Closing Bell: ASX ends almost okay after Telstra-led recovery

Hi! It's Telstra, here... we've been trying to reach you so we can charge you more money! Pic via Getty Images.

- ASX 200 closes 0.16pc lower after modest rally from morning lows

- Six of 11 sectors lower, after rate-sensitive sectors improve after lunch

- Killi Resources surges again with a late surge to dethrone Infini

Local markets have trimmed a morning of losses after iron ore futures slumped in Singapore and led the heavyweight miners lower.

The S&P/ASX200 closed lower on Wednesday by about 13 points or 0.16% to 7,816.80

In New York it was more of the all-time highs for the S&P500 and the tech heavy Nasdaq.

Those two US indices continued to incrementally conquer uncharted territory overnight and they may continue in that vein should the US Federal Reserve come good on all the interest rate cut bets being laid out by US investors.

In the short-term however, if US CPI on Wednesday fails to fit the cutting narrative then perhaps the US banks which kick off Q2 earnings season on Friday will.

US financials jumped overnight, enhancing the chances that traders will grow cautious towards the end of the week.

At home, today was for largely the telco’s, with the ASX Telecommunications sector ahead by more than 3.1% over the past five days.

The Teleco’s added 1.3% on Wednesday in some defiant business with Telstra (ASX:TLS) adding 2.3% a day after slapping customers with costly new price hikes.

Here’s the best of the rest of the ASX Telecoms Services (XTJ) Index:

The Aussie benchmark was lower by lunch with almost every sector in the red.

But after lunch, the improving fortunes of rate sensitive sectors could be put down in no small part to the brokers at the Millionaire’s Factory of Macquarie Bank.

In a note the analysts warned clients that the local economic cycle just clicked over from expansion to contraction – so investors need to position now for a falling interest rate environment and go buy up some REITs and property stocks.

At home a special mention goes to the troublesome iron ore trio.

They dragged the Materials sector down deep into the hole created by Singapore iron ore futures which skimmed a few more bucks off the August contract – the index fell around 1.5% to around $107.50.

Among the other major stocks on the benchmark, Insignia Financial (ASX:IFL) and Orora (ASX:ORA) did much of the bleeding – down -7.8% and -4.4%, respectively.

Leading the losing was the country’s biggest drag – BHP (ASX:BHP) – which was down more than -1% in the early arvo, as was Fortescue (ASX:FMG).

In other big cap news, the fertiliser, explosives, chemicals and mining services conglomerate Incitec Pivot (ASX:IPL) is down around -1.8% after it pulled the plug on negotiations with PT Pupuk Kalimantan Timur (PKT) for the sale of its fertilisers business, Incitec Pivot Fertilisers (IPF).

IPL says the decision follows “careful consideration of how to maximise value for shareholders while balancing the risks of completing the transaction in a reasonable timeframe.”Incitec Pivot says it’ll still handle its blowing stuff up business, Dyno Nobel and fertilisers businesses separately.

IPL has reiterated its intention to pull off a $900mn share buyback.

The big banks, led by the biggest of them all – the Commonwealth Bank (ASX:CBA) – were in gentle retreat on Wednesday, having again smashed Tuesday out of the park, despite remaining utterly friendless friendless with the analyst community.

Yesterday the four majors all climbed an average somewhere near +1.9%. CBA again clocked a new all-time high as the $130 level approaches slowly but surely.

According to Market Matters data, none of the major 15 analysts covering CBA have a Buy rating on the stock, yet year to date, CBA is up about 15%, keeps notching new all-time highs and has almost eclipsed BHP as the country’s largest company by market cap.

Around Easter, the aforementioned trendsetters at Macquarie (followed soonly by Citi) issued damning, aggressive, and much-publicised “sell these awful banks” summations, slapping a staple of Aussie investing right in the teller.

“Commonwealth Bank has rallied well over $15 since these bold calls, with other analysts having subsequently jumped on the bandwagon; CBA needs to drop 10% to get close to when they turned bearish!” says Market Matters boss James Gerrish.

