Broking Bad: ANZ bank is waiting for you in Autopsy Room 4

The last cut is the deepest. Via Getty

Welcome to Stockhead’s Broking Bad – Where the analysts go bad, the companies get mad and the shareholders feel sad.

Now, I don’t want to talk about the Big Banks, let alone my own Big Bank. …I don’t want to debate whether I own ANZ, or if ANZ owns me, but here we are.

The cold, still body of the bank’s first half is on the table.

And to completely undermine any point I might’ve made about all this – turns out the rainy season began in earnest for the banks on Thursday.

Westpac lost 5.61% to $26.35 after a session in the ex-dividend sauna.

CBA fell 2% to $117.43 despite its Q1 trading update lauded by some of the very naysaying analysts below.

NAB just got out of bed late and lost 1.25%.

And the lender of the sender – ANZ – that loopy mutant with the unopenable app and the unclosable savings accounts lost 1.13% to $28.79.

Let’s just get through this. We’ll call it brain medicine for a healthier wallet.

The sudden significance of ANZ’s 1H earnings report is plain.

What follows is both the numbers and the reaction to them, but to be fully appreciated in all their madness, they need to be digested under that rarest of ASX cosmic events – a constellation of broker downgrades for all four of the major Aussie banks, fully eclipsed by synchronous and inexorable rise in stock price.

Something’s gotta give, you’d reckon.

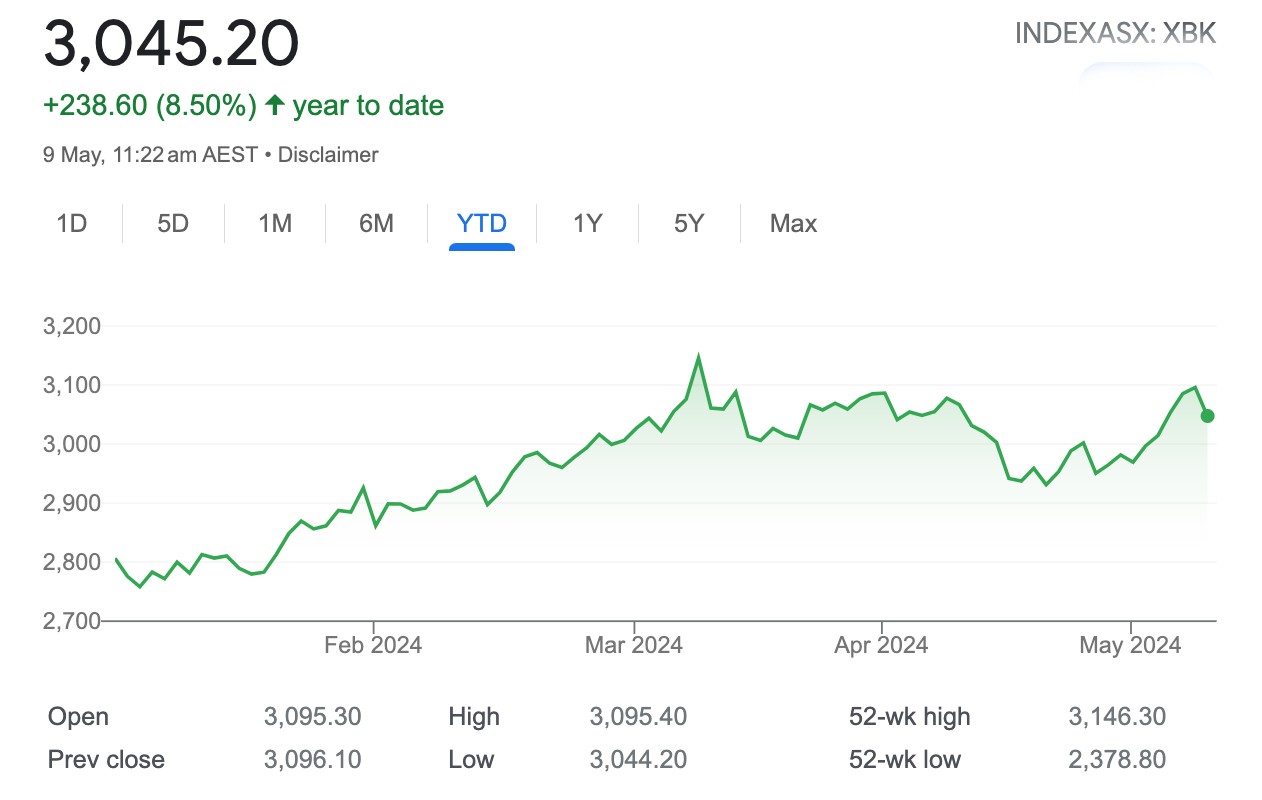

Here’s the Big 4 year-to-date

All four of the majors have run higher while damning the torpedoes of near universal fiscal evisceration at the hands of banking analysts who all suddenly seem to have trodden in the same poo.

