Closing Bell: A little victory for local markets as ASX gains and China has a weekend to get serious about winning

Via Getty

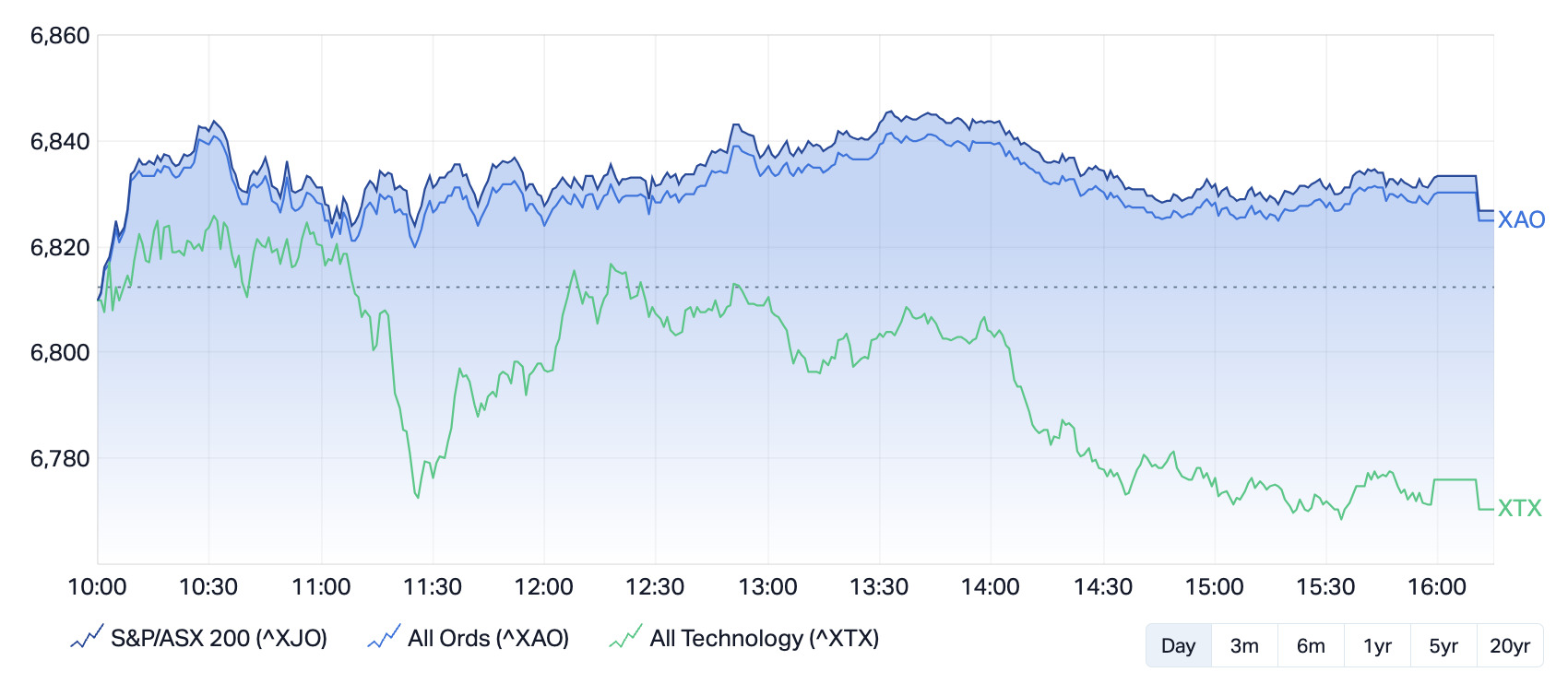

- Benchmark ASX index ends +0.21%, but down -2.2% this week

- Consumer stocks offset Tech losses

- Small caps led by Webcentral

The benchmark has ended another tortuous week of trade with a little Friday victory. Down -2.2% for the week, all victories at this stage are welcome.

The S&P/ASX 200 (XJO) index will start Monday morning at 6,826.9 after finishing 14.6 points or +0.21% led largely by lithium, materials and consumer staple stocks. The All Ords (XAO) index rose +0.19%.

