Closing Bell: ASX gallops as healthcare sector jumps, led by Invion

ASX hits record high again. Picture via Getty Images

- ASX hits record high, driven by consumer stocks

- Zip co-founder steps down, Collins Foods drops

- Invion doubles after commencing phase I/II trial

The ASX hit a new record on Tuesday, marking its third all-time high in just a week.

At the close, the S&P/ASX 200 was up by 0.56%, driven by gains in healthcare and consumer-related stocks, as new data today showed a 2.7% surge in Australian consumer confidence – its highest level since May 2022.

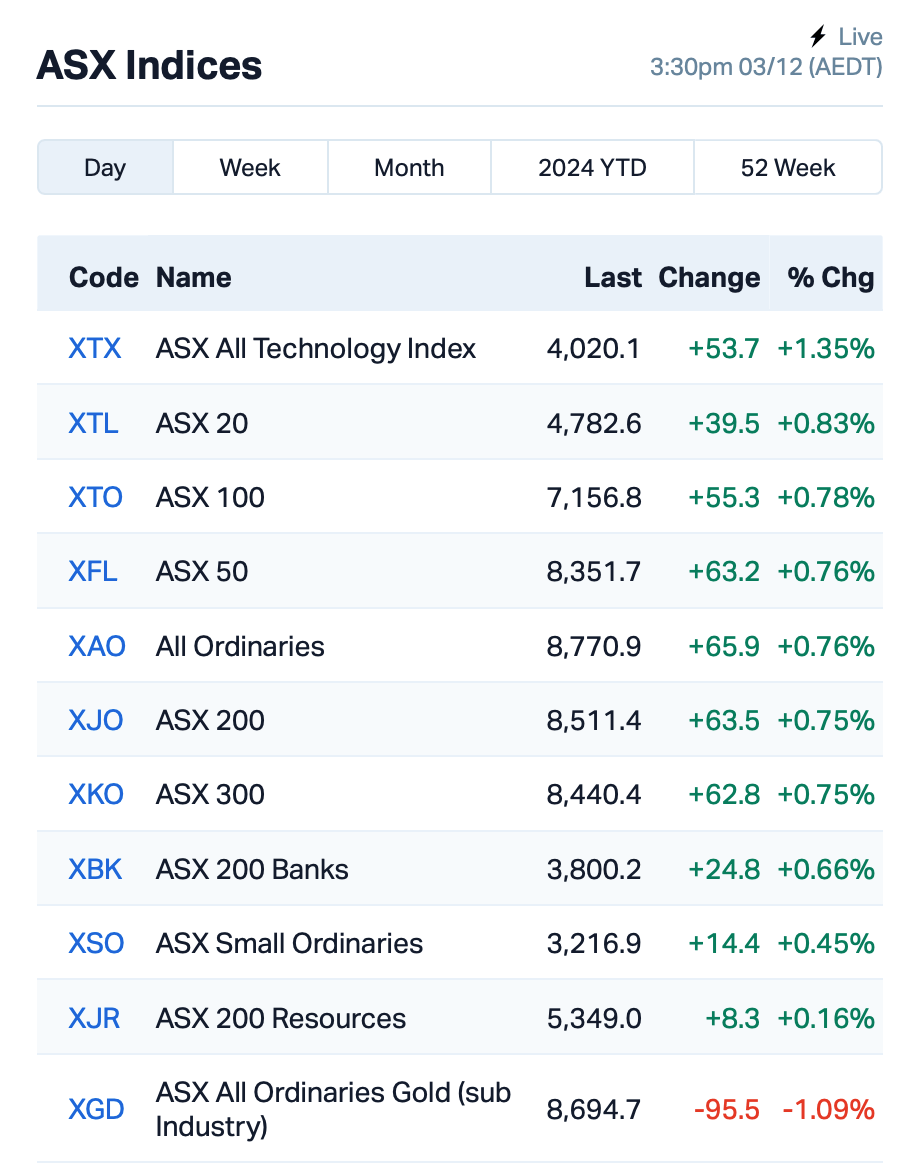

Here’s how the ASX stood at about 4pm AEDT:

In the large end of town, one of the biggest announcements today came from BNPL stock Zip Co (ASX:ZIP), which said that its co-founder and US chairman, Larry Diamond, is stepping down to focus on charitable work.

Diamond and Peter Gray started Zip in 2013, a year before Afterpay. He will remain a shareholder and may give advice on the company’s strategy, but will no longer be involved in day-to-day management. Zip’s shares were down around 1%.

