CLOSING BELL: ASX ends flat, but Azure’s inability to stop finding lithium is helping its neighbours grow

"The benchmark finished flat today? ... you're winding me up, mate." Pic via Getty Images.

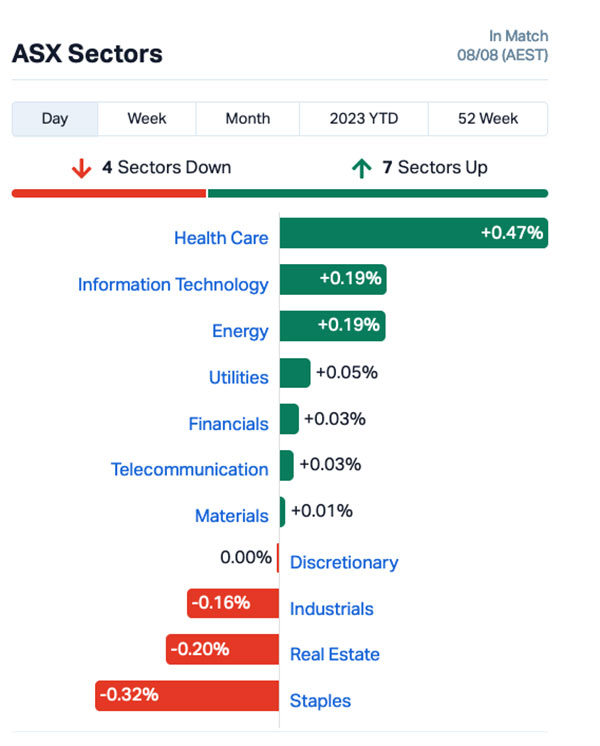

- ASX benchmark finishes the flat, after struggling to find traction since mid-morning

- Health Care romped home to win Best Sector today, up more than 0.4%

- Errawarra’s nearology has continued to pay off, adding around 50% more today.

While it wasn’t a shocker, it definitely wasn’t a day for breaking out the bubbly, as the ASX 200 finished flat despite a solid lead-in from Wall Street overnight.

The US session’s result, along with a handful of chunky performances locally, saw the broader market treading water for most of the day, after the morning’s initial 0.4% bump settled back to +0.2% before lunch. That fell to zero in the dying minutes of the day, because that’s what I get for taking my eye off the ticker that close to the end of the session.

Out in front on the sector list, Health Care stacked on a solid lead for the day, with InfoTech and Materials not too far behind in support.

Real Estate gave back a chunk of yesterday’s win, but it was Consumer Staples running off with the wooden spoon for the day.

Among the large caps, the big shaker was James Hardie (ASX:JHX), which added more than 14% throughout the session, on the back of a well-received quarterly this morning.

That result for James Hardie pushed the company back above the psychologically significant $20 billion in market cap, to levels not seen since early March, 2022.

And Azure Minerals (ASX:AZS) just kept on growing again today, thanks to the last couple of announcements around its Andover lithium play in the West Pilbara region of WA.

AZS added another 7% today, taking the day’s Small Caps winner along for the ride – because it’s obviously the neighbourly thing to do. More on that story shortly.

FROM THE HEADLINES

Beyond the ASX today, there’s been a major policy backflip from the WA government today, with Premier Roger Cook announcing that he’s abandoning the state’s controversial Aboriginal cultural heritage legislation just 39 days after it was enacted.

As the ABC reports, the laws were “designed to avoid a repeat of Rio Tinto’s destruction of 46,000-year-old culturally significant caves at Juukan Gorge in 2020”, however Cook says they “went too far, were too complicated and placed unnecessary burdens on property owners”.

“I understand that the legislation has unintentionally caused stress, confusion and division in the community and for that I am sorry,” Cook told media this morning.

The plan is to revert to the pre-existing Aboriginal Heritage Act 1972, which in turn will be beefed up in certain areas in a bid to find a middle ground.

Cook says that “everyday” property owners won’t ever have the burden of undertaking surveys of their own land under any circumstances, and instead the WA government will embark on a 10-year project to conduct surveys of critical areas within the state, the results of which will be held by the government and published.

Other amendments to the 1972 Act include:

- The newly formed Aboriginal Cultural Heritage Council will take on the role of the Committee established under the 1972 Act to make recommendations to the Minister;

- Proponents and Native Title parties will have the same right of review for Section 18 decisions, with clear timelines and an ability for the Premier to call-in a decision of ‘State significance’, to act in the interests of all Western Australians; and

- When a Section 18 has been approved, it will be a requirement for the owner to notify the Minister of any new information about an Aboriginal site.