The defiant surge in the Big Four share prices – a big part of the benchmark’s latest all-time high, apparently triggered something dark and fearful which appears to have been brewing in local brokers for some time.

First Macquarie doubled down on its jettisoning of the Big 4, warning clients to ‘underweight everything.’

Citi followed two weeks back, Downgrading both Westpac and ANZ, adding them to the Sell ratings already slapped on peers Commonwealth Bank and National Australia Bank.

Stiff competition, uncertainty and slowing credit growth – all bad news Citi said, but almost incidental when bank shares are simply “too expensive.”

In short: there’s little love for the banks and yet little sign of an impending, analyst-urged share price correction.

Which brings us to ANZ’s last 6 months…

1H24 result was largely in-line with expectations, with NPAT of $3.5bn falling -1 half-on-half.

The result saw better non-Net Interest Income (NII), which was further aided by a much better than expected credit loss outcome. To date, ANZ has been the most aggressive of the major banks on their credit loss assumptions.

ANZ’s Collective Provision has fallen from 1.64% of Gross Loans in 1997 to just 0.56% today and ANZ now has the thinnest bad debt coverage of the major banks.

Net Interest Margins (NIM) fell 9bps to 1.56% and was a weak result vis-à-vis peers. Core banking NIM fell 2bps to 1.63%.

Across each of ANZ’s divisions, it saw sequential revenue growth rates that were, in the main, negative: Retail -5%; Commercial -2%; New Zealand flat; Institutional Transaction Banking flat; Corporate Finance up 1%.

The Markets division was the standout, up 27%.

Offsetting some of these negatives, the Board elected to return $2bn to shareholders by way of an on-market buyback.

ANZ remains very well capitalised with a Common Equity Tier 1 (CET1) ratio of 11.85%* even after accounting for the buyback and the acquisition of Suncorp Bank.

*Ed: The big banks now have a minimum capital requirement of 10.25%. The Australian Prudential Regulation Authority APRA has said it expects the major banks to operate with CET1 ratios above 11% once their own targets are considered…

What Shayne said:

“This half’s strong performance is a direct consequence of peer-leading diversification as well as our disciplined focus on productivity and delivery.

“Coming off a record 2023, each division delivered for the Group and we’ve made good progress on the things we said we would: preparing for the integration of Suncorp Bank, growing ANZ Plus, leveraging our Institutional processing platforms, and further driving productivity.

“Our preparations to integrate Suncorp Bank are well advanced. While the time taken to progress the necessary approvals has taken longer than anticipated, we have used that time productively and we are more confident than ever about the benefits that will follow.

“Our flagship digital offering, ANZ Plus, has grown to almost 690,000 customers and approaching $14 billion in deposits at the end of April – and we have just introduced the ability to create joint accounts. Net promoter scores are consistently higher than our peers, while attracting on average 35,000 customers every month, around half of which are new to the bank…”

— ANZ Chief Executive Officer Shayne Elliott.

What everyone else said:

UBS rates ANZ as Hold (from Hold) with a Price Target (PT) of $28.66

UBS reckons the investment case for ANZ is all about what they can do that’s exciting and fruitful following the headline Suncorp Bank acquisition. If management successfully integrates Suncorp through the exisiting business, while sequencing the rollout of ANZ Plus (mobile banking App) then there’s life in the old legs, so to speak.

NIM are low and so too are expected credit losses (2bps).

With this said, UBS says all the biggy-banks have highlighted easing NIM pressures, “as competition resets post the large, fixed interest rate roll-off.”

The banks have also returned capital (possibly an indication of growth perceptions) and opened buyback programmes.

“Although year-on-year revenue growth is weak, the positive trend in earnings is clear,” UBS adds.

Citi rates ANZ as Sell (from Sell) with a PT of $24.50

Cranky Citi again lowers its target for ANZ to $24.50 from $26, in lieu of the 1H results, ANZ cash earnings beat market consensus by +0.5% but missed Citi’s by -0.5%.

