Closing Bell: ASX a little lower after hosting a Big 4 bank midweek spank

Via Getty

- Local markets end lower on big bank sell-off

- Material gains offset by Telco’s and Financials

- Small Caps led by rare earths developer Arafura

Local markets have not showered anyone in glory, profit or confidence on Thursday.

At 4pm on Thursday March 14, the S&P/ASX200 was 21 points or 0.27% lower to…

This afternoon in Sydney some spirited selling across the major big four banks put the heavy hand on the overnight rally in copper prices and some bargain hunting in Aussie iron ore miners.

The tussle was a good one, worthy of retelling.

A mixed night on Wall Street and rising commodity prices had the SPI Futures pointing upwards to begin the session, but that was where the fancy prognostications ended.

The initial betrayal came from one of their own – a sudden string of broker downgrades from the nation’s no. 1 investment bank Macquarie Group (ASX:MQG).

The four majors fell in a heap, all down around 2%, bleeding the Financials sector of more than 2%.

The downgrades come after a stormy share price run up for the majors which have all drawn in stonking profits and have been lazing about at multi-year highs.

On the other hand, iron ore prices continue to come under pressure as Chinese steel mills look to reduce production levels in response to a worldwide glut and deteriorating property market.

According to data released by the China Steel Network Information Research Institute, 11 major steel mills reduced their prices, while seven maintained their prices unchanged.

Chinese officials are also showing signs of being hesitant to help further bail out its struggling property market, the largest steel consumer, which has been hit hard by a debt crisis.

Iron ore prices are around six months lows with the commodity currently trading at US$111/tonne.

And yet, previous share price declines and accelerating recent selling still makes the musclebound trio Rio Tinto (ASX:RIO) , BHP (ASX:BHP) and Fortescue (ASX:FMG).

Core Lithium is not having fun. It’s been downgraded by brokers at Canaccord and lost even more.

Myer stock found lots of buyers after telling the ASX it’d snagged Qantas executive Olivia Wirth as its new CEO and executive chair.

That was the best bit of a stodgy half-year featuring headlined by a near 20% collapse in net profits.

Weighing in the Tech sector, Appen (ASX:APX) fell dramatically after Nasdaq-listed Innodata pulled its $154mn bid for the local AI player after it reportedly breached a confidentiality clause.

Finally, in the new metals camp, Arafura Rare Earths (ASX:ARU) has received a US$533 million ($804.9 million) shot in the arm from the Australian Government for the development of its $1.68 million Nolans rare earths project in the Northern Territory.

Aussie Broadband (ASX:ABB) has given up more than 20% after giving up one of the best contracts in the Aussie telcoverse – Origin Energy (ASX:ORG) – to Superloop (ASX:SLC).

Superloop has killed it, as the jungle demands, by law. It’s also upgraded its FY24 earning guidance, unlike ABB.

These local stocks went ex-divvy today:

Austin Engineering (ASX:ANG) is paying 0.4 cents fully franked

Eagers Automotive (ASX:APE) is paying 50 cents fully franked

Breville (ASX:BRG) is paying 16 cents fully franked

Embelton (ASX:EMB) is paying 15 cents fully franked

H&G High Conviction (ASX:HCF) is paying 2 cents fully franked

Inghams (ASX:ING) is paying 12 cents fully franked

Plato Inc Max Ltd. (ASX:PL8) is paying 0.55 cents fully franked

PWR Holdings Limited (ASX:PWH) is paying 4.8 cents fully franked

Regis Healthcare (ASX:REG) is paying 6.28 cents 50 per cent franked

Shriro (ASX:SHM) is paying 2 cents fully franked

SRG Global (ASX:SRG) is paying 2 cents fully franked

Southern Cross Media Group (ASX:SXL) is paying 1 cents fully franked

TPG Telecom (ASX:TPM) is paying 9 cents fully franked

WCM Global Growth (ASX:WQG) is paying 1.72 cents fully franked

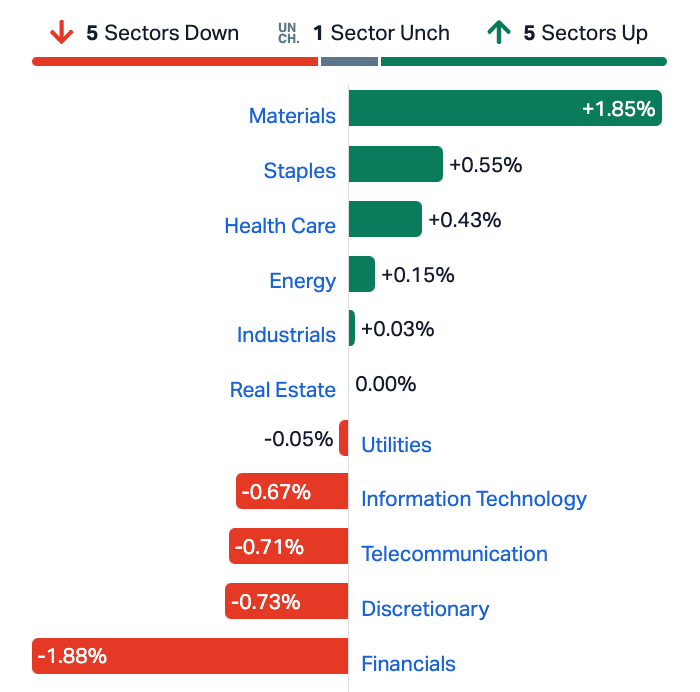

ASX Sectors at 4pm on Thursday

It was an even split on the 11 ASX sectors today.

Five up, five down.

And one undecided.

Around the ‘hood…

Asian-Pacific stock markets mostly fell on Thursday.

Shares in Japan have moved lower, while the ongoing economic and policy uncertainties in China have smacked Hong Kong and mainland China markets for a third day. South Korean stocks have risen in early arvo business.

In the States…

The action and adventure in New York is far from over for the week after the punchy excitement generated by Tuesday’s hard to pick CPI read.

The Americans will chew on producer price inflation (PPI), the still important weekly jobless claims and retail sales figures.

In regular trading overnight the 3 major averages ended mixed. The Dow Jones got up by 0.1%, while the S&P500 and the techy Nasdaq fell 0.2% and 0.55%.

And techyness is still the focus.

The uncontainable shares of AI biggie two-shoes Nvidia (NVDA) dropped 1.1% (but that’s following a 7.2% jump in the previous session.)

Still in the fishy chips space, Intel gave up 4.4% after worries emerged around the chipmakers US gov’t funding outlook.

Apparently still with so much to lose, shares in Tesla lost 4.5% after a biting Wells Fargo downgrade.

Amazon gained 0.7%, helping to offset losses in the Dow Jones.

In after hours trade the app-shaped trading platform Robinhood jumped 10% after reporting a double-digit surge in assets under custody (AUC) for last month.

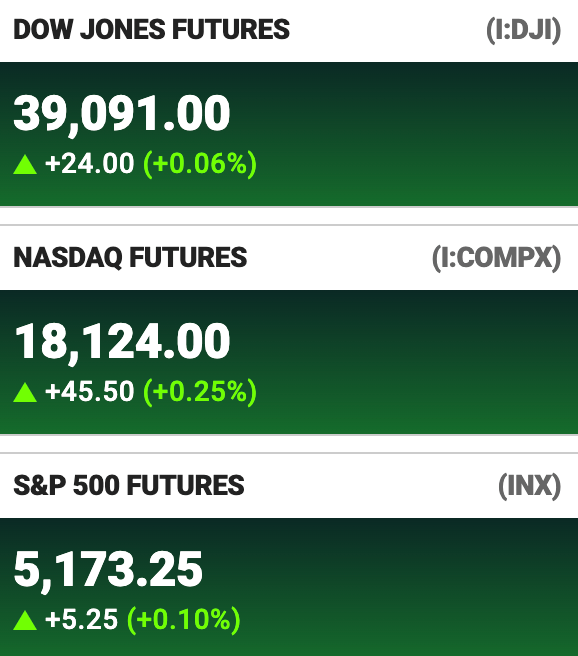

US stock futures rose on Thursday in Sydney:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ARU | Arafura Rare Earths | 0.2525 | 71% | 49,287,576 | $340,769,573 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | 1,004,488 | $1,954,116 |

