Closing Bell: ASX falls flat after strong employment data muddies waters

Getty Images

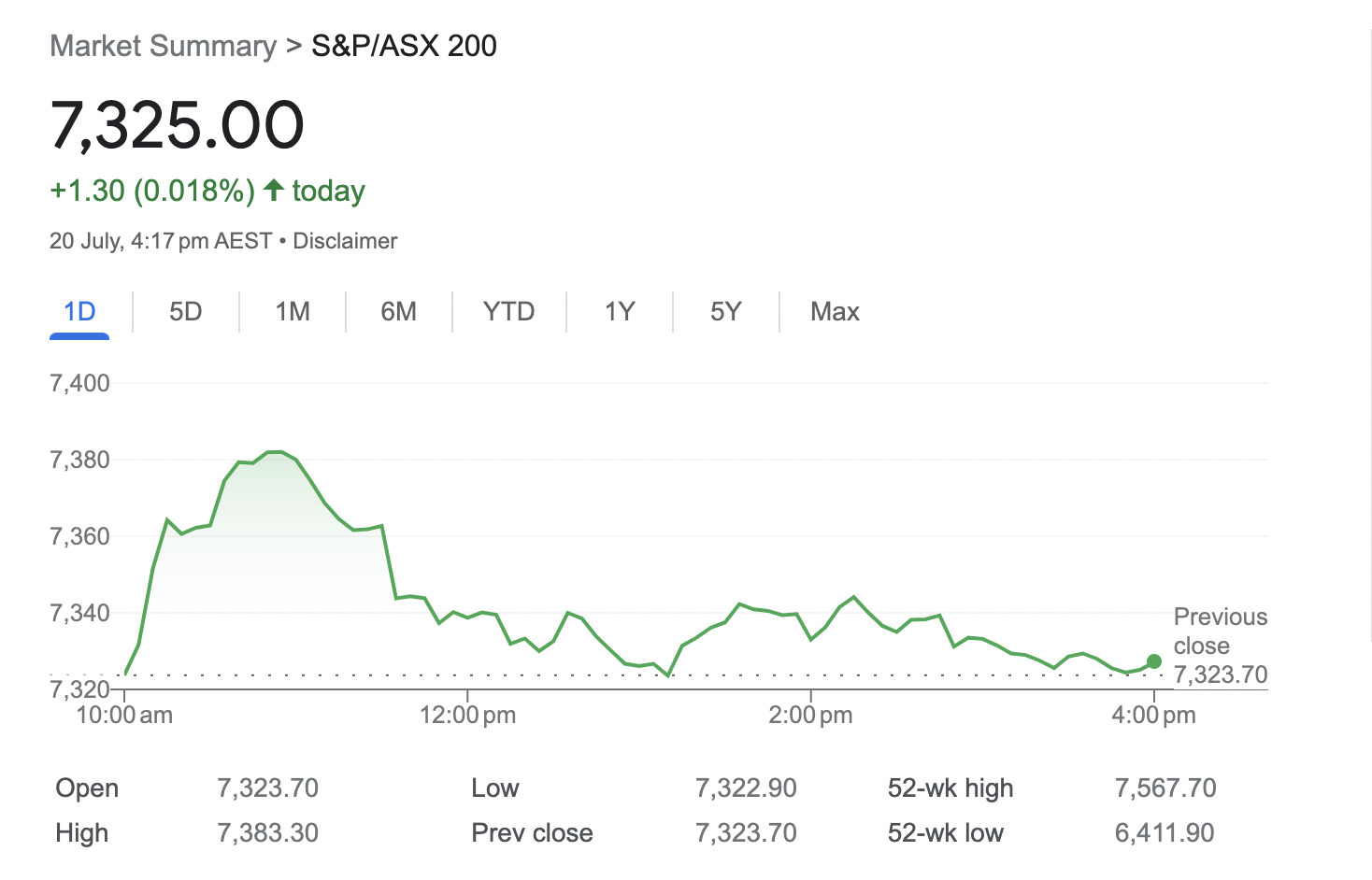

- The ASX 200 burst out of the blocks early but then landed flat (on the whole)

