Closing Bell: ASX down on Beijing tantrum, biotech proves Sandy Beard no rash decision

Pic: Getty

The S&P/ASX200 is lower in late trade on Tuesday, dropping around 30 points or 0.4%, after iron ore futures plunged in Singapore.

The SGX March booking shed a full 10% after lunch (Singapore time) on reports Beijing has just had it with the steel-making ingredients’ latest awesome comeback and has called a meeting of those involved for some old school intimidation.

All the iron ore majors tumbled, led by China-specialist Fortescue Minerals (ASX:FMG) down about 5%.

The ASX Emerging Companies [XEC] was 1.7% down at 4pm in Sydney.

The brave goldies have arisen for a second day, as the shiny safe haven kept rumbling to an eight-month high, while the energy sector backtracked after leading the market higher on Monday.

Not because that particular problem has been solved — it’s just profit taking. There’ll likely be more of that to come…

Did you know Tuesday…

The global rejigging from fossil fuels to sustainable energy has certainly been mucking around with markets of late, and now – thanks largely to Russia’s seriously unsubtle sabre rattling – that energy volatility could be about to whack the global economy.

As the Bank of China’s head of fixed income Mark Todd observes, “with the world lacking in energy – and as the West decides on how to manage the Ukrainian situation – Russia’s President Putin might just be pondering how he can manage gas supplies to Europe.”

Since the Cold War the Soviet Union and its successors have shown a real willingness to use energy as a handy geopolitical weapon, great for prying apart its enemies.

Nord Stream — a pipeline named like a Finnish lullaby — has effectively secured German energy dependence on Russia.

By 2020 Germany was relying on the Russian pipeline for between 50% to 75% of its natural gas – and the left leaning Merkel government ensures the cleaner fuel is used not only to power industry but also for heating and to generate electricity across Germany.

Russian gas exports to Europe hit new and excitingly leverageable record level in 2021 – despite American efforts to ramp up exports of liquefied natural gas to Europe.

And now – not that I’m trying to freak everybody out with an End of Days scenario – crude futures jumped when trading opened this week and off they went – building on Friday’s 3-4% higher settlements.

Meanwhile, the International Energy Agency (IEA) has warned that the looming “chronic underperformance” by the chronically underperforming OPEC + (the plus bit there is Russia and its proxies) in meeting its production targets is “expected to deepen.”

Happily late to the party

Founder of Vanda Insights, Singapore-based energy analyst Vandana Hari, told Stockhead that even if the week proves to be uneventful in terms of an invasion, crude is unlikely to cool off substantially until the tension does. Oil may remain on the boil for several more days.

From the IEA: “Coupled with OECD oil inventories languishing 255 million barrels below their five-year average and at the lowest levels in seven years, the market has been left with a “small cushion,” predicting Canada, Brazil and Guyana can add another 460,000 b/d between them.

Hari notes the Baker Hughes index recorded 19 net additional oil rigs brought into operation in the US last week, its biggest weekly jump in four years.

“But overall, the IEA report ended up supporting bullish oil sentiment,” she told Stockhead.

That’s because it costs a good deal more than before.

“Other than those who ride on two-wheeled transport, everyone knows a trip to the bowser is a grim experience,” Mark Todd (a notorious maestro on a moped) says.

This is not a stimulation.

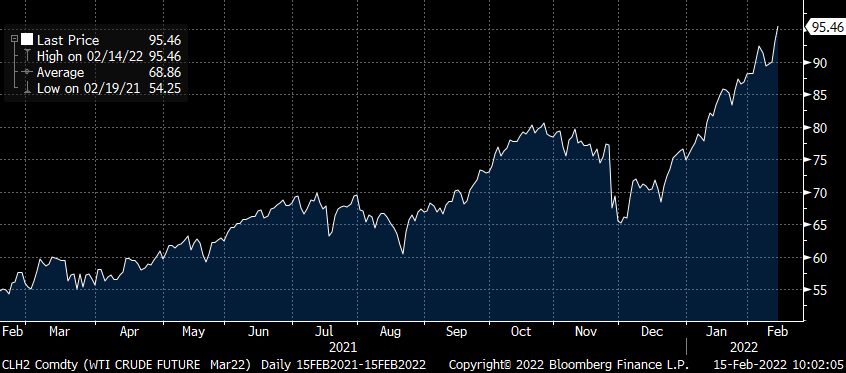

The following chart is the active WTI contract.

