Closing Bell: ASX in disgrace after crashing to 12-month low

Via Getty

- Benchmark ASX index ends -0.6 lower

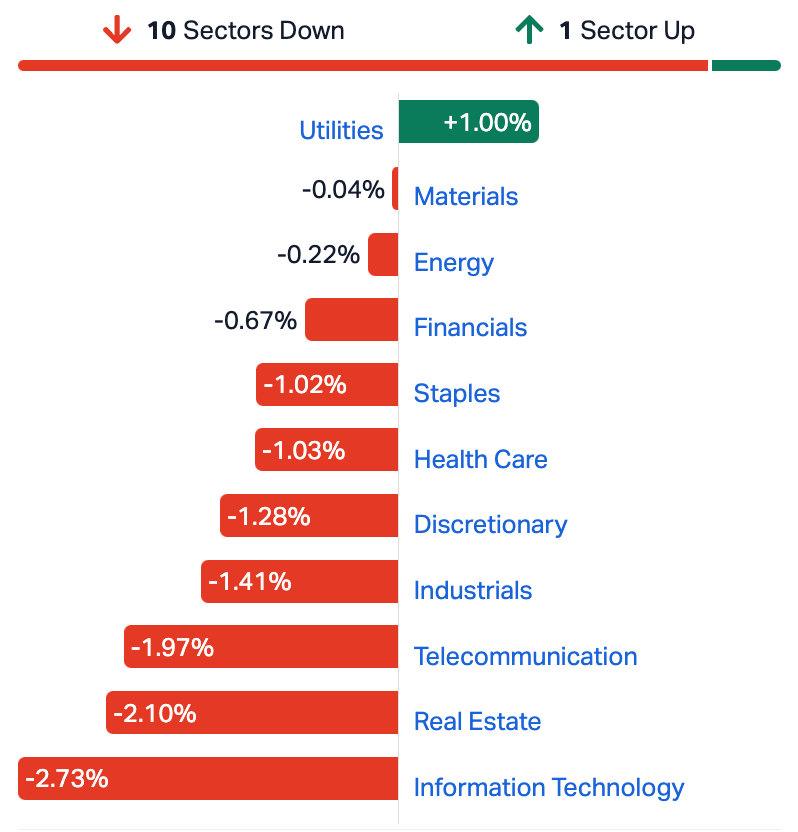

- Utilities only sector in the green

- Small caps led by LSA, AZS

The ASX200 has closed 42 points (-0.61%) lower on Thursday.

May as well get you a pic. I’ll point out the important bits…

ASX200 ON THURSDAY

The benchmark, in fact, has crashed to a new 12-month disgrace after Wednesday’s awful inflation announcement and the awful truth an RBA rate hike seems inevitable.

Today’s intraday low for the ASX200 of 6777.4 was one point above the 6776 low of the 28th of this month last year.

The big news at the top end of town on Thursday was the $1.6bn buyout deal of Azure Minerals by SQM, covered with some glory I might add by our Josh Chiat.

Now there’s rumours abroad that Gina Rinehart – that scuttler of deals such as Albemarle’s $6.6bn takeover bid of Liontown – is amassing a significant stake, buying up through Euroz Hartleys Group.

Shares in Azure are up more than 45%. More of that downstairs.

Tony Sycamore at IG Markets says just two weeks ago, the Australian interest rate market was pricing in just a 5% chance of an RBA rate rise in November:

“Following yesterday’s inflation update and a week of hawkish RBA communique, a 25bp rate rise on Melbourne Cup Day now appears a formality.”

The prospect of higher mortgage payments for households already straining under the cost-of-living pressure weighed on consumer-facing stocks on Thursday.

Myer Holdings lost 4% to $0.48c, Aristocrat Leisure fell 3.37% to $39.01, Domino’s Pizza lost 2.82% to $49.95, and Kogan’s fell 2.67% to $4.73.

It was the same tune for most consumer-facing stocks and the banks that trouble them as higher interest rates lead to a higher portion of households falling behind in mortgage payments.

Westpac led a bad day for the biggest Aussie banks – all four are smaller on Thursday – after the oldest of them warned the ASX of a looming $173m hit to quarterly profits.

Wall Street declined, led by Nasdaq’s 2.4 per cent drop – its biggest fall since February – after Google owner Alphabet recorded its worst one-day loss despite posting better than expected quarterly earnings.

The Shanghai Composite and the Shenzhen Component are both steadily lower, putting an end to a brief two-day run after the tech selloff in New York. The news that China’s most problematic and debt-ridden developer Country Garden fell into in default has hit the Chinese market.

Further afield, commodity traders are eyeballing the economic outlook in China following news that the government has pledged to issue 1 trillion yuan in supplementary bonds for disaster relief and infrastructure enhancement efforts.

The news of China’s National People’s Congress green lighting a mid-year expansion of its budget for the first time since the Asian Financial crisis in 1998 has helped the iron ore players with the three big names all higher.

