Closing Bell: ASX ends Friday in red but in decent nick for week

Turns out Nick's parents had named him well. Pic via Getty Images

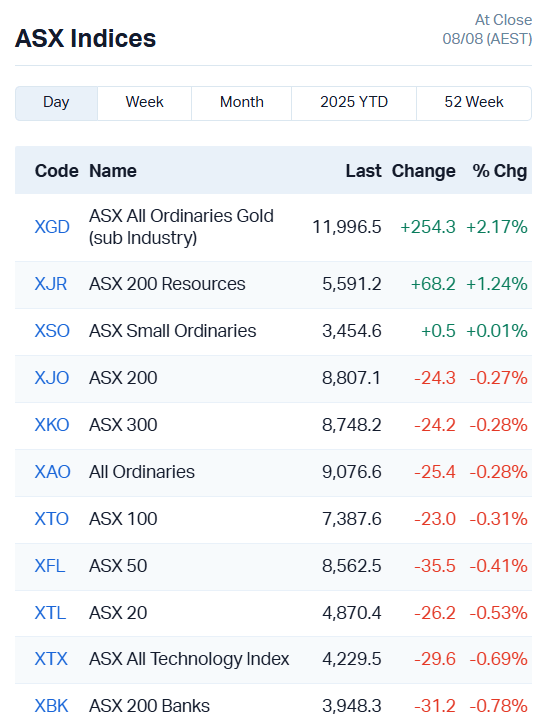

- ASX slides 24 points or 0.28pc

- Market closes out the week positive, just 0.47pc off all-time high

- Gold stocks the power house this week, adding 11.45pc

A positive week of trade

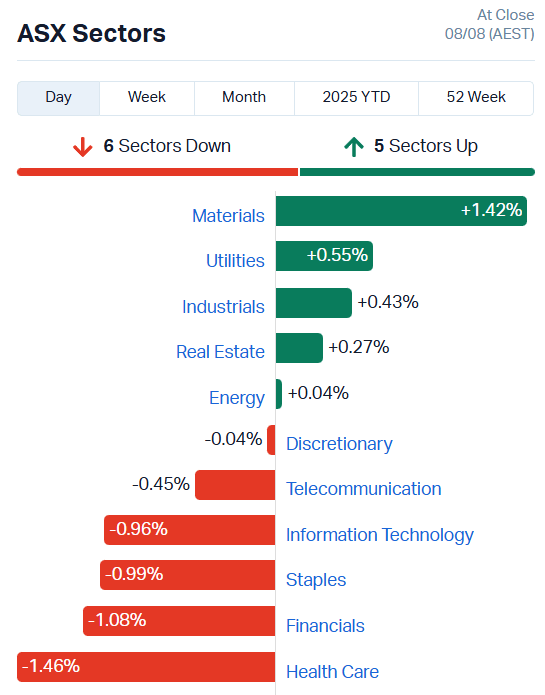

The ASX fell just over 24 points or 0.28% today, with six of 11 sectors moving lower.

While that may sound like a depressing end to the trading week, the ASX 200 has gained more than 150 points or 1.67% over the past five trading days, a solid performance by any measure.

We’re just 0.47% off the all-time high set earlier this week, with demand-side trading remaining mostly in control.

For every sell down on the bourse today there was a buy response, keeping the market hovering around neutral right up until the final hour when the bears won out, however marginally.

As has been the case many, many times, gold stocks were the ASX’s champion this week.

The sub index climbed a full 11.45% over the past five days, now up 42% for the year to date.

Strong gold prices are playing a big part – the precious metal hasn’t fallen below US$3100 an ounce for more than three months.

Today, the bourse also received a little support from the utilities sector.

That certainly wasn’t due to the price of oil, which has plunged back down to US$66.15 a barrel of Brent after falling six sessions in a row.

