Closing Bell: ASX climbs on healthcare strength as PME and TLX jump

Healthcare was the core driver of gains on the ASX today, with several biotech stocks making big price movements. Pic: Getty Images.

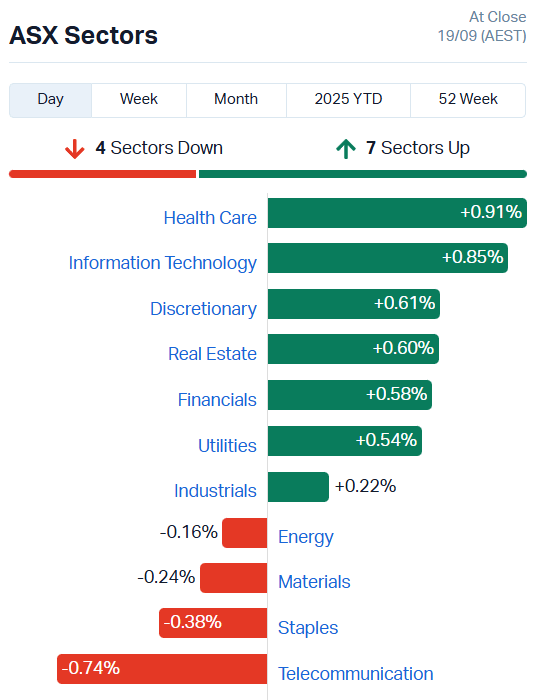

- ASX pares back early gains to lift 0.32pc

- Healthcare, tech, utilities drive gains

- Resources sector drags as gold prices slip from highs

ASX gets clean bill of health

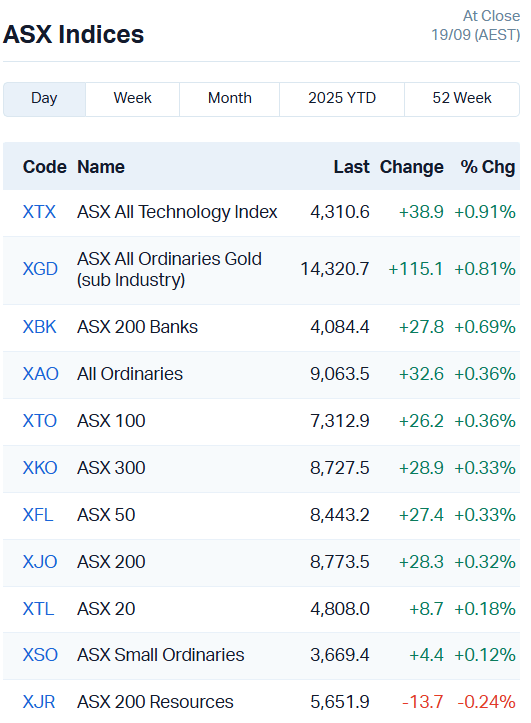

The ASX was looking a little healthier today, adding 0.32% or 28.3 points with 7 of 11 sectors moving higher.

Much of that strength came from the healthcare sector, but most of the defensive and rate-sensitive sectors moved higher today, responding to falling interest rates in the US and a tech rally on Wall Street overnight.

Of particular note was Telix Pharmaceuticals (ASX:TLX), which jumped 5.9% today. The biotech stock was on the receiving end of a research note from Citi Research, which highlighted “substantial upside” in the company.

Healthcare heavy weight Pro Medicus (ASX:PME) also climbed 5.7% on no fresh news, Clarity Pharmaceuticals (ASX:CU6) added 6.2% and Race Oncology (ASX:RAC) surged 21%.

The chemotherapy-focused biotech submitted three new patent application for its potential cancer and cardioprotective therapy, bisantrene.

Over in the world of tech, ReRAM and semiconductor manufacturer Weebit Nano (ASX:WBT) surged 11.8%, Xero (ASX:XRO) climbed 1.4% and Life360 (ASX:360) 3.4%.

Movement in the major banks was mostly positive, contributing some momentum. Commonwealth Bank (ASX:CBA) added 1.1% after a set of bruising losses that lopped 2.6% off the stock over the last 30 trading days.