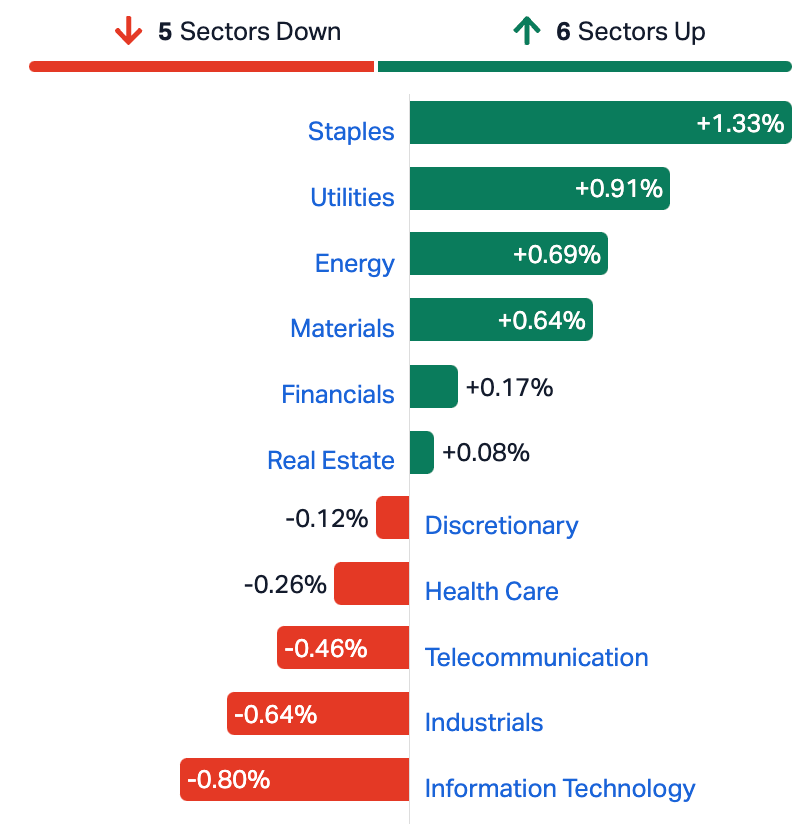

Consumer stocks led, IT Sector names did not.

They sucked today. This will make that a little clearer:

Coles in particular gave it a shake, gaining 2.1% after Morgans gave the supermarket a ratings upgrade from Hold to Add.

Harvey Norman also did pretty well among the bigger boppers, finding an intraday high of almost 3% thanks to its $442m share buyback program.

ASX SECTORS ON FRIDAY

RANDOM SMALL CAP WRAP

The Brazilian-focused lithium explorer Solis Minerals (ASX:SLM) is up almost 10% after lobbing an update on the start of a second drill rig doing its thing at the Estrela Prospect in Brazil.

The HIGHLIGHTS in BULLIES:

- A second large capacity rig is now on site and has commenced drilling on outcropping lithium pegmatite targets at Estrela

- Multiple outcropping pegmatites have been identified at Estrela and are scheduled for testing as part of this initial program of 3,600m

- A regional scale geochemical programme on northern Borborema tenements being mobilised

- Solis continues to negotiate additional acquisitions in the Borborema Province

Solis’ Executive Director, Matthew Boyes:

“Solis is exploring the lithium potential within the Borborema Province, with primary targets at Estrela and Mina Vermelha. Both prospects are located ~15km from the town of Parelhas, where the Company has established a base to facilitate operational management and engage with local communities.”

The co says the second large capacity drill rig has now commenced drilling at the Estrela prospect which will accelerate the programme.

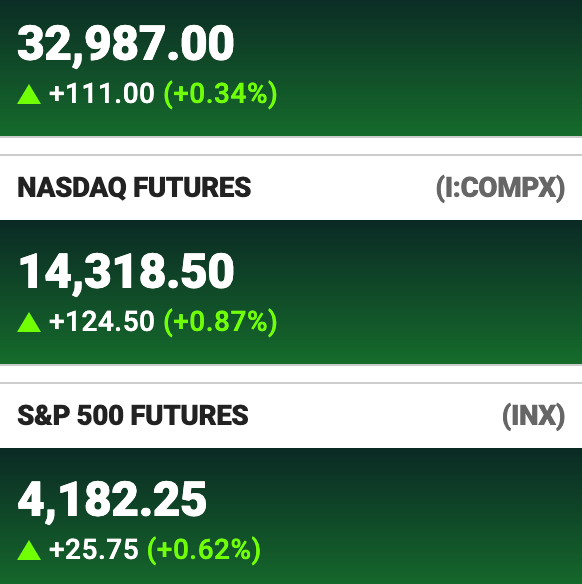

US FUTURES AT 1300 IN NEW YORK

RIPPED FROM THE HEADLINES

US strikes inside Syria

Reports are emerging of the first strikes by US forces in the Middle East since the Oct 7 attacks on Israel by Hamas fighters.