“We believe they will likely feel further “pain &/or frustration” over the coming weeks/months as the banks look set to maintain their advance.

“Analysts are basing their bearish cases on valuation grounds, with CBA trading 26% above its historically average blended P/E of the last 5 years. Still, this year has been a story of stretching elastic bands, with the expensive largely getting more expensive as investors chase stocks/sectors where they feel comfortable.”

ANZ is currently market matters preferred among the Big Four, with a price target around $31, which is circa 5-6% higher.

A similar move at CBA would create a $135.00 monster.

Meanwhile, the price of Gold has moved lower after reports China didn’t (as per) buy up all the gold it could in June following a reserve freeze in May with the precious metal resting around $2,350, but the retreat was minimal and the outlook remains with the bulls.

Fed rate cut expectations could soon help the price rebound, while the risk of a Trump election in the states a likely catalyst for China to reaccelerate its purchases on what’d be worsening US-China relations.

Beijing may continue to sheer off parts of its USD dependency should a new US administration suddenly decides to weaponise its own currency.

Meanwhile…

ASX200 by the sectors on Wednesday

Six of 11 sectors were lower at the close.

The ASX Small Ordinaries (XSO) index climbed 0.2% while the ASX Emerging Companies (XEC) index ended pretty flat again.

Over the last five days, the ASX200 index has gained 1%% and is currently 1.2% off of its 52-week high.

Not the ASX

Overnight on Wall Street, The S&P500 gained less than 0.1% to set its 36th new record this year.

The Nasdaq added a little more than 0.1% – also an all-time high, while it was less fun over on the Dow Jones Industrial Average which again declined 0.1%.

The US Financial sector drove the gains. Goldman Sachs at an all-time high, while another six banks and finance companies in the S&P500 ended at their highest price in at least a year.

JPMorgan, Citigroup, and Bank of America lead out the US Q2 earnings on Friday.

Treasury yields and shares of banks rose following Federal Reserve Chairman J. Powell’s carefully calibrated Congressional testimony.

Powell told the Senate Banking Committee that recent employment data suggest the labor market has “cooled considerably.” He said the central bank is weighing the potential that high rates wreck the economy and cause excessive unemployment against the risk of reigniting inflation with rates cut too soon.

Stocks in the UK and the EU fell on Tuesday.

The STOXX Europe 600 Index lost 0.9% at 511.76, Germany’s DAX slipped 1.2% to 18,236.19 and France’s CAC 40 tumbkled 1.6% to 7,508.66.

US Futures at 4pm on Wednesday in Sydney

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KLI | Killiresources | 0.13 | 65% | 29,200,383 | $9,497,676 |

| LNR | Lanthanein Resources | 0.0045 | 50% | 3,942,800 | $7,330,908 |

| DAL | Dalaroometalsltd | 0.03 | 50% | 763,596 | $1,903,250 |

| I88 | Infini Resources Ltd | 0.735 | 50% | 8,398,707 | $18,611,829 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 1,365,934 | $5,824,681 |

| CLZ | Classic Min Ltd | 0.0015 | 50% | 32,557,764 | $808,365 |

| EXL | Elixinol Wellness | 0.004 | 33% | 91,336 | $3,963,547 |

| AL3 | Aml3D | 0.185 | 28% | 16,257,216 | $54,679,360 |

| TOY | Toys R Us | 0.125 | 25% | 441,364 | $11,569,073 |

| 88E | 88 Energy Ltd | 0.0025 | 25% | 6,349,471 | $57,785,344 |

| AMD | Arrow Minerals | 0.0025 | 25% | 12,235,002 | $21,078,730 |

| LPD | Lepidico Ltd | 0.0025 | 25% | 56,001 | $17,178,239 |

| ME1 | Melodiol Glb Health | 0.0025 | 25% | 2,471,914 | $612,527 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 5,127,690 | $16,634,713 |