| AUK | Aumake Limited | 0.004 | 33% | 162,216 | $5,743,220 |

| PPY | Papyrus Australia | 0.02 | 33% | 35,252 | $7,390,389 |

| CVR | Cavalierresources | 0.175 | 30% | 109,478 | $4,296,904 |

| CVV | Caravel Minerals Ltd | 0.19 | 27% | 2,143,058 | $78,641,970 |

| M4M | Macro Metals Limited | 0.005 | 25% | 18,722,601 | $12,928,267 |

| MCT | Metalicity Limited | 0.0025 | 25% | 2,150,064 | $8,970,108 |

| PUR | Pursuit Minerals | 0.005 | 25% | 7,486,153 | $11,775,886 |

| SLC | Superloop Limited | 1.3075 | 25% | 14,785,592 | $515,733,267 |

| TRE | Toubani Res Ltd | 0.13 | 24% | 137,000 | $14,055,895 |

| LM8 | Lunnonmetalslimited | 0.3 | 22% | 54,961 | $53,369,878 |

| TEM | Tempest Minerals | 0.011 | 22% | 6,301,990 | $4,672,120 |

| AIS | Aeris Resources Ltd | 0.14 | 22% | 9,513,144 | $111,265,437 |

| BUS | Bubalusresources | 0.145 | 21% | 541,727 | $3,860,841 |

| NTM | Nt Minerals Limited | 0.006 | 20% | 875,463 | $4,299,515 |

| AQC | Auspaccoal Ltd | 0.095 | 19% | 2,929,289 | $41,037,407 |

| CPO | Culpeominerals | 0.051 | 19% | 5,683,427 | $7,085,922 |

| SPX | Spenda Limited | 0.013 | 18% | 1,138,100 | $47,569,036 |

| PTR | Petratherm Ltd | 0.02 | 18% | 2,100 | $3,820,769 |

| PNN | Power Minerals Ltd | 0.2 | 18% | 120,253 | $14,853,937 |

| NXM | Nexus Minerals Ltd | 0.042 | 17% | 800,657 | $14,006,165 |

| ICG | Inca Minerals Ltd | 0.007 | 17% | 50,000 | $3,526,958 |

| CYP | Cynata Therapeutics | 0.18 | 16% | 100,370 | $27,842,927 |

| 8CO | 8Common Limited | 0.046 | 15% | 92,650 | $8,963,796 |

Arafura Rare Earths (ASX:ARU) has secured conditional Commonwealth Government approval for a debt financing package of US$533 million to progress its strategically important Nolans Project in the Northern Territory.

The Commonwealth Government approvals are part of a broader financing package Arafura is currently progressing, which Arafura currently has indicative interest from international and commercial financiers for a further US$550 million of senior debt facilities.

The package includes a US$125mn limited-recourse senior debt facility under the Commonwealth Government’s A$4bn Critical Minerals Facility and A$150 million limited-recourse senior debt facilities from the Northern Australia Infrastructure Facility (NAIF).

Both facilities have a 15-year tenor with interest rates and conditions precedent to financial close customary to arrangements of this nature.

ARU says it will advance the remaining debt and equity funding requirements for the Nolans Project aims to be Australia’s first ore-to-oxide rare earths processing facility to deliver sustainably mined and processed rare earth products to its global customers.

Superloop (ASX:SLC) has been awarded a six-year, exclusive contract to provide wholesale internet services to Origin Energy.

SLC says the Origin contract is the largest in Superloop’s history and is expected to add +$19mn of annualised earnings once the current subscriber base is fully transitioned.

SLC says the deal “is a key progress milestone” in a 3-year growth strategy.

The contract is expected to add in excess of $19 million of annualised EBITDA for Superloop once the migration is complete, with further upside based on Origin’s rapidly growing broadband

customer base.

Superloop has also upgraded guidance for FY24 and provided an outlook for FY25, on the back of the continued strength of Superloop’s trading performance and with the impact of the Origin contract win.

The company is now expecting FY24 EBITDA1 of $51–53mn, up from the previous $49-53mn.

FY25 EBITDA YoY growth is expected to rise 60% – 70%.

As part of the deal, approximately 130k Origin broadband customers will be migrated from Origin’s current network provider to Superloop, increasing total customers to circa 560k.

Superloop has issued equity to Origin to further align SLC’s and Origin’s interests in the continued growth of its broadband customer base with Superloop, including shares issued on the achievement of key customer milestones.

Finally, PolarX (ASX:PXX) is in the money late on Thursday.

Surging copper prices could be helping this Northern Star (ASX:NST) backed copper explorer, which owns the Caribou Dome project in the arctic climes of central Alaska.

The $35mn wee-one boasts 7.2Mt of resources at 3.1% copper and 6.5g/t silver at Caribou Dome as well as 4Mt at 1.1% Cu, 1.6g/t gold and 12.6g/t Ag further north at Zackly along with a host of targets across a 35km strike.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MIO | Macarthur Minerals | 0.001 | -67% | 1,007,978 | $99,752 |

| SLZ | Sultan Resources Ltd | 0.014 | -36% | 9,913,971 | $3,645,539 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 4,243,975 | $1,430,067 |

