Closing Bell: All round joy as IT sector jumps 3pc and benchmark snaps being a straight loser on Day 6

This is NOT JUST "A PHASE", mum! This is WHO I AM! Pic via Getty Images.

- ASX200 ends a bad week strongly, up circa 1pc but still in the bin overall

- Sectors led by a huge performance from IT stocks, which led the overall market for the week, too.

- Small cap winners led by IPB, LRL and a bunch of other TLAs.

Local markets are higher.

They know it’s Friday.

Let’s cut to the chase.

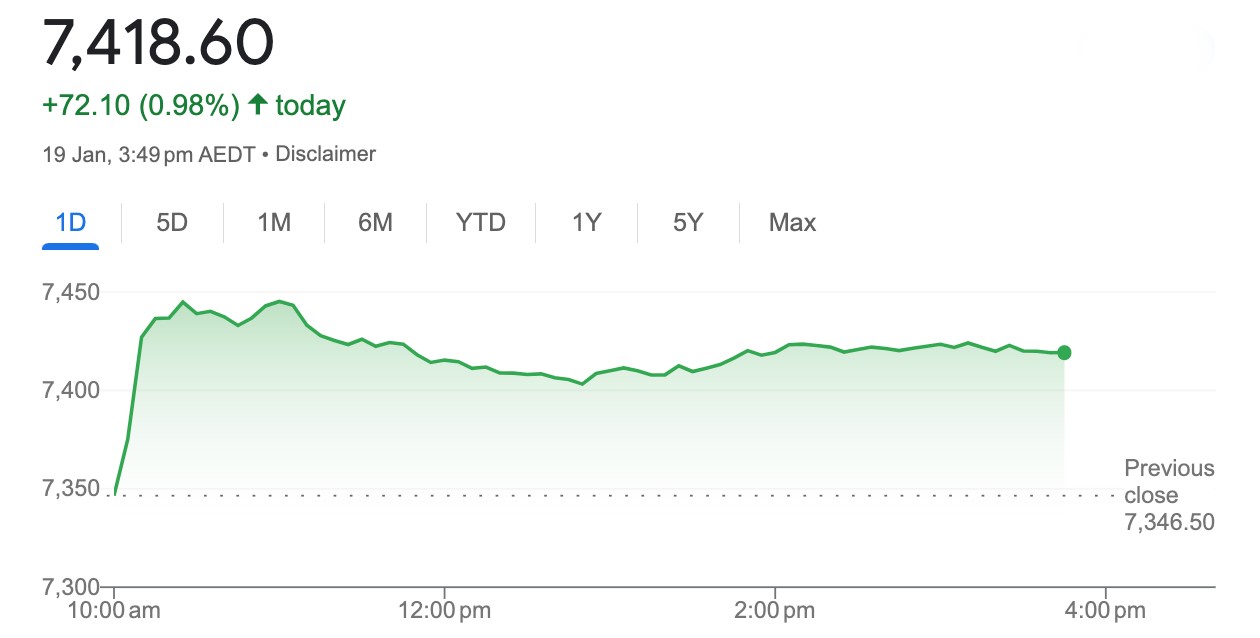

At 3.50pm on the 19th Jan, the S&P/ASX200 was ahead 72 points or 0.1% to 7,418.5:

Energy stocks were also among the first out the gate, after the Brent crude oil rise was close to 1.5% to about US$79 a barrel. Gold also climbed overnight by about up 0.9% to US$2,023.

Some of the local Energy and Materials names have done very well. The big banks lifted as did stocks in the IT Sector, with Xero (ASX:XRO) up almost 5% in the slipstream of US tech stocks.

The coal miners dined out. Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC) made the largest gains after both dropped productive production reports.

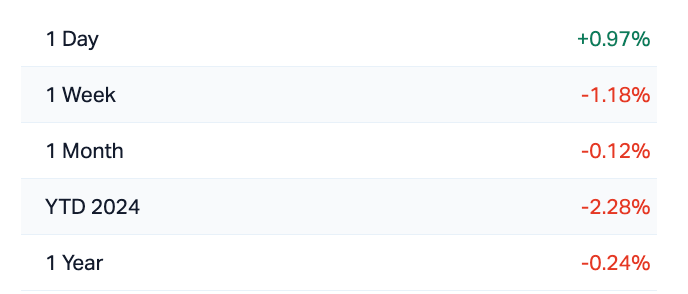

For the week, the benchmark was less impressive:

Health Care and Consumer Discretionary stocks were also among the top drivers, the latter saw gains for Aussie gaming stocks like Aristocrat Leisure (ASX:ALL) and The Lottery Corporation (ASX:TLC).