Those core numbers are still slipping Citi says, with no-one they’re aware of certain of “the strategic merit” of ANZ’s current splurge strategy. This muddies where ANZ’s earnings trough hits rock, concludes a souring Citi.

Citi’s Sell rating is maintained while ANZ slips back to No. 3 in the brokers’ list of Banks I Have Loved.

The net interest margin looks at face value a big miss, but the broker assures ex-markets the NIM is 1.63%, in line.

Core earnings missed by -2% but there was a big win in something whose very use as an indicator, deserving of an acronym – bad and doubtful debts (BDDs) – says nothing good about the nature of big banking.

There’s a dividend of 83c, with some 65% franked – Citi isn’t pleased, grimacing that there’s nothing compensatory for the not-fully-franked payout, no bonus divvy, nuthin’.

And Citi has but this to say about the cracking stock repurchase plan: there’s also a $2bn share buyback.

Jarden rates ANZ Neutral (from Neutral) PT $29.00

“A decent result, albeit below elevated estimates – we upgrade FY24E/FY25E EPS by 2% and 1%, respectively.”

Overall, Jarden says ANZ delivered a decent result, albeit arguably a little softer than elevated expectations following the better-than expected-results of the other three this half.

Whilst ANZ’s cash profit was in line with estimates, this was driven largely by lower BDDs. Revenue was broadly in line, albeit a slightly different mix, and underlying margins were a touch ahead of estimates.

Looking forward, Jarden notes ANZ’s margins were “looking stable” going into 2H24E.

“Similar to NAB and WBC’s results, ANZ’s result largely confirms an expected moderation in NIM pressure and continued benign credit environment. We upgrade our FY24E and FY25E and Earnings Per Share (EPS) by +2% and +1%, respectively, and maintain our Neutral rating.”

On the upside, ANZ noted that the AU retail bank margin actually ended the quarter 1bps above Sep-23’s exit rate, pointing to moderation in deposit and mortgage competition.

“ANZ’s markets income was a key source of income growth in 1H24, rising 27% half-on-half to $1.2bn, the 3rd highest half in nine years. The improvement was broad based across products and driven mainly by offshore regions.

“Whilst we expect the backdrop for markets income to remain conducive, we assume some normalisation towards ~$1bn per half ahead.”

Macquarie rates ANZ as Underperform (from Underperform) with a PT of $26.50

ANZ Bank’s 1H pre-provision result was slightly ahead of Macquarie’s expectations thanks to a foundation of strong markets income.

The broker however, says ANZ’s underlying pre-provision operating profit (PPOP) – ex markets – was a miss compared to Macquarie forecasts, driven by softer-than-expected average interest-earning assets (AIEA) and higher costs.

Assuming an around -$2bn yearly investment spend, Macquarie now believes the new cost base for the bank is around $10.6bn.

The broker’s target falls to $26.50 from $27 after allowing for lower BDD and higher markets income, offset by cost-led downgrades in future years.

On the divvy front, Macquarie says it is doubtful ANZ’s has the capacity to sustain its current payout levels.

The Underperform rating is maintained.

Morgan Stanley rates ANZ as Downgrade to Equal-weight from Overweight TP is $27.70

ANZ Bank served up a mixed 1H24 earnings report with higher expenses offsetting a slightly better than forecast cash profit according to Morgan Stanley, although this met consenus expectations as a result of lower loan loss provisions.

Morgan Stanley is a fan of the 83 cent payout – a while 2 cents better than forecast and also approves of the $2bn on-market buyback, which was a whole half-a-bill more than the broker’s estimate.

Headline margin declined by -9 basis points with a -7 basis point impact from markets.

Expenses were greater by 0.5%, 2% above consensus, due to what appears to be higher restructuring costs and ‘strategic investments’ ANZ Plus and the cloud.

Management didn’t offer guidance. The broker’s FY24 EPS are up by 2%, due to lower loan losses but FY25 EPS are culled some -3%.

Due to ANZ’s “strategic challenges” MS Downgrades to Equal Weight from Overweight.

Target price is lowered to $27.70 from $27.90.

ANZ Consensus Price Target: $28.66.

Final notes:

Just as I hit the button and this goes off to the cloud, the ASX:XBK index is down more than 1%.

Westpac’s the main drag, crashing about 4.5% after going ex-dividend.

But the problem child coming home to roost is CBA stock, which is deteriorating after reporting a drop in its third-quarter profit.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.