Closing Bell: All time high for ASX200, as lithium stock holders get a long-needed breather

Mining and Tech sectors led all the way today, with a strong rally from lithium miners. (Pic via Getty)

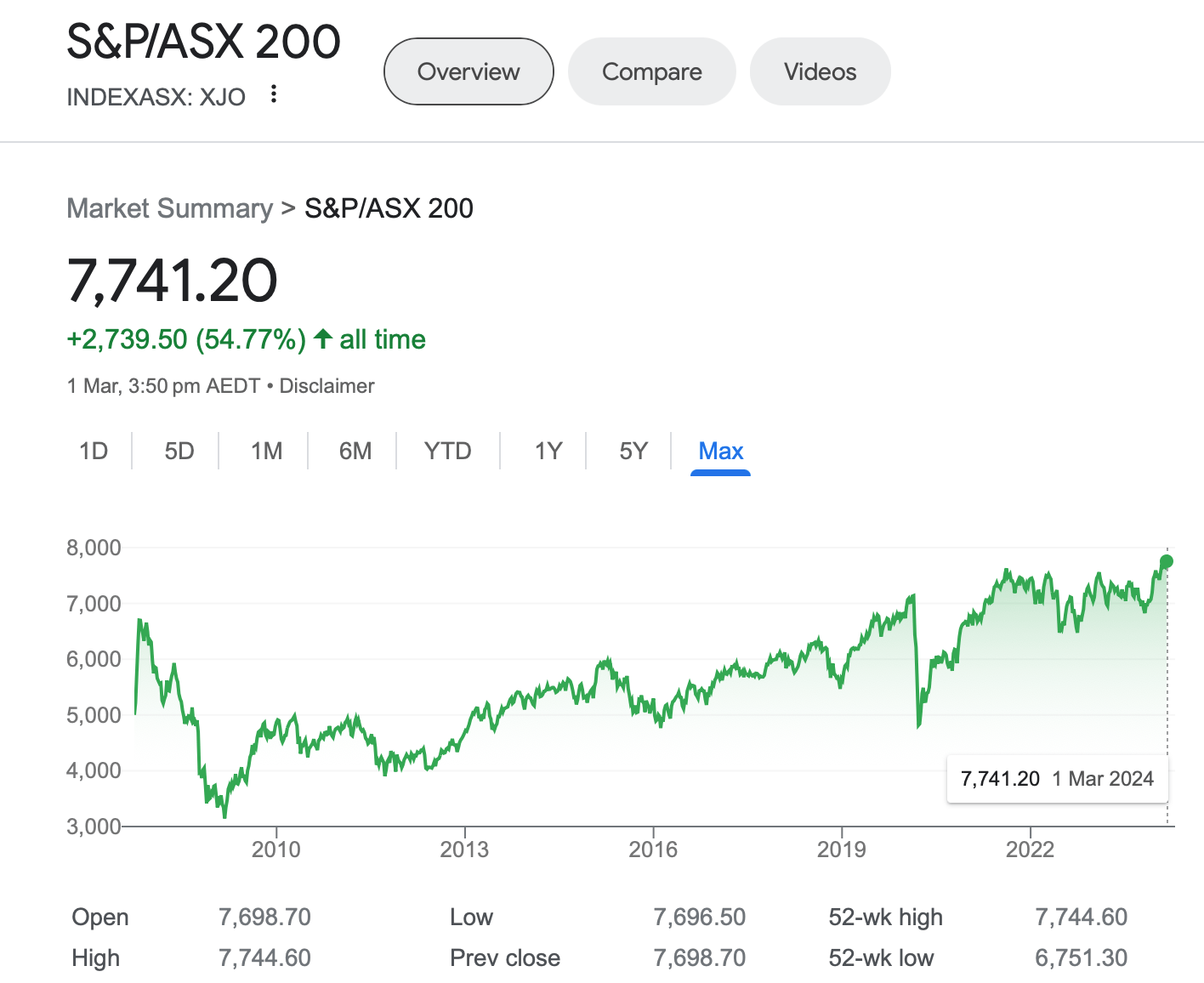

The ASX 200 index rose +0.5% to hit a record high of 7,744.60 today, before pulling back slightly at the close.

