Closing Bell: ASX hits rare air on US-Australian critical minerals deal

You don't see this every day: The ASX 200 powered up 0.7pc to a new closing high. Pic: Getty Images

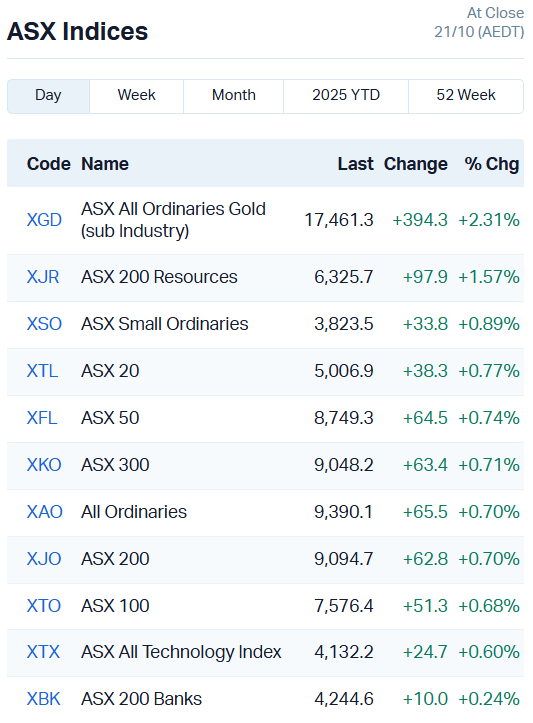

- ASX closes at new high of 9094 points, up 0.7pc

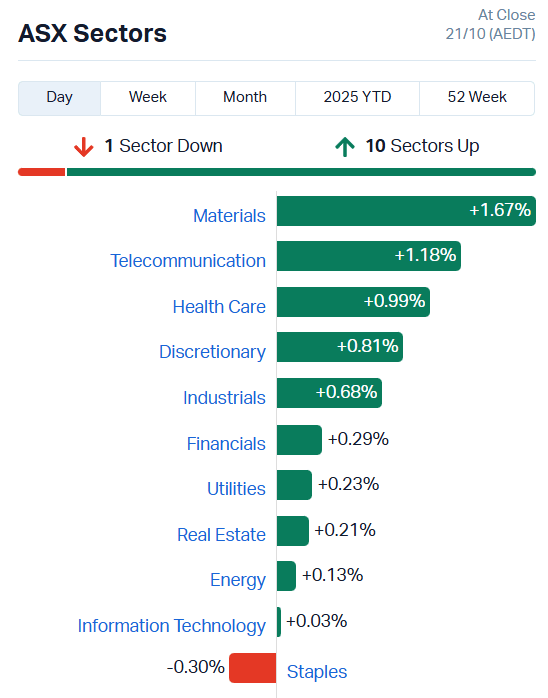

- Broad momentum across sectors with 10 of 11 higher

- US-Australian critical mineral deals fuel more resource stock gains

ASX roars to new highs on US-Australia rare earths deal

The ASX 200 set both an intraday and closing high today.

The bourse pushed as high as 9115 points just after midday and held onto most of those gains to close out at 9094.7 points.

Overall, the market gained 0.7% or 62.8 points, mostly driven by wins in the materials sector.

The big news today we all woke up to was the US-Australia critical minerals deal, the result of a much overdue meeting between US President Trump and our own prime minister.

The meat of the deal involved the creation of a formal US-Australian supply chain framework around critical minerals and rare earths with a focus on defence and security applications.

“US and Australia will take measures to each provide at least US$1 billion in investments towards an US$8.5 billion pipeline of priority critical minerals projects in Australia and the United States over the next six months,” Prime Minister Anthony Albanese said.

Tapped to directly benefit from the deal was Alcoa’s (ASX:AAI) Wagerup gallium recovery program and Arafura Rare Earth’s (ASX:ARU) Nolans project in the NT.

Both will be on the receiving end of direct government investment as well as offtake options that will include price basements for critical minerals.

ARU’s shares bounced 20% before returning to neutral, while AAI added 7.5% by end of trade.

Outside of resources, the telecom and healthcare sectors closed out a solid day.

REA Group (ASX:REA) climbed 3.35% and Seek (ASX:SEK) added 1.5%.