| SRL | Sunrise | 0.605 | 23% | 170,841 | $44,211,474 |

| FBR | FBR Ltd | 0.058 | 23% | 42,133,917 | $208,771,649 |

| ZLD | Zelira Therapeutics | 0.48 | 23% | 12,290 | $4,425,390 |

| TTT | Titomic Limited | 0.135 | 23% | 7,011,732 | $111,207,593 |

| MKG | Mako Gold | 0.011 | 22% | 5,792,871 | $8,784,074 |

| AMS | Atomos | 0.034 | 21% | 6,375,478 | $33,982,545 |

| DDB | Dynamic Group | 0.285 | 21% | 489,487 | $32,674,376 |

| GLL | Galilee Energy Ltd | 0.023 | 21% | 1,236,999 | $6,455,148 |

| SVG | Savannah Goldfields | 0.023 | 21% | 2,500 | $5,340,613 |

| PGO | Pacgold | 0.145 | 21% | 142,156 | $10,097,453 |

| ASR | Asra Minerals Ltd | 0.006 | 20% | 5,763,735 | $10,180,397 |

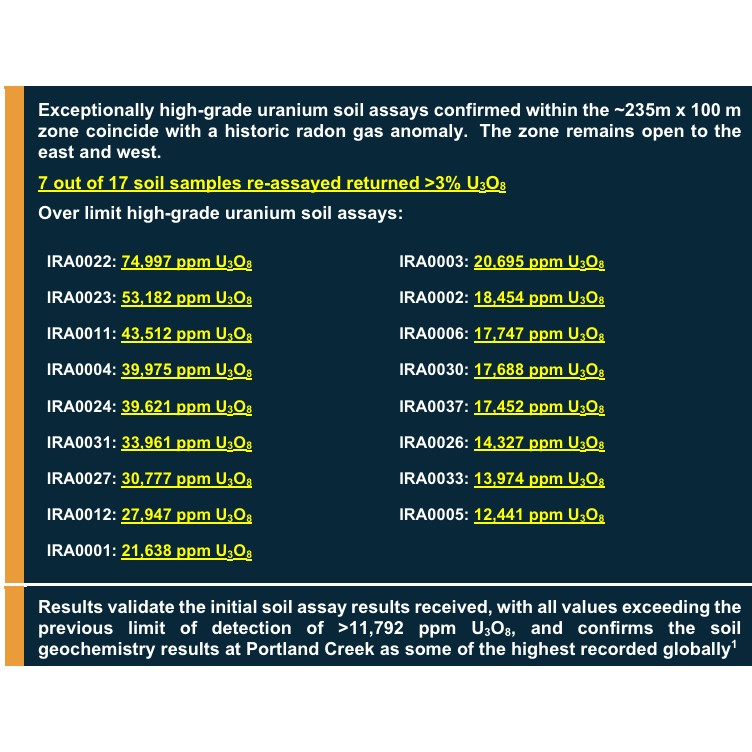

Infini Resources (ASX:I88) has broken Wednesday over its knee with some “stunning” uranium assays. The stock is soaring and there’s a lot of excitement about the “exceptional” nature of I88’s “globally” significant grades…

I88 previously reported that these samples were too much for the lab to handle, so they sent them somewhere else to get tested. W

These are the ones that came back came back and a lot of people who know uranium are scared by the numbers, with values as high as 74,997ppm U3O8.

Also out there enjoying a stellar Wednesday- and a wonderful week at that – is Killi Resources (ASX:KLI), where we’re looking at some “very high grade” copper and gold …with the colour photos to match:

Suddenly in the Cu-Au business this week is the Aussie niobium hunter Norwest Minerals (ASX:NWM) which added copper-gold drill targets at its Arunta West project… in West Arunta – one of Australia’s latest hotbeds of exploration activity.

The catalyst was WA1 Resources (ASX:WA1) unearthing its super high-grade Luni niobium deposit that recently served up a 200Mt niobium resource – the largest find of its kind in over 70 years.

NWM is in early-doors exploration for the 1500km2 Arunta West, mapping targets for the critical minerals program. And it’s just added the huge 3km x 1.5km Tamba copper-in-soil anomaly to its target list, the likely starting point for upcoming drilling plans.