We can see here the evolution of the index, and how far it’s come along since the dark Covid days of March 2020.

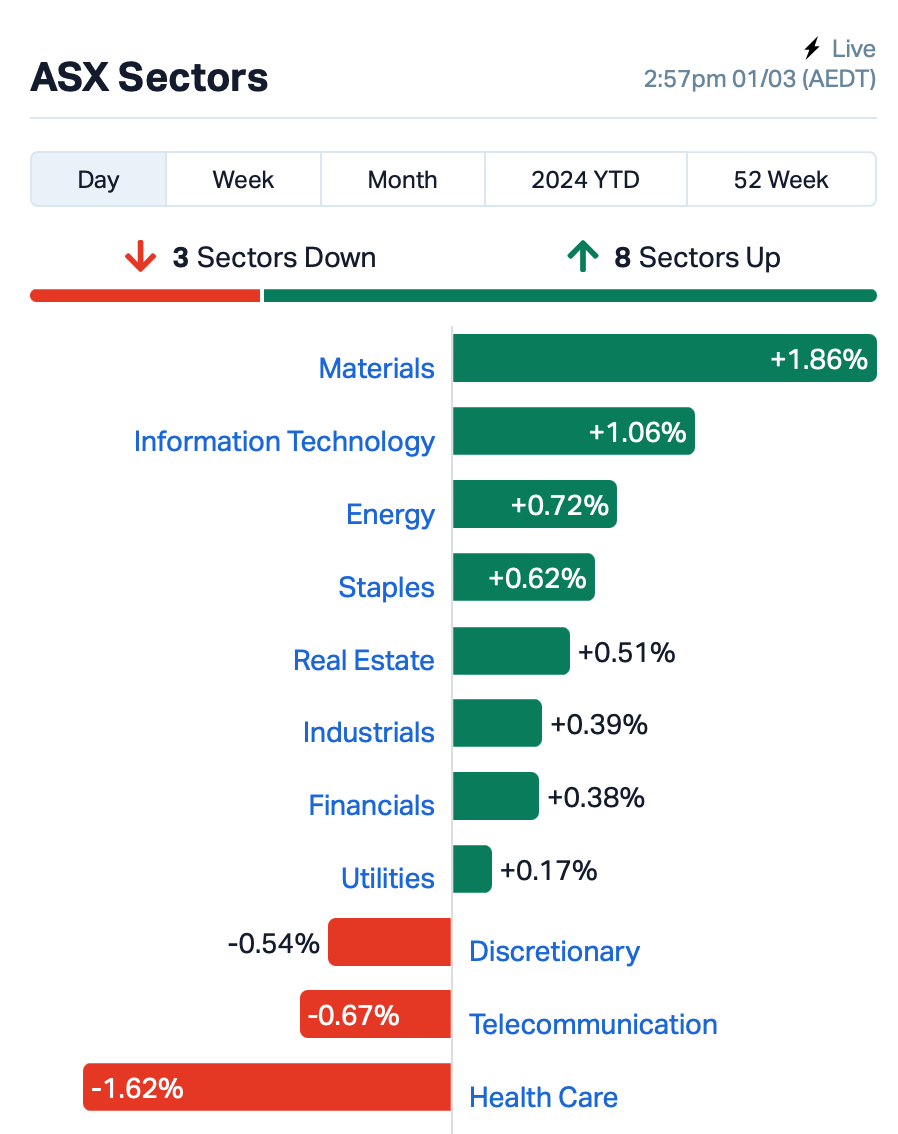

Mining and Tech sectors led all the way today, led by a rally in lithium miners. Technology wasn’t far behind, lifted by heavy hitter Life360 (ASX:360) .

Chinese lithium price agencies, including Asian Metal and the Shanghai Metals Market, have reported slight price lifts in recent days for battery grade lithium chemicals.