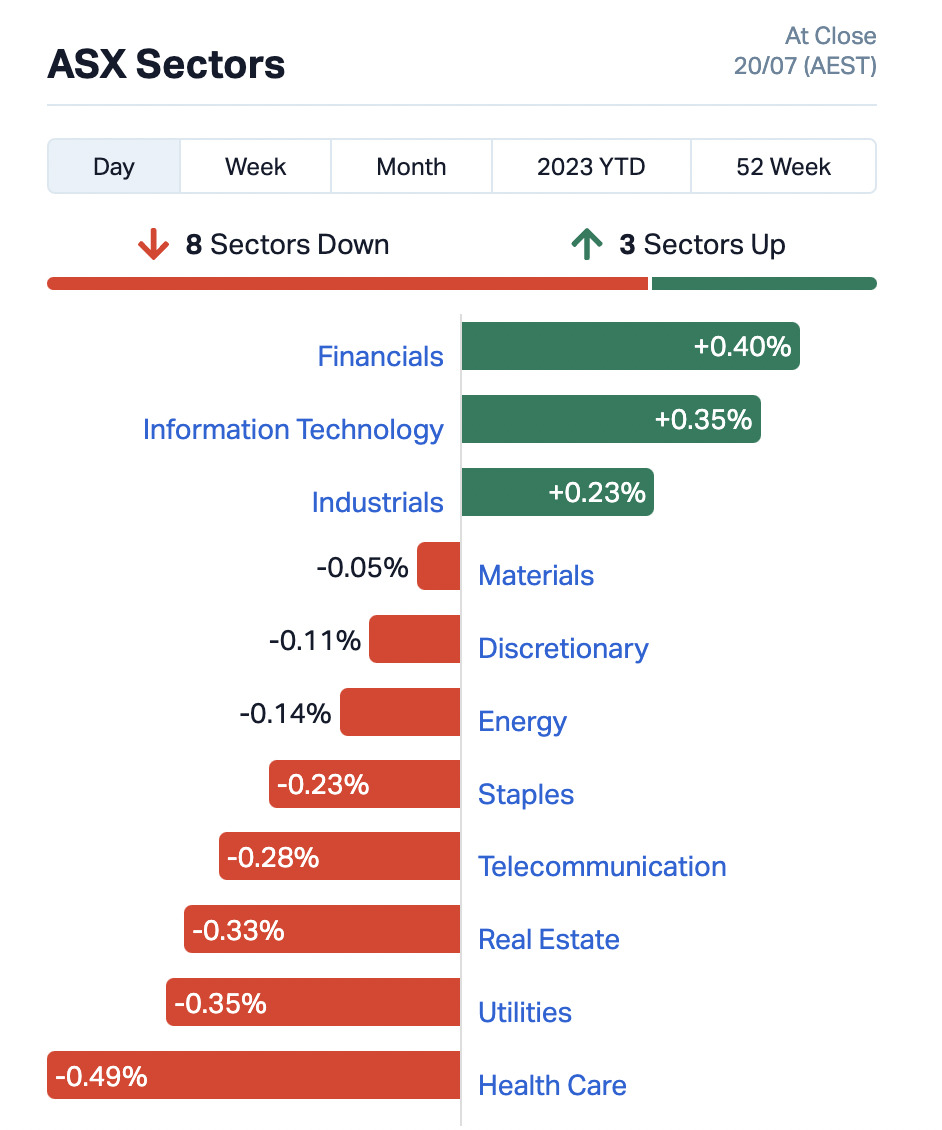

- Sectors wise, Financials, IT and Industrials did okay. The others, very much including Health Care and Utilities, didn’t

- Notable performers today: Nuix (ASX:NXL) and Austral Gold (ASX:AGD)

The ASX threatened to have a far-better-than-expected day earlier. Then some employment statistics were bandied about killing the vibe somewhat, with the unemployment rate falling to 3.5% in June.

We’re all for jobs and people having them – even lawyers, parking inspectors and rival journalists who blatantly copy Stockhead articles without crediting.

But stronger-than-anticipated employment growth and falling unemployment figures do tend to give the RBA yet another excuse to keep grinding its inflation-curbing, rate-hiking axe.

