Closing Bell: ASX inches closer to correction territory as traders move into defensive sectors

The ASX took another hit. And yep, Trump’s tariffs were to blame. Picture via Getty Images

- ASX takes another hit, Trump’s tariffs to blame

- Albanese ignored by Trump ahead of tariff bombshell

- Retailers, miners, banks slump

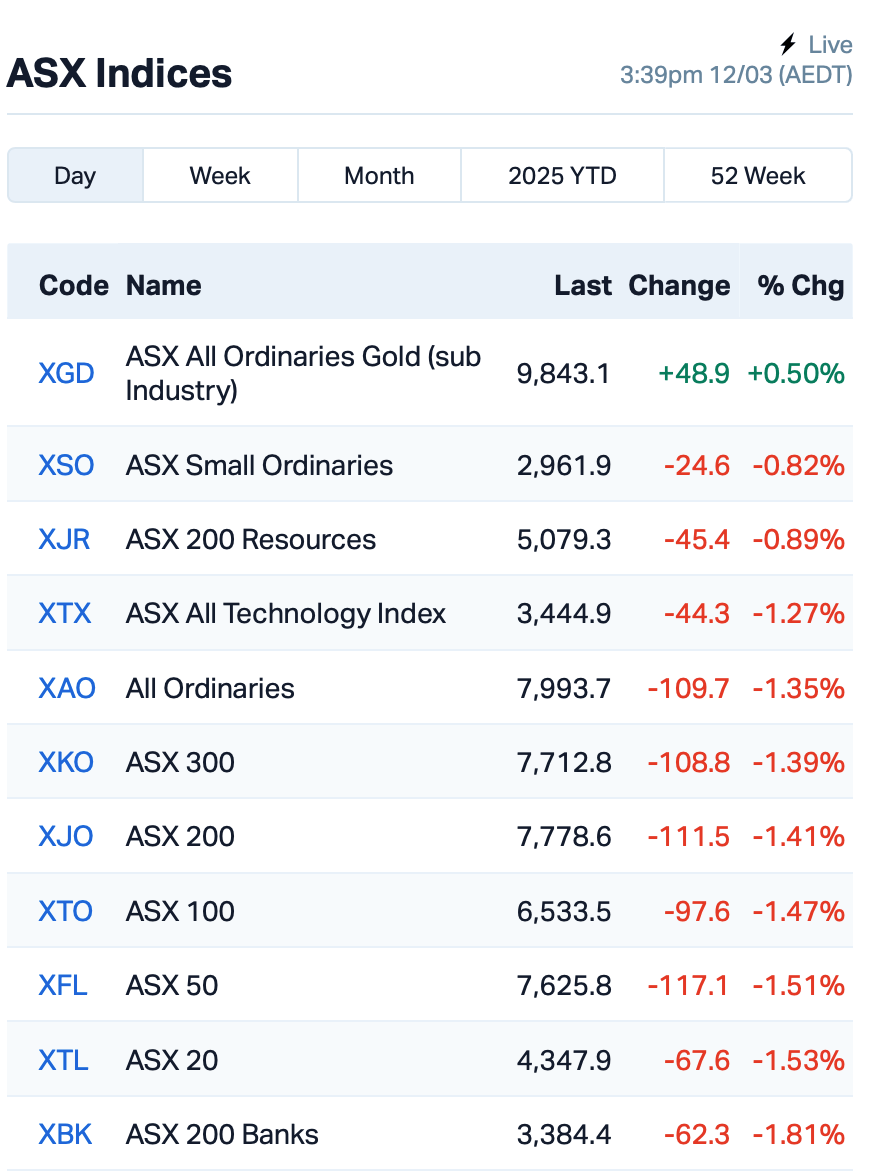

Things got a bit ugly on the ASX on Wednesday with the benchmark ASX 200 index taking another big hit, this time by 1.32%.

The sell-off came after Trump ruled that Australia wouldn’t be getting any exemptions from his tariffs on steel and aluminium exports. These tariffs are now set to start hammering Australian businesses from this afternoon.

Adding fuel to the fire, PM Albanese revealed that Trump had flat-out ignored his calls before making the final decision. Albanese called the move “unjustified” and a slap in the face to the long-standing relationship between the two countries.

But Tom Wickenden at Betashares said Australia’s exports of steel and aluminium to the US account for only about $1bn, or 5% of the total export value – and will likely have minimal impact.

“Australia’s largest exports to the US are services based rather than physical goods or materials, and should therefore not be impacted by the proposed tariffs,” Wickenden said.

Today’s market downturn, meanwhile wasn’t a blip.

The losses on the ASX have piled up over the last few days, pushing the market closer into correction territory, ie: 10% below its record high from February.

“Right now investors are heavily moving out of high-risk growth stocks and tech names, and parking money in healthcare, agriculture, and real estate investment trusts, as these sectors are more stable,” said Moomoo’s Jessica Amir.

