Christian Values: Aussies are rising from the pandemic and consuming ASX retail stocks without much discretion

Picture: Getty Images

Every now and then, Stockhead’s equal second-best editor Christian Edwards gets all twitchy about a stock, sector or staple’s rosy future. Sometimes he even has good reason to, with ‘solid fundamentals’ and everything. Or he just likes the way it catches the sun. Welcome to Christian Values, which is definitely not financial advice. But still a jolly good read.

At Premier Investments (ASX:PMV), it’s not all about Solomon Lew eating Myer’s board anymore.

We’ll get to that but first, a lot has happened at PMV – and the fast-changing retail landscape it occasionally excels in.

It’s now looking a very different sector to the one we began to ignore back when Kogan ate Dick Smith and the then quasi-famous entrepreneur, quasi-famously said: “The outlook for retail is so bad, (that) high-profile collapses will accelerate until there’s very little left.”

“Job losses are concerning. We have 170 retailers slated to close only two weeks into January of this year,” Smith opined.

Fast forward to the overall mess we’re calling 2022 and a few weeks out from Christmas and Lew’s global fashion chain business, investment conglomerate plaything – an ideal weathervane for the local retail set – has suddenly delivered double-digit sales lifts across its global brands during what has been a cracking first quarter.

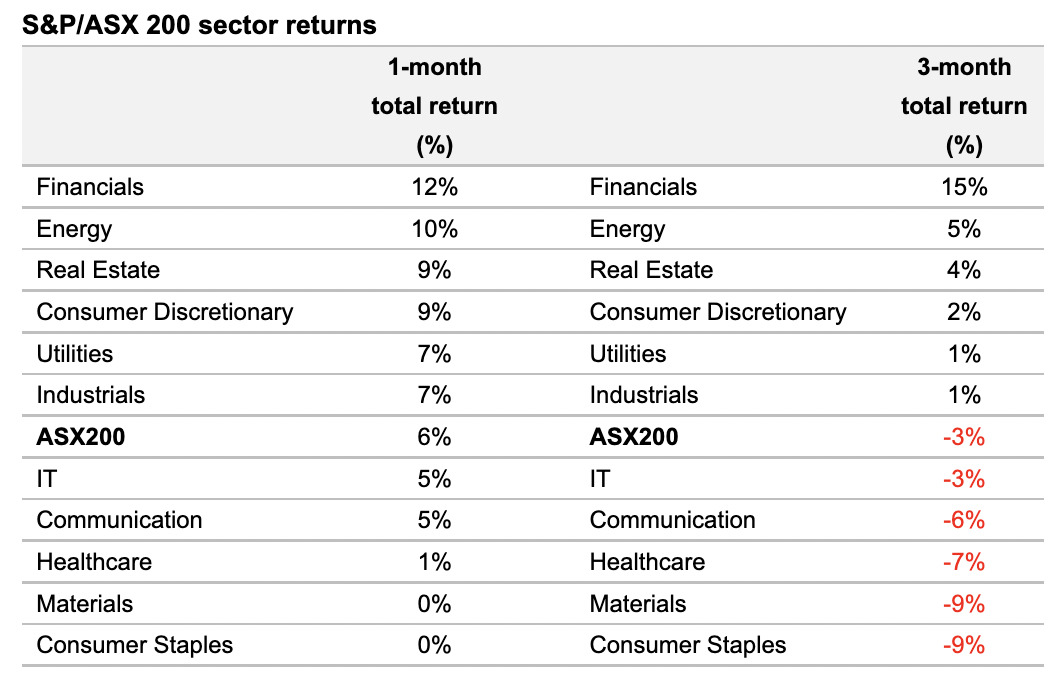

The owner of ultra-retail brands like Peter Alexander and Smiggle looks like a beneficiary of a pretty identifiable cyclical bias to the Aussie sectoral performance even over the last month.

Financials and Energy sector have led market gains, while the more defensive Consumer Staples and Healthcare sectors were underperformers.

But check out Consumer Discretionary, Australia:

As Morningstar’s Retail analyst Johannes Faul told Stockhead last week, there’s not been much discretion at all about the way Australians have been spending during October.

“Despite rising inflation and the RBA’s interest rate hikes, Australians haven’t tightened their belts. Heading into Christmas trading, discretionary categories are outperforming consumer staples like food and liquor.”