“This is not stimulatory,” Todd assures.

“And it is likely to be another data point that the Fed must consider in its – “out of how many options” – playbook.”

Gareth Aird chief economist at the Commonwealth Bank is now saying the first RBA rate hike will come in June. Mr Aird sees the RBA hiking a full per cent by Christmas, followed by one further 25bp rate hike by March next year.

But let’s leave the adults there.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ALT | Analytica Limited | 0.002 | 100% | 429,938 |

| TKL | Traka Resources | 0.015 | 25% | 737,800 |

| AIQ | Alternative Invest | 0.125 | 25% | 175 |

| OAR | OAR Resources Ltd | 0.006 | 20% | 26,891,794 |

| PGD | Peregrine Gold | 0.67 | 18% | 440,179 |

| BRX | Belararoxlimited | 0.405 | 17% | 438,898 |

| ARO | Astro Resources NL | 0.007 | 17% | 1,555,592 |

| LNY | Laneway Res Ltd | 0.007 | 17% | 1,002,511 |

| MBK | Metal Bank Ltd | 0.007 | 17% | 2,657,259 |

| ROG | Red Sky Energy. | 0.007 | 17% | 7,594,710 |

| IS3 | I Synergy Group Ltd | 0.115 | 16% | 9,691 |

| RAN | Range International | 0.015 | 15% | 1,248,572 |

| AXP | AXP Energy Ltd | 0.008 | 14% | 41,768,270 |

| TSC | Twenty Seven Co. Ltd | 0.004 | 14% | 39,851,483 |

| SGM | Sims Limited | 17.04 | 14% | 2,413,274 |

| IEC | Intra Energy Corp | 0.025 | 14% | 839,113 |

| KNM | Kneomedia Limited | 0.017 | 13% | 1,774,543 |

| CV1 | Cv Check Ltd | 0.13 | 13% | 327,373 |

| DBO | Diabloresources | 0.13 | 13% | 153,768 |

| OEC | Orbital Corp Limited | 0.235 | 12% | 387,420 |

| ARC | ARC Funds Limited | 0.66 | 12% | 20,941 |

| LLO | Lion One Metals Ltd | 1.395 | 12% | 12,059 |

| PPY | Papyrus Australia | 0.068 | 11% | 396,567 |

| WGR | Westerngoldresources | 0.15 | 11% | 29,278 |

| FAU | First Au Ltd | 0.01 | 11% | 820,161 |

Oar Resources’ (ASX:OAR) is up about 40% today, after revealing plans to start drilling a brief 8km from Chalice’s world-class Gonneville polymetallic discovery.

The +880km tenement contains a whole whack of geophysical trends thought to represent rock sequences like those at Chalice Mining’s adjacent Julimar Complex.

A new survey is set along the eastern tenement area of Oar Resources’ Crown Nickel-Copper-PGE Project, including areas of historic mining activity. The Eastern Domain is characterised by a mixture of the targeted mafic, ultramafic, and granitic lithologies and has become the focus of OAR’s exploration activity.

OAR says the upcoming survey will seek to identify drilling targets for the first phase of drill testing, which will begin ASAP.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| EN1 | Engage:Bdr Limited | 0.001 | -50.0% | 303,431 |

