Buyers seized hot-stock Nvidia opportunity in volatile August: Selfwealth

Pic: Getty Images

- Semiconductor stocks saw strong interest on Selfwealth platform in August, including Nvidia

- Amazon, Alphabet, and Microsoft faced share price dips but saw increased trading during month

- Despite a volatile August for cryptocurrencies bitcoin-related ETFs gained significant money flow

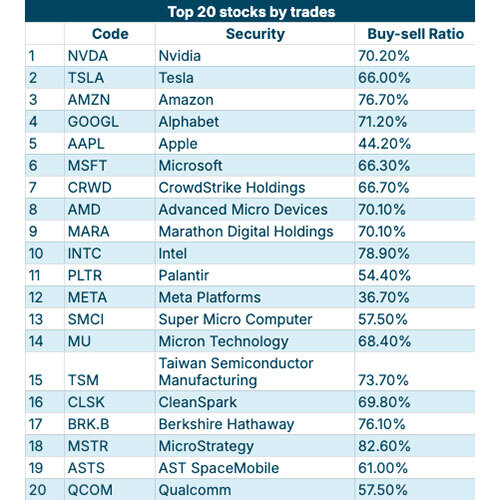

Investors took advantage of the August sell-off and fears of a US recession to buy up one of the Nasdaq’s hottest stocks of the year with trading platform SelfWealth (ASX:SWF) reporting that trades in semiconductor giant Nvidia (NASDAQ:NVDA) rose 155% over the month.

Selfwealth said Nvidia was largely supported by a wave of buying activity with more than seven out of every 10 trades buys.

August was a volatile month of trading for the company and US markets in general with fears of a US recession rattling investors.

Nvidia shares fell more than 15% for the month, amid a tech-led sell-off, before the stock rallied more than 30%.

The collective value of Nvidia shares traded in August across the Selfwealth platform exceeded $200m, which was up more than 10-fold compared with the result from July.

Selfwealth said this was among the highest ever monthly figures on the platform for any stock, be it ASX-listed or US-listed.

Interest remains in chip stocks

Selfwealth said the buy-up of Nvidia stocks in August was part of a broader interest in chip stocks among traders on its platform, which while moderating over recent months remained strong.

Other than well-known Nvidia, shares such as Advanced Micro Devices (NASDAQ:AMD), Intel (NASDAQ:INTC), Super Micro Computer (NASDAQ:SMCI), Micron Technology (NASDAQ:MU), Taiwan Semiconductor Manufacturing (NYSE:TSM), and Qualcomm (NASDAQ:QCOM) were all among the most actively traded US stocks.

“Each of these commanded a strong buy-to-sell ratio, indicating broad-based investor support for semiconductor stocks,” Selfwealth said.

“This cohort of shares saw a moderation in trading activity over preceding months as the AI trade showed signs of unwinding but the sudden resurgence in market volatility at the start of August prompted a new round of buying support amid segment weakness.

Selfwealth said there was also a lift in trading activity for related ETFs, including Direxion Daily Semiconductor Bull 3X Shares (NYSE:SOXL) and GraniteShares 2x Long NVDA Daily ETF (NASDAQ:NVDL).

Selfwealth said with the tech sector at the heart of the August pullback other tech giants including Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), and Microsoft (NASDAQ:MSFT) saw monthly trade volumes up 35.6%, 68.4%, and 39.5% respectively.

“Buying conviction remained strong, even as the three shares posted share price declines,” Selfwealth said.

Still on tech and a competitor to Elon Musk’s Space X, AST SpaceMobile (NASDAQ:ASTS) featured among the most traded Selfwealth shares for the first time, with nearly two-thirds of all trades linked to buying activity.

The satellite designer and manufacturer recently announced the commercial launch of its satellite network in low-Earth orbit.

Bitcoin-related ETFs gain interest

Selfwealth said another interesting trend in August was Bitcoin-related ETFs gaining significant money flow including ProShares UltraShort Bitcoin ETF (NYSE:SBIT) and the ProShares Ultra Bitcoin ETF (NYSE:BITU).

Similar to equities, the leading cryptocurrency experienced a volatile August as risk-off sentiment dominated. Bitcoin initially plunged in value, before recovering some losses, but still ended August down about 10%.

Selfwealth said both bullish and bearish cases for Bitcoin saw increased trading activity throughout August.

At the time of writing, however, it’s worth noting that Bitcoin is up more than 9% for the month of September, which, historically is more often than not a bearish month for the no. 1 cryptocurrency.

Most-held US shares

NASDAQ:TSLA), Nvidia, Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOG) are the top five held US shares on the Selfwealth platform.

Selfwealth said Warren Buffett’s Berkshire Hathaway (NYSE:BRK), in eighth position on its most held stock list, recorded its second consecutive month where the collective value of holdings on the platform rose by double digits.

Growth in August was 10.3%, which followed a reading of 11% in July. BRK’s underlying share price rose 8.5% through the month with more than 75% of trades in the stock last month recorded as buys.

Selfwealth said provider of data analytics and AI software Palantir (NYSE:PLTR) had its third straight month of growth and is now ranked 11th among US securities on the Selfwealth platform, as measured by the value of all holdings.

The company delivered a strong earnings report, which showed quarterly revenue growth accelerating on the back of a surge in deals with commercial customers.

With contrasting share price performances across the month, Selfwealth said GameStop (NYSE:GME) and Bitcoin-focused MicroStrategy (NASDAQ:MSTR) swapped places in 13th and 15th positions respectively.

Semiconductor foundry Taiwan Semiconductor Manufacturing (NYSE:TSM) rejoined its top 20 after a brief absence with renewed interest in chip stocks.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.