Closing Bell: ASX 200 on a five-day winning streak; but CSL, Seek drag down index

Pic via Getty Images

- ASX struggled to rise, with gains tempered by CSL and Seek

- CSL’s earnings and cautious forecast hurt the health sector

- Trump discussed policies with Musk amid a busy day for the markets

After a flat start, Aussie stocks started edging higher in the early afternoon, but gains were tempered by significant drops in biotech giant CSL (ASX:CSL) and recruitment platform Seek (ASX:SEK).

The ASX 200 ended the day 0.15% higher after a morning of teetering around the neutral zone. Today’s rise marks the fifth consecutive day of gains for the index.

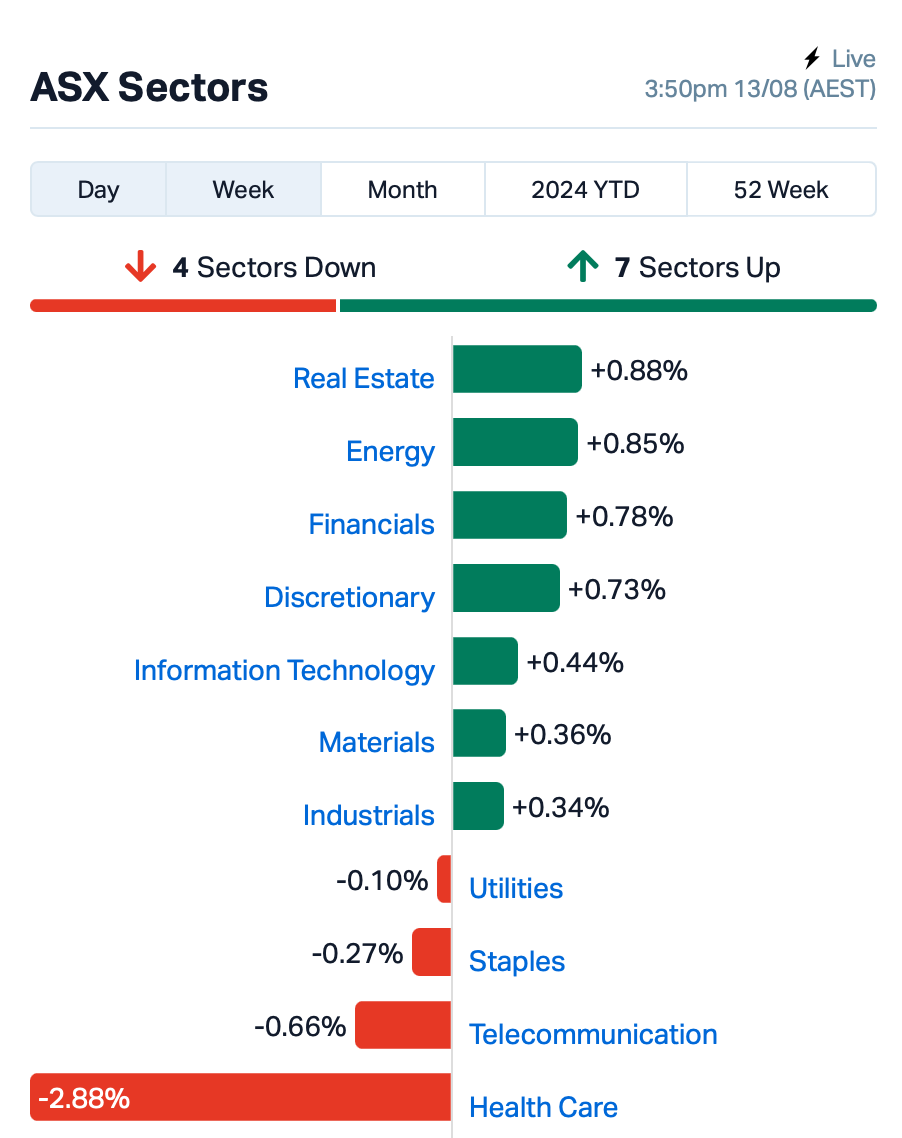

The market saw six out of 11 sectors in the green today, with real estate and mining leading the charge. However, the health sector was dragged down by CSL, sinking almost 3%.

