Closing Bell: ASX closes higher and business turnover is booming

Pic: via Getty Images.

- The ASX 200 rose up 0.23% and the ASX XEC was up 0.45%

- A total of 7 out of 11 sectors were higher, with Energy leading the way

- Business report year-on-year increases in turnover, with mining leading and arts lagging

The ASX 200 gained 0.23% today and the ASX XEC was up 0.45% with 8 out of 11 sectors higher, led by Energy which rallied by 1.40%.

Coal was king today, Whitehaven Coal (ASX:WHC) was up 6.16%, Yancoal (ASX:YAL) rose 4.72% and New Hope (ASX:NHC) was up 2.74%.

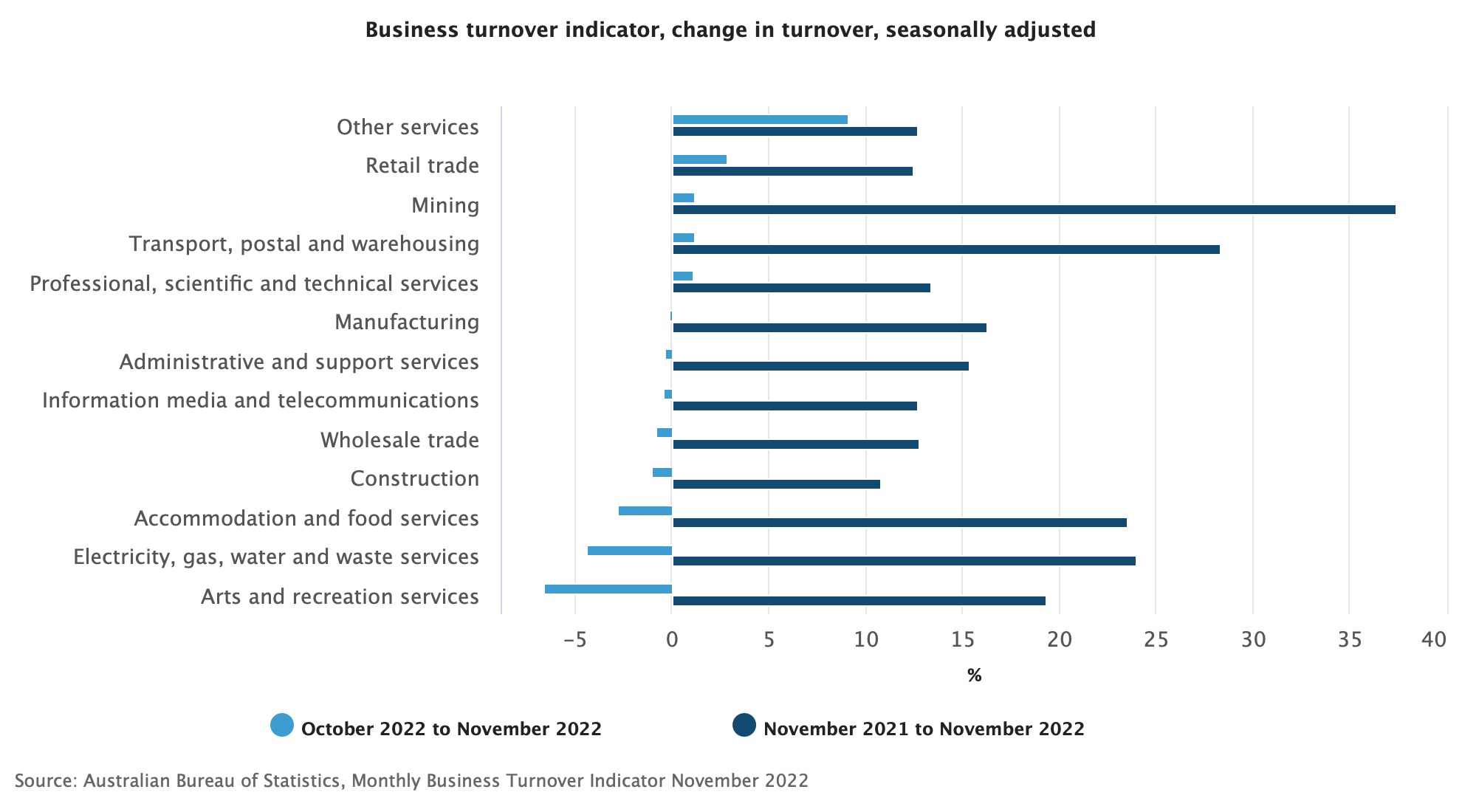

The Australian Bureau of Statistics (ABS) data says business turnover decreased in eight of 13 industries in November 2022 – the first time that most of the industries experienced a monthly fall in turnover since January 2022.

