Closing Bell: ASX bounces back on miners’ rally as US shutdown fears ease

TGIF on the ASX? Yep. Picture via Getty Images

- ASX bounces back with miners leading the charge

- US shutdown fears ease, giving markets a lift

- Myer and Liontown shine as big movers on the ASX

The ASX bounced back on Friday, shaking off a three-day losing streak and finishing 0.52% higher after a rally from the miners.

But for the week, the benchmark ASX 200 index was still down over 2%.

The modest rally today helped the index recover from the correction it had fallen into yesterday when it had dropped over 10% from mid-February.

Meanwhile, in the US, a bit of relief came with news that a government shutdown might be avoided.

The shutdown is expected to be averted after top Democrat Chuck Schumer agreed to support a Republican spending bill that will keep the government funded until September.

If the shutdown were to happen, it would’ve kicked in at midnight tonight (US time).

US stock futures traded higher in Asia this afternoon as the news broke, which gave a little lift to major Asian indices, including the ASX.

But the market is still jittery after Trump threatened a 200% tariff on European wine and booze overnight.

“It’s a very volatile environment and we expect this to continue in the foreseeable future,” said Thomas Taw at BlackRock.

Back home, ASX miners were the stars today after iron ore prices pushed above $US103 per tonne.

BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all climbed.

Gold miners were also on fire after gold hit a fresh record of $US2990 an ounce, and Macquarie forecasted it could hit $US3500 this year.

