Closing Bell: ASX edges ahead as Trump’s tariffs news awaits

Pic via Getty Images

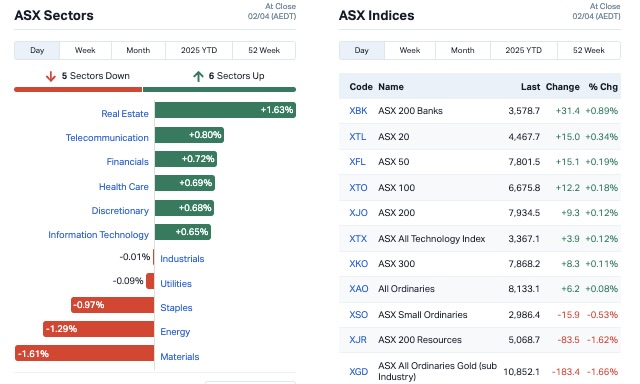

- The ASX 200 got over the line again for another daily win, despite curbed afternoon enthusiasm

- Traders, investors, companies and pretty much anyone who cares about the economic state of the world await the next highwire act in The Trump Tariffs Circus

- Sectors-wise on the local bourse, property stocks propped up the market while big miners dragged

After a strong rally early doors on Wednesday, the ASX faded but still managed to scrape over the line with a 0.12% gain. That came largely thanks to a bounce in property stocks, which helped offset some losses in the big mining players. The overall uptick follows on from a 1% jump on Tuesday.

Trading was a bit subdued in the afternoon, with uncertainty around Trump’s tariff announcements still causing a few upset stomachs.

US President Trump’s team has been scrambling to finalise the details of his reciprocal tariffs, which are expected to hit markets hard (in either direction).

These tariffs, set to be revealed later today US time, could be the trigger for major shifts in the global trade landscape.

What has traders on edge is the unpredictability of how aggressive these new levies will be.

We’re talking about tariffs that could potentially cover more ground than what was seen with the infamous Smoot-Hawley tariffs from the 1930s – an event that’s still cited as a cautionary tale about protectionism.

In fact, there’s talk that the tariffs could drive inflation, which is only making things more volatile.

US and ASX stocks, however, have been riding that wave of hope, with the Nasdaq climbing overnight, and even Bitcoin was up [Ed: Whaddaya mean ‘even’?], earlier breaking the $US85,000 mark.

On the ASX, the property sector was the star performer today. But big names in mining including BHP (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO) took a hit.

In large caps news, casino operator Star Entertainment Group (ASX:SGR) is in hot water after failing to secure a much-needed $750 million lifeline, leaving it facing a potential third brush with administration this year.

Mineral Resources (ASX:MIN) also had a rough day after its CEO Chris Ellison was hit with a class action in Victoria’s Supreme Court. The action alleges that he and the company misled investors about MIN’s corporate practices, causing shares to be artificially inflated.

Westpac (ASX:WBC) , meanwhile, appointed a new chief people officer, which saw its shares climb by 1%.

Across Asia, it’s clear that the mood is cautious. Countries like Japan and South Korea, which rely heavily on exports, are at the mercy of what happens next.

There’s real concern about how these tariffs will impact trade in the region, especially for economies that have been deeply integrated into the global supply chain.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap KGD Kula Gold Limited 0.007 40% 10,452,602 $4,606,268 AFA ASF Group Limited 0.004 33% 28,200 $2,377,193 EMT Emetals Limited 0.004 33% 300,027 $2,550,000 PIL Peppermint Inv Ltd 0.004 33% 3,606,666 $6,634,438 SRN Surefire Rescs NL 0.004 33% 1,235,700 $7,248,923 KNB Koonenberrygold 0.054 32% 65,937,596 $38,579,120 AQX Alice Queen Ltd 0.005 25% 4,602,871 $4,587,560 BP8 Bph Global Ltd 0.005 25% 12,535,939 $2,433,233 CUL Cullen Resources 0.005 25% 200,929 $3,120,308 DTR Dateline Resources 0.005 25% 5,537,199 $10,262,274 FRX Flexiroam Limited 0.005 25% 1,913,444 $6,069,594 HLX Helix Resources 0.003 25% 526,666 $6,728,387 PAB Patrys Limited 0.003 25% 166,600 $4,114,895 A3D Aurora Labs Limited 0.069 21% 164,226 $22,785,314 PGD Peregrine Gold 0.230 21% 314,080 $15,098,154 AX8 Accelerate Resources 0.006 20% 150,000 $3,935,944 ROG Red Sky Energy. 0.006 20% 458,268 $27,111,136 OZM Ozaurum Resources 0.105 19% 17,240,371 $19,938,765 PEB Pacific Edge 0.130 18% 13,024 $89,310,757 TMB Tambourahmetals 0.033 18% 66,750 $3,292,521 ADX ADX Energy Ltd 0.028 17% 901,995 $13,804,543 ASR Asra Minerals Ltd 0.004 17% 2,012,495 $7,119,380 JAV Javelin Minerals Ltd 0.004 17% 9,940,417 $18,138,447

