroona Renewable Energy Project is among four WA projects selected for support under the Australian government’s Capacity Investment Scheme (CIS).

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OM1 | Omnia Metals Group | 0.0095 | -88% | 5,534,529 | $5,233,153 |

| EDE | Eden Innovations | 0.001 | -50% | 300,000 | $8,219,762 |

| H2G | Greenhy2 Limited | 0.017 | -29% | 20,629,222 | $14,356,420 |

| HLI | Helia Group Limited | 3.6 | -26% | 6,186,981 | $1,321,503,314 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 1,222,778 | $57,867,624 |

| BUY | Bounty Oil & Gas NL | 0.003 | -25% | 39,810 | $6,245,887 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 25,500 | $1,842,067 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 6,770,573 | $8,845,917 |

| TOU | Tlou Energy Ltd | 0.023 | -23% | 1,428,568 | $38,957,530 |

| HPC | The Hydration Company | 0.007 | -22% | 91,080 | $2,744,218 |

| EV1 | Evolution Energy | 0.012 | -20% | 327,316 | $5,439,757 |

| FCT | Firstwave Cloud Tech | 0.012 | -20% | 566,589 | $25,702,780 |

| FRX | Flexiroam Limited | 0.004 | -20% | 140,000 | $7,586,993 |

| LNR | Lanthanein Resources | 0.002 | -20% | 185,237 | $6,109,090 |

| RMI | Resource Mining Corp | 0.004 | -20% | 2,330,066 | $3,261,739 |

| TEM | Tempest Minerals | 0.004 | -20% | 23,589 | $3,172,649 |

| SPA | Spacetalk Ltd | 0.22 | -19% | 215,157 | $17,219,617 |

| VN8 | Vonex Limited | 0.029 | -17% | 54,545 | $26,341,123 |

| ANG | Austin Engineering | 0.465 | -17% | 1,528,396 | $347,281,255 |

| ASQ | Australian Silica | 0.02 | -17% | 11,133 | $6,764,649 |

| CZN | Corazon Ltd | 0.0025 | -17% | 2,671,554 | $3,553,717 |

| IFG | Infocus Group Holdings | 0.01 | -17% | 12,459,534 | $2,889,481 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 1,523,821 | $20,705,349 |

| SER | Strategic Energy | 0.005 | -17% | 392,137 | $4,026,200 |

| VML | Vital Metals Limited | 0.0025 | -17% | 272,000 | $17,685,201 |

IN CASE YOU MISSED IT

Errawarra Resources (ASX:ERW) is acquiring 70% of the high-grade Elizabeth Hill silver project in WA, a historic producer that delivered 1.2Moz of silver from just 16,000t of ore in a single year. With silver prices far higher today than when the mine closed in 2000, ERW plans to drill for resource growth and hunt for more high-grade silver deposits across its newly consolidated 180km2 land package.

Greenvale Energy (ASX:GRV) has raised $1.8 million through a placement to drive exploration and drilling at its newly acquired Oasis uranium project in Queensland. The funds will also support further exploration in the Northern Territory’s Pine Creek Mineral Field, with drilling expected to begin at Oasis next month and exploration activities ramping up across its Australian uranium portfolio.

Astral Resources (ASX:AAR) has hit high-grade gold at its Kamperman deposit, with drill results including 3m at 26.6g/t gold in hole FRCD397A. The company is growing increasingly confident in Kamperman, with a pre-feasibility study set for completion by June 2025, and assays pending from a 265-hole aircore drill program at its Feysville project.

Terra Metals’ (ASX:TM1) Dante Reefs project in WA is shaping up as a promising source of high-grade copper-gold-PGM, vanadium-magnetite, and titanium-ilmenite concentrates, with simple, low-cost processing delivering excellent recoveries. The company is gearing up for phase 2 metallurgical optimisation and a maiden resource estimate.

At Stockhead, we tell it like it is. While Errawara Resources, Greenvale Energy, Astral Resources, Terra Metals and Top End Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.