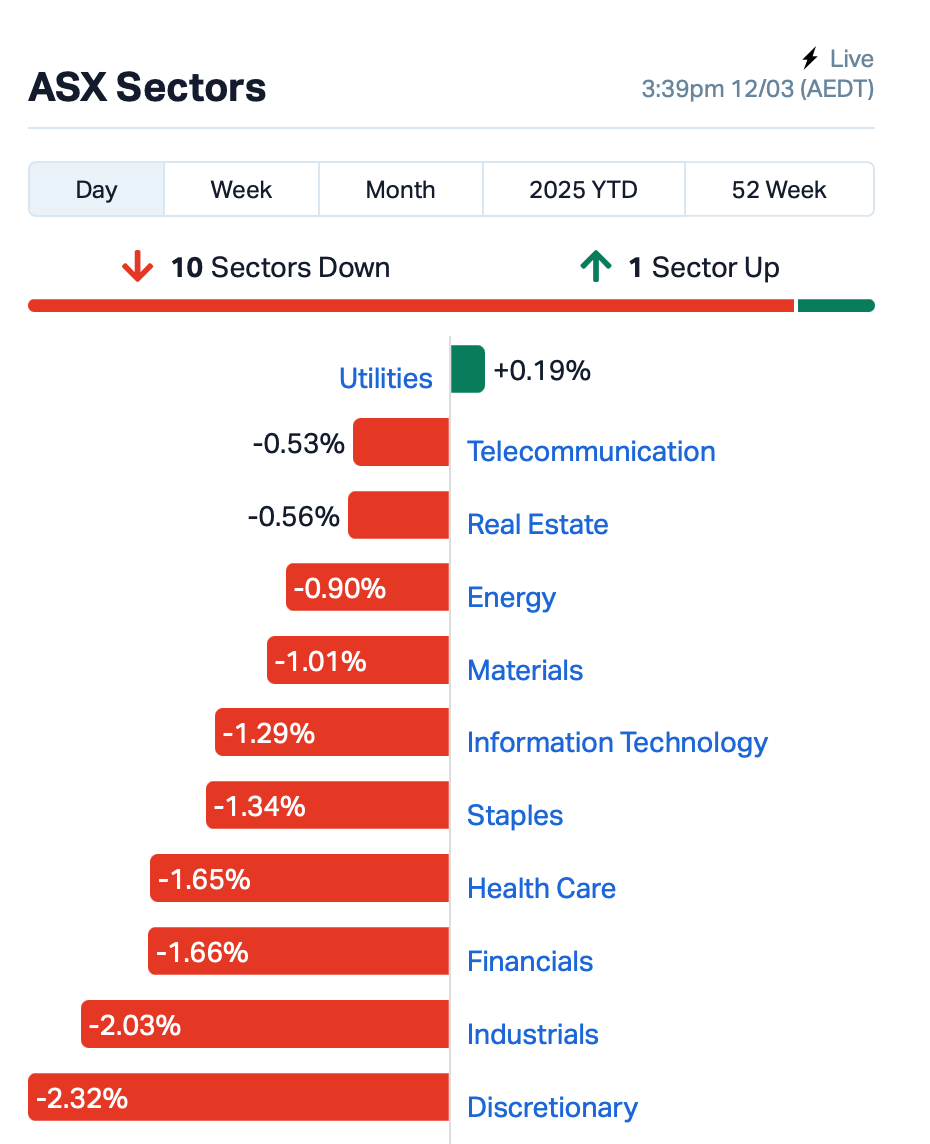

Of the 11 sectors that make up the ASX, only one managed to stay in the green, while the rest of them bled red.

The consumer discretionary sector copped it the hardest, while the banks weren’t far behind.

Goldies were the only sector showing signs of life.

In the large caps space, Rio Tinto (ASX:RIO) was pummelled on the tariff news, down by 2.3%. The company also announced it was looking to sell off up to US$9 billion worth of bonds to cover the cost of buying Arcadium Lithium.

Nickel Industries (ASX:NIC), the top dog in pure-play nickel production listed on the ASX, made a solid rebound, bouncing back 7% after losing nearly a quarter of its value yesterday on tax hike news from Indonesia.

