Closing Bell: ASX bows out lower on last day of 2024, its best year since 2021

The ASX had its best year since 2021. Picture via Getty Images

- ASX closes lower on last day of 2024

- Bitcoin wobbles, Aussie dollar weakens

- Mesoblast bucks trend with 10pc rise

It’s the last trading day of 2024, and the ASX has gone out with a whimper.

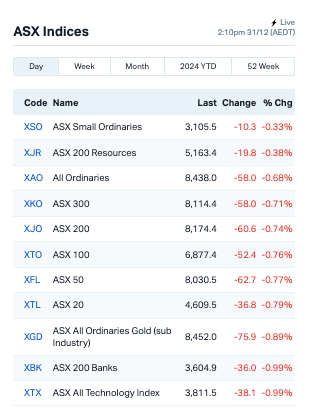

After a rough start on Tuesday, the ASX closed lower by 0.92% following Wall Street’s weak lead, with the so-called “Santa Rally” well and truly fading.

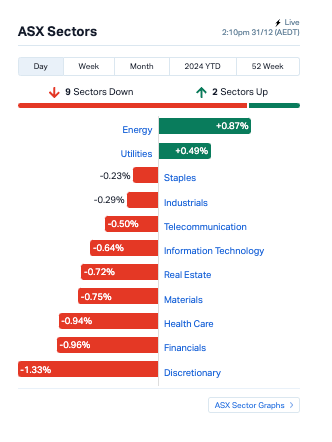

Higher oil and commodity prices overnight weren’t enough to lift the bourse, and nine out of 11 sectors ended up in the red today.

But all in all, the ASX has still had a decent year, up around 8% in 2024, marking its biggest gain since 2021.

Bitcoin, meanwhile, wobbled again, dipping below US$92,000 before clawing back some gains.

The Aussie dollar is also looking weak, and is poised to close out the year at its lowest level since October 2022 at US62.27 cents.

But as the curtain falls on this trading year, some equity strategists are already predicting that global markets will keep grinding higher in 2025, albeit with less flair.

“We anticipate a slow grind higher in the equity market in the near term,” said Justin White at T Rowe Price.

This is how the ASX looked on the last trading session of 2024:

Tech stocks fell, tracking losses on the Nasdaq, while gold stocks were under pressure after the price of bullion dropped.

Mesoblast (ASX:MSB) meanwhile was a bright spot for the day, climbing almost 10% on no specific news.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| X2M | X2M Connect Limited | 0.030 | 43% | 695,384 | $7,915,755 |

| PPY | Papyrus Australia | 0.014 | 40% | 36,446 | $5,520,454 |

| 5EA | 5Eadvanced | 0.120 | 40% | 1,899,640 | $28,975,215 |

| ASR | Asra Minerals Ltd | 0.004 | 33% | 171,737 | $6,937,890 |

| AMS | Atomos | 0.009 | 29% | 1,082,246 | $8,505,129 |

| AHN | Athena Resources | 0.005 | 25% | 2,000,000 | $5,341,870 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 200,000 | $3,220,998 |

| CVB | Curvebeam Ai Limited | 0.135 | 23% | 46,406 | $35,262,460 |

| MTM | MTM Critical Metals | 0.275 | 22% | 12,385,971 | $91,486,975 |

| ALV | Alvomin | 0.050 | 22% | 45,000 | $4,803,514 |

| TM1 | Terra Metals Limited | 0.028 | 22% | 615,702 | $9,136,081 |

| AOK | Australian Oil. | 0.003 | 20% | 6,118,998 | $2,504,457 |

| C7A | Clara Resources | 0.006 | 20% | 200,231 | $2,225,413 |

| CHM | Chimeric Therapeutic | 0.007 | 17% | 1,521,871 | $9,450,899 |

| DOU | Douugh Limited | 0.007 | 17% | 255,174 | $7,093,536 |

| OSL | Oncosil Medical | 0.007 | 17% | 1,091,139 | $27,639,481 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 3,146,498 | $30,899,422 |

| AXE | Archer Materials | 0.575 | 16% | 1,439,325 | $126,149,271 |

| EGY | Energy Tech Ltd | 0.036 | 16% | 10,000 | $13,833,665 |

| RON | Roninresourcesltd | 0.220 | 16% | 70,290 | $7,671,252 |

| MRR | Minrex Resources Ltd | 0.008 | 14% | 125,000 | $7,594,073 |

OncoSil Medical (ASX:OSL) has just randomised its first patient in the TRIPP-FFX trial at Royal Adelaide Hospital, marking a key step in testing its OncoSil device alongside FOLFIRINOX chemotherapy for pancreatic cancer. This takes the total number of global trial participants to 49. CEO Nigel Lange said the milestone is a big step forward in the company’s mission to improve treatment outcomes for pancreatic cancer patients.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VML | Vital Metals Limited | 0.002 | -33% | 545,000 | $17,685,201 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 1,945,141 | $12,677,188 |

| MRD | Mount Ridley Mines | 0.003 | -25% | 136,918 | $3,113,956 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 400,000 | $10,906,075 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 12,500 | $3,657,305 |

| AON | Apollo Minerals Ltd | 0.012 | -20% | 1,663,312 | $10,445,144 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 775 | $7,929,526 |

| TKM | Trek Metals Ltd | 0.021 | -19% | 801,167 | $13,523,194 |

| MKL | Mighty Kingdom Ltd | 0.009 | -18% | 2,428,525 | $2,376,697 |

| CRR | Critical Resources | 0.005 | -17% | 392 | $14,591,779 |

| ENV | Enova Mining Limited | 0.005 | -17% | 455,150 | $5,909,576 |

| ERA | Energy Resources | 0.003 | -17% | 492,781 | $1,216,188,722 |

| LNR | Lanthanein Resources | 0.003 | -17% | 75,000 | $7,330,908 |

| ICI | Icandy Interactive | 0.018 | -14% | 562,130 | $26,888,553 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 1 | $10,370,324 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 6,548,995 | $36,598,998 |

| PXX | Polarx Limited | 0.006 | -14% | 5,169 | $16,628,507 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 345,829 | $14,746,338 |

| LAT | Latitude 66 Limited | 0.038 | -14% | 16,097 | $6,309,631 |

| NAE | New Age Exploration | 0.004 | -13% | 325,000 | $8,575,596 |

| PAB | Patrys Limited | 0.004 | -13% | 357,142 | $8,229,789 |

| ZEU | Zeus Resources Ltd | 0.007 | -13% | 100,000 | $5,125,385 |

IN CASE YOU MISSED IT

Live Verdure (ASX:LV1) has snapped up another 6% stake in Decidr.ai for $13.2 million, taking its total holding to a controlling 51%. This solidifies LV1’s position as a leader in AI-driven innovation, making it the majority owner of one of Australia’s most exciting AI technology platforms.

At Stockhead, we tell it like it is. While Live Verdure is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.