“Department stores, fashion retailers and restaurants have bounced back strongly from subdued trading a year ago, when the Delta outbreak kept their customers away,” Faul said.

Backing this up are the numbers.

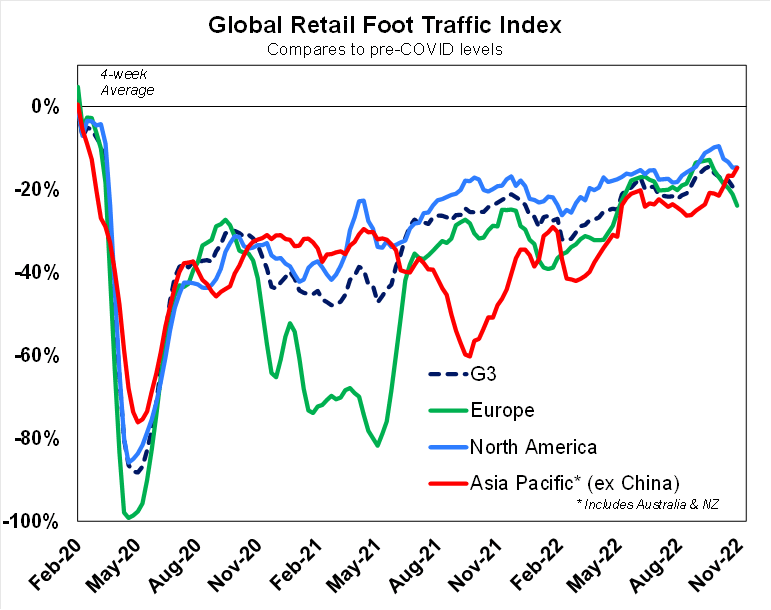

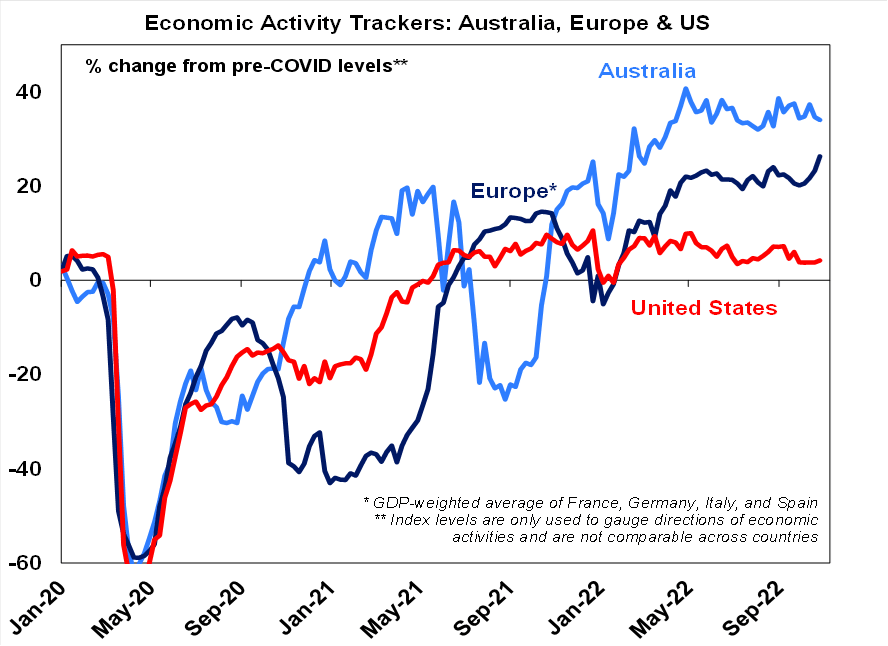

We’re getting out again apparently – not at pre-COVID levels, but we’re defo post-COVID and it’s really anyone’s notion where we might go from here.

Despite the volatility and the rising rate race, Datt Group MD Emanuel Datt told Stockhead recently that ASX retail is showing some real resilience.

“ABS retail data demonstrates that retail spending has not ‘fallen off a cliff’ as per market expectations but rather that consumers continue to invest in improving their home environment despite rising interest rates,” he said.

“Rising interest rates are actually pointing towards lower housing churn and we believe it’s likely that homeowners will focus on improving their existing home versus upgrading, which is good for home retail.”

