Closing Bell: ASX ends day under water; potential mega mining merger turns heads

ASX is under water on Friday. Picture via Getty Images

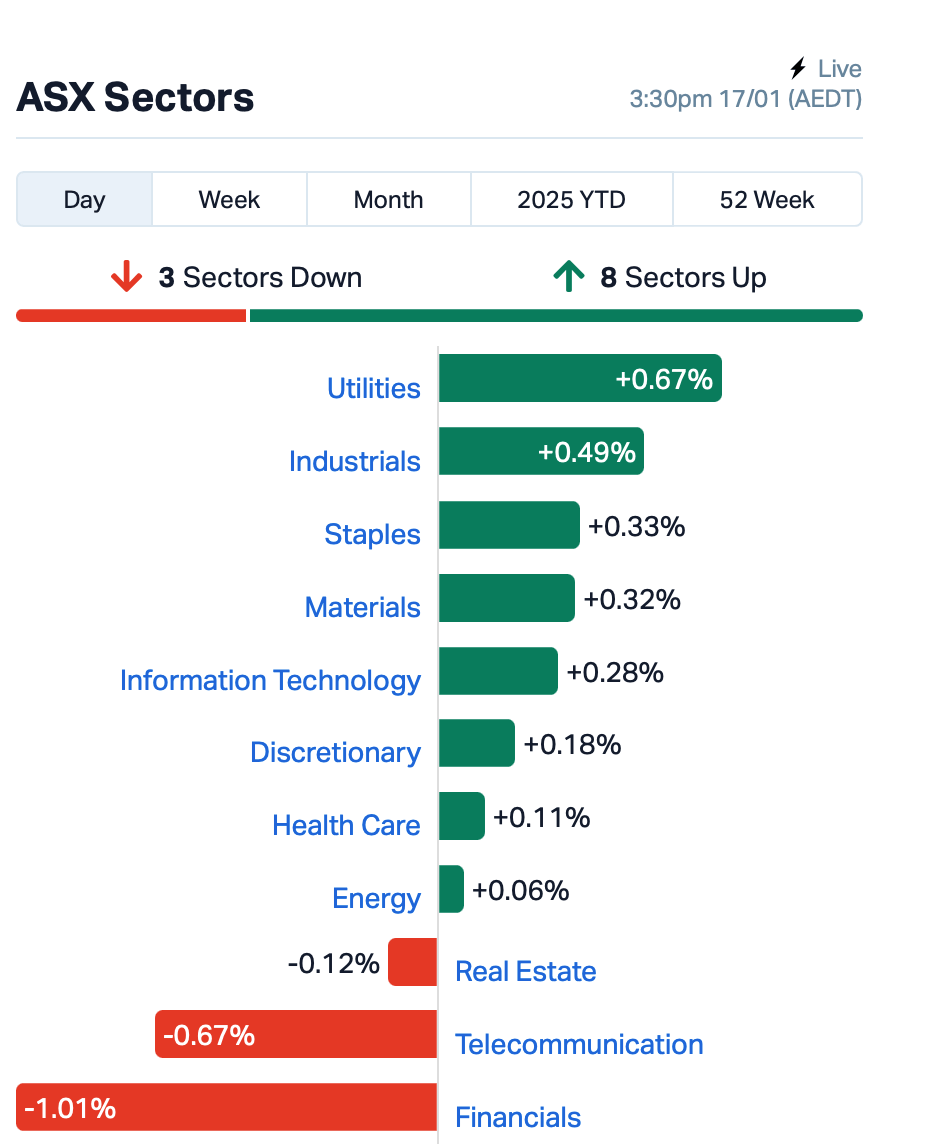

- Banks fall, mining stocks rise

- Rio Tinto in mega merger talks, suggests Bloomberg

- China hits 5pc growth but property struggles

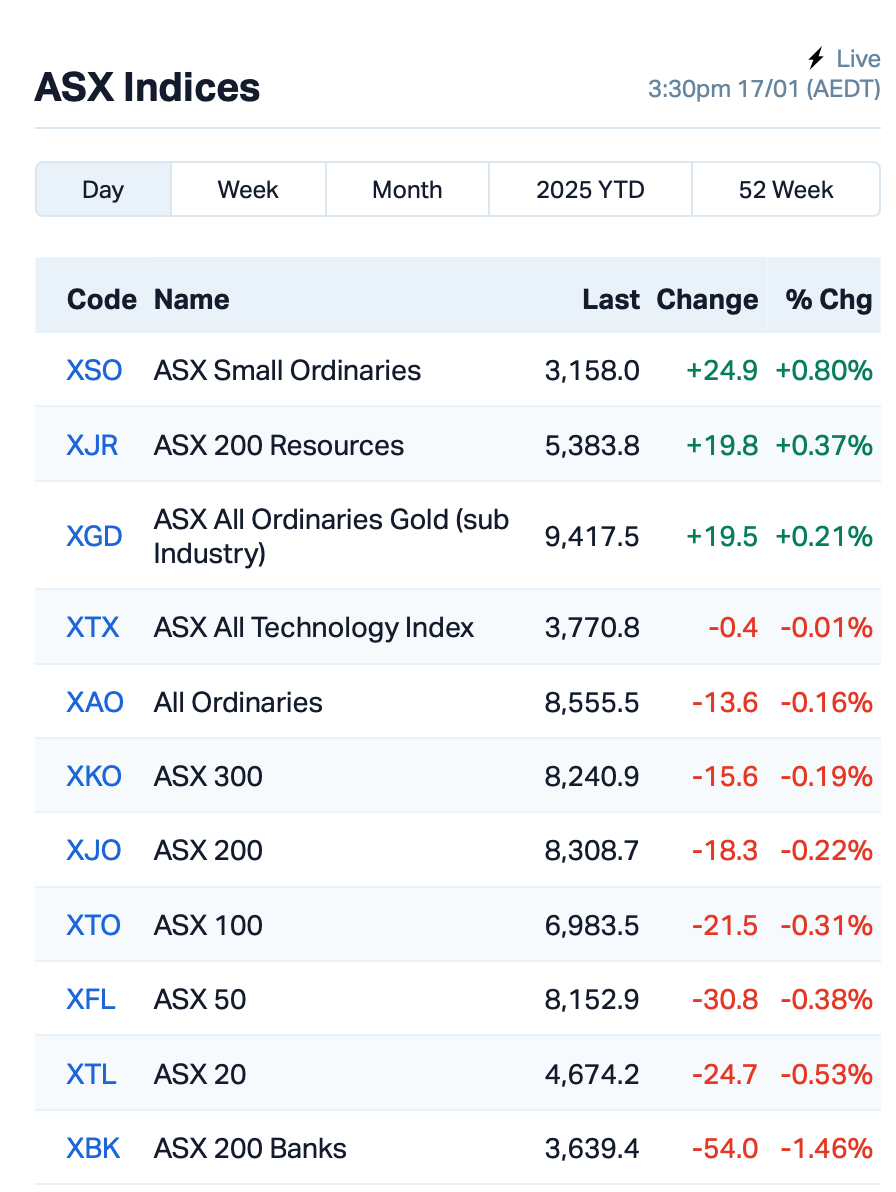

After a day of zigzagging, the ASX closed lower by 0.2% on Friday as losses in the financials and comms sectors took their toll.

For the week, too, the benchmark ASX200 index ended in the red by about 0.2%.

Yesterday’s champs – the major banks – became today’s chumps, leading the selloff.

But it wasn’t all bad news.

Mining stocks picked up some bids after gold jumped to US$2,715 an ounce, while copper and iron ore also gained some ground.

Meanwhile, the market’s keeping an eye on Rio Tinto (ASX:RIO), which slipped 0.5% after a report that first appeared on Bloomberg suggesting that it was in talks with Glencore about a mega merger.

“It would be the world’s biggest mining deal and create the world’s biggest mining company, overtaking BHP,” said Jessica Amir at Moomoo.

Now read: Rio Tinto and Glencore merger talks could create the biggest dog in the mining yard

Elsewhere, CC Capital is turning the screws on its takeover bid for Insignia Financial (ASX:IFL). The private equity firm has now upped its bid to $4.60 per share from $4.30, bringing the deal value to $3 billion. IFL’s shares jumped 6%.

And, Telix Pharmaceuticals (ASX:TLX) has scored a huge win with European regulators, getting the green light for its prostate cancer imaging agent, Illuccix. This sets the stage for a commercial launch in Europe. Shares climbed 2.5%.

This is where things stood leading up to Friday’s close:

And we’ll close the week with some rather good news coming out of China.

Today’s data shows that its GDP expanded 5% in 2024, nailing Beijing’s headline target.

