CLOSING BELL: ASX falters with no US market to copy today

See that bloke on the right? That's your risk assets portfolio, that is. (Getty Images)

- S&P/ASX 200 closes in the red today: -0.35%, as US stock markets enjoy a July 4 chili dog, or something

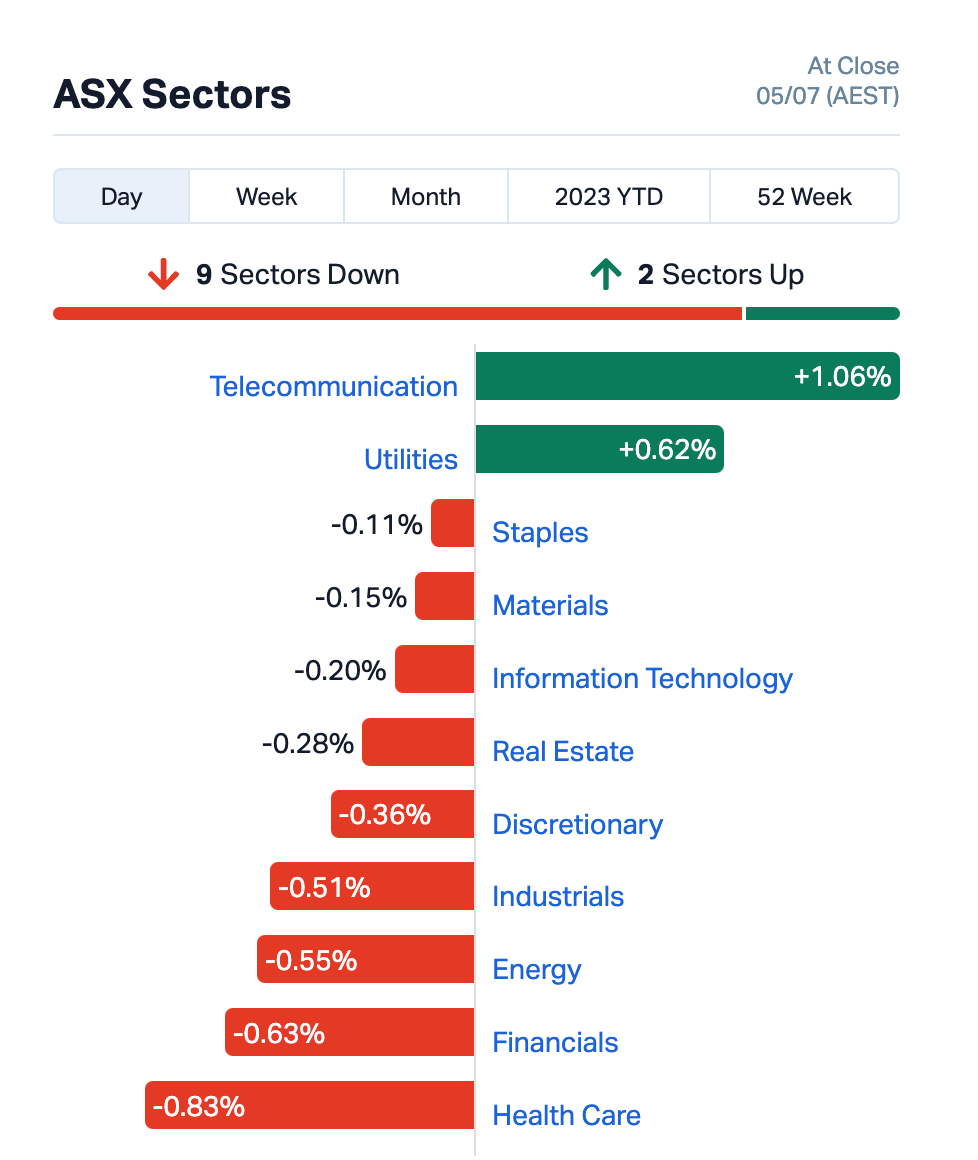

- Sectors-wise, Telcos are ringing in the gainz… annnd that’s about it. Okay, Utilities are going alright

- Standout stocks: Krakatoa Resources (ASX:KTA); Invion (ASX:IVX)

We hated it when the studious kid who used to sit next to us in Chemistry was away, or for some reason was moved by teacher to a different seat. Especially on test days.