Datt reckons The Reject Shop (ASX:TRS), Myer (ASK:MYR) and furniture retailer Nick Scali (ASX:NCK) are looking strong in the Christmas run.

Myer is his store

And PMV Chair Solomon Lew thinks so too.

In fact last month the perpetually paranoid Myer board wrote its umpteenth open letter practically begging Premier Investments to put up or even slightly shut up and just make a full takeover instead of this creepy creeping incremental buying up of the MYR share register.

The board led by Joanne Stephenson also said a flat no to the appointment of Terry McCartney, the retail billionaire’s long-time lieutenant, as a non-executive director.

In a tense exchange of letters ahead of this week’s blockbuster AGM (November 10), PMV rejected MYR’s unedifying plea to stop buying, calling the request “surprising and inappropriate”.

Meanwhile, Datt called NCK’s FY22 results pretty good and well timed, amid supposed headwinds and despite recording underlying net profit falling after tax of $80.2 million, down $4.9% on FY21.

He said it’s important for investors in ASX retail stocks to understand the underlying factors underpinning retail businesses.

“For example, past economic crises have demonstrated the resilience of certain segments of the retail market. In particular, we observe that brands or sectors that are perceived to be better ‘value’ for money have defensive attributes and therefore tend to do better in a broader downturn.

“Everyday retailers such as supermarkets and discount stores tend to outperform in these conditions.”

Datt said conversely, aspirational or higher value brands tend to be more cyclical and more closely linked with broader economic influences.

Premier Investments at a glance:

- Revenue: $1.52b (up 4.3% from FY 2021)

- Net income: $285.2m (up 4.9% from FY 2021)

- Profit margin: 19% (in line with FY 2021)

- EPS: $1.79 (up from AU$1.71 in FY 2021)

- Revenue exceeded analyst estimates by 3.5%

- Earnings per share (EPS) also surpassed analyst estimates by 16%

- Record online sales of $340.1 million in FY22,

- Online sales representing 22.7% of total Group sales for the year

- And up 14.3% on the previous record result in FY21

“The online channel are delivered at a significantly higher EBIT margin than the retail store channel. Our online sales are up fivefold in five years (up 400% on FY17 $68 million),” PMV CEO Murray said.

“Significantly for each of the seven brands, the most viewed window and the largest store is the brand’s online channel.”

