Closing Bell: ASX dips into defensive stance as Trump slaps new sanctions on Russia

The ASX stayed in defence mode most of the week, watching for which way the gold price will go next as Russia is hit with fresh sanctions. Pic: Getty Images

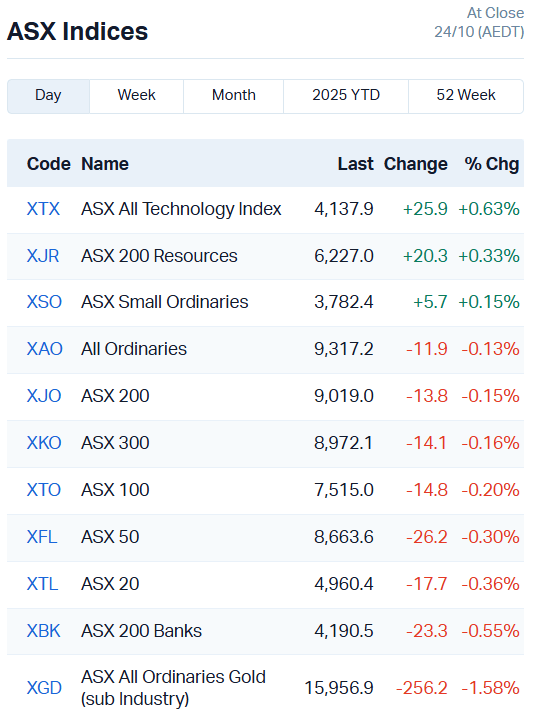

- ASX slides 13 points, down 0.15pc

- Energy gives up early gains, still positive as oil climbs 5pc

- Healthcare leads losses

ASX closes week pretty much flat

It’s been a defensive week for the ASX 200, coming off a hot gold rally and a record high that fuelled plenty of profit taking.

The bourse ticked up just 0.26% this trading week, sitting about 1% off all-time highs.

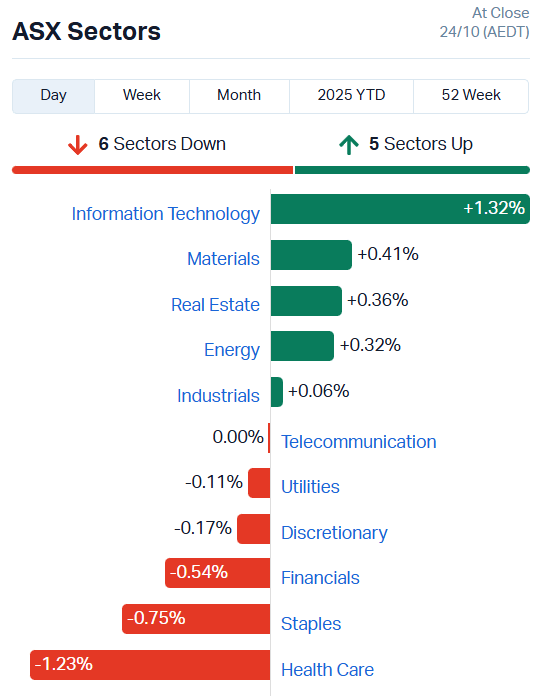

Today, the market shed 13.8 points or 0.15% with 6 of 11 sectors finishing lower.

Info tech led gains today. Toll and road services provider ERoad (ASX:ERD) returned to favour after shedding more than 28% this week, recovering 9.55%.

Yesterday’s standouts in utilities and industrials, LGI (ASX:LGI) and Silex Systems (ASX:SLX), are still riding that momentum, up 7.38% and 9.5% each.

Lithium is also enjoying some breathing room. Liontown Resources (ASX:LTR) climbed 10.41%, Pilbara Minerals (ASX:PLS) 8.62% and Core Lithium (ASX:CXO) 14.29%.

Amongst the large caps, BHP (ASX:BHP) added 0.53%. CSL (ASX:CSL) dragged the healthcare sector lower, down 2.34%.

Most major banks also moved lower, shedding between 0.95% and 0.03%.

Oil stages strong recovery on sanctions

The price of oil shot up more than 5% overnight, hitting US$65.76 a barrel of Brent.

