Can Adore Beauty’s new CEO give this iconic brand a much needed financial makeover?

Adore Beauty’s new CEO Sacha Laing has a three-year growth strategy. Picture via Getty Images

- Adore Beauty faces growth challenges

- New CEO Sacha Laing plans to boost revenue by 30pc in three years

- The three-year focus will be on physical stores, AI and customer growth

Adore Beauty (ASX:ABY), an iconic name in Australia’s online beauty scene, has faced some tough headwinds recently.

After experiencing slowing revenue growth and a modest EBITDA margin of just 2.5% in FY24, the company is feeling the pressure from rising competition.

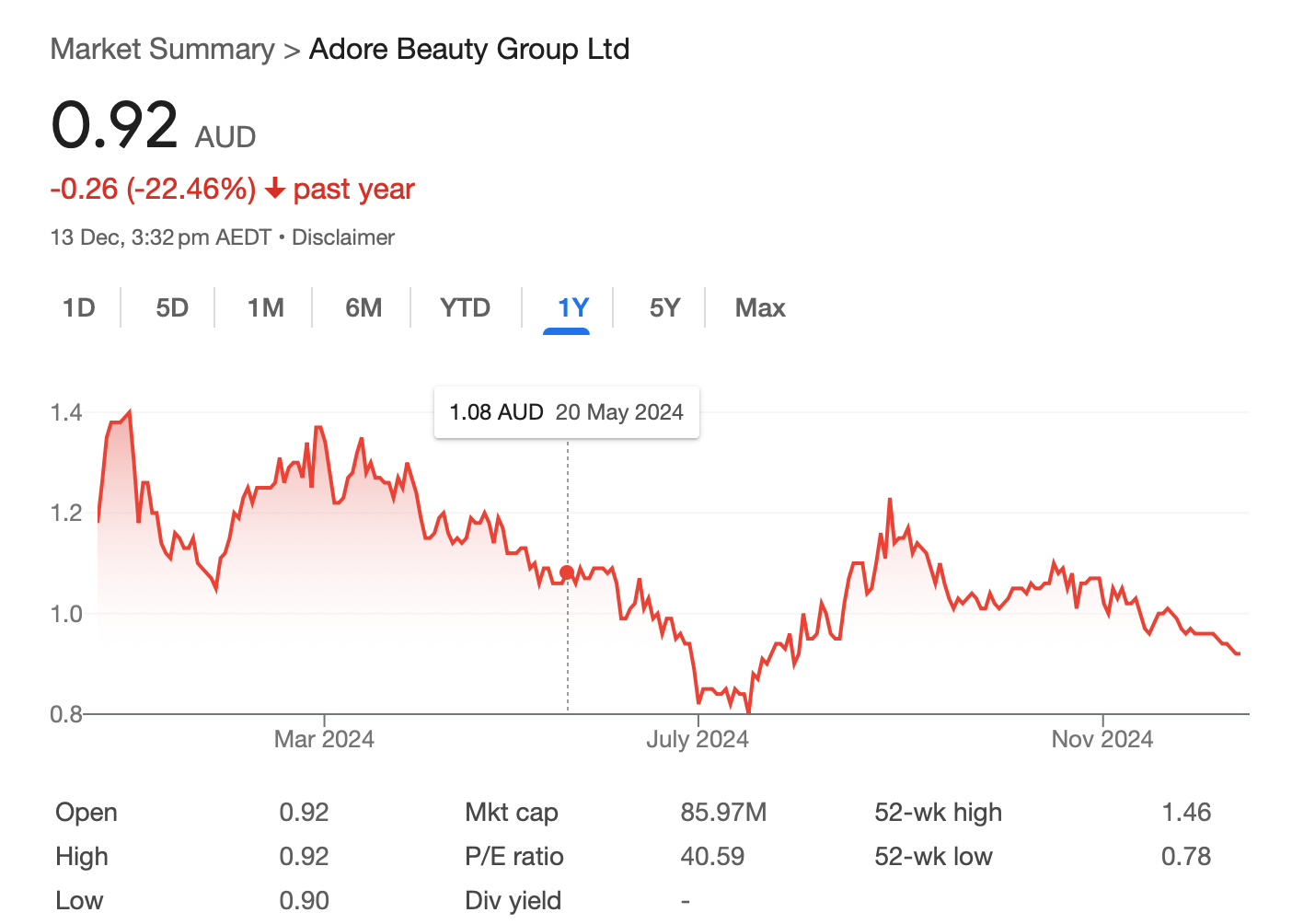

ABY’s share price has taken a hit over the past year, as investors weigh on concerns about its growth potential, particularly amid ongoing macroeconomic pressures.