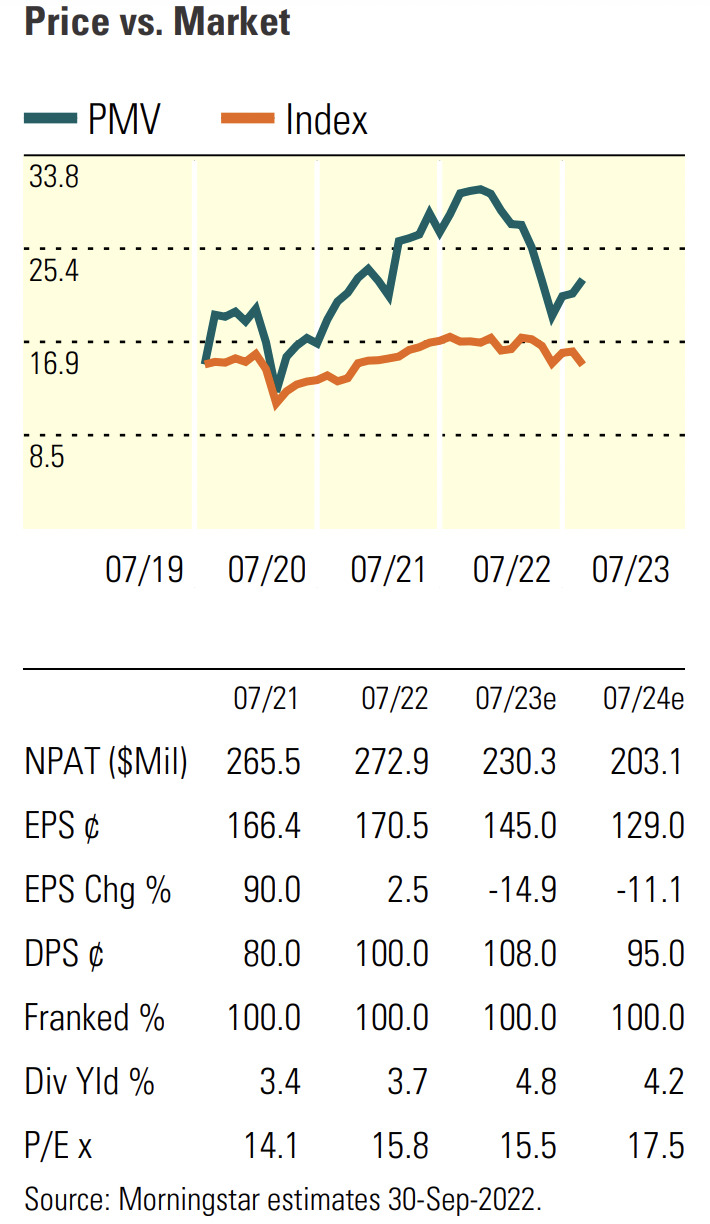

And after jumping about 6% last Friday following a well-taken Q1 update, the board of Premier has announced it’ll be paying its dividend of $0.79 on the 25th of January, a healthy increase on last year, yet the yield is well within Lew’s cash constraints at just 3.7%.

PMV operates a number of specialty retail fashion chains within the specialty retail fashion markets in Australia, New Zealand, as well as expanding into Asia and established positions in Europe.

Despite the various headwinds facing the sector, PMV’s EPS has been on the march for around the last four years, rising at a pace close to 20% per annum.

That’s rapid earnings per share growth and suggests a pretty mature approach to reinvesting and forking out some meaty dividends to the punters.

And looking ahead, revenue is forecast to grow 2% annually over the next three years, (vs a 4.1% growth forecast for the Aussie Specialty Retail industry).

The PMV Group also has investments in listed securities and money market deposits.

Currently Premier Investments wholly owns retail conglomerate the Just Group and holds a circa 28% stake in Breville Group, a provider of small electrical appliances in the consumer products industry, led by local development and innovation.

What else?

Well, Premier Retail – made up of its seven go-to brands Peter Alexander, Smiggle, Just Jeans, Jay Jays, Portmans, Jacqui E. and Dotti – now led by Murray (who began as Premier Retail CEO about a year ago this month), is talking up the outlook in a way certain to catch the attention of investors, saying “customers continued to respond favourably” to all the new 2023 global ranges.

“Premier Retail, our wholly owned retail segment contributed record Earnings before Interest and Tax (EBIT) of $335.0 million, up 10.1% on FY212 and up 100.2% on ‘pre-COVID’ FY19,” he said last week.

“Our omni-channel customer experience allows for a seamless shopping experience in whichever way our customers choose to engage with us. Be it through our over 1,100 bricks and mortar stores across six countries, our 15 websites across four countries or through our wholesale partnership arrangements with international ‘best in class’ retailers.”

Global sales for the first 12 weeks of 1H 2023 are up 42.8% on 1H 2022, noting that 1H 2022 sales were impacted by temporary store closures due to COVID-19.

Likewise, for the first 12 weeks of 1H ’23 global sales are up 21.7% on ‘pre-COVID’ 1H 2020 sales.

Murray says Premier Retail continues to manage its global logistics program effectively and is fully prepared for the 1H 2023 trading periods, with the majority of its required inventory for the peak trading weeks ahead available in the Company’s distribution centres and in stores.

And while the share price has fallen 21% since 2021, it’s up well over 25% since 30 June 2022.

In his report, chairman Solomon Lew said the Group does not seek to close stores, but maintains an “unrelenting” focus on store profitability.

“Our landlords recognise the long-term strength of Premier and its seven iconic brands,” he said.

“With their support, opportunities exist to refresh, upgrade and or expand stores across all of Premier’s brands over the next three to five years as we simultaneously continue to invest in our online potential.”

The Group operates 1,100 brick and mortar stores across six countries, 15 websites across four countries and holds wholesale partnership arrangements internationally.

Comparative Australian Specialty Retail performances:

- Wesfarmers Ltd (ASX: WES) share price has fallen by more than 25% this year, though it’s up 6.4% since the end of June 2022

- JB Hi-Fi Limited (ASX: JBH) share price is down 17.6% in 2022, but it’s 4.6% higher in FY23

- Harvey Norman Holdings Limited (ASX: HVN) share price is down 17.5% for the year yet it has risen 12% from the end of June 2022

- Woolworths Group Ltd (ASX: WOW) share price has fallen 13% in 2022 and is down 6.3% in FY23

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.