As earnings season rolls on, the spotlight has turned to CSL after the company’s disappointing earnings report and cautious outlook for the next fiscal year.

CSL’s revenue for FY24 climbed 11% to $14.8 billion, and NPATA increased 15% to $3.01 billion. However, its modest revenue growth guidance of 5% to 7% for FY25 may have dimmed investor enthusiasm.

Seek also saw its stock plummet 9% as a slowdown in job ads weighed heavily on its earnings.

James Hardie (ASX:JHX) also took a dive of 3%, despite the company managing to chart a 1% increase in Q1 adjusted earnings.

In contrast, Challenger (ASX:CGF) leapt 7% after announcing a 10% hike in its fully franked dividend to 26.5¢.

Energy stocks got a boost as oil prices jumped 3% overnight, fuelled by fears of escalating conflict in the Middle East that could tighten global oil supplies. The US announced it would send a guided missile submarine to the region in response to potential threats against Israel.

Amidst this, Temple & Webster (ASX:TPW) was the standout performer today, soaring 27% after reporting record revenue of $498 million for FY24, a 26% increase from the previous year.

In economic news, Australia’s wage growth for the June quarter inched up by 0.8%, falling slightly short of the anticipated 0.9% rise.

However, the annual increase hit 4.1%, slightly surpassing expectations of 4%. This data hints that the peak of wage growth might be behind us.

Trump-Musk chat

In a much-anticipated two-hour discussion on X, delayed by over 40 minutes that Elon Musk attributed to a cyber attack, Donald Trump and Elon Musk covered a range of topics.

Trump revealed his plan to return to Butler, Pennsylvania, in October, a place where he recently survived an assassination attempt.

He outlined his vision for a historic scale of deportations should he win the presidency in November, and proposed creating an iron dome defence system.

Additionally, Trump said he would dismantle the US Department of Education, shifting educational control back to individual states.

Musk, meanwhile, reinforced his support for Trump.

Kamala Harris’s campaign also seized the moment to send a fundraising email during the interview, branding Musk as a “lackey” for Trump.

What else happened today?

Across the region, Asian stocks bounced back, recovering from last week’s sharp declines, with Japanese shares leading the charge.

The weaker yen provided a boost for Japanese exporters, lifting the MSCI Asia-Pacific index by up to 1% and erasing last week’s losses.

In Hong Kong and mainland China, stocks showed mixed performance as investor sentiment remained cautious, with trading volumes in China hitting a four-year low.

US equity futures edged up in anticipation of upcoming inflation data later tonight (US time), while Treasuries held onto Monday’s gains.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 101,356 | $4,276,846 |

| LSR | Lodestar Minerals | 0.002 | 100% | 248,688 | $2,600,780 |

| CDE | Codeifai Limited | 0.002 | 50% | 37,250 | $2,641,295 |

| ME1 | Melodiol Glb Health | 0.002 | 50% | 245,034 | $789,420 |

| ASQ | Australian Silica | 0.030 | 36% | 35,000 | $6,200,928 |

| AUH | Austchina Holdings | 0.004 | 33% | 1,027,000 | $6,301,151 |

| FAU | First Au Ltd | 0.002 | 33% | 581,895 | $2,492,990 |

| MKL | Mighty Kingdom Ltd | 0.004 | 33% | 8,000,000 | $9,647,829 |

| SHO | Sportshero Ltd | 0.004 | 33% | 290,000 | $1,853,499 |

| VAR | Variscan Mines Ltd | 0.008 | 33% | 1,680,699 | $2,568,002 |

| PLC | Premier1 Lithium Ltd | 0.013 | 30% | 4,703,627 | $1,745,741 |

| SVG | Savannah Goldfields | 0.031 | 29% | 2 | $6,746,038 |

| BPH | BPH Energy Ltd | 0.024 | 26% | 7,955,751 | $21,803,415 |

| AGC | AGC Ltd | 0.275 | 25% | 1,294,988 | $56,451,389 |

| CCZ | Castillo Copper Ltd | 0.005 | 25% | 538,883 | $5,198,021 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 108,911 | $12,000,000 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 1,000,000 | $3,176,585 |