Shares in the minnow rocketed 18.8% on the news to 3.8c per share.

Up more than 20% is Sunrise Energy Metals (ASX:SRL) which reports that although everything is hunky-dory in the Sunrise Nickel-Cobalt Project, there’s been a few interesting developments in the scandium market which have “necessitated a reassessment of a stand-alone, fully-integrated scandium mining, processing and refining facility in Australia.”

These market developments are basically about the increasing use of scandium in specialty semiconductor applications, as well as an increased focus on scandium-containing alloys in the military and defence sectors.

The other main development is that China controls most of the world scandium trade.

SRL says it has received expressions of interest “from a range of parties for scandium offtake.”

A Feasibility Study is underway, discussions with said parties is ongoing and the plan is about “converting expressions of interest into firm offtake commitments.”

On Tuesday, Toys R Us (ASX:Toy) revealed that it’d secured some $4mn in funding made up of $2.49mn via a Placement to new and existing institutional and sophisticated investors as well as securing a deal from Mercer Street Global Opportunity Fund II LP (Mercer) to investa further $1.5 million from the existing $4.2 million (facility limit) convertible securities facility.

The cash will apparently let TOY “take advantage of the hard work over recent months to right size the business and launch the TOY House of Brands Growth Strategy.”

The stock is up 20% today.

Here’s the pitch for the new House of Brands strategy:

- Toys“R”Us has an impressive array of house brands, backed by a large, loyal customer base and a wealth of green shoot opportunities to reset the growth story.

- It’s a “growing and globally vibrant brand” that boasts 1,350+ stores worldwide across 31 countries, with clear avenues for expansion through the

license in ANZ. - The recently completed RIOT Art & Craft acquisition enhances e-commerce offerings with a complimentary vertical, a large customer base, which fills a gap in TOY’s customer lifecycle chain, as well as significantly higher product margins.

- Overhead cost reductions and operational improvements continue to ease financial burdens, including the exit of the UK market and reduction in Clayton distribution facility lease expense.

- Anticipated lease bond repayment would return A$2.7m cash to the Company in Q1 FY25.

- The Company has cleared underperforming inventory and is poised to reinvest significantly in high quality stock to accelerate growth of existing core brands, as well as launch new house brands.

- TOY’s competitive edge to capture online market share in the toy, baby and art & craft spaces by leveraging a high quality user base throughout a child’s lifecycle will be pivotal to unlocking higher repeat purchases and maximising cross-selling.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.002 | -33% | 1,643,621 | $18,592,338 |

| RNE | Renu Energy Ltd | 0.004 | -33% | 1,396,106 | $4,356,804 |

| WML | Woomera Mining Ltd | 0.002 | -33% | 1,104,000 | $3,654,417 |

| ASQ | Australian Silica | 0.02 | -31% | 215,000 | $8,173,951 |

| RC1 | Redcastle Resources | 0.0155 | -26% | 1,044,408 | $6,893,967 |

| BNL | Blue Star Helium Ltd | 0.006 | -25% | 16,447,164 | $15,559,082 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 5,086 | $1,586,566 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | 285,714 | $5,873,960 |

| ROG | Red Sky Energy. | 0.0035 | -22% | 9,102,056 | $24,400,022 |

| PNM | Pacific Nickel Mines | 0.022 | -21% | 1,641,646 | $11,711,087 |

| MMM | Marley Spoon Se | 0.02 | -20% | 463,628 | $2,943,110 |

| AHN | Athena Resources | 0.002 | -20% | 72,333 | $2,676,169 |

| FGH | Foresta Group | 0.008 | -20% | 4,972,725 | $23,553,791 |

| M2R | Miramar | 0.008 | -20% | 788,405 | $1,973,898 |

| MSI | Multistack Internat. | 0.004 | -20% | 73,777 | $681,520 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 1,719,693 | $11,058,736 |