It seems a bit like that on the ASX 200 today, as the US “Swotty Pants” Stock Markets are off for July 4 and celebrating their independence from Pomgolia and its sneering, rocks-in-glasshouses-tossing Lord’s toffs types. We know the feeling.

So… with no one decent to copy, the local bourse had to make up things itself today. And how did that turn out? Pretty piss-poor, really. It’s looking like a C- at best and “a bit of a chat” from Dad at some stage.

We’ll get to some specifics around all that in the school reports below. But first, a quick scan of some newsy headlines tells us:

• AMP (ASX:AMP) took a dive today (down about 5% at the time of typing). And that’s after it exited a trading halt, notifying investors it’s reviewing a Federal Court ruling that’s landed in favour of financial advisers who sought to challenge a controversial August 2019 overhaul of AMP’s “Buyer of Last Resort” policy.

AMP says it’ll provide an update on all this “in due course”.

• Where are those “tax the rich!” protestors from yesterday? Because, as the ABC reports, citing new PropTrack data, Australia’s rental crisis is getting even worse, with housing shortages squeezing rents higher.

Reportedly, median advertised rental prices have risen 2 per cent over the past quarter, to $520 a week and up about 12 per cent from just one year ago. Capital city rents are a whopping 17 per cent higher from June last year.

• Meanwhile, the Aussie dollar retreated a tad after weaker-than-anticipated Chinese economic data brought about some negative vibes. What are we rooting for now, then (er, as the Independence Day-celebrating Yanks would say)? The Chinese money printer to go BRRRR… basically, with a nice fat stimulus package.

“This provides further confirmation that the Chinese economy is slipping towards a double dip slowdown and that further stimulus measures are required to reverse the spiral,” said IG chief market strategist, Tony Sycamore today.

TO MARKETS

The ASX 200 went something, actually exactly, like this today, with a -0.35% close. Is it better to burn out than to fade away? We’ll take a fade in this instance.

Sector-wise, Telecommunications and Utilities both had something half decent to ring home about. Everything else, but particularly Financials and Health Care, were doing their best impression of Jonny Bairstow’s face. (In general. But particularly when he’s out stumped fair and square.)

Before we move on to the BIG winners of the day in small caps, in the slightly larger end of market cap town, we’re seeing…

• Lindian Resources (ASX:LIN): +13.3% on the following bit of news… The two-hole Phase 2 depth extension drill program at the Kangankunde Rare Earths project has been completed on schedule, meaning miners can hit the pub in time for the cricket or footy or darts or whatever. Footnote to this: A report says … “The second diamond-core drillhole was drilled north-to-south down the long axis of the mineralised system, reaching end-of-hole at its targeted depth of 1,000m.”

• Winsome Resources (ASX:WR1): +12% on no fresh news of note.

• Lindsay Australia (ASX:LAU): +11% on nothing totally new today, as it were, but investor sentiment is still riding high on the firm’s newly entered binding agreement to acquire leading rural merchandise retailer WB Hunter, for $34.6 million.

Head over to Large Caps, for more.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IVX | Invion Ltd | 0.008 | 78% | 6,832,348 | $28,897,345 |

| AUZ | Australian Mines Ltd | 0.035 | 75% | 13,993,303 | $12,743,114 |

| KTA | Krakatoa Resources | 0.04 | 74% | 111,814,516 | $8,357,661 |

| CAV | Carnavale Resources | 0.005 | 67% | 153,110,556 | $8,200,655 |

| YPB | YPB Group Ltd | 0.004 | 60% | 7,773,095 | $1,858,654 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 554,589 | $5,824,681 |

| MRQ | Mrg Metals Limited | 0.003 | 50% | 333,333 | $3,971,837 |

| MTB | Mount Burgess Mining | 0.006 | 50% | 72,102,806 | $3,532,684 |

| ARL | Ardea Resources Ltd | 0.665 | 49% | 2,437,996 | $76,493,174 |

| GTR | Gti Energy Ltd | 0.0085 | 42% | 26,087,379 | $11,686,525 |

| ANR | Anatara Ls Ltd | 0.039 | 39% | 226,300 | $3,357,872 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 28,337,672 | $11,409,104 |