The Association of Mining and Exploration Companies has welcomed the change, saying it had “endeavoured to work with Government and traditional owners to ensure that the newly minted framework would work in operation”.

“When it became clear that this was not the case, and that all involved were struggling with the complexity of the new requirements, we realised that a new approach was needed,” AMEC chief Warren Pearce said.

“Government has heard this message and is responding to industry and community concern.”

In overseas news, fresh data from China shows that the country’s imports and exports are falling, providing further evidence that Beijing’s left the handbrake on the Chinese economy again.

China’s exports dropped 14.5% for the year to July – the the largest exports decline since February 2020, when Covid put the Chinese economy into lockdown.

Meanwhile, at the same time, imports fell 12.4%, as demand for goods continues to slide amid growing concerns of another global slowdown.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ERW | Errawarra Resources | 0.1725 | 50% | 2,831,810 | $6,957,960 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 78,129 | $5,824,681 |

| CTN | Catalina Resources | 0.005 | 43% | 1,437,974 | $4,334,704 |

| EDE | Eden Inv Ltd | 0.004 | 33% | 1,082,794 | $8,990,833 |

| ENA | Ensurance Ltd | 0.265 | 33% | 3,604,003 | $18,031,185 |

| NGY | Nuenergy Gas Ltd | 0.027 | 29% | 674,151 | $31,100,065 |

| OAU | Ora Gold Limited | 0.0075 | 25% | 25,716,905 | $26,621,551 |

| ADS | Adslot Ltd. | 0.005 | 25% | 56,000 | $13,066,471 |

| MHK | Metalhawk. | 0.135 | 23% | 30,000 | $8,664,811 |

| AYA | Artryalimited | 0.325 | 20% | 154,390 | $16,990,701 |

| AJQDA | Armour Energy Ltd | 0.12 | 20% | 212,197 | $9,842,684 |

| IVX | Invion Ltd | 0.006 | 20% | 73,333 | $32,108,161 |

| MRQ | Mrg Metals Limited | 0.003 | 20% | 9,639,313 | $5,464,797 |

| OAR | OAR Resources Ltd | 0.006 | 20% | 11,022,829 | $13,065,679 |

| HIO | Hawsons Iron Ltd | 0.043 | 19% | 26,280,600 | $33,086,558 |

| AX8 | Accelerate Resources | 0.025 | 19% | 1,257,417 | $7,971,637 |

| LM1 | Leeuwin Metals Ltd | 0.405 | 17% | 55,579 | $15,450,825 |

| UBI | Universal Biosensors | 0.27 | 17% | 83,677 | $48,844,970 |

| NGS | NGS Ltd | 0.014 | 17% | 2,039,304 | $2,982,089 |

| CTQ | Careteq Limited | 0.029 | 16% | 73,988 | $3,003,538 |

| RCE | Recce Pharmaceutical | 0.705 | 16% | 832,471 | $108,735,129 |

| WTL | Wt Financial Grp Ltd | 0.09 | 15% | 1,091,646 | $26,460,280 |

| OMA | Omegaoilgaslimited | 0.195 | 15% | 2,619,000 | $25,997,104 |

| PPL | Pureprofile Ltd | 0.032 | 14% | 3,035,873 | $31,733,026 |

| GAP | Gale Pacific Limited | 0.24 | 14% | 220,986 | $58,042,539 |

By the end of the session this afternoon, Errawarra Resources (ASX:ERW) was way out in front of the rest of the small caps pack – up more than 52% late in the day thanks to a bonus-round of continued nearology-driven investment, because next door neighbour Azure Minerals’ (ASX:AZS) can’t stop finding lithium.

Ensurance (ASX:ENA) is in second place, up more than 32% on news that the company has entered a binding scheme implementation deed with PSC Insurance Group (ASX:PSI), which will see the latter acquire 100% of ENA.

PSC Insurance says the price is to be “the greater of $25.2 million and 5,000,000 PSC shares – to be satisfied by way of the issue of 5,000,000 PSC shares with any difference between the value of those shares and the purchase price of $25.2 million to be paid in cash”.

The transaction values ENA at no less than $25.2 million and each ENA share at 28 cents per ENA share, with ENA shareholders set to receive approximately 0.056 new PSC share for each ENA share they hold.

And Hawsons Iron (ASX:HIO) has popped more than 22% on news that Stage 2 resource analysis of exploration drilling results have confirmed the presence of a prospective, near-surface zone hosting magnetite mineralisation at targeted grades at its self-titled magnetite project in Western NSW, 60km southwest of Broken Hill.