PolyNovo (ASX:PNV) is up 6.38%, Immutep (ASX:IMM) added 5.17% and Dimerix (ASX:DXB) 6.8%.

Only consumer staples lost ground.

Endeavour Group (ASX:EDV) slipped 1.39%, Treasury Wine Estates (ASX:TWE) 1.27% and Bega Cheese (ASX:BGA) 1.86%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GSS | Genetic Signatures | 0.4 | 67% | 1024145 | $54,513,319 |

| TAS | Tasman Resources Ltd | 0.023 | 44% | 2499343 | $4,469,644 |

| EMU | EMU NL | 0.044 | 38% | 1733717 | $7,909,297 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 7290424 | $10,372,811 |

| CR1 | Constellation Res | 0.25 | 32% | 496150 | $15,274,945 |

| NIM | Nimyresourceslimited | 0.094 | 29% | 5261847 | $19,820,239 |

| PVT | Pivotal Metals Ltd | 0.019 | 27% | 13352999 | $13,608,388 |

| CMG | Criticalmineralgrp | 0.2 | 25% | 174361 | $14,487,098 |

| DSM | Desertmineralsltd | 0.25 | 25% | 2705544 | $5,000,012 |

| ERA | Energy Resources | 0.0025 | 25% | 3882461 | $810,792,482 |

| GGE | Grand Gulf Energy | 0.0025 | 25% | 1666666 | $5,640,850 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 614602 | $3,674,173 |

| MRD | Mount Ridley Mines | 0.005 | 25% | 2169162 | $3,962,868 |

| PLCR | Premier1 Lithium Ltd | 0.0025 | 25% | 739838 | $736,121 |

| RAN | Range International | 0.005 | 25% | 3117263 | $4,317,161 |

| ROG | Red Sky Energy. | 0.005 | 25% | 23000 | $21,688,909 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 1496561 | $23,794,766 |

| WYX | Western Yilgarn NL | 0.054 | 23% | 1542849 | $6,907,347 |

| DUN | Dundasminerals | 0.049 | 23% | 892616 | $4,288,734 |

| UNT | Unith Ltd | 0.011 | 22% | 3634341 | $13,671,978 |

| ATR | Astron Ltd | 0.85 | 21% | 1011880 | $293,410,256 |

| MHM | Mount Hope | 0.235 | 21% | 12452306 | $5,881,200 |

| EXT | Excite Technology | 0.012 | 20% | 20611305 | $20,726,419 |

| GES | Genesis Resources | 0.012 | 20% | 50018 | $7,828,413 |

| YAR | Yari Minerals Ltd | 0.012 | 20% | 14455728 | $8,394,638 |

In the news…

Genetic Signatures (ASX:GSS) is building revenue momentum, achieving a 15% sales increase year-on-year in its latest quarterly report. The molecular diagnostic test specialist is enjoying particularly high growth in Europe, the Middle East and Africa, with gastrointestinal testing up 52%.

Tasman Resources (ASX:TAS) has locked in commitments to raise $2 million in a placement to support a drilling program at the Parkinson Dam project. TAS is targeting gold, silver, copper and base metals.

Freehill Mining (ASX:FHS) has successfully improved iron ore from the Yerbas Buenas project to a grade of up to 71.7%. The company ground the 400kg bulk sample to 3mm and ran it through a 35Hz magnetic drum, and secondly through a 45Hz drum.

Desert Minerals (ASX:DSM) has officially listed to the ASX after a successful IPO that raise $5 million at $0.20 per share.

DSM is exploring two projects; the Mt Monger gold project in WA and the Scotty lithium project in Nevada, US. The company welcomed a cornerstone investment from Nasdaq-listed Snow Lake Energy Ltd.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| C7A | Clara Resources | 0.004 | -33% | 55228799 | $4,459,770 |

| NTM | Nt Minerals Limited | 0.002 | -33% | 212196 | $3,632,709 |

| MIO | Macarthur Minerals | 0.053 | -33% | 225246 | $25,078,245 |

| MKR | Manuka Resources. | 0.071 | -24% | 33344864 | $99,266,791 |

| NVA | Nova Minerals Ltd | 1.115 | -23% | 5808744 | $590,033,055 |

| ADR | Adherium Ltd | 0.004 | -20% | 252340 | $9,315,873 |

| PIL | Peppermint Inv Ltd | 0.004 | -20% | 5999616 | $12,545,104 |

| SER | Strategic Energy | 0.008 | -20% | 20607292 | $10,989,333 |

| VEN | Vintage Energy | 0.004 | -20% | 50000 | $10,434,568 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 451183 | $8,447,870 |