| NC6 | Nanollose Limited | 0.073 | 30% | 108,220 | $8,337,637 |

| ACR | Acrux Limited | 0.058 | 29% | 1,173,471 | $12,967,896 |

| MRR | Minrex Resources Ltd | 0.018 | 29% | 11,485,832 | $15,188,145 |

| RGS | Regeneus Ltd | 0.009 | 29% | 360,000 | $2,145,058 |

| CXU | Cauldron Energy Ltd | 0.0075 | 25% | 1,201,244 | $5,589,412 |

| CWX | Carawine Resources | 0.15 | 25% | 62,011 | $23,618,096 |

| AD1 | AD1 Holdings Limited | 0.005 | 25% | 379,026 | $3,290,276 |

| ICN | Icon Energy Limited | 0.005 | 25% | 266,548 | $3,072,055 |

| RDN | Raiden Resources Ltd | 0.01 | 25% | 31,434,892 | $16,442,151 |

| SBR | Sabre Resources | 0.04 | 25% | 6,221,281 | $9,327,558 |

| TTTR | Titomic Limited | 0.005 | 25% | 4,986,862 | $2,198,708 |

| ICE | Icetana Limited | 0.043 | 23% | 121,342 | $6,976,495 |

| IBG | Ironbark Zinc Ltd | 0.011 | 22% | 9,997,270 | $13,201,058 |

Some standouts:

• Invion (ASX:IVX) : +78% > Invion is a clinical-stage life-sciences company leading global clinical development of the Photosoft technology for the treatment of cancers, atherosclerosis, and infectious diseases.

Today, it announces an Aussie patent for the Photosoft tech, building on previously granted patents and extending the tech’s IP for around another two decades. It’s planning to commence clinical trials regarding a lead compound INV043 before the end of this year.

• Krakatoa Resources (ASX:KTA): +74% > It was the “lithium boom” heard round the world,” wrote Gregor in today’s ASX Small Caps Lunch Wrap. The explorer hit peak assays of 4.3% Li2O, 1.7% Rb2O, and 0.5% Cs2O at its post-pivot King Tamba project, 80 clicks NW of Magnet Mountain in WA.

• Carnavale Resources (ASX:CAV): +67% > Bumper grades in RC drilling at the Kookynie gold project in WA have given CAV shares a lift today. “Spectacular results” and “RC drilling defines a significant new high-grade plunging gold zone at McTavish East,” reportedly.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LDX | Lumos Diagnostics | 0.093 | -40% | 53,032,013 | $47,960,112 |

| SAN | Sagalio Energy Ltd | 0.009 | -31% | 37,536 | $2,660,582 |

| AT1 | Atomo Diagnostics | 0.058 | -30% | 17,945,041 | $47,383,952 |

| FFT | Future First Tech | 0.007 | -30% | 4,752,145 | $7,148,366 |

| AUK | Aumake Limited | 0.003 | -25% | 446,784 | $5,949,038 |

| CCO | The Calmer Co Int | 0.003 | -25% | 3,859,363 | $1,779,110 |

| CLE | Cyclone Metals | 0.0015 | -25% | 1,108,712 | $20,529,010 |

| BDG | Black Dragon Gold | 0.028 | -22% | 200,000 | $7,224,122 |

| LRL | Labyrinth Resources | 0.008 | -20% | 845,625 | $9,594,873 |

| NZS | New Zealand Coastal | 0.002 | -20% | 18,227,392 | $4,135,025 |

| WFL | Wellfully Limited | 0.004 | -20% | 975,000 | $2,464,721 |

| NRX | Noronex Limited | 0.014 | -19% | 279,705 | $4,342,195 |

| EQS | Equitystorygroupltd | 0.045 | -18% | 134,226 | $2,233,814 |

| S66 | Star Combo | 0.09 | -18% | 260,095 | $14,859,128 |

| ADG | Adelong Gold Limited | 0.01 | -17% | 597,436 | $7,155,868 |

| OSM | Osmondresources | 0.16 | -16% | 46,446 | $7,540,890 |

| AW1 | Americanwestmetals | 0.165 | -15% | 13,884,968 | $58,239,016 |

| FRS | Forrestaniaresources | 0.11 | -15% | 1,033,390 | $11,510,567 |

| BFC | Beston Global Ltd | 0.011 | -15% | 4,590,222 | $25,961,610 |

| SRZ | Stellar Resources | 0.011 | -15% | 265,000 | $13,077,535 |

| AUQ | Alara Resources Ltd | 0.024 | -14% | 1,772,496 | $20,106,451 |

| AVM | Advance Metals Ltd | 0.006 | -14% | 747,150 | $4,119,911 |

| OAR | OAR Resources Ltd | 0.003 | -14% | 9,801,396 | $8,998,633 |

| TTI | Traffic Technologies | 0.012 | -14% | 82,612 | $10,607,383 |

| PYC | PYC Therapeutics | 0.069 | -14% | 3,685,890 | $273,320,280 |

LAST ORDERS

“Hey Rob, do you need help with that Last Orders section today, mate?”