Collins Foods (ASX:CKF), owner of KFC and Taco Bell, dropped 3.5% after lowering its FY25 earnings and dividend forecasts due to a tough consumer market and pressures on margins.

Star casino operator, Star Entertainment Group (ASX:SGR), rallied by 9.5% after announcing it has secured the first $100 million tranche of a new debt facility. This will result in a net cash increase of around $37.1 million after fees, boosting the company’s financial position.

And some good news from China today. The country’s central bank said it plans to maintain supportive monetary policies in 2025, aiming to boost economic growth and mitigate risks from a potential trade war with the US.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IVX | Invion Ltd | 0.360 | 100% | 774,715 | $12,370,080 |

| RIE | Riedel Resources Ltd | 0.002 | 100% | 1,000,637 | $2,223,836 |

| ION | Iondrive Limited | 0.021 | 75% | 54,291,979 | $8,502,090 |

| ERL | Empire Resources | 0.003 | 50% | 6,674,567 | $2,967,826 |

| 1TT | Thrive Tribe Tech | 0.002 | 33% | 1,600,000 | $1,055,042 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 899,422 | $9,507,891 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 498,138 | $1,794,553 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 1,043,931 | $2,415,749 |

| BDG | Black Dragon Gold | 0.024 | 33% | 3,603,375 | $5,433,889 |

| EUR | European Lithium Ltd | 0.061 | 33% | 9,361,804 | $64,313,641 |

| NC6 | Nanollose Limited | 0.029 | 32% | 18,326 | $3,784,140 |

| BUS | Bubalusresources | 0.140 | 27% | 697,399 | $4,000,068 |

| MX1 | Micro-X Limited | 0.069 | 25% | 4,305,039 | $31,988,207 |

| CUL | Cullen Resources | 0.005 | 25% | 280,000 | $2,773,607 |

| CZN | Corazon Ltd | 0.003 | 25% | 499,662 | $1,535,811 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1,200,021 | $12,314,111 |

| MEL | Metgasco Ltd | 0.005 | 25% | 121,100 | $5,830,347 |

| OLI | Oliver'S Real Food | 0.010 | 25% | 710,000 | $3,525,855 |

| PRM | Prominence Energy | 0.005 | 25% | 434,958 | $1,556,706 |

| TMK | TMK Energy Limited | 0.003 | 25% | 3,949,071 | $18,651,130 |

| VML | Vital Metals Limited | 0.003 | 25% | 18,906,180 | $11,790,134 |

| CRS | Caprice Resources | 0.022 | 22% | 3,348,452 | $7,415,162 |

| FRX | Flexiroam Limited | 0.011 | 22% | 855,195 | $7,070,794 |

| MTM | MTM Critical Metals | 0.110 | 22% | 20,507,875 | $36,594,790 |

Invion (ASX:IVX) rallied after the biotech announced the dosing of its first patient in a phase I/II trial for non-melanoma skin cancer (NMSC) using its drug INV043. The trial, conducted in Brisbane, aims to test the drug’s safety and effectiveness in treating skin cancer, a condition that makes up over 98% of all skin cancers globally. INV043 has shown promise in preclinical studies, potentially offering treatment with minimal scarring and pain, unlike current methods.

Read also Tim Boreham’s Let there be light (therapy). Invion up 160pc on skin cancer trial news

Diversified explorer Bubalus Resources (ASX:BUS) has been granted an option to acquire a portfolio of exploration licences in the heart of the Victorian goldfields, comprising highly prospective and drill-ready projects. The company has also welcomed Brendan Borg as a non-executive director, a geologist with extensive experience in the battery minerals sector.

Vital Metals (ASX:VML) rose after expanding its Nechalacho Rare Earths Project by staking an additional 25km² of land in Canada. This increases its total footprint to over 75km², boosting its potential for rare earths exploration. The new claims are fully owned by Vital’s Canadian subsidiary, Cheetah Resources.

Iondrive (ASX:ION) has completed a $6 million capital raise through the issue of new shares, priced at a 16.7% premium. The funds will be used to build a pilot plant for its battery recycling technology, which extracts critical minerals from old lithium-ion batteries using an environmentally sustainable process. Strong participation from institutional investors and key shareholders, including Terra Capital, Strata Investment Holdings, and Ilwella, has boosted confidence in Iondrive’s commercial prospects.

Corazon Mining (ASX:CZN) has started an aerial geophysical survey at its MacBride base and precious metals project in Canada, aiming to identify drill targets for early 2025. The survey will focus on areas with potential for copper-zinc-gold-silver deposits, including extensions of known deposits and new unexplored areas. The data from this modern, high-tech survey will help define precise drilling targets and could speed up exploration. The project is located in Manitoba’s Lynn Lake district, a historically rich mining area with potential for significant mineral discoveries.