But all industries recorded year-on-year increases in business turnover, led by Mining (+37.4%), Transport, postal and warehousing (+28.3%) and Electricity, gas, water and waste services (+24%).

Arts and recreation services saw the largest fall of -6.6%, after dropping 3.2% in October.

ABS head of industry statistics Sybille McKeown said that after through-the-year growth peaked at 52.9% in September 2022, turnover for the Arts and recreation services industry cooled to a 19.3% increase through the year to November 2022.

“The positive impact from the relaxing of COVID-19 Delta lockdowns towards the end of 2021 has been replaced with declining ‘discretionary’ spending in the face of rising interest rates and inflation,” she said.

NOT THE ASX

Chinese shares ended higher yesterday, reversing early losses, as more capital flowed into the market on expectations that the economy will pick up in 2023. Market sentiment was also boosted by the meeting between US Treasury Secretary Janet Yellen and Chinese Vice-Premier Liu He, which could help mitigate tensions between the two countries.

In the US, sentiment is shifting after weekly data released on Thursday showed jobless claims falling to the lowest level since September, suggesting the labor market remains tight.

But a batch of lukewarm corporate earnings releases and the Fed’s latest look at the business climate have added to traders’ concerns.

“The housing market is clearly in a recession; the manufacturing sector is teetering on the edge of a recession,” CIBC Private Wealth US chief investment officer David Donabedian said

“We are going into 2023 with a more cautious consumer, and as the year progresses we will see some signs that the job market is faltering.”

And the mixed economic data weighed on European stocks too.

“Having seen the biggest one-day decline this year in Wednesday’s trading, US markets have continued the softer theme today, opening lower even as weekly jobless claims fell to their lowest level since September of last year at 190k,” CMC Markets analyst Michael Hewson wrote.

“Building permits and housing starts for December both declined, falling 1.6% and 1.4% respectively.”

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LML | Lincoln Minerals | 0.017 | 148% | 19,031,505 | $3,941,168 |

| MGG | Mogul Games Grp Ltd | 0.0015 | 50% | 1,000,000 | $3,263,441 |

| WBE | Whitebark Energy | 0.0015 | 50% | 1,250,000 | $6,464,886 |

| C1X | Cosmosexploration | 0.38 | 41% | 3,639,935 | $6,750,000 |

| PR1 | Pureresourceslimited | 0.415 | 34% | 580,073 | $7,796,503 |

| DCX | Discovex Res Ltd | 0.004 | 33% | 500,000 | $9,907,704 |

| GCR | Golden Cross | 0.008 | 33% | 54,469 | $6,583,537 |

| WFL | Wellfully Limited | 0.02 | 33% | 321,384 | $5,867,223 |

| AYA | Artryalimited | 0.49 | 29% | 30,348 | $23,861,539 |

| ADD | Adavale Resource Ltd | 0.023 | 28% | 3,001,059 | $9,182,622 |

| CUF | Cufe Ltd | 0.023 | 28% | 10,567,056 | $17,390,023 |

| BMO | Bastion Minerals | 0.049 | 26% | 4,820,017 | $4,091,747 |

| AHN | Athena Resources | 0.011 | 22% | 5,352,982 | $7,834,208 |

| TIA | Tian An Aust Limited | 0.3 | 20% | 20,000 | $21,652,208 |

| EDE | Eden Inv Ltd | 0.006 | 20% | 6,850,296 | $13,656,369 |

| RBR | RBR Group Ltd | 0.003 | 20% | 1,950,096 | $3,516,845 |

| RLG | Roolife Group Ltd | 0.012 | 20% | 4,438,132 | $7,022,309 |

| KWR | Kingwest Resources | 0.05 | 19% | 1,676,913 | $11,832,526 |

| IMB | Intelligent Monitor | 0.13 | 18% | 77,370 | $14,377,032 |

| KSN | Kingston Resources | 0.13 | 18% | 1,340,069 | $45,721,902 |

| TNY | Tinybeans Group Ltd | 0.26 | 18% | 114,546 | $13,504,800 |

| GLA | Gladiator Resources | 0.02 | 18% | 1,434,813 | $9,080,888 |

| WR1 | Winsome Resources | 2.14 | 18% | 4,749,570 | $256,059,478 |

| TMB | Tambourahmetals | 0.135 | 17% | 273,860 | $4,737,149 |

| LYK | Lykosmetalslimited | 0.105 | 17% | 35,227 | $5,616,000 |

The biggest winner CuFe (ASX:CUF) has today pushed the restart button on the small but high-grade JWD iron ore joint venture in the Pilbara, which shipped first ore in October 2021. Prices are now up ~50% from when mining activity was suspended, just one year later.