“Nah, Gregor, all good – thought you were sick today? I’ve totally got it covered, but thanks.”

[Later, 20 mins before deadline]

“Actually, Gregor, if you wouldn’t mind…”

” First cab off the Last Orders rank today is a brand-spanking-new ETF offering from Global X, bearing the catchy title of “Global X Bloomberg Commodity ETF (Synthetic)” (ASX: BCOM), which is now live on the ASX.

Global X says this lovely new ETF “tracks the Bloomberg Commodity Index 3-Month Forward Excess Return and offers investors liquid exposure to a broad-based basket of soft and hard commodities, including energy, grains, precious metals, metals, and livestock”, so it’s a proper moveable feast.

It’s been specifically geared to let Aussie investors gain exposure to a well-diversified basket of commodities which are significant to the world economy and have low correlation with share and bond prices – all in a neat package to keep the trading fees low and, in general, just make things tons simpler.

“BCOM offers exposure to commodities which are some of the most significant to the global economy,” said Blair Hannon, Head of Investment Strategy with Global X. “They tend to have the largest and most liquid futures markets, making them easiest for investors to access.”

Importantly, commodities function as a natural hedge against inflation; their prices tend to rise when inflation is rising. For this reason, commodities can add protective benefits to a portfolio as inflation continues to prove persistent,” he continued.

Elsewhere, Ardea Resources (ASX:ARL) came out of the trading halt it called yesterday (citing a Pre-Feasibility Study from the Kalgoorlie nickel project Goongarrie Hub as the reason) with this very nifty piece of news.

The company has signed a non-binding MoU with a Japanese Consortium consisting of Sumitomo Metal Mining, Mitsubishi Corporation, and Mitsui & Co, to develop the aforementioned Kalgoorlie nickel project’s Goongarrie Hub.

Under the MoU, that consortium will work alongside Ardea to The Consortium is to first define a scope of work for the aforementioned Goongarrie Hub Definitive Feasibility Study, and then sole-fund the DFS I just re-re-mentioned, once the scope has been agreed upon.

“We look forward to Ardea and the KNP Goongarrie Hub joining the successful Australia and Japan project development model and welcome the contribution of the Consortium in developing Ardea’s Battery and Critical Minerals projects,” said Ardea managing director and CEO, Andrew Penkethman.

And finally, in some rather more downbeat news, the Happy Valley Nutrition (ASX:HVM) saga has – apparently – drawn to the conclusion that the company has spent the past few months working feverishly to avoid, after Andrew Grenfell and Kare Johnstone were appointed as Voluntary Administrators, with effect from 05 July 2023.

It’s been a real slog for the NZ-based milko, but as far as I can tell, the company simply ran out of time and credit options, and so down the curtains will come. An initial statutory meeting of creditors “must be held within eight business days after the administration begins”, and is expected to take place on 18 July 2023. “

TRADING HALTS

Johns Lyng Group (ASX:JLG) – Capital raising.

Sacgasco (ASX:SGC) – Capital raising.

GreenTech Metals (ASX:GRE) – Pending the release of announcement related to further exploration results from the company’s Ruth Well project. GreenTech just wants to make sure the market’s well informed… it’s good like that.

NickelX (ASX:NKL) – This one’s pending additional information regarding an advanced nickel and lithium project acquisition option.

Titan Minerals (ASX:TTM) – Pending the release of an announcement in relation to a resource estimate at the Dynasty Gold Project in Ecuador.

Alphinity Global Equity Fund (ASX:XALG) – A halt due to issues with the dissemination of the iNAV. “We expect the trading Halt will be lifted today once the dissemination of the iNAV resumes,” reads an announcement.

Alphinity Global Sustainable Equity Fund (ASX:XASG) – As above.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.