Tony says any hopes that yesterday’s solid earnings report from Microsoft would offset Alphabet’s disappointing cloud revenues and rising bond yields ‘proved futile’ as the Nasdaq ended 2.5% lower overnight.

ASX-listed IT stocks followed suit, led by Megaport (ASX:MP1), which has plunged near 20%.

The tech sector is just awful. Down 2.7% today.

ASX SECTORS ON WEDNESDAY

RANDOM SMALL CAP WRAP

Oleg Vornik’s DroneShield (ASX:DRO), the Aussie counter-drone equipment maker, is heading to Kyiv, deploying to Ukraine under the latest Aussie Government aid package.

Oleg says DRO’s received ‘multiple orders from the Australian Government as part of a $20mn military assistance package to Ukraine.’

DRO is delivering well over half of that entire package – a total value to DroneShield of $10.4mn.

Some $5 million of cash receipts from the $10.4 million total was included in the record $48.2 million cash receipts YTD to 20 October, announced earlier this week in DRO’s quarterly 4C release. The remaining cash receipts are expected to come in before year end.

People who liked the news:

The Hon Anthony Albanese, Prime Minister of Australia:

“This contribution will provide Ukraine with some of the best capabilities in the world, while investing in Australia’s sovereign defence industry and technology sector.”

The Hon Richard Marles, Deputy Prime Minister of Australia and Minister for Defence:

“Australia continues to stand with Ukraine as we work with our partners to support Ukraine’s sovereignty and territorial integrity.”

And Oleg:

”Russian drone attacks on Ukraine have been a regular occurrence since the start of the war. DroneShield is pleased to be supplying our drone detection and defeat systems to Ukraine under this sovereign aid package.”

US FUTURES AT 1300 IN NEW YORK

RIPPED FROM THE HEADLINES

It’s gone nuts in Singapore.

That’s where news has escaped that the seasonally adjusted jobless rate has burst skyward – hitting a full 2.0% in the third quarter, up from 1.9% in the previous period. That’s the highest level since well, around this time last year.

There could also be a sprinkle of nuts now that Cameron England at The Australian has the latest scoop on Sara Lee, where sales of those pretty yummy-in-the-tummy desserts have surged in the wake of last week’s nightmare news that the cake-making geniuses had been placed in administration.

Cameron says the good news is there’s some 50 potential buyers signing up to show interest in saving the operation – that’s according to FTI Consulting the voluntary administrators running the cake sale.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.0015 | 50% | 3,039,397 | $2,133,790 |

| CLE | Cyclone Metals | 0.0015 | 50% | 10,716,539 | $10,264,505 |

| CRS | Caprice Resources | 0.036 | 44% | 460,234 | $2,918,923 |

| AZS | Azure Minerals | 3.5 | 43% | 80,258,613 | $1,087,665,095 |

| LSA | Lachlan Star Ltd | 0.095 | 40% | 1,312,373 | $14,114,977 |

| NC6 | Nanollose Limited | 0.045 | 36% | 44,753 | $4,913,250 |

| PNX | PNX Metals Limited | 0.004 | 33% | 2,661,562 | $16,141,874 |

| SEG | Sports Ent Grp Ltd | 0.24 | 33% | 65,571 | $47,000,165 |

| NAG | Nagambie Resources | 0.022 | 29% | 1,302,588 | $9,889,347 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,350,000 | $6,727,274 |

| MHK | Metalhawk. | 0.11 | 25% | 354,310 | $6,931,849 |

| BNR | Bulletin Res Ltd | 0.13 | 24% | 2,554,135 | $30,827,066 |

| HRE | Heavy Rare Earths | 0.07 | 23% | 332,392 | $3,447,812 |

| MAU | Magnetic Resources | 0.49 | 23% | 1,081 | $8,167,545 |

| 1MC | Morella Corporation | 0.006 | 20% | 2,106,538 | $30,693,279 |

| DCL | Domacom Limited | 0.012 | 20% | 139,855 | $4,355,018 |

| LVT | Livetiles Limited | 0.006 | 20% | 2,578,129 | $5,885,553 |

| MTL | Mantle Minerals Ltd | 0.003 | 20% | 3,750,034 | $15,368,615 |

| SWP | Swoop Holdings Ltd | 0.215 | 19% | 70,080 | $37,477,609 |

| HAR | Harangaresources | 0.16 | 19% | 331,890 | $8,884,893 |

| WA1 | Wa1Resourcesltd | 6.63 | 18% | 1,712,823 | $238,138,320 |

| DVL | Dorsavi Ltd | 0.013 | 18% | 46,120 | $6,123,278 |

| GW1 | Greenwing Resources | 0.135 | 17% | 784,589 | $20,038,920 |

| BFC | Beston Global Ltd | 0.007 | 17% | 70,000 | $11,982,281 |

| NVQ | Noviqtech Limited | 0.0035 | 17% | 160,000 | $3,714,586 |

Lachlan Star (ASX:LSA) has been a huge beneficiary now DevEx Resources (ASX:DEV) has done with the canny sale of its portfolio of copper-gold exploration assets in the Lachlan Fold Belt to LSA.

