Closing Bell: ASX slumps as Trump renews tariff threats

Sick to death of the word 'tariff' yet? Yep, us too. Pic: Getty Images

- ASX closes lower on Wednesday, dropping 52.10 points or 0.61% to 8538.60

- Seven of 11 ASX sectors were in the red as US President Donald Trump renewed his tariffs push

- Telix lifts on permanent US healthcare system code for PSMA PET imaging agent

The Aussie share market fell on Wednesday after US President Donald Trump doubled down on his protectionist trade stance, threatening higher tariffs on copper and pharmaceutical imports.

On Tuesday, Trump warned of a 50% tariff on copper, sending prices of the red metal up almost 10%, and up to a 200% tariff on pharmaceutical imports.

He also announced a new round of tariffs on imports from more than a dozen countries and confirmed that the deadline for trade deals had been extended from July 9 to August 1.

Trump said there would be no further extensions beyond the new deadline, adding that he would continue sending letters to world leaders outlining US tariff rates on their exports – effective August 1 – unless individual trade agreements were finalised before then.

Overnight, markets digested Trump’s latest rhetoric with the Nasdaq rising 0.03%, while the S&P 500 fell 0.07% and the Dow Jones dipped 0.37%. In a sign of market resilience, the S&P 500 still remains near its all-time-high, which was set just last week.

Across the Tasman today, the Reserve Bank of New Zealand (RBNZ) followed the Australian central bank and left its official cash rate on hold at 3.25% citing near-term inflation risks.

The hold followed a 25 basis points cut in May, which was the RBNZ’s sixth straight cut, with total easing in the cycle that started last August 225 basis points.

Yesterday, the Reserve Bank of Australia (RBA) also kept the official cash rate on hold at 3.85%, wanting to be sure inflation remained on track to reach 2.5% on a sustainable basis and citing “uncertainty in the world economy remains elevated”.

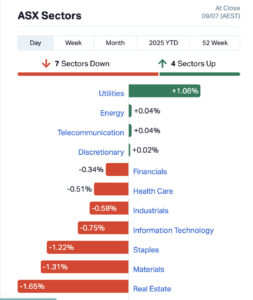

7/11 sectors slush about in the red

The S&P/ASX 200 closed the day down 52.10 points or around 0.61% at 8538.60, with seven of the 11 sectors in the red. Utilities led the winners up 1.06%, while energy and telecommunications both rose 0.4% and discretionary put on 0.2%.

Real estate was the biggest laggard down 1.65%, followed by materials losing 1.31% and consumer staples down 1.22%

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VUL | Vulcan Energy | 3.99 | 8% | 1,022,405 | $806,902,920 |

| MLX | Metals X Limited | 0.6125 | 7% | 7,552,502 | $509,675,134 |

| SMR | Stanmore Resources | 2.065 | 6% | 1,585,510 | $1,748,699,770 |

| SKC | Skycity Ent Grp Ltd | 0.915 | 6% | 740,797 | $657,577,506 |

| TLX | Telix Pharmaceutical | 25.38 | 6% | 1,495,371 | $8,134,718,041 |

| CU6 | Clarity Pharma | 2.78 | 5% | 1,360,714 | $853,799,050 |

| LTR | Liontown Resources | 0.7475 | 5% | 11,871,690 | $1,724,877,536 |

| EOS | Electro Optic Systems | 2.82 | 4% | 2,029,500 | $522,900,188 |

| IEL | Idp Education Ltd | 4.075 | 4% | 2,632,123 | $1,091,077,947 |

| HLI | Helia Group Limited | 4.93 | 4% | 1,316,569 | $1,294,308,799 |

| PLS | Pilbara Minerals | 1.5325 | 4% | 41,234,362 | $4,762,536,409 |

| RDX | Redox Limited | 2.235 | 3% | 329,124 | $1,134,175,884 |

| PCI | Perpetual Cred Trust | 1.22 | 3% | 409,073 | $574,233,792 |

| JIN | Jumbo Interactive | 10.46 | 3% | 247,523 | $630,998,900 |

| ORI | Orica Limited | 20.385 | 3% | 1,357,134 | $9,524,239,059 |

| NEC | Nine Entertainment | 1.655 | 3% | 1,975,235 | $2,553,077,018 |

| ALD | Ampol Limited | 26.17 | 3% | 417,090 | $6,069,554,462 |

| SSM | Service Stream | 1.94 | 3% | 1,238,523 | $1,164,151,348 |

| RUL | RPM Global Holdings | 3.26 | 3% | 243,087 | $701,921,098 |

| DMP | Domino Pizza Enterprises | 18.91 | 2% | 869,694 | $1,742,570,877 |

| VGN | Virgin Australia | 3.125 | 2% | 837,418 | $2,385,070,921 |

| BVS | Bravura Solution Ltd | 2.1 | 2% | 1,055,982 | $919,125,704 |

| AD8 | Audinate Group Ltd | 6.57 | 2% | 251,502 | $535,190,344 |

| SUL | Super Ret Rep Ltd | 15.11 | 2% | 339,879 | $3,335,457,405 |

| IGO | IGO Limited | 4.405 | 2% | 2,455,721 | $3,263,824,274 |

Making news…

Telix Pharmaceuticals (ASX:TLX) surged today having secured a permanent healthcare system code from the US Centers for Medicare & Medicaid Services for its PSMA PET imaging agent, Gozellix, as it brings the new imaging agent to market.