According to the US Dept. of Defence the military strikes on two facilities in eastern Syria were used by Iran’s Islamic Revolutionary Guard Corps and sent in retaliation for recent attacks on US forces. That’s an escalation.

The States have moved a lot of assets – troops, warships, missiles, artillery, warplanes and more – into the region in the hopes of exacting a high cost from Iran and its proxies, such as the Lebanese Hezbollah, should they seek to widen the conflict between Israel and Hamas.

Chinese stocks

On the mainland stocks are ahead for a fourth straight session with the Shanghai Composite and the Shenzhen Component both higher on Friday.

The benchmark indexes are also looking flush to finish the week higher, as sentiment took a promising turn this week in the wake of fresh stimulus measures from Beijing, which look decent enough to lend a hand to China’s sluggish economy and markets.

Earlier this week, the government of President Xi announced that it would throw caution to the wind on its budget deficit and pledged to issue 1 trillion yuan in extra bonds.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WCG | Webcentral Ltd | 0.305 | 177% | 34,029,854 | $36,203,885 |

| IND | Industrial Minerals | 1.005 | 123% | 5,770,692 | $28,971,000 |

| NZS | New Zealand Coastal | 0.003 | 50% | 9,752,952 | $3,334,020 |

| TOR | Torque Met | 0.22 | 42% | 2,739,165 | $18,704,626 |

| AYT | Austin Metals Ltd | 0.007 | 40% | 62,882 | $5,079,373 |

| IVX | Invion Ltd | 0.007 | 40% | 3,887,216 | $32,108,161 |

| BNR | Bulletin Res Ltd | 0.17 | 36% | 4,303,400 | $36,698,888 |

| HRE | Heavy Rare Earths | 0.095 | 36% | 209,881 | $4,234,155 |

| AVW | Avira Resources Ltd | 0.002 | 33% | 248,516 | $3,200,685 |

| MSI | Multistack International | 0.004 | 33% | 86,000 | $408,912 |

| MTL | Mantle Minerals Ltd | 0.004 | 33% | 41,523,795 | $18,442,338 |

| SIS | Simble Solutions | 0.004 | 33% | 800,109 | $1,808,852 |

| PEC | Perpetual Res Ltd | 0.021 | 31% | 1,054,797 | $9,898,653 |

| ZGL | Zicom Group Limited | 0.06 | 30% | 200,000 | $9,869,760 |

| AMM | Armada Metals | 0.026 | 30% | 37,021 | $2,571,361 |

| LBT | LBT Innovations | 0.005 | 25% | 1,750,400 | $1,423,601 |

| OAR | OAR Resources Ltd | 0.005 | 25% | 1,328,648 | $10,452,543 |

| SFG | Seafarms Group Ltd | 0.005 | 25% | 500,427 | $19,346,397 |

| TMX | Terrain Minerals | 0.005 | 25% | 320,000 | $5,030,575 |

| YPB | YPB Group Ltd | 0.0025 | 25% | 125,000 | $1,486,923 |

| MTC | Metalstech Ltd | 0.18 | 24% | 7,560 | $27,347,666 |

| 1CG | One Click Group Ltd | 0.016 | 23% | 23,986,148 | $7,996,277 |

| CAI | Calidus Resources | 0.195 | 22% | 5,427,225 | $97,260,778 |

| TPC | TPC Consolidated Ltd | 7.6 | 22% | 19,331 | $70,892,856 |

| ERW | Errawarra Resources | 0.175 | 21% | 2,572,553 | $10,078,080 |

Webcentral Group (ASX:WCG) entered into binding agreements with an investment group based in Europe consisting of Oakley Capital and its partners to sell two-thirds of its domain name registry, consumer hosting and email hosting services business for circa $165m.

Webcentral’s MD Joe Demase:

“In partnership with Tom and Jochen, the Oakley team is uniquely positioned to support the next stage of Webcentral’s growth, enabling us to expand our capabilities, further improve our services to clients, and pursue new growth opportunities internationally.”

WCG’s big deal bullies:

• Total Transaction Value of $165M

• Net cash proceeds of $115M

• Net cash position of $84M after debt repayment and transaction costs

• Retained one-third equity interest in Domains Business

• Agreement to buy $12M of cloud services and managed support services from Webcentral over 5 years, with a minimum of $4M in the first year

• Completion expected by late-November 2023

Industrial Minerals (ASX:IND) has agreed to ‘binding terms’ with North West Quarries for the exclusive option to acquire an 80% interest in the non-construction material mineral rights – which also include lithium and HPQ – at the Pippinagarra Quarry Project near badly misspelled Port Hedland.