| SHN | Sunshine Metals Ltd | 0.025 | -19% | 27897188 | $77,549,967 |

| RMX | Red Mount Min Ltd | 0.035 | -19% | 42459569 | $33,346,256 |

| KLR | Kaili Resources Ltd | 0.205 | -18% | 1154636 | $36,850,091 |

| BEZ | Besragoldinc | 0.07 | -17% | 1063131 | $34,902,334 |

| C29 | C29Metalslimited | 0.025 | -17% | 112720 | $5,225,647 |

| GWR | GWR Group Ltd | 0.1 | -17% | 2446307 | $38,832,799 |

| EMT | Emetals Limited | 0.005 | -17% | 4680730 | $5,100,000 |

| TMX | Terrain Minerals | 0.005 | -17% | 7194625 | $16,090,886 |

| DTR | Dateline Resources | 0.36 | -16% | 35088806 | $1,468,623,783 |

| ICR | Intelicare Holdings | 0.022 | -15% | 1926896 | $15,808,576 |

| EUR | European Lithium Ltd | 0.285 | -15% | 35415257 | $505,029,300 |

| NAE | New Age Exploration | 0.003 | -14% | 3575000 | $9,470,690 |

| RNX | Renegade Exploration | 0.006 | -14% | 7979879 | $14,488,577 |

| SIS | Simble Solutions | 0.006 | -14% | 7225607 | $7,618,312 |

| SRJ | SRJ Technologies | 0.019 | -14% | 2413667 | $30,341,191 |

In Case You Missed It

Pure Hydrogen (ASX:PH2) has secured a $2.5m loan facility that provides it with immediate liquidity to support growth initiatives for its zero emissions vehicles.

Victory Metals (ASX:VTM) has materially increased the grades of three important heavy rare earths from its North Stanmore project with a simple separation process.

Challenger Gold (ASX:CEL) has secured contracts with Orica and Thor S.A. to start drill-and-blast services to de-risk the start of toll milling.

Export Finance Australia has thrown early support behind the Donald project of Astron (ASX:ATR), issuing a conditional letter of support for up to A$80m.

Latrobe Magnesium (ASX:LGM) has secured a letter of interest from the US Export-Import Bank to finance up to US$122 million for the company’s Stage 2 commercial plant in the Latrobe Valley.

Brightstar Resources’ (ASX:BTR) drilling backs push to develop Yunndaga as its third underground gold mine with production starting in 2026.

Trek Metals’ (ASX:TKM) confidence in the Christmas Creek gold system has been boosted by visible gold in maiden diamond core drilling.

Energy Transition Minerals (ASX:ETM) has been ruled preferred and successful buyer for the Penouta tin-tantalum-niobium mine, setting the stage for production to restart.

MST Access has placed a 16c price target on Investigator Resources (ASX:IVR), calling its Paris project the standout build-ready silver development in Australia right now.

Neurizon Therapeutics (ASX:NUZ) has secured a new Australian patent for its lead drug candidate, NUZ-001.

Power Minerals (ASX:PNN) is looking to extend the mineralised footprint at Santa Anna niobium-rare earth element project in Brazil with a third round of drilling.

Mount Hope Mining (ASX:MHM) has struck gold in maiden drilling at the Mt Solitary prospect, pulling 19m at 4.5g/t from shallow depths including a standout 1m at 50g/t.

Greenvale Energy (ASX:GRV) has identified new cross-cutting fault structures and gas anomalies which align with existing uranium hits.

Trading halts

Alicanto Minerals Ltd (ASX:AQI) – cap raise

Australian Oil Company Ltd (ASX:AOK) – cap raise

Infini Resources Ltd (ASX:I88) – cap raise

Leeuwin Metals Ltd (ASX:LM1) – cap raise

LGI Limited (ASX:LGI) – cap raise

Omnia Metals Group Ltd (ASX:OM1) – cap raise

Spectur Ltd (ASX:SP3) – cap raise

SSH Group Ltd (ASX:SSH) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.