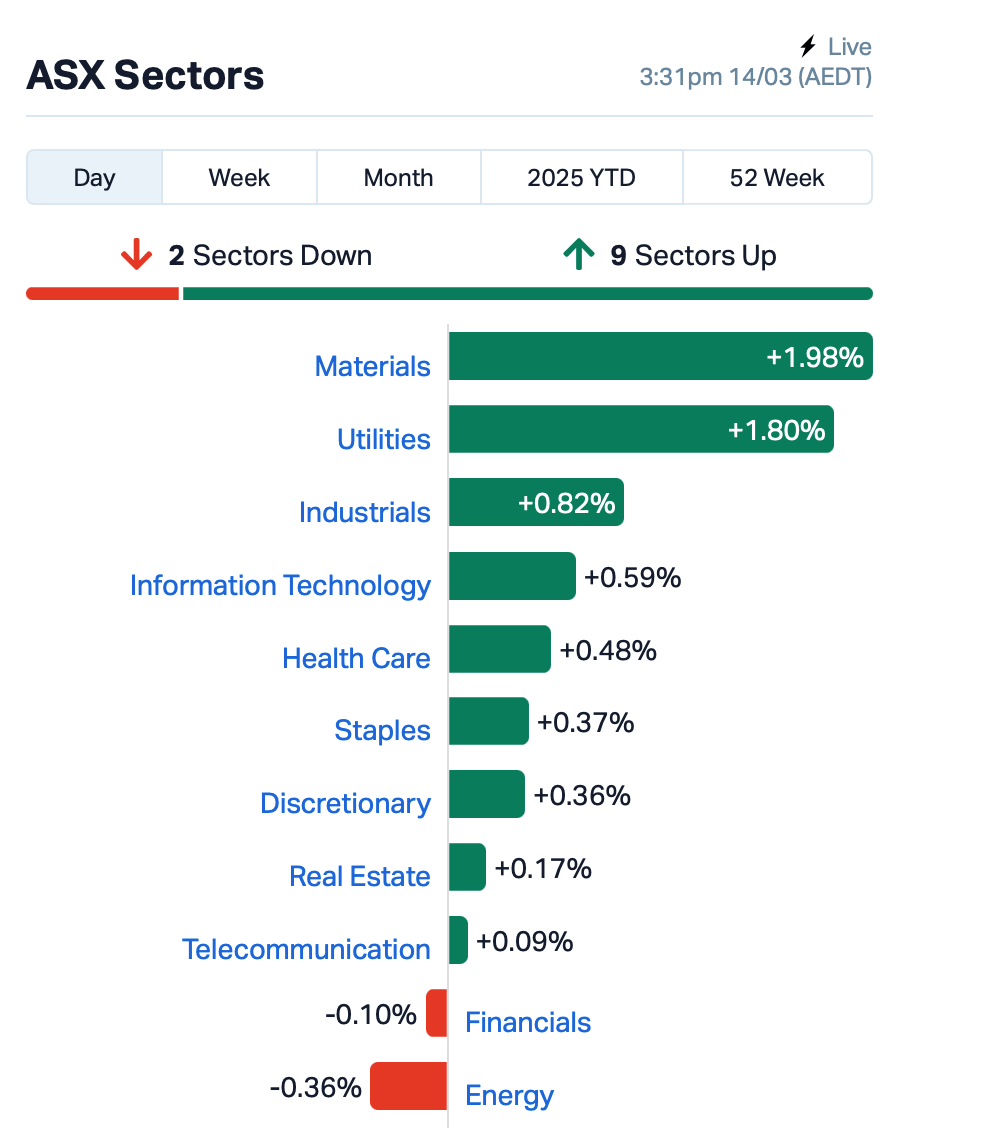

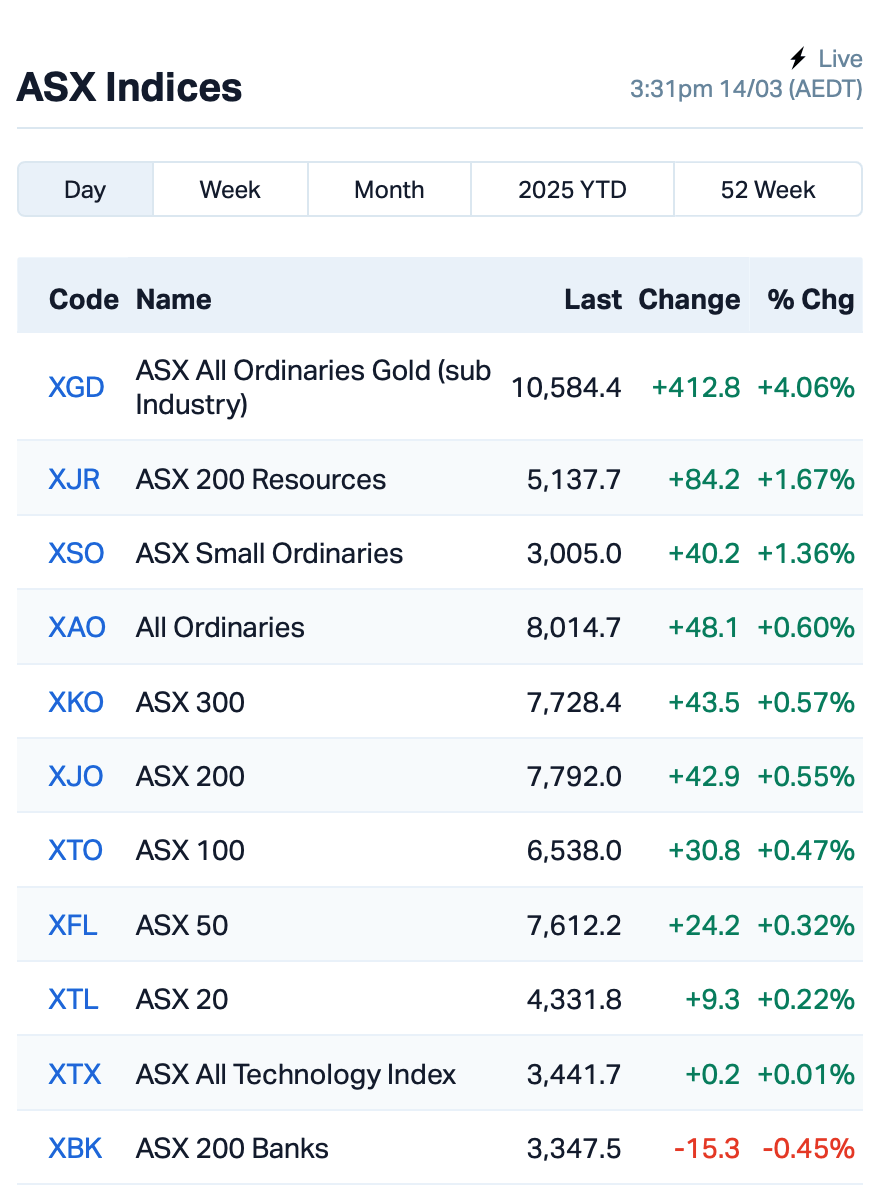

This is where we stood leading up to Friday’s close:

In the large caps space, retailer Myer (ASX:MYR) rose 1.6% after chairwoman Olivia Wirth overhauled her leadership team following the resignation of CFO Matt Jackman.

Liontown Resources (ASX:LTR) has trimmed its half-year loss to $15.2 million, down from $31.3 million last year. Revenue hit $100.4 million, with over 100,000 tonnes of spodumene concentrate sold.

The miner kicked off production at its Kathleen Valley mine in July last year, however, due to low lithium prices, Liontown has revised its production forecast to 2.3 million tonnes per year from FY25. Shares jumped 7%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap 1TT Thrive Tribe Tech 0.002 100% 1,777,522 $2,031,723 H2G Greenhy2 Limited 0.006 100% 8,298,304 $1,794,553 SFG Seafarms Group Ltd 0.002 100% 1,203,988 $4,836,599 RLT Renergen Limited 0.760 69% 94,458 $13,646,689 GTR Gti Energy Ltd 0.003 50% 1,500,000 $5,997,899 TX3 Trinex Minerals Ltd 0.002 50% 622,579 $1,878,652 CXU Cauldron Energy Ltd 0.010 25% 5,023,762 $11,691,237 CZN Corazon Ltd 0.003 25% 2,736,366 $2,369,145 ERA Energy Resources 0.003 25% 3,683,265 $810,792,482 LNR Lanthanein Resources 0.003 25% 2,310,254 $4,887,272 OSL Oncosil Medical 0.005 25% 472,775 $18,426,321 VML Vital Metals Limited 0.003 25% 