Micro-X (ASX:MX1) has responded to a US government website publication stating that its US subsidiary, Micro-X Inc, has been awarded an $8.15 million development contract. The company confirms it is in advanced discussions with a US agency but has not yet received a fully executed contract.

Caprice Resources (ASX:CRS) has started exploration at its Cuddingwarra gold project in WA’s Murchison Gold Fields, where visible gold has been found in quartz reefs above a high-priority target, CUD-GPX01. This target shares similar structural features with nearby gold deposits, such as Westgold’s Cue gold mines. The project covers a 10km mineralised corridor, with drilling planned after further surface sampling.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.001 | -50% | 250,000 | $9,395,940 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,869,172 | $9,296,169 |

| VPR | Voltgroupltd | 0.001 | -33% | 32,505 | $16,074,312 |

| DAF | Discovery Alaska Ltd | 0.013 | -28% | 63,846 | $4,216,225 |

| ASR | Asra Minerals Ltd | 0.003 | -25% | 20,694 | $9,250,410 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 5,059,212 | $11,649,361 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 687,500 | $2,013,147 |

| CAV | Carnavale Resources | 0.003 | -25% | 8,344,166 | $16,360,874 |

| MOM | Moab Minerals Ltd | 0.003 | -25% | 212,333 | $3,571,435 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 7,287,765 | $5,635,721 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 210,296 | $9,673,198 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 257,497 | $13,151,701 |

| PGD | Peregrine Gold | 0.120 | -20% | 238,500 | $10,181,763 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 693,249 | $1,956,751 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 15,484 | $13,474,426 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 41,000 | $5,884,982 |

| AMS | Atomos | 0.012 | -18% | 7,474,778 | $17,010,259 |

| OD6 | Od6Metalsltd | 0.030 | -17% | 416,310 | $4,632,846 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 50,167 | $3,671,296 |

| AS2 | Askarimetalslimited | 0.010 | -17% | 5,427,986 | $2,560,254 |

| BMO | Bastion Minerals | 0.005 | -17% | 5,390,137 | $5,068,348 |

| ERA | Energy Resources | 0.003 | -17% | 2,572,223 | $1,216,188,722 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 1,795,820 | $3,895,612 |

IN CASE YOU MISSED IT

St George Mining (ASX:SGQ) is raising $3 million to fund exploration, including a planned drill program at its Mt Alexander project in WA, following up on lithium and gold targets discovered through surface sampling. The company is also finalising arrangements to secure the high-grade Araxá niobium-REE project in Minas Gerais, Brazil, with a further capital raise planned to fund the acquisition.

Sun Silver (ASX:SS1) has reported 16.76m at 494g/t gold in the inaugural drilling campaign at its Maverick deposit in Nevada, USA. The same hole returned antimony grades above 10,000ppm over 3.24m from 195.07m in hole MR24-205. Assays with antimony results exceeding the detection limit of 10,000ppm have been sent for re-assay to determine the mineralised concentration above this limit.

Also in Nevada, James Bay Minerals (ASX:JBY) has got the drills spinning at its new Independence gold play. The company is undertaking 2000m of diamond and reverse circulation drilling, with the DD program targeting extensions at depth and the RC program testing vertical continuity and resource growth.

Equinox Resources (ASX:EQN) is working through permitting applications to extract a 10,000t bulk sample from its Alturas antimony project in Canada for downstream testing and processing, a timely move as antimony prices have surged to US$38,500/t due to Chinese export restrictions.

Sunshine Metals (ASX:SHN) has kicked off geophysical surveys at the Coronation and Coronation South prospects within its Ravenswood Consolidated project in North Queensland, in an effort to ready-up Au-Cu targets to drill.

Soil sampling and field mapping have already been completed, with the geochemical and geophysical data to provide high-quality drill targets for testing in the new year.

Trigg Minerals (ASX:TMG) is utilising advanced UAV geophysical technology in its exploration efforts for antimony-gold mineralisation along the Bielsdown Fault, hosting the Wild Cattle Creek deposit, where the company is finalising a revised MRE.

The company believes the UAV surveys will help reduce drilling costs by minimising exploratory drilling in low-priority areas and ensuring resources are allocated efficiently and effectively.

At Stockhead, we tell it like it is. While St George Mining, Bubalus Resources, Sun Silver, James Bay Minerals, Equinox Resources, Sunshine Metals and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.