It’s a got-cake-but-can’t-eat-it kinda thing. Even if you can now afford said cake because you just landed a job – which is unlikely to be at Telstra, sadly.

“The RBA has the opportunity to take out a little more inflation-reducing insurance without worrying about unemployment rising significantly,” said NAB’s head of market economics, Tapas Strickland, according to David Rogers over on The Australian‘s Business section.

Apparently, the NAB (which incidentally is planning to roadblock certain local crypto exchanges, but that’s another story) reckons the RBA will likely further increase interest rates to 4.6% in the months ahead, although there could also be some “mild softening” ahead.

And if there’s anything to encourage mild softening, it’s almost certainly inflation-based pillow talk.

TO MARKETS

So then, the ASX 200’s worm chart looks a bit like Australia’s first innings overnight. Yes, apart from that positive bit at the start for the ASX, it’s just like Smith ‘n’ Labuschagne and co – a fizzer of a performance.

Still, runs on the board/boarse, eh? And in the end, maybe it’s just a pass mark for both – with about 300 or so runs for the ASX, and a +0.018% gain for the Aussie Test team.

Zooming in a bit further, we land on the sectors. Financials, IT, Industrials – well done today, good job. You get an early mark.

The rest of you? Come and receive your detentions on the way out. Health Care, Utilities, Real Estate, Telcos – you get Saturday-morning ones. A bit like The Breakfast Club. But crapper.

Some standout pumpers in the larger end of the ASX market cap town:

• Neuren Pharmaceuticals (ASX:NEU): +7% > on no fresh news today, although Emma has a good write-up on the firm’s recent happenings of note here.

• Genesis Minerals (ASX:GMD): +7.5% > on no news of note.

• Latin Resources Limited (ASX:LRS): +11% > on no news of note.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AJQ | Armour Energy Ltd | 0.003 | 50% | 24,260,558 | $9,842,684 |

| BVR | Bellavistaresources | 0.2 | 43% | 395,173 | $5,316,151 |

| XRG | Xreality Group Ltd | 0.058 | 41% | 969,908 | $18,300,210 |

| CCO | The Calmer Co Int | 0.0035 | 40% | 18,154,461 | $1,410,194 |

| RML | Resolution Minerals | 0.007 | 40% | 8,288,027 | $6,286,459 |

| NYR | Nyrada Inc. | 0.059 | 37% | 672,965 | $6,708,374 |

| ADR | Adherium Ltd | 0.004 | 33% | 1,266,667 | $14,998,225 |

| GCR | Golden Cross | 0.004 | 33% | 643,627 | $3,291,768 |

| MCT | Metalicity Limited | 0.002 | 33% | 127,925 | $5,604,129 |

| 1CG | One Click Group Ltd | 0.024 | 33% | 74,556,427 | $11,053,276 |

| NXL | Nuix Limited | 1.09 | 33% | 6,520,487 | $263,283,416 |

| AUR | Auris Minerals Ltd | 0.013 | 30% | 2,228,578 | $4,766,260 |

| ODY | Odyssey Gold Ltd | 0.029 | 26% | 335,113 | $17,607,369 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 1,809,000 | $15,569,766 |

| PKO | Peako Limited | 0.01 | 25% | 1,279,002 | $3,765,852 |

| TMX | Terrain Minerals | 0.006 | 20% | 9,439,194 | $5,415,997 |

| 5GG | Pentanet | 0.097 | 20% | 3,061,510 | $30,271,904 |

| AWJ | Auric Mining | 0.055 | 20% | 381,859 | $6,019,541 |

| GLL | Galilee Energy Ltd | 0.11 | 20% | 351,710 | $31,145,450 |

| ADD | Adavale Resource Ltd | 0.025 | 19% | 11,336,343 | $10,988,472 |

| BXN | Bioxyne Ltd | 0.019 | 19% | 205,000 | $30,426,326 |

| PET | Phoslock Env Tec Ltd | 0.02 | 18% | 841,713 | $10,614,639 |

| AGD | Austral Gold | 0.041 | 17% | 252,980 | $21,430,897 |

| ADV | Ardiden Ltd | 0.007 | 17% | 323,079 | $16,130,012 |

| CAV | Carnavale Resources | 0.007 | 17% | 17,921,350 | $16,401,310 |

A couple of standouts:

• Nuix (ASX:NXL): +33% >As Eddy reported earlier in the day: “Nuix says its Annualised Contract Value (ACV) for FY23 will be between $184-$186 million, up 15% on pcp. Bottom line statutory EBITDA will be between $32-$35 million, up 164-189% on pcp.”