| RHY | Rhythm Biosciences | 0.066 | 25% | 557,025 | $13,175,628 |

| LTP | Ltr Pharma Limited | 1.200 | 24% | 4,167,163 | $81,821,433 |

| TPW | Temple & Webster Ltd | 11.710 | 23% | 1,300,324 | $1,127,675,669 |

| AS1 | Asara Resources Ltd | 0.011 | 22% | 1,504,100 | $7,939,578 |

| GC1 | Glennon SML Co Ltd | 0.480 | 22% | 4,391 | $18,841,641 |

| ABE | Ausbondexchange | 0.034 | 21% | 27,533 | $3,154,707 |

Packaging giant Orora (ASX:ORA) saw its share price lift 18% in morning trade after announcing it had rejected a $2.55/share takeover offer by US private equity group Lone Star, describing it as “opportunistic” and “conditional”.

“The board, together with its advisers, carefully considered the indicative proposal and determined that it is not in the best interests of its shareholders to further engage with Lone Star on the basis of the indicative proposal, which materially undervalues Orora,” ORA says in an ASX announcement.

Variscan Mines (ASX:VAR) is up 17% after announcing it has appointed Square Trading as its exclusive marketing manager for the worldwide sale of zinc concentrates from its Novales-Udias and Guajaraz Projects in Spain.

VAR says Square Trading will also assist the company to secure third-party financing to construct and operate the mines it is developing. Square Trading is a shareholder in Zinc GroupCo, which is VAR’s largest shareholder.

LTR Pharma (ASX:LTP) is up 25% today after announcing it has entered a co-development agreement with Aptar Pharma for Spontan, its nasal spray treatment for erectile dysfunction (ED). LTP says the deal will combine LTP’s pharmaceutical development capabilities with Aptar Pharma’s expertise in nasal spray technology, supporting a streamlined regulatory pathway and market access for Spontan.

Rock chip sampling of Leeuwin Metals’ (ASX:LM1) West Pilbara iron ore project has has shown values of >50-55% iron along a 1.7km strike.

Satellite imagery and mapping turned up the prospectivity for lucrative channel iron deposits (CID), with multiple target areas present within the project area.

CID’s are a major source of cheap iron ore that is close to the surface and can be calcined into 63%+ iron, mined nearby at Rio Tinto’s (ASX:RIO) 326Mt at 56.3% iron Mesa A and CZR Resources’ (ASX:CZR) 33.4Mt at 55% iron Robe Valley in the Pilbara’s Robe River region. Further ground exploration is about to commence at West Pilbara to try and prove up the CID targets, which could turn the project into another Robe River iron ore mining operation.

After listing on the Aussie bourse in June, Canadian miner Resouro Strategic Metals (ASX:RAU) has been exploring the development potential of the massive 1.7 BILLION tonne rare earths resource it estimated at its Tiros project in Minas Gerais, Brazil.

Along with scale, the project also averages an impressive 3900 parts per million (ppm) TREO, with 1100ppm of them the high-value magnetic rare earths such as neodymium, praseodymium, dysprosium and terbium – elements used in tech that are ever-growing in demand. Its’ also got a titanium dioxide content of 12% within over half the combined measured and indicated 1Bt at 4050ppm inventory. RAU has been busy conducting metallurgical wizardry to see if those grades can translate into economically lucrative production.

Australian Silica Quartz (ASX:ASQ) was up on no specific news. But ASQ’s 2000m reverse circulation (RC) drilling program at its Quartz Hill MSGi project in QLD that it completed last year has ended up proving an MRE of 17.3Mt at a whopping 99.04% silica (SiO2). Since then, it’s started work on a scoping study that’s looking at suppling 300,000tpa of silicon metal feedstock lump to offtake partner Quinbrook, which is proposing to develop a multi-billion-dollar polysilicon manufacturing facility powered by large-scale solar near Townsville.

A diamond drill hole has been completed to a depth of 64.5m to validate an RC hole and will provide samples for metallurgical testing for the progressing study.

Australian Gold and Copper (ASX:AGC) is still on the rise after its Achilles discovery in Cobar, NSW.

The stock was worth 7.9c by ANZAC day this year, before shooting up to 56c per share in May on the back of revealing exceptional grades of up to 45g/t and 3000g/t silver – with a whopping 38% lead and zinc content from drilling. The discovery is unusual, and what AGS says is a “true greenfields discovery”.