At the same time Fastmarkets, the most quoted Western price agency along with Benchmark Mineral Intelligence and Platts, kept prices stable saying there was low demand and limited liquidity in the lithium spot market.

It’s shown how sharply sentiment can shift battery metals stocks.

In the big end, Pilbara Minerals (ASX:PLS) rose 2.5% while IGO (ASX:IGO) and Arcadium (ASX:LTM) are also higher, the latter by over 8.5%.

Read more: Tony Sage’s European Lithium completes merger for Wolfsberg lithium project

The market has also been in gung-ho mood after the much-anticipated data release overnight of the PCE (Personal Consumption Expenditures) Index, which showed a rise to 2.4 % in January, from 2.6% in December – in line with expectations.

The data release led to a rally in US stocks, with Tech the main benefactors as traders bet on a June rate cut.

Overall, the futures market now signals 80 basis points of reduction this year, slightly more than the 78 basis points implied before the PCE data release.

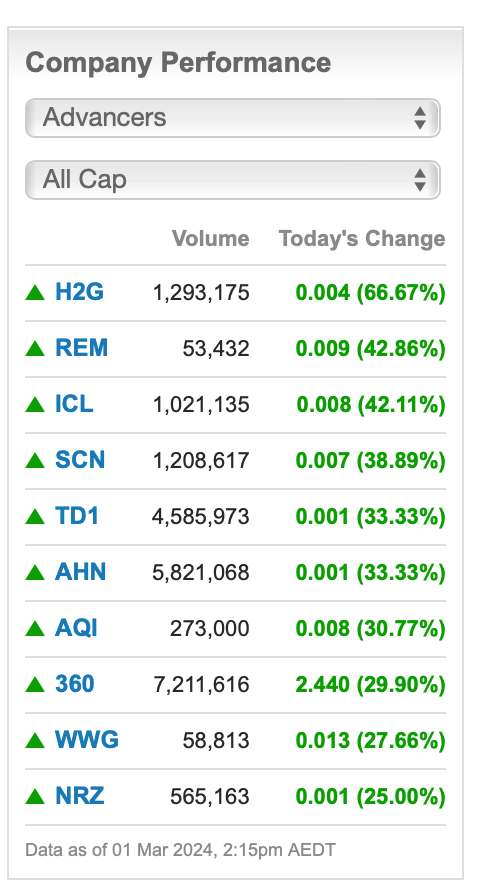

On the ASX, the standout stock today was Life 360 (ASX:360), the app for families, which rose +35% after blowing full year predictions out of the water.

More than 61 million people use the 360 app each month, and the company reported full year revenue of $US305 million, which increased 33% on pcp.

Top 10 best performing stocks (all caps) on Friday, as per Commsec:

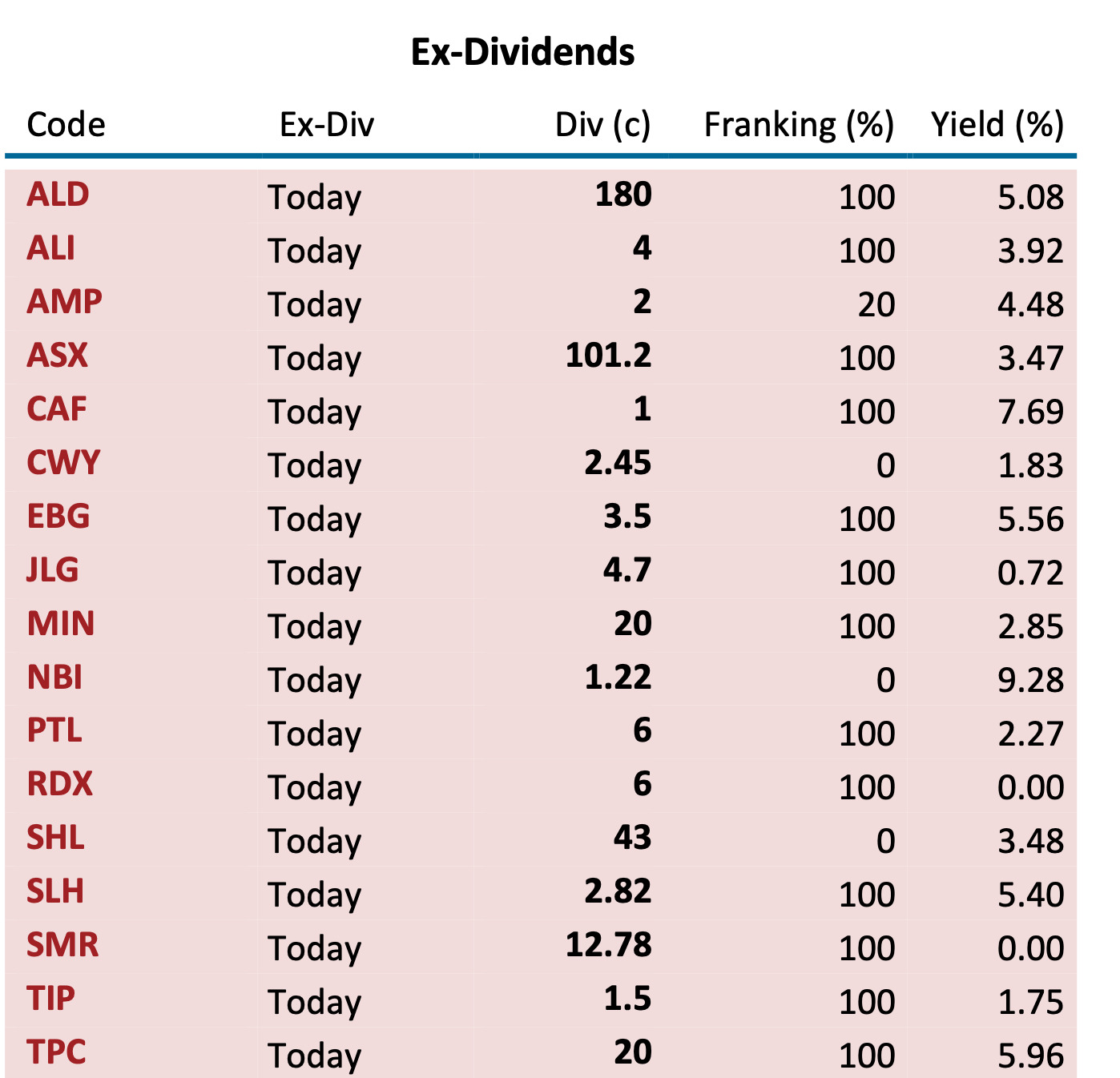

Stocks that went ex-dividends today:

US Markets

Choppy trading overnight in New York as traders reacted to the PCE data release and subsequent commentaries from analysts on what that would mean for monetary policy.

Overall, the consensus was that the soft PCE number is supportive of interest rate cuts this year.

Two US Federal Reserve officials also supported this view after speaking publicly and confirming they expected cuts prior to year’s end.

Sentiment also jumped after the US House of Representatives approved a short-term funding bill ahead of tonight’s midnight (US time) deadline, averting a government shutdown.

In commodities, iron ore (NYMEX CHN port;62%Fe) fell -9% overnight, while gold climbed +0.5% to US$2,054.70.

The next catalyst for markets will be the euro zone’s January CPI inflation due later tonight.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICL | Iceni Gold | 0.032 | 68.4 | 1,157,328 | $4,684,660 |