But the country’s property sector, once a key driver of growth, is still in the doldrums, weighing on the economy.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap EDE Eden Inv Ltd 0.002 50% 6,000,000 4,109,876 8IH 8I Holdings Ltd 0.013 44% 120,260 3,133,448 CTO Citigold Corp Ltd 0.004 33% 411,004 9,000,000 RGL Riversgold 0.004 33% 625,689 5,051,138 SKK Stakk Limited 0.008 33% 733,302 12,450,478 IXU Ixup Limited 0.010 25% 1,282,356 16,255,887 VML Vital Metals Limited 0.003 25% 17,435 11,790,134 L1M Lightning Minerals 0.081 23% 1,908,234 6,819,669 EQS Equitystorygroupltd 0.023 21% 25,000 2,785,203 HVY Heavymineralslimited 0.180 20% 182,727 10,056,539 1TT Thrive Tribe Tech 0.003 20% 39,801,985 5,079,308 CRR Critical Resources 0.006 20% 448,601 12,159,816 GLA Gladiator Resources 0.012 20% 360,324 7,582,968 IS3 I Synergy Group Ltd 0.006 20% 196,667 1,781,089 CND Condor Energy Ltd 0.032 19% 33,378,617 15,831,009 WGR Westerngoldresources 0.064 19% 318,811 9,266,673 APC APC Minerals 0.013 18% 346,172 1,123,904 AZL Arizona Lithium Ltd 0.013 18% 6,050,137 49,211,960 SMM Somerset Minerals 0.013 18% 871,431 2,880,817 SCN Scorpion Minerals 0.020 18% 1,483,739 6,960,755

Lightning Minerals (ASX:L1M) has confirmed spodumene at its Esperança Project in Brazil’s Lithium Valley, with high-grade lithium soil samples returning up to 429ppm at Caraíbas and 320ppm at Canabrava. These results are building momentum for L1M’s upcoming 2,000m drill program at Esperança, set for Q1 2025. The strong assays bolster confidence in the area’s potential as a major lithium hotspot.

Immuron’s (ASX:IMC) Travelan, a supplement targeting harmful bacteria in the gut, is on fire, with sales soaring in the December 2024 quarter. Global sales hit $2.5 million, up 70% on the prior quarter and 249% from last year. Australia’s sales jumped 83% quarter-on-quarter, while North America grew 43%. The growth is driven by new listings in Australian pharmacies, expanded distribution in Canada and the US, and a strong presence on Amazon.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap AXP AXP Energy Ltd 0.002 -25% 5,490,000 $11,649,361 CR9 Corellares 0.003 -25% 45,161 $1,870,974 RAN Range International 0.003 -25% 18,425,450 $3,757,161 NUZ Neurizon Therapeutic 0.135 -21% 4,671,849 $83,691,980 GES Genesis Resources 0.004 -20% 323,152 $3,914,206 MEL Metgasco Ltd 0.004 -20% 3,230,786 $7,287,934 SIS Simble Solutions 0.004 -20% 1,500,000 $4,181,652 TMX Terrain Minerals 0.004 -20% 27,371,939 $9,053,477 YOW Yowie Group 0.018 -18% 15,000 $5,046,094 CDR Codrus Minerals Ltd 0.014 -18% 136,823 $2,811,588 BEO Beonic Ltd 0.250 -17% 130,826 $20,269,666 ADG Adelong Gold Limited 0.005 -17% 175,000 $6,707,934 AOK Australian Oil. 0.003 -17% 4,706 $3,005,349 ASR Asra Minerals Ltd 0.003 -17% 299,057 $6,937,890 BP8 Bph Global Ltd 0.003 -17% 6,000 $1,419,924 ERA Energy Resources 0.003 -17% 28,642 $1,216,188,722 GMN Gold Mountain Ltd 0.003 -17% 1,300,000 $13,737,670 LML Lincoln Minerals 0.005 -17% 1,574,851 $12,337,557 MRD Mount Ridley Mines 0.003 -17% 180,000 $2,335,467 KKO Kinetiko Energy Ltd 0.061 -16% 81,603 $104,578,713 VRL Verity Resources 0.016 -16% 196,468 $2,817,046 OLH Oldfields Holdings 0.055 -15% 49,092 $13,848,843

IN CASE YOU MISSED IT

Health technology company Singular Health Group Ltd (ASX:SHG) flexed today with a successful proof of concept demonstration for its 3Dicom software with MoU partner Provider Network Solutions (PNS) – based in Florida, US.

3Dicom helps compartmentalise patient information so practitioners can easily access medical imaging data from across the industry. Today’s successful technical proof of concept with PNS marks Phase 1 of the MoU between the two companies.

PNS CEO Dr Jose Pelayo said he was “blown away by the speed of the DICOM retrievals”. PNS established in Florida in 1998 and today connects payors with more than 3,200 specialty providers, managing roughly 3.5 million lives across the southern US state.

At Stockhead, we tell it like it is. While Singular Health group is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.