ASX SECTORS at 3.45pm on FRIDAY

Around the ‘hood…

Japanese stocks are back doing what they haven’t done in about 35 years after a few days of less than stellar gains, following another month of unfair inflation data.

Tokyo’s annual inflation rate dropped to 2.6% in December last year from 2.8% in November pointing to the lowest figure since mid last year.

Meantime, consumer inflation slowed to 2.3% year-on-year, down from 2.5% the previous month, as electricity and gas bills shrank with core inflation the lowest in 18 months.

Pretty good, but still beyond the BoJ’s official 2% target for a 21st straight month.

OFC, we’d give Gregor’s right testicle – it’s worth its weight in testicle meat, after all – for those numbers here or in the states and we’ve been tightening the policy underpants like mad hounds to achieve it.

We’re watching gold…

Gold is set to end the week lower as the greenback and US Treasury yields rallied after US initial jobless claims unexpectedly declined to 187K, the lowest level since September.

US retail sales rose more than expected in December.

In the hawkish Fedspeak corner, Governor Christopher Waller pushed back earlier this week on aggressive policy easing bets, saying the US economy’s strength gives policymakers flexibility to move “carefully and slowly.”

The safe haven is looking settled at about $US2021.

Markets are now pricing a 57% chance of a Fed rate cut in March, which is suddenly down a great deal from the 75% of ab out this time last week,

US stock futures are mixed on Friday morning in Sydney after last night’s Nasdaq led rally on Wall Street during the previous session.

The Dow ended higher by about 0.55%, the S&P 500 gained 0.89% and the Nasdaq Composite climbed happily away by 1.35%,.

7 out of 11 S&P500 Sectors did the lifting led by Tech, Comms and Industrials.

Here’s where US Futures are at 4pm in Sydney.

Via Fox News

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 246,030 | $10,471,172 |

| IPB | IPB Petroleum Ltd | 0.011 | 38% | 8,020,157 | $4,520,980 |

| PXX | Polarx Limited | 0.012 | 33% | 12,927,188 | $14,756,551 |

| CAV | Carnavale Resources | 0.005 | 25% | 920,166 | $13,694,207 |

| GES | Genesis Resources | 0.005 | 25% | 776,636 | $3,131,365 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 183,092 | $2,357,944 |

| VBS | Vectus Biosystems | 0.3075 | 23% | 12,750 | $13,302,340 |

| EME | Energy Metals Ltd | 0.195 | 22% | 17,000 | $33,549,330 |

| MTB | Mount Burgess Mining | 0.003 | 20% | 7,027,489 | $2,612,034 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 188,333 | $3,451,450 |

| FHS | Freehill Mining Ltd. | 0.013 | 18% | 13,991,721 | $31,348,179 |

| AUA | Audeara | 0.034 | 17% | 62,000 | $4,193,624 |

| FGH | Foresta Group | 0.015 | 15% | 3,139,186 | $29,183,536 |

| KOB | Kobaresourceslimited | 0.115 | 15% | 40,115 | $10,541,667 |

| OD6 | Od6 Metals | 0.115 | 15% | 94,322 | $5,501,550 |

| FGL | Frugl Group Limited | 0.008 | 14% | 86,286 | $7,291,817 |

| GSR | Greenstone Resources | 0.008 | 14% | 194,000 | $9,576,794 |

| ZEU | Zeus Resources Ltd | 0.008 | 14% | 1,335,637 | $3,214,967 |

| BGE | Bridge SaaS | 0.08 | 14% | 96,321 | $8,357,794 |

| GAS | State GAS Limited | 0.165 | 14% | 208,936 | $39,762,884 |

| CNQ | Clean Teq Water | 0.29 | 14% | 9,267 | $16,618,011 |

| NC6 | Nanollose Limited | 0.025 | 14% | 542,308 | $3,495,500 |

| TBN | Tamboran | 0.17 | 13% | 640,077 | $309,043,080 |

| BML | Boab Metals Ltd | 0.175 | 13% | 270,743 | $28,436,729 |

| 88E | 88 Energy Ltd | 0.0045 | 13% | 11,683,136 | $98,901,682 |

IPB Petroleum (ASX:IPB) is nominally at the top of the Small Caps ladder today despite no news since it told the market about a signing an MoU with Australian oil and gas development tech company, Pivotree.

The MoU sets IPB up to use Pivotree technology for the potential future development within its WA-424-P Permit focussed on the proven Gwydion oil and gas discovery and potential Idris extension.

Meanwhile, the likes of Pivotal Metals (ASX:PVT), Mount Burgess Mining (ASX:MTB) and Genesis Resources (ASX:GES) are moving about quite a bit on decent volume, despite little or nothing in the way of news to the market today.

