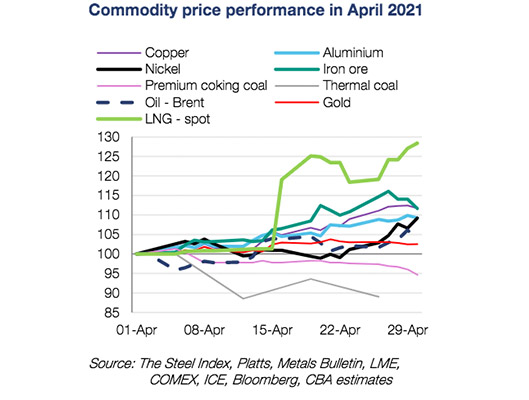

CHART: The best performing commodities in April

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

ASX investors are riding the commodity boom, and data from CBA this week shows April was another strong month.

The bank’s commodity spot price index rose by another 7.4 per cent, and is currently trading at its highest level since 2013.

While the decade-highs in copper prices and iron ore have been well-documented, April’s gains were actually led by liquified natural gas.

LNG prices were flat through the first half of the month before ripping higher, due largely to increased demand out of Europe and Asia, CBA said.

April commodity prices

European markets came out of the winter gas season with materially lower storage levels than usual — at around 30 per cent of capacity, compared to a five-year average of 43 per cent.

That discrepancy has underpinned near-term gas demand as Europe stores up for the summer gas season between April and October.

In Asia, restocking demand was driven by China and Japan which are already gearing up for next year’s winter season, CBA said.

“That’s an early start for winter restocking and reflects all the LNG supply disruptions over the last month,” the bank said.

Elsewhere, copper prices hit their highest level since 2011 on April 29.

As the global economy recovers from COVID-19, copper demand is being driven by a multitude of factors including the prospect of more large-scale infrastructure projects (particularly in the US), and its prevalence in the production of vehicles and energy systems as part of the shift to a decarbonised economy.

Iron ore also continued to rise through the month and hit new all-time highs of $US194/tonne on April 27.

For now, iron ore markets continue to be driven by booming end-user demand out of China, CBA said.

In that context, margins at Chinese steel mills are still elevated even though their iron ore input costs are at historic highs.

“China’s steel mill margins in Aprilwere also the highest since 2018,” CBA said.

“That’s noteworthy because margins are facing the twin pressures of high iron ore and coking coal prices.”

“China is paying more than double the price for imported coking coal given China’s unofficial ban on Australian coking coal.”

Across CBA’s commodities complex, spot prices for thermal coal and coking coal were the only two that recorded monthly declines in April.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.