The near-surface discovery has opened up options for Hawsons to change tack in terms of mining strategy, which could see the company significantly shorten the project’s ramp-up to full production.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| E33 | East 33 Limited. | 0.026 | -28% | 143,540 | $18,687,193 |

| MCT | Metalicity Limited | 0.0015 | -25% | 504,218 | $7,472,172 |

| MEB | Medibio Limited | 0.0015 | -25% | 9,551,760 | $10,301,188 |

| EPX | Ept Global Limited | 0.023 | -23% | 33,500 | $13,377,411 |

| AMM | Armada Metals | 0.025 | -22% | 299,829 | $2,194,178 |

| DMM | Dmcmininglimited | 0.055 | -21% | 520,415 | $2,096,500 |

| INP | Incentiapay Ltd | 0.0055 | -21% | 1,009,117 | $8,855,445 |

| SKF | Skyfii Ltd | 0.04 | -20% | 720,424 | $20,984,408 |

| ADR | Adherium Ltd | 0.004 | -20% | 2,135,000 | $24,997,042 |

| KOB | Kobaresourceslimited | 0.105 | -19% | 105,526 | $13,704,167 |

| MRZ | Mont Royal Resources | 0.21 | -19% | 190,653 | $17,805,494 |

| HPC | Thehydration | 0.04 | -17% | 86,207 | $7,117,111 |

| G1A | Galena Mining | 0.1 | -17% | 2,602,596 | $90,308,242 |

| SNS | Sensen Networks Ltd | 0.05 | -17% | 139,119 | $40,848,859 |

| TMB | Tambourahmetals | 0.25 | -17% | 992,608 | $12,680,762 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 200,000 | $11,366,372 |

| CXM | Centrex Limited | 0.097 | -16% | 5,145,727 | $70,670,838 |

| RBL | Redbubble Limited | 0.595 | -15% | 895,387 | $194,404,156 |

| AJL | AJ Lucas Group | 0.012 | -14% | 296,373 | $19,260,215 |

| OPN | Oppenneg | 0.006 | -14% | 44,117 | $7,816,757 |

| TIG | Tigers Realm Coal | 0.006 | -14% | 170,000 | $91,466,917 |

| IDA | Indiana Resources | 0.054 | -14% | 2,229,893 | $33,747,592 |

| ILA | Island Pharma | 0.086 | -14% | 26,501 | $8,126,847 |

| MYR | Myer Holdings Ltd | 0.6125 | -14% | 15,283,895 | $583,107,959 |

| SYA | Sayona Mining Ltd | 0.13 | -13% | 65,675,095 | $1,543,994,402 |

LAST ORDERS

A quickie first up from Dateline Resources (ASX:DTR), after the company annoucned that it has received a handy US$0.5 million stage payment, due under the payment terms of its agreement to sell its interest in Gunnison Gold, the vehicle that owns the Gold Links mine and associated assets in Colorado.

There are a further two staged payments of US$0.5M due in October and December and a third payment of US$0.45M due in February 2024, and Dateline is entitled to receive a US$2M payment upon the first ounce of gold produced at the Lucky Strike mill.

Further production based payments are expected over the next 12-24 months, depending on how things pan out.

Meanwhile, Red Metal (ASX:RDM) has responded to an ASX request for information, after it was noticed that one of Red’s directors, Joshua Pitt, purchased a number of company securities during a Closed Period for trading of company shares was in place, due to the impending release of the company’s June quarterly.

The ASX noted that Pitt had purchased 815,070 RDM securities in three transactions, on 28 July, 31 July and 1 August 2023, while RDM’s Quarterly Activities/Appendix 5B Cash Flow Report was lodged on 31 July.

Red Metals acknowledged that section 4.1 of the company’s trading policy states (in part):

“Key Management Personnel must not, except in exceptional circumstances, deal in securities of the Company during the following periods:

…

(c) two weeks prior to, and 48 hours after the release of the Company’s quarterly reports (if applicable)”

However, it has subsequently pointed out that company personnel can purchase shares within that window, under “exceptional circumstances” and once they have obtained “the prior written approval of the Chairman of the Board or the Board before doing so”.

Discussion of the quarterly in question determined that there was no price sensitive information inside, and thus determined that Pitt was clear to make the purchases he desired – in short, ‘no harm, no foul’ and everything is above board.

TRADING HALTS

Limeade (ASX:LME) – Halt called pending the outcome of the special shareholders meeting to approve to the merger between Limeade and WebMD Health Corp.

Adriatic Metals (ASX:ADT) – Capital raising.

MPower (ASX:MPR) – Finalisation of a refinancing transaction.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.