National Australia Bank (ASX:NAB) also added about 1%, while Westpac (ASX:WBC) moved in the opposite direction, shedding 0.34%.

The ASX 200 Resources index slid 0.24%, but some gold companies were still on the up.

Chalice Mining (ASX:CHN) added 8.2%, Challenger Gold (ASX:CEL) 8.3% and Medallion Metals (ASX:MM8) 9.7%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 14D | 1414 Degrees Limited | 0.082 | 356% | 15418682 | $5,249,830 |

| SW1 | Swift Networks Group | 0.015 | 114% | 81516801 | $6,604,085 |

| AVM | Advance Metals Ltd | 0.083 | 54% | 37208436 | $16,067,754 |

| KGD | Kula Gold Limited | 0.023 | 53% | 54589039 | $15,549,575 |

| RAS | Ragusa Minerals Ltd | 0.035 | 52% | 1108577 | $4,098,572 |

| PGY | Pilot Energy Ltd | 0.009 | 50% | 17781539 | $12,951,960 |

| IXRR | Ionic Rare Earths - Rights | 0.003 | 50% | 622779 | $759,261 |

| MRQ | Mrg Metals Limited | 0.0055 | 38% | 10241641 | $10,906,075 |

| CXU | Cauldron Energy Ltd | 0.014 | 27% | 10525774 | $19,680,771 |

| BGT | Bio-Gene Technology | 0.029 | 26% | 1649033 | $7,016,405 |

| NFM | New Frontier | 0.015 | 25% | 3018517 | $19,262,552 |

| ERA | Energy Resources | 0.0025 | 25% | 2094030 | $810,792,482 |

| RDS | Redstone Resources | 0.005 | 25% | 1166666 | $4,177,069 |

| NVQ | Noviqtech Limited | 0.031 | 24% | 24435421 | $7,021,747 |

| ILA | Island Pharma | 0.445 | 22% | 2960786 | $92,628,518 |

| MML | Mclaren Minerals | 0.028 | 22% | 800967 | $4,570,900 |

| VFY | Vitrafy Life Science | 1.4 | 21% | 17789 | $47,793,580 |

| RAC | Race Oncology Ltd | 3.1 | 21% | 2090901 | $446,672,721 |

| EPX | EPX Limited | 0.041 | 21% | 2874993 | $25,519,930 |

| BLZ | Blaze Minerals Ltd | 0.003 | 20% | 202666 | $7,187,500 |

| ECS | ECS Botanics Holding | 0.006 | 20% | 5061754 | $6,480,248 |

| SIS | Simble Solutions | 0.006 | 20% | 4045767 | $5,441,652 |

| VTM | Victory Metals Ltd | 1.435 | 19% | 1110217 | $157,611,854 |

| FML | Focus Minerals Ltd | 0.9425 | 19% | 1350504 | $227,814,123 |

| RRR | Revolverresources | 0.1 | 18% | 3067447 | $23,483,312 |

In the news…

1414 Degrees (ASX:14D) has advanced its thermal energy storage SiBrick solution a step further toward mass production, melting one type of brick at 1100°C and the other at 1400°C.

14D says both variants maintained their chemical and physical integrity through hundreds of melting-solidification cycles.

The company is developing the bricks to power its camel-cap-titled SiPHyR reactor, enabling low-cost hydrogen production using methane pyrolysis.

Swift Networks (ASX:SW1) has inked a deal with one of Australia’s largest aged care providers, Opal Healthcare, to integrate Swift TV into its proprietary systems.

Opal will install Swift TV’s all-in-one entertainment package in 562 screens across four of its residential care communities. Opal owns 142 care facilities servicing 13,000 residents.

Kula Gold (ASX:KGD) hit visible gold in diamond drilling at the Mt Palmer gold project, intersecting sulphides as well.

The drill core revealed “strong showings of native visible gold” in five intersections, ranging from 31.4m to 36.45m downhole. KGD has sent the drill core to the lab for assay to determine the true grade of the hits.

NoviqTech (ASX:NVQ) has launched a beta version of its subsidiary’s quantum intelligence products in the form of QI Provenance and QI AI, the first step in launching NVQ’s hybrid quantum-classical ecosystem.