| SFG | Seafarms Group Ltd | 0.003 | -25% | 387,556 | $19,346,397 |

| VPR | Volt Power Group | 0.0015 | -25% | 346,898 | $21,432,416 |

| CTQ | Careteq Limited | 0.018 | -25% | 8,588,216 | $5,653,135 |

| MIO | Macarthur Minerals | 0.097 | -22% | 100,854 | $20,781,686 |

| NYR | Nyrada Inc. | 0.1025 | -21% | 3,710,065 | $20,281,131 |

| APX | Appen Limited | 0.765 | -21% | 21,948,216 | $211,568,405 |

| ASR | Asra Minerals Ltd | 0.004 | -20% | 122,500 | $8,319,979 |

| ECT | Env Clean Tech Ltd. | 0.004 | -20% | 68,525 | $14,321,552 |

| ESR | Estrella Res Ltd | 0.004 | -20% | 2,078,464 | $8,796,859 |

| ME1 | Melodiol Glb Health | 0.004 | -20% | 2,358,325 | $1,964,980 |

| NAE | New Age Exploration | 0.004 | -20% | 2,574,236 | $8,969,495 |

| VML | Vital Metals Limited | 0.004 | -20% | 2,333,538 | $29,475,335 |

| NME | Nex Metals Explorat | 0.017 | -19% | 198,399 | $7,403,183 |

| SKY | SKY Metals Ltd | 0.034 | -19% | 1,901,456 | $19,378,720 |

| RAS | Ragusa Minerals Ltd | 0.03 | -19% | 263,446 | $5,276,155 |

| ABB | Aussie Broadband | 3.52 | -19% | 8,821,411 | $1,278,149,911 |

| IMI | Infinitymining | 0.061 | -19% | 22,671 | $8,906,504 |

| DY6 | Dy6Metalsltd | 0.044 | -17% | 31,965 | $2,093,279 |

| OSX | Osteopore Limited | 0.3 | -17% | 94,084 | $3,718,328 |

| FGL | Frugl Group Limited | 0.005 | -17% | 1,009,300 | $8,938,647 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 501,371 | $6,259,695 |

| PLN | Pioneer Lithium | 0.14 | -15% | 121,165 | $4,690,125 |

ICYMI – PM Edition

Race Oncology (ASX:RAC) has appointed international cardiometabolic expert Associate Professor Erin Howden, of the Baker Heart and Diabetes Institute in Melbourne, to its scientific advisory board.

PharmAust (ASX:PAA) has submitted supplementary clinical data from its recently completed Phase 1 MEND Study on treatment for motor neurone disease and amyotrophic lateral sclerosis for review with the US Food and Drug Administration.

Web3 company Animoca Brands, through its SPORTPASS subsidiary, has partnered with English football side Queens Park Rangers FC with the new portal launched today offering 200 unique 1-of-1 handcrafted turf collectibles and player memory cards, among others, to dedicated fans.

Torque Metals (ASX:TOR) has uncovered consistent lithium results with a peak grade of 4.42% Li2O from its recently completed drilling program at the New Dawn project, 600m west of the Bald Hill mine in the WA Goldfields.

Initial reconnaissance work by DY6 Metals (ASX:DY6) at its recently acquired Mzimba South and Afro Gifts (Karonga South) licences in northern Malawi has uncovered the potential for a major lithium discovery, with rock chip sampling at the former returning grades up to 6.2% Li2O.

Hot Chili (ASX:HCH) has executed a five-year MoU deal with Puerto Las Losas SA to evaluate bulk tonnage loading alternatives for its future copper concentrate production from the Costa Fuego project in Chile.

Trinex Minerals (ASX:TX3) is rolling out the diamond rig to investigate six walk-up drill targets at Gibbons Creek in the uranium-rich Athabasca Basin where the company recently inked a farm-in deal with TSXV-listed ALX Resources for an option to acquire an initial 51% interest in the Canadian project.

Western Yilgarn’s (ASX:WYX) historical data review over the Boodanoo Northeast application licence, about 90km south of Mount Magnet in WA, has proven a success with the identification of an exciting 2km gold target.

Impact Minerals (ASX:IPT) has submitted three exploration licence applications to capture potential strike extensions of newly discovered rare earth and copper anomalies at its Arkun project, 150km east of Perth.

And Pure Hydrogen (ASX:PH2) expects its 60%-owned subsidiary H-Drive International to receive first revenue from hydrogen fuel cell vehicle orders this month, with demand also showing no signs of slowing down.

At Stockhead we tell it like it is. While Animoca, Arafura Rare Earths, DY6 Metals, Hot Chili, Impact Minerals, PharmAust, Pure Hydrogen, Race Oncology, Torque Metals, Trinex Minerals and Western Yilgarn are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.