Burn after reading: Who’s made it onto UBS’ Most and Least Preferred Australian Stocks hit list?

Pray you're not on the list. Via Getty

Ok. The 2023 check list so far:

China hasn’t exploded in a puff of self-destruction. Tick

Putin hasn’t nuked anyone yet. Tick

Gazprom’s energy play Vs the EU has fallen over after an insensibly warm European winter, (although climate change: still bad) Tick

Labour markets looking good. Tick

Global economy seems to be less maudlin and jaundiced than it was ahead of Christmas. Tick

Yes. We’re a few weeks now a new year and things aren’t just feeling non-2022, they’re even looking up. And a few of the investment banks are starting to move on some of these mildly positive indicators.

In Germany, the almost transparent Chancellor (his name is Olaf Scholz) has been muttering something about Berlin dodging a recession, just like this Van Eck analyst reckons this lucky country will.

Meantime in New York (or is it Geneva?) the entirely superfluous International Monetary Fund (IMF) just told an empty presser it might be able to stop crapping on everyone from a great height and upgrade its forecasts.

The macro backdrop has proven resilient, UBS told its local clients this week, and the indicators have ‘all been positive’ for risk assets.

Macro out, micro in

“Whilst 2022 was dominated by macro — whereby investors get a constant barrage of data to shape their views; we believe that 2023 is going to be dominated by the outlook for corporate earnings —a data set that comes around only 4 times a year (and only twice in Australia).”

“As a result we expect 2023 to be more volatile than the current VIX of <20 would suggest (the lowest levels of volatility we have seen in 12 months).”

Wall Street might remain a bit of a razor’s edge, but UBS believes that the outlook for Aussie corporate earnings is defo less downbeat.

This week, the UBS Australian equities team raised their ASX/200 Index Target to 7,500 (from 7,250) on the back of the global economic outlook as China’s reopening continues to offset fears around ongoing monetary tightening.

The benchmark rose 0.1% to 7,393 on Wednesday and ended at its strongest level in more than 8 months.

Overweight ASX

The UBS-linked, LGT Crestone continues to maintain its overweight to Australian equities, although last year diversified across that exposure by adding to Emerging Market exposure and down-weighting Australia by 1pt.

Perhaps the better marker for LGT Crestone’s stance on Aussie markets is that during 2022, the wealth manager expanded its national footprint, the firm now has well over 300 Aussie-based staff, including 94 investment advisers, in offices across Melbourne, Brisbane, Sydney and Adelaide.

With that said, there appears to be a general consensus that it’s still way too premature to cash-up and call the start of a cyclical economic upswing.

The rates ball is still definitely in play – economists are always banging on about how these are awful lagging indicators and the impacts of rate hikes around the world still have some uphill work to finish before they’ve marched their merry way through the various national economic digestive tracts.

And in this regard, UBS says investors are likely to be seeking, ‘more structural and consistent sources of revenue growth.’

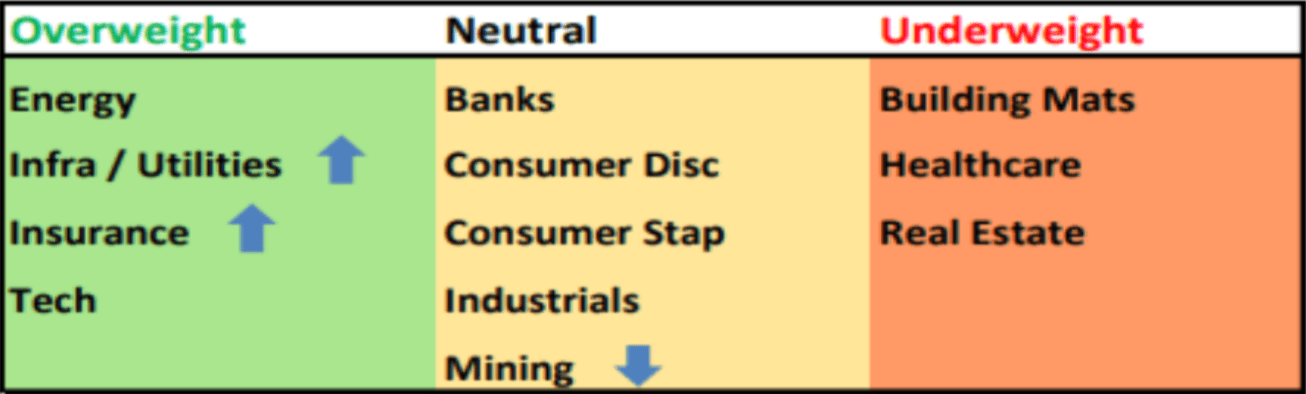

UBS upgrades ASX Infrastructure & Utilities

For now the local team is turning to the big builds part of the local bourse. Upgrading the Infrastructure & Utilities Sectors to an overweight recommendation.