While there was a sell-off after an $11m cap raise, it’s been back on the rise since last week, after revealing some high-grade assay results from a follow-up RC drill campaign. Drill intercepts up to 5m at 16.9g/t gold, 1,667g/t silver, 0.4% copper and 15% lead+zinc were unearthed late last month.

IN CASE YOU MISSED IT

Frontier Energy (ASX:FHE) has scored a major milestone after its Waroona renewable energy project in WA was assigned Certified Reserve Capacity by the Australian Energy Market Operator. This provides guaranteed Reserve Capacity payments that underpin debt financing.

GreenTech Metals (ASX:GRE) has identified a large 400m by 50-100m conductor plate at the Shelby target within its Whundo copper-zinc project in the Pilbara. This conductor may represent a new, deeper discrete mineralised horizon.

Satellite imagery and regional mapping of Leeuwin Metals’ (ASX:LM1) West Pilbara iron ore project has identified compelling iron ore targets, with values of >50-55% Fe along a 1.7km strike. Mineralisation remains open along strike and further mapping, sampling and surveys will start shortly.

Mako Gold’s (ASX:MKG) scout drilling program at the Tchaga North prospect on the flagship Napié project in Côte d’Ivoire has returned shallow high-grade gold with notable intersections such as 7m at 5.39g/t gold from 87m along the same southwest trend where previous rock chip sampling had returned up to 76g/t gold.

Renegade Exploration’s (ASX:RNX) rock chip sampling at the new Magazine prospect within Renegade Exploration’s Cloncurry project has returned significant results topping up at 40.6% copper and 16.9g/t gold in separate chips.

Terrain Minerals (ASX:TMX) has completed an airborne electromagnetic survey over its Lort River project that identified five high-priority bedrock conductors within the same mineralised belt as IGO’s Nova-Bollinger mining operations. These indicate the presence of valuable sulphide minerals.

Torque Metals (ASX:TOR) has completed infill and extensional diamond drilling at Paris gold project in WA’s goldfields region. Assays are expected in late August while fine tuning is underway for the upcoming 7000m reverse circulation drill program.

Viridis Mining and Minerals (ASX:VMM) has increased its footprint at the Colossus rare earth project in Brazil through the acquisition of seven tenements totalling 198.9 hectares that are adjacent to the Centro Sul and Cupim South prospects.

White Cliff Minerals’ (ASX:WCN) rock chip sampling has underscored the large-scale, high-grade potential of White Cliff Minerals’ Great Bear Lake project in Canada’s Northwest Territories after returning up to 42.6% copper, 38.2g/t gold and 310g/t silver from the Phoenix target. Assays are pending for the other five project areas.

Killi Resources (ASX:KLI) will next week start diamond drilling at the new Kaa epithermal gold-copper target within its wholly owned Mt Rawdon West project in Queensland.Rock chip sampling had returned high-grade gold and copper results of 238g/t gold, 2.1% copper and 513g/t silver, indicating that the 1.8km long Kaa prospect is a new, previously unrecognised epithermal mineral system. The company plans to drill five holes to test sulphide targets from the induced polarisation survey and beneath the high-grade rock chips.

“We are excited to have reached this point with the drill rig mobilising to the project. This campaign will be the first holes ever at the target, and we look forward to reporting on the drilling starting next week,” chief executive officer Kathryn Cutler said.

QMines (ASX:QML) has commenced drilling at its Develin Creek project in Queensland, focusing on resource definition drilling at the existing Sulphide City and Scorpion resources.

The program aims to improve confidence in the existing resource and convert the largely inferred resource to the indicated and measured JORC categories.

This drilling program will also meet contractual requirements for the acquisition of the remaining 49% interest in the project.

Vertex Minerals (ASX:VTX) has raised $3.8m through a placement of shares priced at 8c each to institutional and sophisticated investors to advance its Reward gold mine in the famous Lachlan Fold Belt into production

TRADING HALTS

Nothing to see here today.

At Stockhead, we tell it like it is. While Frontier Energy, GreenTech Metals, Leeuwin Metals, Mako Gold, Renegade Exploration, Terrain Minerals, Torque Metals, Viridis Mining Minerals, White Cliff Minerals, Killi Resources, QMines and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.