Effective from October 1, Telix said assignment of the code was a significant milestone supporting provider billing and reimbursement for Gozellix, and a further step toward receiving Transitional Pass-Through payment status.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LIC | Lifestyle Communities | 4.46 | -37% | 5,885,326 | $857,049,980 |

| PNR | Pantoro Gold Limited | 2.93 | -10% | 2,225,613 | $1,280,570,162 |

| BMN | Bannerman Energy Ltd | 2.86 | -8% | 1,100,939 | $640,858,171 |

| PDN | Paladin Energy Ltd | 7.1 | -8% | 3,651,761 | $3,088,753,882 |

| SLX | Silex Systems | 3.845 | -8% | 577,756 | $990,519,812 |

| DYL | Deep Yellow Limited | 1.62 | -7% | 3,807,515 | $1,702,575,259 |

| BOE | Boss Energy Ltd | 3.685 | -7% | 5,225,415 | $1,643,089,184 |

| RSG | Resolute Mining | 0.6375 | -7% | 12,152,383 | $1,458,399,259 |

| TCG | Turaco Gold Limited | 0.4575 | -7% | 923,654 | $509,393,553 |

| EVN | Evolution Mining Ltd | 7.325 | -7% | 9,841,052 | $15,698,647,565 |

| OBM | Ora Banda Mining Ltd | 0.6975 | -6% | 6,447,342 | $1,403,444,721 |

| WAF | West African Res Ltd | 2.26 | -6% | 4,525,535 | $2,747,225,297 |

| BC8 | Black Cat Syndicate | 0.78 | -6% | 3,218,956 | $587,263,945 |

| GMD | Genesis Minerals | 4.03 | -6% | 2,331,042 | $4,837,889,012 |

| BGL | Bellevue Gold Ltd | 0.91 | -6% | 15,383,943 | $1,424,654,693 |

| RMS | Ramelius Resources | 2.335 | -5% | 11,361,320 | $2,863,053,955 |

| VAU | Vault Minerals Ltd | 0.3925 | -5% | 22,518,713 | $2,823,026,454 |

| SX2 | Southgold Consol | 5.99 | -5% | 351,340 | $892,491,621 |

| NEM | Newmont Corporation | 87.51 | -5% | 415,874 | $10,052,419,248 |

| EMR | Emerald Res NL | 3.72 | -5% | 1,363,397 | $2,584,329,183 |

| RRL | Regis Resources | 4.32 | -5% | 4,492,238 | $3,446,463,978 |

| WGX | Westgold Resources | 2.725 | -5% | 7,091,589 | $2,697,293,713 |

| CYL | Catalyst Metals | 5.32 | -5% | 1,289,282 | $1,404,948,242 |

| KCN | Kingsgate Consolid. | 2.405 | -5% | 854,275 | $649,534,264 |

| HGH | Heartland Group | 0.74 | -5% | 40,198 | $728,577,377 |

Retirement homes developer Lifestyle Communities (ASX:LIC) fell today after the Victorian Civil and Administrative Tribunal ruled in favour of residents at its two Melbourne estates.

The ruling reportedly found deferred management fees charged by LIC were invalid, with the company telling investors it was appealing the decision.

IN CASE YOU MISSED IT

Resolution Minerals (ASX:RML) is gearing up to start drilling in August at Horse Heaven in Idaho after receiving US Forest Service approval.

Verity Resources (ASX:VRL) has appointed Xirlatem and Dr Rick Gordon to oversee expansion plans at Verity’s Monument gold project.

Pioneer Lithium (ASX:PLN) has expanded its position in the southern Namibia uranium hotspot by acquiring the Gaobis project.

Argent Minerals (ASX:ARD) has unlocked 1.8km of previously uncharted gold strike at its Trunkey Creek gold project in New South Wales.

Kingsland Minerals (ASX:KNG) is testing whether rutile and gallium can be commercially extracted from the Leliyn graphitic schist in the NT.

Drilling at Perpetual Resources (ASX:PEC) Igrejinha lithium asset in Minas Gerais has uncovered 200m of consistent LCT pegmatites.

Challenger Gold (ASX:CEL) has confirmed heap leach processing is an economical option for low-grade gold production at Hualilan in Argentina, beyond an initial toll mining period.

Arizona Lithium (ASX:AZL) is selling its Big Sandy lithium project to double down on its near-term Prairie lithium project in Canada.

LAST ORDERS

Zenith Minerals (ASX:ZNC) is cashed up to pursue its exploration goals at the Dulcie Far North and Red Mountain gold projects after bringing home $3.5m in a rights issue.

ZNC plans to drill 9000-12,000 metres at Dulcie to drum up new tonnes for a resource expansion, having just acquired over 6km of fresh strike.

The ground team will also complete a diamond drilling program at Red Mountain, targeting large-scale gold in the search for a copper-gold porphyry system.

Pantera Minerals (ASX:PFE) has offloaded the Smackover lithium brine project in the US to Energy Exploration Technologies Inc in return for $6m in cash and $34m in shares, maintaining exposure to the recovering lithium market through its new shareholding in EnergyX.

TRADING HALTS

Mithril Resources (ASX:MTH) – cap raise

BMG Resources (ASX:BMG) – pending release of assays

Falcon Metals (ASX:FAL) – pending exploration results

Chariot Corporation (ASX:CC9) – continuation of suspension

Almonty Industries (ASX:AII) – pending resource estimate

At Stockhead, we tell it like it is. While Zenith Minerals and Pantera Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.