In a great deal for DEV as well, the company gets 75,672,720 ordinary shares in LSA for a deemed value of $7.5 million (representing a holding of 36.46%) plus a 2% net smelter royalty.

DevEx’s Managing Director Brendan Bradley, and Executive Director Stacey Apostolou, will also join the board of LSA.

“The sale of our NSW copper-gold assets to Lachlan Star allows us to focus on the exciting emerging discoveries we have at the Nabarlek Uranium Project in the NT and Kennedy Ionic Clay-hosted REE Project in Queensland.

“The transaction will see the copper-gold portfolio become the key focus for Lachlan Star, with DevEx retaining exposure to the significant upside of these assets through our 36% shareholding,” Bradley said this morning.

Azure Minerals (ASX:AZS) is, of, course having a big day.

Really, the place for all knowledge around this is the work of our Josh Chiat, who says AZS shareholders will net a 1430% gain if they take up a massive offer lobbed in by shareholder lithium monster, SQM.

The Chilean miner is offering $3.52 cash per share to take the 60% owner of the Andover lithium discovery in WA’s north off the market.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.004 | -38% | 172,760,493 | $22,730,328 |

| CHK | Cohiba Min Ltd | 0.002 | -33% | 1,045,766 | $6,639,733 |

| GCR | Golden Cross | 0.002 | -33% | 168,919 | $3,291,768 |

| HAL | Halo Technologies | 0.14 | -30% | 788,652 | $25,899,043 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 1,262,525 | $15,569,766 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 1,142,275 | $8,855,936 |

| SIS | Simble Solutions | 0.003 | -25% | 1,132,461 | $2,411,803 |

| ADD | Adavale Resource Ltd | 0.008 | -20% | 4,047,107 | $7,303,693 |

| ADS | Adslot Ltd. | 0.004 | -20% | 1,675,038 | $16,122,478 |

| LNU | Linius Tech Limited | 0.002 | -20% | 41,952,252 | $11,305,727 |

| TMG | Trigg Minerals Ltd | 0.008 | -20% | 584,005 | $2,493,846 |

| YPB | YPB Group Ltd | 0.002 | -20% | 1 | $1,858,654 |

| ZAG | Zuleika Gold Ltd | 0.014 | -18% | 350,000 | $8,891,861 |

| MP1 | Megaport Limited | 9.52 | -17% | 6,065,261 | $1,830,817,593 |

| FAU | First Au Ltd | 0.0025 | -17% | 2,020,026 | $4,355,980 |

| FHS | Freehill Mining Ltd. | 0.0025 | -17% | 528,131 | $8,534,403 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 125,000 | $78,400,214 |

| MGT | Magnetite Mines | 0.34 | -16% | 199,868 | $31,089,845 |

| SLZ | Sultan Resources Ltd | 0.017 | -15% | 905,335 | $2,963,801 |

| BPM | BPM Minerals | 0.07 | -15% | 179,605 | $5,409,722 |

| WML | Woomera Mining Ltd | 0.009 | -14% | 4,251,023 | $10,040,043 |

| ASR | Asra Minerals Ltd | 0.006 | -14% | 37,893 | $10,126,460 |

| AVM | Advance Metals Ltd | 0.003 | -14% | 500,000 | $2,059,956 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 250,000 | $9,096,537 |

| EEL | Enrg Elements Ltd | 0.006 | -14% | 784,903 | $7,069,755 |

TRADING HALTS

Webcentral Group (ASX:WCG) – Pending an announcement by Webcentral in relation to a business and assets sale transaction

Income Asset Management Group (ASX:IAM) – Pending a capital raising by way of placement

Omnia Metals (ASX:OM1) – Pending the release of an announcement regarding a material acquisition

Iris Metals (ASX:IR1) – Pending an announcement by the company to the market regarding material exploration findings from a diamond drilling program

Findi (ASX:FND) – Pending an announcement by Findi in relation to the execution of a contract that will have a material impact on earnings

Industrial Minerals (ASX:IND) – Pending release of an announcement in relation to a proposed project acquisition

Paterson Resources (ASX:PSL) – Pending an announcement in relation to a capital raising

SportsHero (ASX:SHO) – Pending an announcement concerning a capital raising

Carnavale Resources (ASX:CAV) – Pending an announcement regarding exploration results from drilling at the Company’s Kookynie Gold Project

Sabre Resources (ASX:SBR) – Pending an announcement to the market in relation to a capital raising

Mineral Commodities (ASX:MRC) – Requested as the company expects to make an announcement in connection with an accelerated non-renounceable entitlement offer

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.