The company says its QI Provenance product enables tamper-proof digital credentials and asset provenance through an API, empowering businesses to embed verifiable trust into their systems, while it’s request-only QI AI is an agentic model designed for natural language interaction.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.12 | -37% | 3529579 | $76,635,003 |

| PIL | Peppermint Inv Ltd | 0.0025 | -29% | 17863859 | $8,651,384 |

| CT1 | Constellation Tech | 0.0015 | -25% | 7139259 | $2,949,467 |

| OB1 | Orbminco Limited | 0.0015 | -25% | 1952345 | $6,805,136 |

| FGR | First Graphene Ltd | 0.067 | -24% | 3462162 | $73,368,568 |

| AUR | Auris Minerals Ltd | 0.007 | -22% | 2118838 | $4,289,634 |

| AVW | Avira Resources Ltd | 0.011 | -21% | 1445217 | $3,220,000 |

| CNJ | Conico Ltd | 0.004 | -20% | 47867 | $1,360,729 |

| DTM | Dart Mining NL | 0.002 | -20% | 167000 | $3,436,315 |

| WEL | Winchester Energy | 0.002 | -20% | 1000000 | $3,407,547 |

| EIQ | Echoiq Ltd | 0.2025 | -19% | 11123225 | $161,946,928 |

| HMI | Hiremii | 0.041 | -18% | 77019 | $7,553,621 |

| 8IH | 8I Holdings Ltd | 0.01 | -17% | 211744 | $4,177,930 |

| EM2 | Eagle Mountain | 0.005 | -17% | 134999 | $6,810,224 |

| M2R | Miramar | 0.0025 | -17% | 14490927 | $3,584,770 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 499134 | $2,972,151 |

| SPX | Spenda Limited | 0.005 | -17% | 7162517 | $27,691,293 |

| VEN | Vintage Energy | 0.005 | -17% | 1649986 | $12,521,482 |

| VFX | Visionflex Group Ltd | 0.0025 | -17% | 4008996 | $10,103,581 |

| MCM | Mc Mining Ltd | 0.12 | -16% | 9490 | $91,726,136 |

| JNO | Juno | 0.023 | -15% | 290172 | $5,649,400 |

| CGR | Cgnresourceslimited | 0.047 | -15% | 696846 | $4,992,801 |

| BLU | Blue Energy Limited | 0.006 | -14% | 254000 | $14,900,337 |

| C7A | Clara Resources | 0.003 | -14% | 75001 | $2,601,533 |

| M4M | Macro Metals Limited | 0.006 | -14% | 14652566 | $29,537,903 |

In Case You Missed It

VHM (ASX:VHM) has secured Commonwealth environmental approval for its flagship Goschen rare earths and mineral sands project in northwest Victoria.

American Uranium (ASX:AMU) is preparing to start hydrogeologic testing and resource expansion drilling at its Lo Herma ISR uranium project in Wyoming.

Swift Network Group (ASX:SW1) has secured a contract for its new connected TV product, Swift TV, with Australia’s largest aged care provider Opal HealthCare.

Shares in radiopharmaceuticals company Telix Pharmaceuticals (ASX:TLX) surged more than 7% after positive coverage from Citi Research.

Last Orders

Island Pharmaceuticals (ASX:ILA) has been granted a Type C meeting for its Galidesivi ropen Investigational New Drug (IND) application, offering a potential fast-track option for clinical study design.

Trading halts

1414 Degrees (ASX:14D) – response to ASX price query

Beam Communications (ASX:BCC) – status of ZOLEO joint venture sale

Decidr AI Industries (ASX:DAI) – cap raise

Impact Minerals (ASX:IPT) – cap raise

PYC Therapeutics (ASX:PYC) – board and management changes

Range International (ASX:RAN) – cap raise

TG Metals (ASX:TG1) – cap raise and response to ASX price query

Way2Vat (ASX:W2V) – acquisition and cap raise

At Stockhead, we tell it like it is. While Island Pharmaceuticals, Medallion Metals, Race Oncology and Weebit Nano are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.