| H2G | Greenhy2 Limited | 0.010 | 66.7 | 1,394,175 | $2,512,535 |

| REM | Remsensetechnologies | 0.030 | 42.9 | 81,432 | $2,702,378 |

| SCN | Scorpion Minerals | 0.025 | 38.9 | 1,208,617 | $7,370,211 |

| 360 | Life360 Inc. | 11.230 | 37.6 | 8,247,405 | $1,668,454,718 |

| TD1 | Tali Digital Limited | 0.002 | 33.3 | 4,585,973 | $4,942,733 |

| AHN | Athena Resources | 0.004 | 33.3 | 6,771,068 | $3,211,403 |

| WWG | Wisewaygroupltd | 0.060 | 27.7 | 58,813 | $7,862,812 |

| AQI | Alicanto Min Ltd | 0.033 | 26.9 | 369,000 | $15,998,757 |

| IND | Industrialminerals | 0.265 | 26.2 | 123,863 | $14,439,600 |

| EDE | Eden Inv Ltd | 0.003 | 25.0 | 5,883,178 | $7,356,542 |

| HXG | Hexagon Energy | 0.015 | 25.0 | 405,184 | $6,154,991 |

| NRZ | Neurizer Ltd | 0.005 | 25.0 | 775,106 | $5,855,643 |

| PEC | Perpetual Res Ltd | 0.010 | 25.0 | 1,646,466 | $5,120,235 |

| OXT | Orexploretechnologie | 0.029 | 20.8 | 1,026,709 | $4,689,976 |

| ASR | Asra Minerals Ltd | 0.006 | 20.0 | 280,000 | $8,265,812 |

| ANR | Anatara Ls Ltd | 0.030 | 20.0 | 1,444,091 | $4,197,343 |

| IR1 | Irismetals | 0.580 | 19.6 | 840,750 | $62,824,466 |

| AON | Apollo Minerals Ltd | 0.025 | 19.0 | 140,000 | $14,623,201 |

| CC9 | Chariot Corporation | 0.320 | 18.5 | 53,532 | $22,082,317 |

| MXO | Motio Ltd | 0.032 | 18.5 | 85,000 | $7,241,355 |

| SRX | Sierra Rutile | 0.100 | 18.5 | 4,216,616 | $35,635,862 |

| BPH | BPH Energy Ltd | 0.026 | 18.2 | 9,152,337 | $24,146,060 |

| EMV | Emvision Medical | 2.650 | 17.8 | 320,380 | $175,403,502 |

| FTL | Firetail Resources | 0.049 | 16.7 | 21,307 | $6,254,033 |

Family safety app Life360 (ASX:360) has announced its quarter and CY23 results including revenue of $305 million, a YoY increase of 33%, in line with guidance of $300 million-$310 million and core Life360 subscription revenue of $200 million, up 52% YoY. Net loss of $28.2 million was a $63.5 million improvement from CY22.

Focused on project development of low-emission fuels and energy materials Hexagon Energy Materials (ASX:HXG) says it progressed confidential commercial discussions with potential strategic partners regarding its WAH2 project and received indicative pricing for several key aspects of the project during the December quarter.

Syrah Resources (ASX:SYR) announced a binding offtake agreement with Posco Future M Co for natural graphite fines, from Syrah’s Balama Graphite Operations in Mozambique. Key terms of the offtake agreement include: Volume of up to 2kt per month (24kt) in the year following commissioning, and from 2kt per month (24kt per annum) to 5kt per month (60kt per annum) at the option of Posco Future M from the second year to the end of the term. The whole term of the deal is for six years.

Chariot Corporation (ASX:CC9) has expanded its Black Mountain lithium project in Wyoming by 218 contiguous claims, resulting in a 206% increase in the project tenure area. The Black Mountain project now comprises 352 claims covering 2,686ha of tenure. Chariot has also increased its ownership interests in its Wyoming Lithium Portfolio to 93.9%

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.004 | -30.0 | 31,865,038 | $6,449,060 |

| WEC | White Energy | 0.035 | -25.5 | 50 | $5,322,061 |

| HCD | Hydrocarbon Dynamic | 0.003 | -25.0 | 106,225 | $3,234,329 |

| IS3 | I Synergy Group Ltd | 0.006 | -25.0 | 10,000 | $2,432,643 |

| UCM | Uscom Limited | 0.023 | -23.3 | 764,118 | $5,716,007 |

| ATH | Alterity Therap Ltd | 0.004 | -20.0 | 10,100,000 | $21,913,774 |

| MGU | Magnum Mining & Exp | 0.016 | -20.0 | 4,049,846 | $16,187,228 |

| CTO | Citigold Corp Ltd | 0.004 | -20.0 | 3,000,000 | $15,000,000 |

| VBS | Vectus Biosystems | 0.200 | -20.0 | 10,982 | $13,302,340 |

| NAE | New Age Exploration | 0.004 | -20.0 | 2,603,021 | $8,969,495 |

| TMX | Terrain Minerals | 0.004 | -20.0 | 2,480,000 | $7,158,353 |

| CTN | Catalina Resources | 0.004 | -20.0 | 26,000 | $6,192,434 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20.0 | 48,780 | $3,097,704 |