UBS reckons that due to the ‘competitive yields they offer in an environment no longer threatened by rising discount rates.’

This does seem to be something of a thin string to pull, but the argument and the math when the premium is compared against bonds is beyond my pay grade.

UBS is basically appraising some old school ASX dividend stocks, (perhaps more safe havens than outright defensives) rather than growth (capital gains) stocks. The time is right to favour some dividend yield as a handy yardstick for measuring your equities investment value.

To calculate the divvy yield, you usually divide the total annual dividend by the share price.

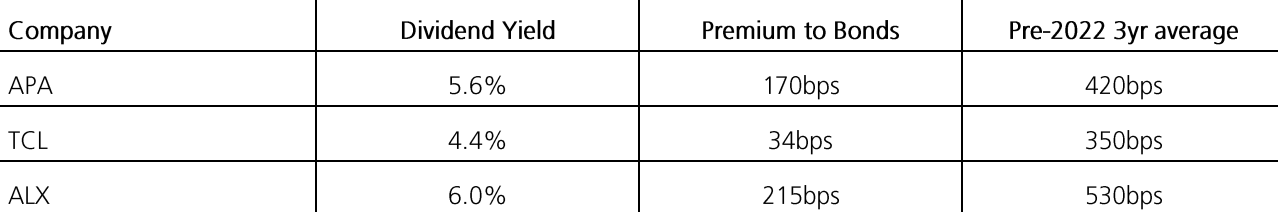

The table below shows the current dividend yield premium to bonds vs historical averages:

Welcome to the big time, fellas

UBS’ ASX Sector Recommendations

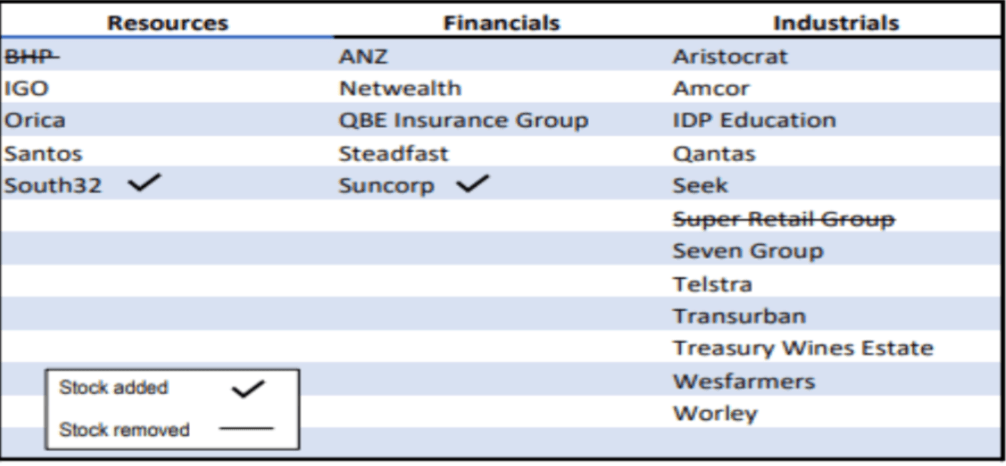

Finally, these little insider snippets (below) are UBS Australia’s Most and Least preferred stock lists.

As bankers tell their kids before bed, if you’re still on the list at the end of the financial year one side get flowers and the others… well, let’s just say they send something, but it ain’t flowers…

UBS Australia Best preferred, Jan 17, 2023

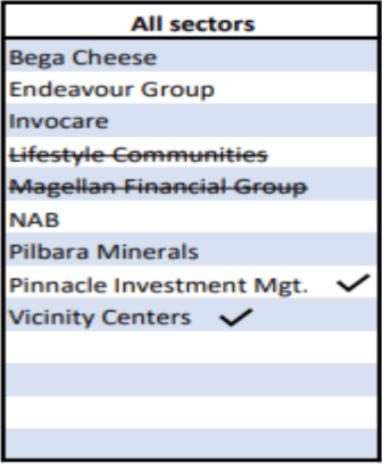

UBS Australia’s Least preferred, Jan 17, 2023

And this little snippet looks ALL wrong to me. It’s got to be a misprint of some sort. Bega Cheese owns Kraft Peanut Butter now. That’s always a buy in my book.

But no. This is correct. ‘Least preferred.’

Read it and weep.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.