It’s no secret why – the White House imposed sanctions overnight on two of Russia’s largest oil companies, Rosneft and Lukoil.

Putin and Trump won’t be chatting in Hungary after negotiations on a ceasefire folded like wet paper in a stiff breeze.

Trump complained that he and Putin have “good conversations” that “just don’t go anywhere”.

If manipulation and gaslighting were an Olympic sport, Putin would take the gold every time.

Unfortunately for Russia, it looks like Ukraine was ready and waiting for the oil sanctions.

Kyiv has kept up a sustained barrage of drone and airstrike attacks on Russian infrastructure over the last few months, but yesterday took the campaign to a whole new level.

Attacks on key energy infrastructure plunged the region of Belgorod into darkness overnight, even as residents struggle to obtain oil for generators. More than half of Russia’s regions are running out of fuel.

Russia’s oil exports were being affected even before the sanctions, falling 4% in September to their lowest levels since the invasion began.

Trump’s latest sanctions are hitting one of Russia’s largest revenue-making streams, just as large swathes of the Russian people are suffering the direct effects of the war, perhaps for the first time since the invasion began.

“Maybe they should stop being too comfortable there in Belgorod?” Ukrainian President Zelensky said earlier this month.

“They must understand: if they want to leave us without power, then we will do the same.”

Back at home, energy stocks are edging higher. Woodside (ASX:WDS) climbed 0.95%, Yancoal (ASX:YAL) 2.08% and Ampol (ASX:ALD) 0.34%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TAS | Tasman Resources Ltd | 0.038 | 65% | 3531154 | $6,425,113 |

| RAN | Range International | 0.005 | 43% | 1018610 | $3,777,516 |

| HWK | Hawk Resources. | 0.04 | 33% | 8180634 | $10,159,854 |

| PKY | Pathkey.Ai Ltd | 0.02 | 33% | 2892930 | $4,541,236 |

| UNT | Unith Ltd | 0.013 | 30% | 4534292 | $15,191,087 |

| TAT | Tartana Minerals Ltd | 0.054 | 29% | 541590 | $8,994,128 |

| EVG | Evion Group NL | 0.032 | 28% | 21508429 | $10,979,417 |

| VHL | Vitasora Health Ltd | 0.033 | 27% | 47086501 | $45,093,807 |

| ELT | Elementos Limited | 0.355 | 27% | 1232858 | $82,626,351 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | 900000 | $2,599,469 |

| GGE | Grand Gulf Energy | 0.0025 | 25% | 546731 | $5,640,850 |

| PIL | Peppermint Inv Ltd | 0.005 | 25% | 2246213 | $10,036,083 |

| WSR | Westar Resources | 0.008 | 23% | 4160514 | $2,591,711 |

| VBS | Vectus Biosystems | 0.17 | 21% | 297286 | $7,466,666 |

| CTO | Citigold Corp Ltd | 0.012 | 20% | 3450375 | $30,000,000 |

| RBX | Resource B | 0.055 | 20% | 90560 | $5,298,486 |

| SKK | Stakk Limited | 0.0605 | 19% | 84936347 | $125,784,252 |

| AUR | Auris Minerals Ltd | 0.02 | 18% | 5076726 | $9,318,037 |

| INF | Infinity Metals Ltd | 0.02 | 18% | 445731 | $8,150,887 |

| PIM | Pinnacleminerals | 0.2 | 18% | 2166411 | $17,078,780 |

| LMG | Latrobe Magnesium | 0.042 | 17% | 41367855 | $104,233,273 |

| NC1 | Nicoresourceslimited | 0.175 | 17% | 31324 | $18,517,586 |

| PFT | Pure Foods Tas Ltd | 0.035 | 17% | 219988 | $4,212,769 |

| SP3 | Specturltd | 0.035 | 17% | 2026096 | $9,507,004 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 610000 | $19,040,782 |

In the news…

Range International (ASX:RAN) achieved record sales revenue in the third quarter of 2025, marking its best quarter ever.

The zero-waste plastic waste specialist cranked revenue up 33% to US$671,000 compared to Q2, and 55% compared to the same quarter in 2024.