Kula Gold’s (ASX:KGD) drilling at the Mt Palmer Gold Mine in WA’s Southern Cross Goldfields has returned solid results, including 12m at 3.4g/t gold, building on previous hits like 7m at 3g/t, including 1m at 10.6g/t. Drilling is still going with more results due, and Kula’s now met the requirements to earn 80% of the Mt Palmer JV. This project fits into Kula’s strategy of focusing on exploration near existing operations.

Koonenberry Gold’s (ASX:KNB) first drill at the Enmore gold project in NSW has also been impressive – see below for details.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap LNU Linius Tech Limited 0.001 -33% 110,000 $9,226,824 ERW Errawarra Resources 0.046 -27% 4,191,021 $6,043,002 AOK Australian Oil. 0.002 -25% 1,009,814 $2,003,566 EDE Eden Inv Ltd 0.002 -25% 8,336,515 $8,219,762 TFL Tasfoods Ltd 0.003 -25% 126,916 $1,748,382 CRR Critical Resources 0.004 -20% 3,164,943 $12,321,106 ERA Energy Resources 0.002 -20% 25 $1,013,490,602 TEM Tempest Minerals 0.004 -20% 484,000 $3,172,649 BNL Blue Star Helium Ltd 0.007 -19% 2,188,264 $21,559,082 RGT Argent Biopharma Ltd 0.130 -19% 17,524 $9,483,563 ZAG Zuleika Gold Ltd 0.009 -18% 3,957,122 $8,160,679 ION Iondrive Limited 0.014 -18% 6,086,052 $20,108,218 S66 Star Combo 0.133 -17% 43,800 $21,613,277 VRL Verity Resources 0.015 -17% 3,708,071 $3,318,130 ALR Altairminerals 0.003 -17% 1,000,000 $12,890,233 EM2 Eagle Mountain 0.005 -17% 35,123 $6,810,224 GCM Green Critical Min 0.010 -17% 19,919,913 $23,540,140 IPB IPB Petroleum Ltd 0.005 -17% 135,315 $4,238,418 ADO Anteotech Ltd 0.011 -15% 725,182 $35,168,904 CYB Aucyber Limited 0.083 -15% 234,373 $16,029,209 DRE Dreadnought Resources 0.012 -14% 14,350,629 $58,228,800 GES Genesis Resources 0.006 -14% 84,916 $5,479,889 HT8 Harris Technology Gl 0.012 -14% 1,600 $4,605,512 QXR Qx Resources Limited 0.003 -14% 23 $4,585,272

IN CASE YOU MISSED IT

Koonenberry Gold’s (ASX:KNB) first Sunnyside diamond hole has struck a 170m intersection grading 1.75g/t gold from 77m, including a high-grade interval of 18.3m at 9.95g/t gold. This high-grade find lines up with previous visible gold zones and shows the system’s got serious gold potential. Results from a further three holes are pending, with drilling ongoing. The company believes the gold is open for more discovery both up-dip and along strike.

Pure Hydrogen (ASX:PH2) has secured a landmark US$28 million Master Supply and Distributor Agreement (MSDA) with Mexico-based GreenH2 LATAM to supply hydrogen equipment, including electrolysers, refueling, storage, and transport solutions. The partnership aligns with Mexico’s shift toward renewable energy under its new government.

Terra Metals (ASX:TM1) has confirmed high-grade polymetallic mineralisation at its Dante project in WA, highlighting the potential for open-cut mining. The company is now focussed on metallurgical optimisation and a maiden resource estimate.

Ovanti (ASX:OVT) is selling 15.75% of its 21% stake in Malaysian finance firm i-Destinasi Sdn Bhd for ~A$10.8 million, retaining a 5.25% interest. The company sees strategic value in holding a stake while also advancing its US market entry through a licensing deal with BNPLPay Protocol.

At Stockhead, we tell it like it is. While Koonenberry Gold, Pure Hydrogen, Terra Metals and Ovanti are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.