China still needs Australian commodities, but weak consumer sentiment is a threat

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

In recent days diplomatic tensions between Australia and China have risen, sparking fear that the trade relationship between the nations is under threat.

Forty per cent of Australia’s exports go to China and of these 82 per cent satisfy domestic consumer demand directly or indirectly. This includes commodities such as coal and iron ore utilised in industrial production.

On the other hand, Australia imports $80bn annually and this is 25 per cent of all imports. Around $16bn of this comes from telecommunications equipment and computers.

And China is still a major supplier for many other goods that account for a smaller amount of Australia’s imports. For instance, Australia only imports $1bn of lighting fixtures and fittings but 75 per cent comes from China.

COVID-19 has strained the Australia-China relationship and is expected to continue having an impact. Most notable is the ban on overseas visitors, which has hit the tourism and education sectors.

But public spats between officials on both sides have led to fears the relationship won’t return to pre-COVID normality.

Last week, China threatened to impose an 80 per cent tariff on barley imports, and farmers — led by the National Farmers’ Federation — expressed concern.

China needs commodities and exports have surged

Nevertheless, economists believe despite the public spats between diplomats on both sides, they know deep down both economies need one another to recover.

In recent weeks China has ramped up its appetite for Australian commodities. In March 2020 it imported 4.3 million tonnes of coking coal, more than double its imports in March 2019.

Shipments of iron ore rose 32 per cent in March and LNG cargoes to China rose from 29 in March to 40 in April.

With China seeking to reboot its economy, leaders may be cautious about putting their words into actions — at least when it comes to commodities.

Natixis warned at the end of March, as signs China was getting back to work became apparent, China’s prospects of recovery depended on imports as much as government stimulus.

“China cannot fully isolate itself from the rest of the world, especially after taking the hit from such a massive shock in the first two months of the year,” it said.

On Friday, NAB released a client note depicting strong economic data out of China. It showed industrial production, particularly manufacturing, was rising.

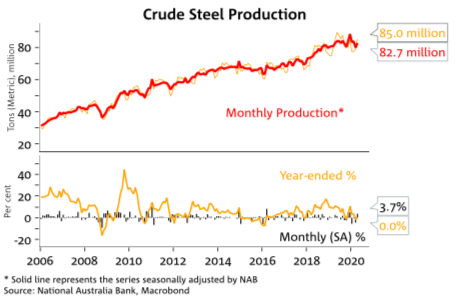

Industrial production year on year is almost back to 2019 levels. Crude steel production was one particularly strong sector, with monthly production reaching 82.7 million tonnes.

Weak consumer spending a threat

But NAB, along with Bloomberg, warned that consumer spending overall was weak despite showing signs of a recovery and the introduction of stimulus measures by the government.

Chinese retail sales made a slight recovery in April but were still down 7.5 per cent year on year, a figure exceeding estimates.

Bloomberg economists Chang Shu and David Qu think consumer confidence might improve in weeks to come but more government support will be needed and is likely to come.

“The economic outlook will probably improve slightly in the coming months as other countries exit lockdowns,” the economists said.

“Even so, China needs to sustain and step up policy support, given weakness in private-sector demand, the global downturn and some resurgence of trade tensions with the US.

“Clearer signals are likely to come when the government announces the annual spending plan at the opening of the National People’s Congress on May 22.”

NAB agreed, predicting a bounce was likely to continue although April’s weak figures showed the virus continued to weigh on consumer confidence.

“While it is clear the industrial side of the Chinese economy has bounced, the consumer side has not,” the bank said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.