Water treatment stock De.mem (ASX:DEM) lifted 4.7%. Zero-emission power generation specialist Volt Group (ASX:VPR) climbed 3.8%, and gas and renewable energy stocks Frontier Energy (ASX:FHE) and APA Group (ASX:APA) added 1.1% and 0.7% each.

Looking beyond our gold stocks (there are many on the top gainers list today) a handful of tech and financial companies moved strongly higher.

Financial technology company Iress (ASX:IRE) surged 12%, while Block Inc (ASX:XYZ) jumped 8.5% and AMP (ASX:AMP) added 7.4%.

Words are wind, especially on the global stage

Regular readers may remember a hint of scepticism from this author when discussing US President Trump’s fabulous trade deals.

Without exception the trade deals have been scant on detail, announced with exuberant adjectives (and oddly placed capital letters) on Trump’s own social media platform with very few concrete terms and little actionable structure.

There’s a lot of good reasons negotiations on this scale can take years, with final documents being reviewed and redrafted dozens of times until the deal is officially locked in.

Japan is enjoying the consequences of this new laissez-faire approach to international trade deals after the White House ostensibly reneged on its deal with Tokyo in its latest Executive Order salvo.

Promised an exemption from automotive tariffs and a 15% flat tariff on Japanese goods, the White House has instead slapped the 15% import tax on top of existing levies and have made no exceptions for Japanese cars in its 25% automotive sector tariffs.

“The recent Japan-US agreement regarding US tariff measures does not constitute a legally binding international commitment,” economy and fiscal policy minister Akazawa Ryosei told a Lower House budget committee hearing in Tokyo on Monday.

Minister Akazawa explained the negotiation team had been pressing the US to sign the necessary presidential order to officially enact the new trade terms, and promptly headed off to Washington to ask nicely.

He’s since been assured by US treasury secretary Scott Bessent and commerce secretary Howard Lutnick that it was a simple oversight that would soon be corrected, but no such corrections have occurred as yet.

Ah, diplomacy.

Hopefully minister Akazawa can get something binding in writing this time. We won’t be holding breath.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LMLR | Lincoln Minerals | 0.004 | 100% | 1095482 | $624,734 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | 18001119 | $6,447,446 |

| AFA | ASF Group Limited | 0.004 | 33% | 30000 | $2,377,193 |

| BNL | Blue Star Helium Ltd | 0.008 | 33% | 17382394 | $20,207,312 |

| CT1 | Constellation Tech | 0.002 | 33% | 26333 | $2,212,101 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 68622 | $4,230,637 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 1751490 | $11,167,964 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 87500 | $8,179,556 |

| RGL | Riversgold | 0.004 | 33% | 7027880 | $5,051,138 |

| AQC | Auspaccoal Ltd | 0.009 | 29% | 922587 | $4,903,273 |

| KNG | Kingsland Minerals | 0.125 | 25% | 115558 | $7,256,091 |

| ADR | Adherium Ltd | 0.005 | 25% | 307808 | $7,452,665 |

| ARV | Artemis Resources | 0.005 | 25% | 6159350 | $11,462,689 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 330000 | $1,842,067 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 1015000 | $20,444,766 |

| DM1 | Desert Metals | 0.027 | 23% | 8720706 | $9,730,305 |

| PER | Percheron | 0.011 | 22% | 19865649 | $9,786,939 |

| WCE | Westcoastsilver Ltd | 0.17 | 21% | 9940854 | $44,479,664 |

| ADO | Anteotech Ltd | 0.023 | 21% | 9308953 | $51,400,706 |

| CRR | Critical Resources | 0.006 | 20% | 1735007 | $13,850,427 |

| GLL | Galilee Energy Ltd | 0.012 | 20% | 58488 | $7,071,929 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 5862348 | $15,630,562 |

| LIO | Lion Energy Limited | 0.012 | 20% | 119834 | $4,521,677 |

| PFT | Pure Foods Tas Ltd | 0.024 | 20% | 6168 | $2,808,512 |

| RAN | Range International | 0.003 | 20% | 5148248 | $2,348,226 |

In the news…

TMK Energy (ASX:TMK) has hit 54 metres of net coal in its latest pilot well (LF-07) at the Gurvantes XXXV Coal Seam Gas project in Mongolia. The well was drilled and cased to a total depth of 420m, with downhole pump and similar equipment to be installed presently.