RAN also boasts a healthy sales pipeline for Q4, with a relocation of its Re>Pal factory enabling direct rental of pallets to customers in the near future.

Tartana Minerals (ASX:TAT) has locked-in a maiden gold resource of just over 500,000 ounces at the Cardross project. The fresh gold estimate brings TAT’s total inventory across the Cardross and Mountain Maid projects to more than 1 million ounces.

Evion (ASX:EVG) is set to be $2.3 million richer after securing commitments for a placement led by US-based Atlas Strategic Assets Inc.

Atlas’ advisory council and management includes the former Attorney General of the United States, a retired US Army four-star general and a former senior White House negotiator.

The strategic asset firm is snapping up a 15.92% stake in Evion in return for $1.843 million. EVG will channel the fresh capital to advancing its vertically integrated graphite development plans in Madagascar, India and Europe.

Vitasora Health (ASX:VHL) has expanded into new healthcare networks in the US via its agreement with Evolent Care Partners.

VHL says the expansion could generate US$12-US$18 million in annualised recurring revenue, as it delivers Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) services across the US mainland.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.001 | -50% | 818350 | $2,949,467 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 2.03E+08 | $4,880,668 |

| MGX | Mount Gibson Iron | 0.35 | -26% | 13813075 | $554,801,505 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 119659 | $3,749,332 |

| 1AD | Adalta Limited | 0.004 | -20% | 1214667 | $8,452,646 |

| MDR | Medadvisor Limited | 0.022 | -19% | 6718569 | $17,073,143 |

| MNC | Merino and Co | 0.14 | -18% | 2900 | $9,023,017 |

| YUG | Yugo Metals Ltd | 0.045 | -17% | 1759352 | $16,004,520 |

| AOK | Australian Oil. | 0.0025 | -17% | 18926 | $3,183,849 |

| BLU | Blue Energy Limited | 0.005 | -17% | 3540699 | $14,945,842 |

| CR9 | Corellares | 0.005 | -17% | 722486 | $6,045,419 |

| DTI | DTI Group Ltd | 0.005 | -17% | 4889 | $5,382,617 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 28425 | $5,511,260 |

| MRQ | Mrg Metals Limited | 0.005 | -17% | 161291 | $16,359,112 |

| OVT | Ovanti Limited | 0.005 | -17% | 5531619 | $33,094,738 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 1128015 | $7,482,954 |

| IFG | Infocusgroup Hldltd | 0.011 | -15% | 3405154 | $5,865,398 |

| PVT | Pivotal Metals Ltd | 0.017 | -15% | 13799970 | $18,144,518 |

| RAU | Resouro Strategic | 0.255 | -15% | 115110 | $14,587,377 |

| RB6 | Rubixresources | 0.115 | -15% | 834 | $8,295,750 |

| TR2 | Tali Resources Ltd | 0.6 | -14% | 73678 | $26,253,500 |

| EXT | Excite Technology | 0.012 | -14% | 15435319 | $29,016,987 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 4306198 | $26,495,787 |

| PRM | Prominence Energy | 0.003 | -14% | 10000 | $3,112,117 |

| RDN | Raiden Resources Ltd | 0.006 | -14% | 4876111 | $24,156,240 |

In Case You Missed It

New Age Exploration (ASX:NAE) is preparing to drill up to 4000m at Wagyu in WA, chasing Hemi-style gold with proceeds from a $3.75m cap raise.

Red Mountain (ASX:RMX) has punched out consistent high-quality results in the first nine months of its tenure at the Armidale antimony-gold project in NSW.

Last Orders

Astral Resources (ASX:AAR) has inked a land use agreement with the Marlinyu Ghoorlie Native Title Claimant Group covering key Feysville gold project tenements. The deal outlines a cooperative framework that will facilitate ongoing dialogue as Astral advances Feysville toward production.

Trading halts

Anteris Technologies (ASX:AVR) – pending announcement

Lodestar Minerals (ASX:LSR) – material acquisition

Mount Ridley Mines (ASX:MRD) – maiden gallium mineral resource estimate

Pantera Lithium (ASX:PFE) – material tenement agreements

Resolution Minerals (ASX:RML) – pending announcement

At Stockhead, we tell it like it is. While Astral Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.