CHART: The months of the year when the ASX performs best — and why

Pic: Ryan Pierse via Getty Images.

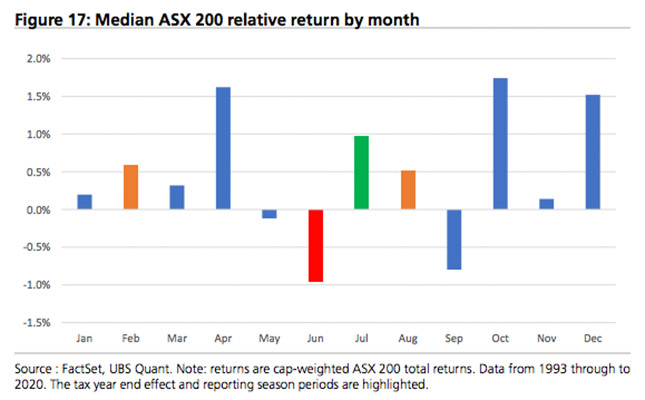

The best time of year to buy stocks is just before either April, October or December, UBS says.

Conversely, the rumours are true; it pays to be wary just before tax-selling season kicks off in June.

The data forms part of recent research by the bank on how ASX stocks are affected by seasonal changes.

The analysis was carried out using monthly returns on the ASX 200 from January 1993 through to December 2020.

Here’s what each month looks like:

Tax time

Over 28 years of data, the analysts found that Australian stocks exhibit “quite a strong tax year end effect”.

June is the worst month, posting a relative fall of 1% as investors get their tax affairs in order heading into the June 30 financial year deadline.

That can include tax-loss trades to reduce their ATO bill.

But just as quickly, investors buy back in as returns in July “almost perfectly mirrored” the June fall.

Divvie dates

However, July isn’t as lucrative as April or October, where the ASX 200 typically rises by more than 1.5% relative to other months.

UBS attributed the outperformance of those two months to a ‘dividend trade’ in the lead-up to bank reporting season.

In a normal year, Australia’s major banks churn out two healthy dividend payments (interim and final).

Leading up to both payments, the banks trade ex-dividend, which is the day after the deadline to buy bank shares and still be eligible for the dividend payment.

Crunching the numbers, UBS said the most common months of the year for banks to trade ‘ex-divvie’ are May and November.

So the months prior to each deadline — April and October — is where investors pony up for an extra slice of the action in the banking cash splash.

And because banks make up such a big weighting of the ASX 200, dividend-based demand for financial stocks helps drive the broader index higher, UBS said.

Santa rally

December is the other standout month of the year, although UBS’ detailed quantitative analysis to ascribe reasons for its outperformance is slightly… less technical.

“We do observe what looks to be a Santa Claus rally in the month of December,” UBS said.

Consolidating the good Christmas vibes, UBS said December not only competes for the title of Best Month — it’s also a more consistent performer with a “hit rate” (relative to other months) of more than 80%.

And while April and October gains are driven by the big end of town, December differs.

“The Santa Claus rally looks to primarily be caused by the outperformance of mid caps, with some assistance from small caps,” UBS said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.