| CAQ | CAQ Holdings Ltd | 0.013 | -48.0% | 19,811 |

| ANL | Amani Gold Ltd | 0.001 | -33.3% | 8,593,572 |

| CCE | Carnegie Cln Energy | 0.002 | -33.3% | 5,648,115 |

| 9SP | 9 Spokes Int Limited | 0.006 | -25.0% | 8,751,845 |

| BAS | Bass Oil Ltd | 0.0015 | -25.0% | 4,066,401 |

| TEG | Triangle Energy Ltd | 0.016 | -23.8% | 7,067,394 |

| HLF | Halo Food Co. Ltd | 0.1 | -23.1% | 8,858,132 |

| SGQ | St George Min Ltd | 0.047 | -23.0% | 12,740,328 |

| SIH | Sihayo Gold Limited | 0.007 | -22.2% | 980,001 |

| CLE | Cyclone Metals | 0.004 | -20.0% | 3,253,351 |

| GTG | Genetic Technologies | 0.004 | -20.0% | 613,144 |

| NTL | New Talisman Gold | 0.002 | -20.0% | 5,952,720 |

| OEX | Oilex Ltd | 0.004 | -20.0% | 6,131,195 |

| BSX | Blackstone Ltd | 0.48 | -19.3% | 10,694,811 |

| BOC | Bougainville Copper | 0.625 | -18.3% | 432,272 |

| TAS | Tasman Resources Ltd | 0.02 | -16.7% | 3,456,515 |

| TMK | Tamaska Oil Gas Ltd | 0.01 | -16.7% | 8,368,545 |

| MAY | Melbana Energy Ltd | 0.066 | -16.5% | 105,424,336 |

| LBY | Laybuy Group Holding | 0.105 | -16.0% | 4,057,038 |

| LDR | Lode Resources | 0.185 | -15.9% | 966,272 |

| ODM | Odin Metals Limited | 0.027 | -15.6% | 4,238,308 |

| MCM | Mc Mining Ltd | 0.081 | -14.7% | 2,400 |

| MRI | Myrewardsinternation | 0.094 | -14.5% | 2,564,030 |

| ADY | Admiralty Resources. | 0.018 | -14.3% | 437,563 |

Laybuy letting go…

Hmm. Laybuy Holdings raised $40m at an all-in IPO in September 2020 at $1.41 per share.

The company closed today at 10.5c.

ANNOUNCEMENTS YOU MAY HAVE MISSED

Lakes Blue Energy (ASX:LKO) says drilling of the Wellesley-2 well is at 1,475m depth, just above the predicted reservoir section. Any significant gas show(s) will be tested once target depth has been reached, the company says.

A recently completed $1.6m placement means the company will be cashed up with $7.1m, significantly reducing funding that will need to be secured for drilling of the Wombat-5 gas well later in 2022.

Mark Creasy’s Yandal Investments is now a substantial shareholder in gold and lithium explorer Peregrine Gold (ASX:PGD). Yandal subscribed for 4.5m shares at $0.50 each to raise $2.25m.

Advanced Human Imaging (ASX:AHI) has announced co-founder and former CEO Dr Katherine Iscoe will be rejoining the leadership team as a non-executive director and CEO. Furthermore, Nick Prosser has been appointed as the interim non-executive Chairman.

Prosser has served on the AHI board since 2018, is on the board of several ASX-listed companies and founder of Canberra Data Centres, which was acquired by Infratil and Commonwealth Superannuation Corporation for an enterprise value of $1.16 billion in 2016.

eSports and gaming technology company Emerge Gaming (ASX:EM1) has extended its voluntary suspension on the bourse as it spins out its major sales generator MIGGSTER.

Emerge said it was working to achieve a positive result for the company and shareholders through the divestment of the gaming platform MIGGSTER. The company is looking to update the market on or before February 21 and has requested a suspension until this time.

Matters of the heart

Heart specialist Anteris Technologies (ASX:AVR) has turned down a merger proposal with NASDAQ-listed special purpose acquisition company Medicus Sciences Acquisitions Corp (MSAC) with the “its me and not you line”.

The company said despite some advantages to the merger, “such as relatively expeditious access to US capital markets, the company’s board concluded the timing of the proposal was not in shareholders nor the company’s best interests at this point.”

TRADING HALTS

The following companies went into a halt on Monday and are expected to recommence trading over the next few days.

Bowen Coking Coal (ASX:BCB) – capital raise

Critical Resources (ASX:CRR) – capital raise

Advanced Human Imaging (ASX:AHI) – pending announcement

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.