CHRIS OF DEATH: Left at the altar and now kicked out of All Tech, growing up is hard for Sezzle

Via Getty

Every now and then, Stockhead’s enfant terrible dep ed Christian Edwards gets all het up about a stock’s poor performance. After getting tired of his sleeve-tugging – and making him promise to consult a proper expert – we allow him to plant his Chris of Death on the unlucky target. And ooh, does it leaves a mark

Sezzle Inc is on struggle-street for the second straight session after the exchange revealed the buy now pay later firm is losing a cherished spot from the ASX All Tech Index as part of the next quarterly rebalance.

That means funds tracking the index will be required to unload all their Sezzle stock holdings in about a fortnight, or at any time prior to 19 September.

What happens then is the sudden glut of supply in SZL shares will deflate any remaining demand in SZL and so onto its share price.

A recap before the rebalance

Y’all may’ve met Sezzle Inc before – the tech-driven payments company which doesn’t want to be pigeon-holed as a BNPL.

We last saw SZL waiting – not entirely bereft – at the altar after a long and otherwise smooth engagement to BNPL Big Daddy Zip Co.

A lot’s happened since then. but first let’s recap.

SZL’s bread and butter is the provision of a payment platform which facilitates transactions twixt consumers and retailers.

Sezzle’s main gig however, is really foisting short-term, interest-free instalment planned payment products which aim, I suppose, to deliver consumers both a budgeting and financing value proposition.

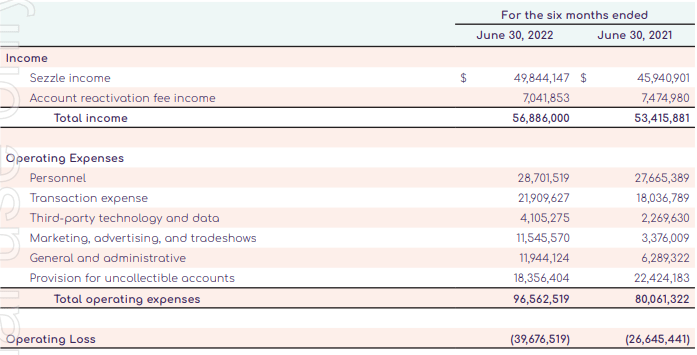

From Ord Minnett’s view, Sezzle is now all about beating a pathway to profitability, a not unreasonable conclusion which could be applied to every tech/growth/BNPL stock, everywhere.

The diff being Ord is upbeat about the steps already undertaken by Sezzle, which the broker says are expected to generate US$40 million in annualised revenue and cost savings, and, again in Ord Minnett’s view, continue to help drive SZL towards positive free cash flow and profitability.

I made a list of the initiatives, worth considering:

1) Offboarded or renegotiated rates with merchants and network partners

2) Cut and slashed workforce

3) Scaled back fruitless efforts to take over Europe and Brazil

4) Ceased payment processing in India

5) Cut and slashed third-party spend

6) Launched the Sezzle Premium subscription product

As a result of these initiatives above, Sezzle’s July cash burn fell by circa 30% to US$1.8m.

A decent start on the bottom line and in appreciation, earlier in August, Ord Minnett increased the SZL target price to $1.10, up from $0.60.

They like management’s ‘renewed vigor’ to slash and burn transaction costs and they very much like the new push for SZL to gain greater uptake in ACH-linked* payments (which have extremely low costs).

*eh, An ACH payment is a type of electronic bank-to-bank payment in the US that circumvents the card networks of Visa et al. Study up on your BNPL stuff, Australia.

Winchester does Sezzle

Over to you, Luke:

After buggerising around on it for a bit, the Sezzle Platform allows end-customers to make online purchases and effectively split the payment for the purchase over four equal, interest free, payments over six weeks. The end-customer makes the initial payment at the time of checkout and makes the subsequent payments fortnightly.

Sezzle, where do we begin? Chart says a lot, this is a business that probably isn’t long for this world, the Zip merger was their last throw of the dice and now that has fallen through Sezzle are in the last chance saloon.

Ok, so BNPL is a commodity product.

It becomes a race to the bottom and there aren’t many ways competitors can really gain an edge. Afterpay obviously had first mover advantage but for the tag-alongs what can you do? Well, one thing you can do is target the customers the others won’t.

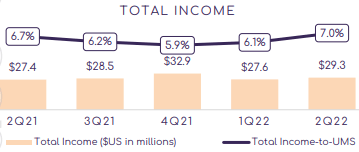

Afterpay, Klarna and Affirm dominate the traditional retailers, so most of the challenger BNPLs target smaller merchants and try to drive an edge there. Our good friends at Sezzle take that a bit further and target customers whose businesses can best be described as “questionable”. Look at their income as a % of total transactions, it has averaged 5-7% the last few quarters. Before they were bought by Square, Afterpay had margins ~4%.

Riddle me this Sezzlers: Why would a merchant give away 7% to Sezzle when they can use Afterpay at 4%? Well. Because Afterpay won’t onboard them.

Saddling up to mount the ESG line

The most obvious merchants who need an alternative to the majors are merchants who straddle the ESG line.

It’s a niche, admittedly.

Adult shops, cannabis dispensaries, firearm shops, etc. They aren’t illegal, but for major/traditional players it isn’t worth the brand risk of working with these merchants so they are forced to seek alternatives.

Sezzle provides that service and rightfully takes their pound of flesh for the additional risk.

But let’s get to the bad and ugly.

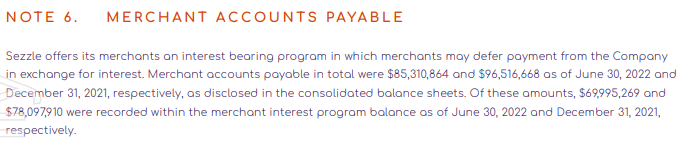

Unlike their peers, Sezzle runs a very interesting program called the Merchant Interest Program.

In a sentence this program allows merchants to defer the cash payment from Sezzle and instead earn interest akin to a bank account. Again, this raises questions, mainly how many small retailers can afford not to be collecting cash up front given working capital is such a constraint? Why would you use Sezzle as a bank account rather than a proper institution?

The simple answer comes back to our original point, we are likely talking about merchants who can’t access traditional finance companies.

But let’s finish the story…

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.