IPH (ASX:IPH), the patent and trademark firm dropped 10%, becoming the worst performer on the ASX 200 today. The company announced that its long-time CFO, John Wadley, was stepping down.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap FRS Forrestania Resources 0.037 61% 7,023,499 $6,036,453 88E 88 Energy Ltd 0.002 50% 22,311,038 $28,933,812 CTO Citigold Corp Ltd 0.005 43% 2,323,151 $10,500,000 BYH Bryah Resources Ltd 0.004 33% 5,693,246 $1,880,402 H2G Greenhy2 Limited 0.004 33% 8,311,935 $1,794,553 DGR DGR Global Ltd 0.009 29% 758,317 $7,305,872 ASR Asra Minerals Ltd 0.003 25% 300,000 $4,746,254 LNR Lanthanein Resources 0.003 25% 10,000,000 $4,887,272 RGL Riversgold 0.005 25% 7,550,028 $6,734,850 TAS Tasman Resources Ltd 0.005 25% 858,305 $3,220,998 ABE Ausbondexchange 0.029 21% 112,648 $2,704,035 T3D 333D Limited 0.006 20% 358,614 $880,917 EMH European Metals Hldg 0.190 19% 246,622 $33,191,153 CNJ Conico Ltd 0.007 17% 200,000 $1,424,924 PVT Pivotal Metals Ltd 0.007 17% 200,701 $5,443,355 SPQ Superior Resources 0.007 17% 116,661 $13,019,183 NMG New Murchison Gold 0.015 15% 79,930,797 $107,087,025 PR2 Piche Resources 0.070 15% 106,832 $5,092,847 AJX Alexium Int Group 0.008 14% 3,594 $11,105,001 ENV Enova Mining Limited 0.008 14% 21,390,749 $8,614,505 LIO Lion Energy Limited 0.016 14% 205,651 $6,330,348 MKL Mighty Kingdom Ltd 0.008 14% 75,000 $1,512,444 QXR Qx Resources Limited 0.004 14% 212,621 $4,585,272 GIB Gibb River Diamonds 0.041 14% 52,678 $7,722,340

Forrestania Resources (ASX:FRS) has successfully secured $500,910 through a placement of 20,036,400 shares at $0.025 each. The placement was made at a 29.7% premium to the recent 10-day average share price, showing strong backing from existing shareholders, directors and staff. The funds will go toward drilling at the Lady Lila prospect, where there’s an estimated resource of 24,000 ounces of gold and further exploration at the Ada Ann prospect.

Pivotal Metals’ (ASX:PVT) first full metallurgical testwork on its Horden Lake project in Quebec has confirmed the deposit’s massive potential. Copper recoveries were solid, hitting 87-94%, with high-grade concentrates produced. The testwork used simple, low-cost flotation methods, meaning lower risks and costs to get the project off the ground.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOK | Australian Oil. | 0.002 | -33% | 16,183 | $3,005,349 |

| ERA | Energy Resources | 0.002 | -33% | 503,868 | $1,216,188,722 |

| TON | Triton Min Ltd | 0.005 | -29% | 1,454,227 | $10,978,721 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 1,048,604 | $4,063,446 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 132,000 | $6,716,008 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 1,836,495 | $9,673,198 |

| LU7 | Lithium Universe Ltd | 0.007 | -22% | 1,910,608 | $7,073,817 |

| PSL | Paterson Resources | 0.007 | -22% | 40,000 | $4,104,341 |

| AVE | Avecho Biotech Ltd | 0.006 | -21% | 24,140,300 | $22,185,079 |

| APC | APC Minerals | 0.012 | -20% | 4,425 | $1,757,597 |

| TOU | Tlou Energy Ltd | 0.012 | -20% | 1,829,572 | $19,478,765 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 1,248,969 | $10,601,880 |

| BLZ | Blaze Minerals Ltd | 0.002 | -20% | 10,000 | $3,917,370 |

| NTM | Nt Minerals Limited | 0.002 | -20% | 3,775,125 | $3,027,257 |

| OSL | Oncosil Medical | 0.004 | -20% | 3,054,333 | $23,032,901 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 337,514 | $11,683,736 |

| ASB | Austal Limited | 3.615 | -20% | 16,611,322 | $1,634,783,882 |

| AVD | Avada Group Limited | 0.370 | -20% | 39,267 | $39,070,112 |

| PEK | Peak Rare Earths Ltd | 0.097 | -19% | 1,065,675 | $42,251,293 |

| X2M | X2M Connect Limited | 0.017 | -19% | 1,632,854 | $7,945,166 |

| G88 | Golden Mile Res Ltd | 0.009 | -18% | 188,235 | $5,986,726 |

| TGH | Terragen | 0.025 | -17% | 160,507 | $15,150,515 |

| ADY | Admiralty Resources. | 0.005 | -17% | 2,800,000 | $15,776,876 |

| NC6 | Nanollose Limited | 0.033 | -15% | 377,520 | $9,079,290 |

IN CASE YOU MISSED IT

Mount Hope Mining (ASX:MHM) has reprocessed aeromagnetic data and uncovered several promising copper targets near historic mines at its Mount Hope project in NSW’s Cobar region. With these new insights, the company is fine-tuning its drill targets and getting ready to kick off its maiden drilling program.

Arika Resources (ASX:ARI) has struck significant shallow gold at its Queen of the May prospect, with standout hits such as 20m at 1.62 g/t gold from 28m. With more assays pending and follow-up drilling planned, the company is aggressively expanding its footprint in the underexplored Laverton gold field.

Victory Metals’ (ASX:VTM) scoping study confirms North Stanmore as a world-class rare earths and scandium project with a 31-year mine life and a strong $1.2 billion NPV. With low costs, high recoveries, and growing offtaker interest, the company is targeting project commissioning by Q3, 2028.

At Stockhead, we tell it like it is. While Mount Hope Mining, Arika Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.