Adore Beauty’s 12-month share price chart

While the company has a loyal customer base and $200 million in annual revenue last year, big players like Mecca, Sephora and even global giants like Amazon are intensifying the battle in the online beauty market.

To add to the challenge, 87% of beauty sales in Australia still happen in-store, leaving a huge gap for Adore Beauty to tap into.

Enter Sacha Laing, the newly appointed CEO with a vision for turning things around.

Laing is a highly experienced retail exec with over 25 years in the industry, having held CEO roles at Alquemie Group, General Pants Co, and Colette by Colette Hayman, as well as executive positions at iconic Australian brands like Country Road and David Jones.

With a strong background in omnichannel strategy, Laing’s appointment is a strategic move that could help Adore Beauty capture more market share.

It’s a big task, but Laing is confident that, within three years, he can significantly improve the company’s margins and set it on a path toward stronger profitability.

Adore Beauty’s three-year strategy

With Laing’s appointment, Adore Beauty has just revealed an ambitious omnichannel strategy targeting 30% revenue growth and tripling of EBITDA margin in three years.

Laing believes that to achieve this goal, Adore Beauty must diversify beyond its existing online model, particularly to increase customer acquisition and scale.

“We’re operating in a market where 87% of beauty revenue is still generated offline, so opening physical stores is the logical next step for us,” he told Stockhead.

His plan is pretty ambitious: open 25 or more stores across the country over three years, focusing on high-traffic shopping centres.

These stores will serve as hubs for new customer acquisition, while also improving the omnichannel experience for existing loyal customers.

The physical retail push is only part of the equation. Laing sees the company’s ability to improve EBITDA margins as a pivotal element of its growth strategy.

He targets a big shift from the current 2.5% EBITDA margin in FY24 to an 8% margin by FY27.

“It’s not just about increasing revenue – it’s about leveraging scale, improving operational efficiencies and expanding our own-brand offerings to drive better margins across the board.”

“Scale is really important for us. With physical stores, we can reduce the cost of doing business and drive efficiencies, which will feed into our bottom line.”

iKOU brand targets revenue growth

A key strategy in improving those margins is to expand the company’s own brand offering, such as the recently acquired iKOU beauty line.

iKOU currently generates $8 million in revenue. It’s a high-margin business – approximately double the margin of third party products – and it’s expanding rapidly.

“iKOU is a fantastic business. It’s highly profitable, and we see huge growth potential, especially as we expand into new regions like Melbourne and Queensland,” Laing said.

He aims to grow iKOU’s contribution to revenue to 8-10% by the end of FY27, and sees a path to expand gross margins by 200 basis point if this is successful.

Boosting customer acquisition

Laing also highlighted a crucial aspect of Adore Beauty’s growth strategy: the balance between loyal customers and the need for new customer acquisition.

“Having 80% of your customers being repeat buyers is a good thing, but it’s also a signal that you’ve got a customer acquisition issue,” he said.

To drive long-term growth, therefore, Adore Beauty will need to attract new customers.

This can be done through increased digital marketing spend, but Laing believes opening new physical stores is the more efficient route.

“You can either go and spend a lot on digital marketing to prospect new customers, or you can open stores in geographies where you don’t currently have customers, and that allows you to attract them more efficiently.”

The power of data and AI

Another strategy will focus on leveraging data and AI to improve customer experience and operational efficiency.

Adore Beauty has already introduced an AI-driven chatbot, “ABi,” which now handles 58% of customer queries.

“ABi’s learning every day and improving quickly. It’s helping us to respond faster to customer inquiries, and it frees up our customer service team to handle more complex issues,” Laing explained.

Laing also emphasised using data analytics to inform marketing decisions.

Adore Beauty’s in-house algorithm, powered by 1.6 million transactions annually, optimises ad spending across channels.

“It helps us understand where to put our marketing dollars for the best return.”

Laing will also focus on deepening relationships with loyal customers, using subscriptions and the mobile app as key tools.

“Subscriptions create frequency, and that’s crucial for driving revenue.”

Adore’s app currently generates 30% of revenue, enabling the company to reach engaged, profitable customers without paying for marketing.

“We’re not paying anyone for that traffic, which makes app users incredibly valuable to us.”

What can investors look forward to?

Looking ahead, Laing remains optimistic about Adore Beauty’s potential for growth.

He acknowledged the broader challenges in the retail landscape but believes that Adore Beauty is uniquely positioned to thrive.

“Beauty is a strong category, and even in a slowing market, there’s significant opportunity for us.”

The goal is to increase revenue by 30% by FY27, a target Laing believes is achievable despite macro headwinds.

“We’re talking about taking the business from $200 million to $260 million – a 30% revenue growth – but the real story is about profitability.

“We’re targeting a significant shift in EBITDA margin, from 2.5% to 8% by FY27.”

The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.