| NAG | Nagambie Resources | 0.024 | -17.2 | 744,136 | $23,102,435 |

| AHK | Ark Mines Limited | 0.145 | -17.1 | 3,602 | $9,703,122 |

| 88E | 88 Energy Ltd | 0.005 | -16.7 | 11,874,578 | $150,744,375 |

| M4M | Macro Metals Limited | 0.003 | -16.7 | 469,999 | $8,436,233 |

| TNY | Tinybeans Group Ltd | 0.105 | -16.0 | 47,455 | $10,548,418 |

| PTL | Prestal Holdings Ltd | 0.370 | -15.9 | 64,009 | $75,002,180 |

| PAA | Pharmaust Limited | 0.295 | -15.7 | 3,422,571 | $135,940,618 |

| SSH | Sshgroupltd | 0.110 | -15.4 | 21,996 | $8,566,981 |

| HT8 | Harris Technology Gl | 0.011 | -15.4 | 425,529 | $3,888,761 |

| NGS | NGS Ltd | 0.011 | -15.4 | 608,019 | $3,265,956 |

| AJL | AJ Lucas Group | 0.012 | -14.3 | 110,000 | $19,260,215 |

| AGH | Althea Group | 0.030 | -14.3 | 3,018,141 | $13,861,538 |

Nickel developer Centaurus Metals (ASX:CTM) was down more than 11% after announcing major changes to its DFS plans for its Jaguar mine in Brazil.

Previously planning to head all the way to nickel sulphate, the chemical derived from nickel sulphide used in EV batteries, instead it will only take its product to a concentrate in the initial stages of its mine life.

The aim is to bring both capex and opex costs down in the face of a surplus of nickel heading into the battery market from Indonesia, which has killed premiums for nickel sulphate and halved nickel prices over the past 18 months.

Centaurus says the decision to defer its downstream component wasn ‘not taken lightly’, fingering the ongoing weakness in the nickel market and softer nickel sulphate pricing against inflationary pressure for the call.

New Zealand King Salmon (ASX:NZK) says it has received the final government approval to proceed with an aquaculture project that will be a New Zealand-first, and also a world-first, in farming the King Salmon species in the open ocean. The company’s next step will be to complete an 18-month programme of rigorous benthic (seabed), seabird and marine mammal monitoring. This will provide a baseline of information, against which it can measure the impacts of a working salmon farm.

ICYMI – PM Edition

Trinex Minerals (ASX:TX3) has entered an option to acquire an initial 51% interest in the highly prospective Gibbons Creek uranium project in the Canada’s Athabasca Basin, while also raising $1.25 million for exploration activities over three walk-up targets on the 139km2 property.

Conrad Asia Energy (ASX:CRD) has signed a memorandum of understanding with Perusahaan Gas Negara to provide LNG and infrastructure from its two Aceh production sharing contracts offshore Indonesia.

And Tony Sage’s European Lithium (ASX:EUR) has emerged with an 83% stake in new NASDAQ listing Critical Metals Corp – currently valued at $1.3 billion – after spinning off its Wolfsberg lithium project, with the company now set to focus on exploring the rest of its 114.6km2 ground package in Austria.

TRADING HALTS

Land and Homes (ASX:LHM) – LHM is suspended from quotation immediately at the request of LHM, pending LHM’s appointment of sufficient directors to comply with section 201A(2) of the Corporations Act 2001 (Cth).

At Stockhead, we tell it like it is. While European Lithium is a Stockhead advertiser, the company did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.