CUF says first product is expected to be ready for haulage to port by the end of January and, to protect itself from future price volatility, it is building a hedge book to cover future sales.

“To date positions have been taken, basis March quotation period, with 10,000t swapped at US$120.70 and 20,000t of collars entered with a floor price of US$110/t and ceiling price of US$129/t, basis 62% Fe,” the company says.

In addition to planning the restart of mining, the JWD site team has continued to recover high grade material from a waste stockpile on site, crushing and screening it for trucking to port.

A further 8-10,000t of this material priced at US$116.50/t is expected to be loaded next week on a vessel shared with the neighbouring C4 project.

CUF is also contributing a parcel of 20,000t of lower grade fines product to a joint ship with C4, which will load during February.

The company has negotiated a US$2m prepayment facility with its JWD offtake partner Glencore to assist in funding the working capital associated with the ramp up.

“It’s pleasing to see the iron ore price back at levels that allow mining to recommence at JWD,” CUF executive director Mark Hancock says.

“With the relaxing of Covid related restrictions expected to drive economic activity in China and continued strong demand for our product from SE Asia we are optimistic that 2023 will offer a period of attractive pricing for JWD iron ore.

“This combined with an improved cost base arising from falling fuel prices lowering sea freight and road haulage cost and improved stripping ratios favourably impacting mining costs means Cufe is well placed as we move into the next phase of JWD operations.”

The $20m capped junior stock is up 140% so far this month. It had $4.1m in the bank at the end of September.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PHL | Propell Holdings Ltd | 0.031 | -23% | 460,917 | $4,245,329 |

| TKL | Traka Resources | 0.007 | -22% | 40,000 | $6,504,971 |

| SKY | SKY Metals Ltd | 0.04 | -20% | 583,761 | $18,839,174 |

| TAS | Tasman Resources Ltd | 0.009 | -18% | 1,734,683 | $7,382,678 |

| IMR | Imricor Med Sys | 0.25 | -18% | 95,381 | $46,161,026 |

| FTC | Fintech Chain Ltd | 0.025 | -17% | 104,165 | $19,523,088 |

| AD1 | AD1 Holdings Limited | 0.01 | -17% | 188,482 | $8,408,776 |

| CPT | Cipherpoint Limited | 0.005 | -17% | 7,727 | $5,631,083 |

| MFD | Mayfield Childcr Ltd | 1.16 | -17% | 630,371 | $90,784,660 |

| CTT | Cettire | 1.67 | -15% | 1,348,803 | $745,320,720 |

| ERL | Empire Resources | 0.006 | -14% | 459,999 | $7,790,544 |

| FLX | Felix Group | 0.12 | -14% | 39,818 | $21,940,760 |

| PUR | Pursuit Minerals | 0.0215 | -14% | 9,956,515 | $28,563,746 |

| H2G | Greenhy2 Limited | 0.032 | -14% | 1,885,324 | $15,493,966 |

| SMX | Security Matters | 0.195 | -13% | 104,000 | $37,780,095 |

| TSL | Titanium Sands Ltd | 0.013 | -13% | 151,818 | $21,095,968 |

| ADV | Ardiden Ltd | 0.007 | -13% | 3,180,950 | $21,506,683 |

| EMU | EMU NL | 0.007 | -13% | 100,000 | $5,498,145 |

| LCT | Living Cell Tech. | 0.011 | -12% | 2,986,718 | $16,067,047 |

| PKO | Peako Limited | 0.015 | -12% | 131,681 | $6,446,660 |

| NXS | Next Science Limited | 0.64 | -12% | 127,040 | $155,722,847 |

| TRP | Tissue Repair | 0.27 | -11% | 55,000 | $14,268,008 |

| PPY | Papyrus Australia | 0.04 | -11% | 365,585 | $21,133,230 |

| TFL | Tasfoods Ltd | 0.04 | -11% | 89,485 | $19,669,298 |

| AUR | Auris Minerals Ltd | 0.016 | -11% | 5,600 | $8,579,267 |

TRADING HALTS

Leaf Resources (ASX:LER) – clarification around the recent non-binding Letter of Intent for the offtake of premium wood pellets

IMDEX (ASX:IMD) – capital raising

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.