Buffett was right says Goldman Sachs, Apple is a total, utter Buy

A Goldman Apple. Via Getty

Apple’s stock looks like it’s back on the cart – just as Warren Buffett, the Oracle of Omaha – has been assuring everyone since forever (Q1 2016, in fact).

In the last 3 trading sessions the share price has vaulted 7% and the bulls appear to back in the orchard.

That’s no news to The Oracle. Apple has been Warren’s biggest holding by a country buffet and his investment vehicle, Berkshire Hathaway, currently has around 900 Million Apple shares worth hmm.. US$136 billion.

The trade makes up over 40% of Berkshire’s entire stock portfolio. Put it another way, Berkshire owns almost 6%% of all the outstanding Apple stock.

And that was a trade he first made back in 2016.

Apple’s (APPL) apparent turnaround in fortunes this time is less about a clever new phone and more about a big clever bank – namely Goldman Sachs which initiated coverage and issued a very big buy recommendation for the first time in nearly 7 years.

Goldman’s new price target of US$199 implies 32% upside from the stock’s last close and is clearly above the average of US$169.61. In fact after becoming known as one of the rare Apple-doubters on Wall Street, the new PT is second only to Tigress Financial’s US$210, making it easily among New York’s most bullish pro-APPL sell-side researchers.

In a torrid time for the original tech giant, APPL’s stock began the year well enough, coming off it’s 2022 annus horribilis lows at around US$122 to circa US$154 before losing a bit of the momentum last month.

Now, Apple stock is moving past is it’s six-month price ceiling, following the profoundly bullish (nigh-on 100-page) treatise of an initiation report by GS this week.

The New York-based banking behemoth is sharing its new found enthusiasm, emphasising most pointedly how wildly impressed with Apple’s quality positioning and brand loyalty – facts which have allowed it to amass a user base like a Coronavirus spreads. (About 2 billion devices are out there.)

This sticky branding gives it, according to the Wall Street firm, cracking visibility in terms of its growth trajectory by almost cleansing itself of departing customers, squishing any new user acquisition costs and encouraging the continual purchasing of new, differently named, but really, let’s be honest, pretty much identical devices.

CEO Tim Cook put it this way:

The installed base is now over 2 billion active devices and we set records across each geographic segment and major product category. And so it was a broad-based change. We also saw strong double-digit in several of the emerging markets, which is very important to us. For example, India and Brazil are just two examples.

Obviously, it bodes well for the future.

According to Goldman, this standing audience of a customer base – combined with the growth posted by the company in services – should more than offset the more recent extraneous variable factors which have been whacking Apple of late – like troublesome manufacturers stuck out in the woods of China, longer replacement cycles or the more visible slowdown in the global market for computers and tablets and such.

Goldman also very much likes APPL’s ‘attractive’ level of valuation – both in absolute and relative terms – and in comparison with other large tech plays getting about doing similar things.

Analysts say the vast majority of Apple’s profit growth over the next five years is expected to be driven by its services business, which should take gross margins to a very handsome 40% by 2027, up from an already handsome one-third (33%) last year.

This alone, GS reckons, justifies the existence of a valuation premium.

“Apple’s success in premier hardware design and resulting brand loyalty has led to a growing installed base of users that provide visibility into revenue growth by reducing customer churn, lowering customer acquisition costs for new product and services launches, and encouraging repeat purchases,” Goldman’s new APPL man Micheal Ng wrote this week.

Ng says services, with their better-looking profit margins should support a premium multiple for the stock.

“The durability of Apple’s installed base and the resulting revenue growth visibility from attaching more services and products is what underpins the recurring revenue — or Apple-as-a-Service — opportunity,” Ng said.

The APPL Buffett:

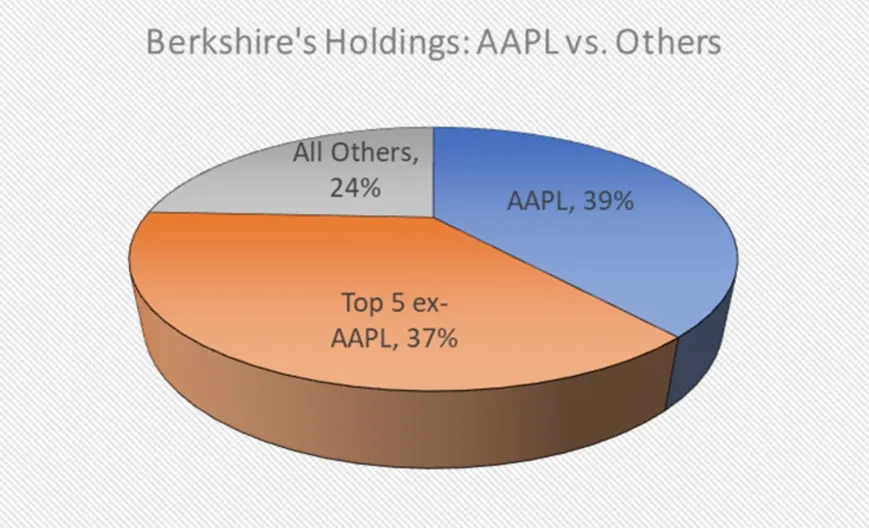

For context, Buffett owns more of APPL than his next four largest investments combined.

Berkshire Hathaway’s 5 biggest positions are, in order of size: Apple (39%), Bank of America (11%), Chevron (10%), Coca-Cola (less than 9%) and American Express (less than 8%).

Not all just apples

Nevertheless, Apple continues to navigate a challenging environment and remains focused on investing in long-term growth plans.

Its disappointing 2023 first-quarter financial results – which were in keeping with a poor set of earnings for all Big Tech companies – reflect some ongoing supply chain issues.

The tech posted quarterly revenue of US$117.2bn, down 5% YoY. That was APPL’s largest quarterly revenue drop in just about 7 years.

Looking ahead to 2023, CEO Tim Cook told investors the company has already ironed out the core issues – that production is back to pre-shutdown goals and all the little Applemites are”determined to do things with unmatched creativity and unrivalled innovation.”

During the December quarter company grew total company revenue on a constant currency basis and generated $34 billion in operating cash flow and returned over $25 billion to shareholders during the December quarter.

On ther guidance front, because of ‘continued uncertainty’, and because when you’re APPL you don;t have to, the company didn’t provide a concrete number for projected revenue, but Cook expects the March quarter performance to match December.

While FX will continue to be a headwind, (they expect a YoY impact of -5%, on the aforementioned services front, Apple expects revenue to grow.

Again, from Tim Cook:

China’s picking up too. Last quarter, sales declined by 7% on a reported basis, but we actually grew on a constant currency basis.

“And that was despite some significant supply constraints. Obviously, the sort of COVID restrictions throughout China that happened in various places throughout the country also impacted the demand during the quarter. When you look at the opening that started happening in December, we saw a marked change in traffic in our stores compared to November.”

“And that followed through to demand as well,” Cook added, happily.

Apple’s delivering a cash dividend of US$0.23 per share payable sometime next week, too.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.