“The project is located within world class Pilbara lithium province of Western Australia and near some of the world’s largest hard rock lithium mines. IND hold a number of tenements in the region that are prospective for HPQ and lithium, making the addition of this Project a logical expansion of IND’s activities in the Pilbara region,” the company told the ASX this morning.

IND has also recently applied for further tenure ‘proximal’ to the Pippingarra Project.

Bougainville Copper (ASX:BOC) has this afternoon confirmed a breakthrough has been made with the Autonomous Bougainville Government (ABG) with respect to ending court proceedings relating to the Company’s EL01 exploration licence in the Panguna project area.

It’s good progress – the stock has jumped 40%.

Back in January 2018, the ABG refused an extension EL01 with BCL granted leave for a Judicial Review of the decision in the PNG National Court.

Aside from those proceedings BCL also reports:

“That through this dialogue, BCL and the ABG have agreed on terms for a Deed of Settlement to end the Judicial Review proceedings with parties fulfilling their if respective undertakings.”

ABG President Ishmael Toroama is now reportedly reconsidering BCL’s EL01 application “with a view to extending the exploration licence for a period of five years.

“On delivery of respective undertakings, including the extension of ELO1, BCL has agreed to withdraw the Judicial Review proceedings. The PNG National Court is expected to consider an application to stay the Judicial Review on 13 November 2023.”

REE and gold explorer Terrain Minerals (ASX:TMX) is also ahead after announcing it had raised more than $430k in a non-renounceable entitlement offer. The company says 15.85% of shareholders (187) participated in the offer with a recorded unallocated shortfall of ~$355k.

TMX in September raised ~$785k through a placement to sophisticated and professional investors.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 3,979,292 | $20,529,010 |

| MXC | MGC Pharmaceuticals | 0.001 | -50% | 2,180,264 | $8,855,936 |

| CC9 | Chariot Corporation | 0.255 | -43% | 4,097,408 | $32,999,206 |

| HCT | Holista CollTech Ltd | 0.009 | -31% | 514,492 | $3,624,401 |

| AHN | Athena Resources | 0.003 | -25% | 2,517,894 | $4,281,870 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 467,729 | $31,285,147 |

| DXN | DXN Limited | 0.0015 | -25% | 141,752 | $3,446,680 |

| PNX | PNX Metals Limited | 0.003 | -25% | 650,000 | $21,522,499 |

| LPD | Lepidico Ltd | 0.008 | -20% | 31,249,601 | $76,383,079 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20% | 1,190,663 | $3,083,418 |

| SMS | Star Minerals | 0.035 | -19% | 106,044 | $1,558,870 |

| AUE | Aurum Resources | 0.11 | -19% | 449,333 | $4,240,227 |

| CBY | Canterbury Resources | 0.022 | -19% | 135,000 | $3,902,135 |

| CRS | Caprice Resources | 0.031 | -18% | 171,781 | $4,436,763 |

| KP2 | Kore Potash PLC | 0.009 | -18% | 106,571 | $7,345,837 |

| BOD | BOD Science Ltd | 0.05 | -17% | 340,000 | $10,640,310 |

| ADV | Ardiden Ltd | 0.005 | -17% | 4,572,479 | $16,130,012 |

| EPM | Eclipse Metals | 0.01 | -17% | 2,774,644 | $24,336,718 |

| FFG | Fatfish Group | 0.01 | -17% | 1,761,412 | $14,282,876 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | 45,145 | $4,276,016 |

| AKN | Auking Mining Ltd | 0.037 | -16% | 370,000 | $8,980,563 |

| ESR | Estrella Res Ltd | 0.006 | -14% | 38,337,988 | $10,385,003 |

| EXL | Elixinol Wellness | 0.006 | -14% | 2,323,377 | $4,419,407 |

| HTG | Harvest Tech Grp Ltd | 0.024 | -14% | 1,107,375 | $19,780,973 |

| M24 | Mamba Exploration | 0.03 | -14% | 312,785 | $2,134,417 |

TRADING HALTS

Strandline Resources (ASX:STA) – Pending an announcement by the company in relation to an operating strategy update at the Coburn Project.

Dorsavi (ASX:DVL) – Capital raising.

Emperor Energy (ASX:EMP) – Capital raising.

Nova Eye Medical (ASX:EYE) – Pending an announcement by the Board related to a proposed change to national USA Medicare reimbursement for Minimally Invasive Glaucoma Surgical (MIGS) products.

Associate Global Partners (ASX:APL) – Pending an announcement by the company in connection with an equity raising to be undertaken by way of an entitlement offer.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.