| NRZ | Neurizer Ltd | 0.009 | -18% | 4,413,127 | $20,926,737 |

| CDR | Codrus Minerals Ltd | 0.035 | -17% | 60,000 | $6,946,275 |

| BDT | Birddog | 0.075 | -17% | 218,687 | $17,373,698 |

| ARV | Artemis Resources | 0.01 | -17% | 1,697,036 | $21,170,354 |

| AVE | Avecho Biotech Ltd | 0.0025 | -17% | 877,146 | $9,507,891 |

| SIS | Simble Solutions | 0.0025 | -17% | 1,333,333 | $2,260,352 |

| FCT | Firstwave Cloud Tech | 0.016 | -16% | 100,000 | $32,490,368 |

| PPK | PPK Group Limited | 0.565 | -14% | 239,707 | $59,375,249 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 149,721 | $8,246,534 |

TRADING HALTS

Orthocell (ASX:OCC) – pending an announcement by the Company in relation to receipt of regulatory approval for Striate in Canada.

Nimy Resources (ASX:NIM) – pending an announcement with regards to a proposed material capital raise.

WA1 Resources (ASX:WA1) – pending the release of an announcement to the market in relation to a proposed capital raising.

Power Minerals (ASX:PNN) – pending an announcement in relation to an agreement for the funding and development of the Pular Lithium Project.

ICYMI – PM EDITION

American West Metals (ASX:AW1) has intersected visual copper sulphides in early drilling at the Cyclone and Lightning Ridge prospects at its Storm project in Canada. This bolsters the likelihood of an upgrade to the existing resource of 17.5Mt at 1.2% copper and 3.4g/t silver.

Brightstar Resources (ASX:BTR) is accelerating development of its Menzies and Laverton gold projects by upgrading its current pre-feasibility study work to a more detailed definitive feasibility study. This will enable the company to make a final investment decision in early 2025.

Culpeo’s (ASX:CPO) diamond drilling at the Lana Corina project in Chile has intersected near surface, high-grade copper mineralisation, extending its largest mineralised intercept to 454m at 0.93% copper equivalent.

Earths Energy (ASX:EE1) is poised to progress its advanced South Australian geothermal energy projects after a review confirmed they have significant development potential.

HyTerra (ASX:HYT) has received the Permit to Drill from the Kansas Corporation Commission for the Sue Duroche-3 hydrogen and helium well within its flagship Nemaha project. The proposed well is 200m from the historical Sue Duroche-3 well that reported up to 92% hydrogen and 3% helium.

Impact Minerals’ (ASX:IPT) pre-feasibility study for its Lake Hope high purity alumina mine in WA remains on schedule for release in Q4 2024. The release will increase its stake in the project to 80% and set up potential HPA pilot production in 2025.

Mako Gold (ASX:MKG) has started a scout 1500m reverse circulation drill program over three target zones at the Tchaga North prospect within its Napié gold project in Côte d’Ivoire. This is aimed at increasing the current 868,000oz resource.

Neurotech (ASX:NTI) has reported further benefits from its Phase 2/3 trial of autism patients participating in its world-first broad-spectrum cannabinoid drug therapy NTI164 with significant improvements in symptoms.

Pursuit Minerals (ASX:PUR) has started drilling the second deep diamond hole at its Rio Grande Sur lithium brine project in Brazil as the program targeting growth to the existing inferred resource of 251,300t lithium carbonate equivalent at 351mg/L.

It follows on the first hole, which struck deeper high-grade lithium brines of up to 629mg/L below the existing resource at the Maria Magdelena tenement.

Hole DDH-2 at the Sal Rio 02 tenement, which is on the margins of the salar, was selected by the geological onsite team following interpretation of the transient electromagnetic (TEM) survey results from field work carried out in late 2023.

White Cliff Minerals’ (ASX:WCN) maiden field program at its Great Bear Lake project in northern Canada has returned visual observations of widespread iron-oxide-copper-gold and uranium mineralisation.

At Stockhead, we tell it like it is. While American West Metals, Brightstar Resources, Culpeo, Earths Energy, HyTerra, Impact Minerals, Mako Gold, Neurotech, Pursuit Minerals and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.