260,000 $11,790,134 KCC Kincora Copper 0.031 24% 80,725 $6,025,393 RAC Race Oncology Ltd 1.270 23% 425,681 $178,933,514 MLX Metals X Limited 0.670 23% 31,876,768 $483,083,388 ELT Elementos Limited 0.061 22% 1,246,311 $11,806,592 BEZ Besragoldinc 0.034 21% 1,095,960 $11,633,691 SRZ Stellar Resources 0.017 21% 26,667,420 $29,116,508 EPM Eclipse Metals 0.006 20% 364,756 $14,299,095 INF Infinity Lithium 0.024 20% 236,909 $9,251,842 SRI Sipa Resources Ltd 0.012 20% 355,725 $4,163,983 COB Cobalt Blue Ltd 0.066 20% 1,182,484 $24,171,032 PGO Pacgold 0.072 18% 270,181 $8,018,715

Renergen Limited (ASX:RLT), a producer of liquid helium and liquefied natural gas, is up today on the back of what the company says is a “long-awaited event of filling a helium container with liquid”, which has now taken place. In other words, RLT has now begun its commercial liquid helium sales.

“The quality of both our LNG and liquid helium now exceeds minimum design specifications,” emphasised the company, adding: “We remain committed to increasing production and developing the Virginia Gas Project to its full potential.”

Vital Metals (ASX:VML), an advanced-stage exploration/development rare earths company, is up today after announcing this morning that it has entered a 12-month convertible loan agreement for $1 million and has formed a Canadian Strategic REE Consortium with industry expertise.