The software tech company’s shares are essentially surging after it flagged a 51-61 per cent increase in full-year underlying earnings.

Nuix tipped earnings at between $44m and $47m, up on the $29.2m reported in the 2022 financial year. This doesn’t include costs from the firm’s legal tussles, though or the acquisition of Topos Labs. As Eddy noted, statutory earnings are anticipated to land between $32m and $35m.

Nuix ended the financial year with cash on hand of $29.6m and no debt.

• Nyrada (ASX:NYR): +37% > The firm, which specialises in developing drugs to combat cardiovascular and neurological diseases, has announced a review of its operating costs and financial plans.

Reportedly, as part of the review, the Nyrada Board of Directors has voluntarily agreed to halve their director fees effective today and until further notice. This will apparently reduce the company’s annualised operating outflows by approximately $0.3 million.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OPN | Oppenneg | 0.008 | -27% | 2,353,000 | $2,667,830 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 2,245,747 | $31,285,147 |

| CLE | Cyclone Metals | 0.0015 | -25% | 360,268 | $20,529,010 |

| WFL | Wellfully Limited | 0.003 | -25% | 3,055,983 | $1,971,777 |

| CVR | Cavalierresources | 0.12 | -20% | 4,000 | $4,774,337 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 42,173,731 | $3,336,824 |

| GFN | Gefen Int | 0.004 | -20% | 849,414 | $340,501 |

| ETR | Entyr Limited | 0.009 | -18% | 3,831,410 | $21,745,393 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 143,107 | $2,085,100 |

| HLX | Helix Resources | 0.005 | -17% | 462,000 | $13,938,875 |

| RKT | Rocketdna Ltd. | 0.01 | -17% | 1,349,999 | $6,406,711 |

| TLX | Telix Pharmaceutical | 10.21 | -16% | 7,264,794 | $3,873,655,528 |

| MRZ | Mont Royal Resources | 0.19 | -16% | 789,128 | $15,408,600 |

| CHW | Chilwaminerals | 0.15 | -14% | 331,664 | $8,028,125 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 14,127,791 | $3,644,818 |

| SRZ | Stellar Resources | 0.013 | -13% | 9,487,199 | $15,089,464 |

| RMI | Resource Mining Corp | 0.041 | -13% | 104,534 | $24,708,250 |

| ATR | Astron Corp Ltd | 0.415 | -13% | 51,453 | $69,607,420 |

| ELE | Elmore Ltd | 0.007 | -13% | 1,244,702 | $11,195,071 |

| TSL | Titanium Sands Ltd | 0.007 | -13% | 765,161 | $11,251,183 |

| ABE | Ausbondexchange | 0.18 | -12% | 9,065 | $7,944,386 |

| X2M | X2M Connect Limited | 0.051 | -12% | 105,000 | $9,209,899 |

| USL | Unico Silver Limited | 0.11 | -12% | 31,307 | $37,006,449 |

| JPR | Jupiter Energy | 0.022 | -12% | 6,487 | $30,746,253 |

| AZY | Antipa Minerals Ltd | 0.015 | -12% | 1,205,922 | $61,149,875 |

LAST ORDERS

Ever wanted to own an airport?

You and John Travolta both, eh? Well, now you* can own a stake in a choice one over the ditch in Auckland.

(*That is, if you are an institutional investor. Which you’re probably not, but read on anyway.)

According to a report in The Aus today, investment bank UBS is said to be looking for investors for a sale of a stake in Auckland International Airport (market cap: $11.18b) that could be offered as this evening.

“It is understood that the investment bank is targeting institutional investors as buyers after strategic buyers were initially targeted,” wrote Bridget Carter.

“On offer is a 7 per cent stake in the Auckland Airport that is owned by the Auckland Council.”