Labyrinth Resources (ASX:LRL) is moving nicely on a double-shot of happy news that has identified the company as the hottest ticket in town for anyone who loves great big steaming piles of cash in the bank.

Week before last, Labyrinth told the market that its sold off the Labyrinth and Denain gold projects in the Abitibi region of Quebec, Canada for US$3.5 million in cash money.

And this morning, the company was rolling in it again, after the Canadian tax office sent it a cheque for CAD $415,453, a rebate against expenditure incurred by Labyrinth hunting for resources last calendar year.

Lastly for the lead-up to lunch, market minnow Mantle Minerals (ASX:MTL) is moving quickly, after delivering a resource upgrade at the Highway nickel deposit, within the Pardoo Ni-Cu Project, located in the Pilbara region of northern Western Australia.

Later in the day, not a whole heap had changed. PolarX made a late charge on old news to get near the top of the ladder, the highly mysterious Freehill got mysteriously higher, and there were a few other very small companies making out-sized, news-free gains as the arvo wore on.

Mesoblast (ASX:MSB) announced today that the US FDA has granted its allogeneic cell therapy Revascor (rexlemestrocel-L) a Rare Pediatric Disease (RPD) Designation following results from the randomised controlled trial in children with a potentially life threatening congenital heart condition called hypoplastic left heart syndrome (HLHS).

And that’s about it from the Small Caps – the rest are being hinky and at this stage of a pretty barf-tastic week, I don’t think I’m alone with the feeling that I am rapidly running out of sh-ts to give.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CAZ | Cazaly Resources | 0.02 | -26% | 3,407,731 | $12,275,180.75 |

| S3N | Sensore Ltd | 0.075 | -21% | 2,593,915 | $3,457,357.71 |

| M2R | Miramar | 0.024 | -20% | 21,111 | $4,466,086.32 |

| RNO | Rhinomed Ltd | 0.024 | -20% | 176,489 | $8,571,590.82 |

| ATH | Alterity Therapeutics | 0.004 | -20% | 631,968 | $19,056,630.93 |

| APS | Allup Silica Ltd | 0.035 | -19% | 360,441 | $1,654,515.34 |

| NGS | NGS Ltd | 0.014 | -18% | 50,000 | $4,270,865.75 |

| BMG | BMG Resources Ltd | 0.015 | -17% | 11,147,530 | $11,408,348.92 |

| FG1 | Flynn Gold | 0.05 | -17% | 554,003 | $8,743,455.18 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 6,583,512 | $10,556,231.21 |

| VML | Vital Metals Limited | 0.005 | -17% | 2,075,208 | $35,370,401.71 |

| AEI | Aeris Environmental | 0.034 | -15% | 48,500 | $9,825,782.04 |

| MHK | Metalhawk. | 0.084 | -14% | 151,516 | $9,742,615.71 |

| CTN | Catalina Resources | 0.003 | -14% | 3,170,012 | $4,334,704.12 |

| ECT | Env Clean Tech | 0.006 | -14% | 863,701 | $20,050,172.65 |

| LSR | Lodestar Minerals | 0.003 | -14% | 3,547,276 | $7,081,890.72 |

| OPN | Openn Negotiation | 0.006 | -14% | 42,809 | $7,904,257.45 |

| VRC | Volt Resources Ltd | 0.006 | -14% | 431,923 | $28,910,746.89 |

| EQS | Equity Story Group | 0.031 | -14% | 13,000 | $1,534,132.66 |

| FOS | FOS Capital Ltd | 0.19 | -14% | 70,644 | $11,837,350.58 |

| IBX | Imagion Biosys Ltd | 0.2 | -13% | 239,034 | $7,508,706.73 |

| GMN | Gold Mountain Ltd | 0.0035 | -13% | 287,448 | $9,076,314.34 |

| RIE | Riedel Resources Ltd | 0.0035 | -13% | 100,000 | $8,895,342.53 |

| RR1 | Reach Resources Ltd | 0.0035 | -13% | 13,718,725 | $12,841,188.45 |

| VAL | Valor Resources Ltd | 0.0035 | -13% | 4,531,819 | $16,693,339.16 |

TRADING HALTS

Evolution Energy Minerals (ASX:EV1) – pending an announcement in relation to a proposed investment in Evolution by BTR New Materials.

European Lithium (ASX:EUR) – pending an announcement in connection with an update on the NASDAQ merger transaction…

Sacgasco (ASX:SGC) – to allow for security holders to vote on a resolution to approve the divestment of the Company’s main undertaking, as identified in the Notice of Meeting dispatched 15 December 2023.

NeuRizer (ASX:NRZ) – pending release to the market of an update to its Appendix 5B released to the market yesterday.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.