China influencers vanish in lavish lifestyle purge, Beckham bends one for Alibaba and Shanghai’s open house surgery

News

News

China’s economy might be a little slower than usual, but the news flow has been ramping up like crazy. Here’s a quick, handy snapshot of some of this week’s must-know market moving madness from the Middle Kingdom.

As reported by state and indy media including Shanghai Daily, SCMP, Caixin, Bloomberg, Global Times The FT and friends, as well as Chinese social media platforms like Weibo, Douyin, and Xiaohongshu (Little Red Book).

First up and of serious concern for any investors in the (largely) European luxury houses: Beijing’s launched a new campaign Vs wealth-waving local influencers.

Douyin said in a statement on Monday that it would also start cracking down on fake “hot events” – for example videos of staged medical crises and domestic disputes designed to boost views.

“Douyin guides creators to record true, good lives,” the company said.

Already we’re seeing a bunch of famed social media accounts and posts getting disappeared from Chinese cyberspace. That’s obviously going to be very bad news for the small army of mainly young Chinese influencers whose day-to-day involves getting heaps of kit from luxury brands and then posting themselves covered in said lavish goods, purchases and their luxurious lifestyles and sharing it all on the array of social media platforms.

Popular Influencer Bao Yu Jia Jie (Sister Abalone), who boasts 2 million followers on Dou Yin and regularly flaunted her elaborately decorated mansion and – in the words of one journalist – “was regularly seen dripping with diamond and pearl necklaces,” was one of many major names targeted for ostentatious shows of wealth.

Never a smart play in President Xi Jinping’s austere China of 2024.

The latest morality campaign follows the Chinese internet watchdog’s crackdown which kicked off last month and was aimed at curbing behaviour such as “deliberately showcasing a lavish lifestyle built on wealth.”

China’s Communist government has, under Xi, strangled the Western associated vulgarities of capitalism and the various freedoms of its social media celebrities and their roaming voices.

Given the already lowering valuations of the China-exposed luxury sector amid slowing demand, history suggests investors should brace for double digit stock falls if past episodes are anything to go by.

Although China’s ‘Clear & Bright’ campaign in 2021 did not impact demand in a meaningful way, it did see the sector fall 12% on average. This time however, the crackdown comes on the back of already sluggish Chinese demand.

In terms of exposure to the Chinese consumer, think:

In the uncertain context of these uncertain times, UBS retains a bias for the lux brands with “balanced growth across nationalities” and no over-reliance on the usually profligate Chinese consumer.

Three names they reckon fit the bill best: Hermes, Richemont and …Ferrari*.

(*Ed: Oh. Ferrari. Didn’t see that one coming.)

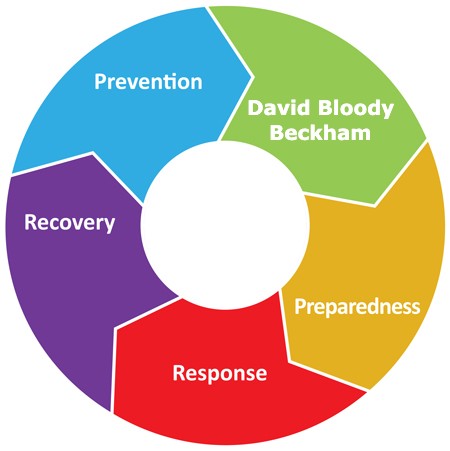

Alibaba Group’s mega online marketplace “AliExpress” has gone back to enlist English soccer star David Beckham as a global brand ambassador, the company announced Monday, as the Chinese e-commerce giant doubles down on efforts to boost sales overseas.

The universal Chinese emergency marketing wheel:

The one-year partnership is part of a campaign for the upcoming UEFA Euro 2024 soccer tournament, AliExpress said. Users of the online marketplace will get a chance to win discounts and other prizes like match tickets.

AliExpress is part of Alibaba International Digital Commerce Group, one of six units formed following the company’s major restructuring in 2023.

And that was a cracking segment last quarter – revenue out of the international retail-commerce biz jumped 60% on last year to US$11.3bn for the year ended March 31, with 36% of that revenue growth via AliExpress.

But to remind everyone of the scale of China’s (underperforming) e-com sector – both incumbent giants – Alibaba and JD.com – got absolutely smashed by Pinduoduo’s (PDD) quarterly growth when the adolescent e-commerce monster reported on Wednesday.

The relative newbie successfully tapped domestic online shopping trends, including the clear local preference for bargain hunting in times of austerity.

China’a wobbly old economic recovery has seen PDD – owner of both upstart e-comm platforms Temu and Pinduoduo – drop a Q1 net income about 250% better than last year to almost US$4bn on sky-high revenue.

Meanwhile, China is pumping another 344 billion yuan ($47.5 billion) into a state-backed semiconductor industry investment fund to drive its chip industry development amid an escalating technology race with the United States.

State media reports that Phase #3 of China’s National Integrated Circuit Industry Investment Fund will be flooded with funding from 19 state-owned investors led by the Ministry of Finance.

The fund will go in for in equity investment and asset management in the integrated circuit industry.

Shanghai will reduce the minimum down payment ratio for first-home buyers to 20% (vs 30% before) and cut the ratio for second-home buyers to 30% for suburban areas (vs 40% before) and to 35% for the rest of the city (vs 50% before).

Shanghai will concomitantly slash its minimum mortgage rate for first-home purchase to LPR-45bps (vs LPR-10bps earlier). The mega-city will also welcome back non-Shanghai residents to the fold by shortening the number of years of social insurance and income tax payments required before buyers become eligible to dive in.

Finally, Shanghai officials will also abolish home-purchase restrictions by divorced couples, and there’s a fair few of those – most of them doing pretty well to afford it.