Shares were down a fraction at $7.51 on the ASX at closing time.

Industrials

AML3D (ASX:AL3) has announced another sale of one of its proprietary ARCEMY®X metal 3D printing systems to support the US Navy’s submarine industrial base, which Stockhead is advised was the reason for a 5.56% share price gain today.

The ARCEMY®X is the largest AML3D system, capable of printing industrial-scale components and will be located at the US Navy’s new Danville Centre of Additive Manufacturing Excellence in Virginia.

The sale follows the shipping of an ARCEMY®X, in early June, for use at the Oak Ridge National Laboratory, in Tennessee, to accelerate adoption of advanced additive manufacturing across the US defence industrial base.

Lithium

You’ll find far more in-depth lithium coverage elsewhere on Stockhead, but just quickly – this minnow performer caught our eye today in passing…

Lithium Plus Minerals (ASX:LPM) scored a +6.7% gain on the back of some thick, high-grade action.

The NT-focused “pure play” lithium outfit has today confirmed “significant intersections” of high-grade spodumene mineralisation in all four of its diamond drill-hole assays returned from its Phase 3 drilling at the Lei Prospect.

These returns include: 0m @ 1.64% Li2O from 445.0m in BYLDD011, and 39m @ 1.39% Li2O from 552.0m in BYLDD015. The mineralisation at the primary Lei pegmatite has been extended roughly 200m deeper and remains open for further action.

Additionally, according to the company notice, “detailed planning for resource definition drilling is underway, targeting a maiden high-grade lithium resource during 2023. And rig mobilisation to the “highly prospective Kings Landing prospect” is expected in coming weeks.

Gold

Here’s another smallish (but well-formed) player having a beaut day on the bourse with a more than +17% gain at stumps today.

Austral Gold (ASX:AGD), which puts a good deal of its focus on exploration over in Chile, Argentina and the US, has announced that production is set to begin, before the month’s out, on its Reprocessing Project at the Guanaco/Amancaya mine complex in Chile.

The reprocessing operation is designed to supplement existing production for the next 10 years, according to the company.

What stands out, too, is its low cost production with projected cash operating costs below $700 per gold equivalent ounce.

Just to clarify further, during the balance of 2023, the Company expects the project to contribute 7,000-9,000 gold equivalent ounces (“GEOs”) at a cash cost of production below $700 per GEO.

And the project total’s proven mineral reserves are estimated at 223,000 gold ounces and 1,043,000 silver ounces.

More gold

Annnd, we’ve just been handed some late mail here from our most excellently moustachioed (and excellent in general) Josh Chiat regarding the capital raising that’s been happening for BC-based explorer Gold Mountain (ASX:GMN).

Peak Asset Management has announced that GMN, at $0.0075 a share is its latest funding placement, representing a 35.8% discount to the 5 Day Volume Weighted Average Price (VWAP).

This cap-raising interest comes after Gold Mountain revealed a proposed acquisition of 75% interest in significant lithium tenement package in the Lithium Valley, Brazil.

From info provided to Stockhead, we understand that the package reportedly consists of 204 tenements in 12 project areas, with a total area of 3,921 km2 (“Tenements”), including 607 km2 in the Lithium Valley of northeast Minas Gerais state.

Also, recent exploration at GMN’s Logradouro project has reportedly identified over 250 pegmatites “with more expected to be present”.

Anything else going on?

Of course there is. For more, we suggest you check out Em’s arvo column: In Case You Missed It.

Oh, and then there’s this, too…

TRADING HALTS

Alto Metals (ASX:AME) – Capital raising.

Aston Minerals (ASX:ASO) – Capital raising.

Metal Hawk (ASX:MHK) – Capital raising.

Greenstone Resources (ASX:GSR) – Capital raising.

Surefire Resources (ASX:SRN) – A trading halt request “to facilitate an orderly market in the company’s securities pending an announcement in relation to the publication of test results from a study conducted by Lava Blue Ltd on High Purity Alumina (HPA) production from Surefire’s 100% owned Victory Bore deposit.”

If no announcement is delivered before week’s end, Surefire wants the halt in place until market open on Monday morning.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.