The company is currently completing a scoping study for its Tardiff deposit in Canada, examining the potential size and scalability of rare earths and niobium recovery from the deposit.

Race Oncology (ASX:RAC) has turned heads in the ASX biotech sector today after the company was given ethics approval for a phase I trial of RC220 alone and in combination with doxorubicin in adult solid tumour patients. The trial will be the first time patients have received the drug RC220 bisantrene.

Catalyst Metals (ASX:CYL) has kicked off ore production at Plutonic East in WA, a pre-existing underground mine just 2km from the Plutonic processing plant. The move is part of Catalyst’s plan to reduce operating risks by opening up more ore sources and mining fronts. The redevelopment, which started in April 2024, was completed on time and on budget, using funds from operating cash flow. This marks the first of three new mines Catalyst plans to develop as it works towards doubling production in the area.

Elementos (ASX:ELT) has also kicked off drilling at its Cleveland tin project in Tasmania, targeting copper, gold, silver and tin. The drilling will test for extensions of high-grade copper and gold discovered in a previous hole. The program includes three drill holes totalling around 600m, aimed at exploring a promising target identified through strong electromagnetic results.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ASP | Aspermont Limited | 0.003 | -40% | 2,223,688 | $12,350,058 |

| GT1 | Greentechnology | 0.038 | -34% | 3,125,351 | $22,547,622 |

| MRD | Mount Ridley Mines | 0.002 | -33% | 400,000 | $2,335,467 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 3,395,842 | $57,867,624 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 6,192,496 | $2,433,233 |

| BUY | Bounty Oil & Gas NL | 0.003 | -25% | 2,707,328 | $6,245,887 |

| TMK | TMK Energy Limited | 0.003 | -25% | 47,742,986 | $37,454,660 |

| CKA | Cokal Ltd | 0.040 | -22% | 4,866,915 | $55,026,398 |

| STM | Sunstone Metals Ltd | 0.006 | -21% | 2,782,048 | $36,050,025 |

| RB6 | Rubixresources | 0.087 | -21% | 50,000 | $6,759,500 |

| BSX | Blackstone Ltd | 0.059 | -20% | 5,761,415 | $50,064,225 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 1,592,735 | $10,601,880 |

| ALR | Altairminerals | 0.002 | -20% | 2,500 | $10,741,860 |

| CRR | Critical Resources | 0.004 | -20% | 652,357 | $12,321,106 |

| DTM | Dart Mining NL | 0.004 | -20% | 82,091 | $3,438,820 |

| KGD | Kula Gold Limited | 0.004 | -20% | 4,865 | $4,606,268 |

| GUM | Gumtree Australia | 0.110 | -19% | 22,914 | $43,331,298 |

| GES | Genesis Resources | 0.009 | -18% | 2,945 | $8,611,254 |

| TOU | Tlou Energy Ltd | 0.009 | -18% | 3,309,687 | $14,284,428 |

| PLN | Pioneer Lithium | 0.120 | -17% | 53,269 | $5,555,194 |

| NME | Nex Metals Explorat | 0.025 | -17% | 3,330 | $9,823,174 |

| AMS | Atomos | 0.005 | -17% | 19,235 | $7,290,111 |

| ECT | Env Clean Tech Ltd. | 0.003 | -17% | 116,684 | $10,940,431 |

| KPO | Kalina Power Limited | 0.006 | -14% | 247,436 | $20,221,206 |

IN CASE YOU MISSED IT

Explorer Latitude 66 (ASX:LAT) has appointed Jeremy Read as non-executive director to its board. Read is described as a “seasoned minerals resource industry executive”, having worked in Australia, Sweden, Finland, Norway, Africa, North America and India.

Commodities Read has worked with include precious and base metals, particularly in nickel sulphides, copper and gold. He previously spent 11 years working for BHP and today serves as the chairman of Godolphin Resources (ASX:GRL).

At Stockhead, we tell it like it is. While Latitude 66 and Race Oncology are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.