It’s a big milestone for TMK, marking the end of a 12-month drilling campaign that more than doubled the production well capacity of the project.

That’s about all the news there was for our ASX leaders today.

Orbital Corporation (ASX:OEC), West Coast Silver (ASX:WCE) and Cooper Metals (ASX:CPM) were all on the receiving end of a “Please Explain” from the ASX, but all three waved the query away with a “nothing to see here” response despite their energetic price movements.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.001 | -50% | 3163 | $2,101,969 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 1000000 | $13,368,619 |

| ERA | Energy Resources | 0.002 | -20% | 417063 | $1,013,490,602 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 35251000 | $16,854,657 |

| NMT | Neometals Ltd | 0.053 | -17% | 13605102 | $49,311,459 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 10984548 | $13,492,060 |

| FBR | FBR Ltd | 0.005 | -17% | 20988659 | $34,136,713 |

| SER | Strategic Energy | 0.005 | -17% | 8058707 | $5,029,750 |

| X2M | X2M Connect Limited | 0.016 | -16% | 1397517 | $8,266,080 |

| THB | Thunderbird Resource | 0.011 | -15% | 7121261 | $5,066,638 |

| GBZ | GBM Rsources Ltd | 0.028 | -15% | 19528632 | $46,723,417 |

| IME | Imexhs Limited | 0.26 | -15% | 38000 | $16,363,021 |

| GQG | GQG Partners | 1.725 | -15% | 51043533 | $5,969,687,327 |

| CR3 | Core Energy Minerals | 0.012 | -14% | 168120 | $5,735,554 |

| DMG | Dragon Mountain Gold | 0.006 | -14% | 735460 | $2,762,702 |

| LU7 | Lithium Universe Ltd | 0.006 | -14% | 2312305 | $6,551,857 |

| UNT | Unith Ltd | 0.006 | -14% | 1787092 | $10,351,498 |

| AVH | Avita Medical | 1.49 | -14% | 2931774 | $126,677,480 |

| CU6 | Clarity Pharma | 3.8 | -13% | 9179912 | $1,628,986,228 |

| OLY | Olympio Metals Ltd | 0.096 | -13% | 360574 | $11,337,403 |

| AEV | Avenira Limited | 0.007 | -13% | 4145346 | $34,069,152 |

| AIV | Activex Limited | 0.014 | -13% | 25000 | $3,448,041 |

| AUZ | Australian Mines Ltd | 0.007 | -13% | 74703 | $13,688,097 |

| M4M | Macro Metals Limited | 0.007 | -13% | 12279145 | $31,819,340 |

| VKA | Viking Mines Ltd | 0.007 | -13% | 712594 | $10,751,590 |

In the news…

FBR (ASX:FBR) shares are sliding after the company entered into a $20m share subscription facility with GEM Global Yield LLC and launched a $1m placement at $0.0045 per share, a 25% discount to the company’s last closing price.

The fresh funding will go to development of the Hadrian X robot among several other work streams. FBR has designed its bricklaying robot to build structural walls more efficiently than traditional manual methods.

In Case You Missed It

Western Gold Resources (ASX:WGR) has appointed a drilling contractor for a 35,000m program at Gold Duke as it looks to update the scoping study and start mining this year.

Trading Halts

Beacon Minerals (ASX:BCN) – drilling results at Lady Ida Project

Beonic (ASX:BEO) – cap raise

Etherstack (ASX:ESK) – material contract signing

Everest Metals Corporation (ASX:EMC) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.