Breakfast on Wall St: NVDA snaps streak as shares pop on cracking AI outlook

Via Getty

As forecast by this very publication (we were emailed), US chipmaker and curiosity of the week, Nvidia (NVDA) dropped its Q4 and FY earnings after the market closed in New York, and, as also predicted, the numbers were perhaps not reflective of a stock which has jumped by about half since Christmas.

Evidently that’s in general agreement as the NVDA stock jumped circa 9% in late trading overnight after the company reported better revenue and net income than Wall Street expected, despite a year-over-year decrease in both categories.

For the quarter ending January, NVDA was a beat on consensus earnings per share (EPS), delivering US$0.88, Vs expectations of $US0.81

In fiscal Q4 2023, Nvidia forecast it’d clock just US$6 billion. Wednesday night’s (US time) US$6.05 billion in quarterly revenue might be down about 20%, but it’s a beat on its own guidance and the Street’s expectations and this is a company still capable of pulling US$1.4 billion in profit on a slow track.

In 2021, US$5 billion in revenue a quarter was a new Nvidia record. Now it’s the status quo: the company says it’s expecting to see US$6.5 billion next quarter

Even before the numbers dropped, US fund Piper got out in front of the earnings call on Wednesday – no need to take that risk, I might’ve told someone – to tell everyone of their consistently enthusiastic enthusiasm for the company, which has taken on the traders’ mantle as the chipmaker most likely to succeed during a downturn that’s been snuffing out both PC and semiconductor trade.

The broker reiterated its Rating of Overweight for the NVDA stock, saying that overall:

“We are bullish going into the January quarter results and April quarter guide for NVDA.”

Come for the chips, stay for the AI

Speaking more to the fans than the analysts during a post-match call, founder and CEO Jensen Huang was all fired up over the AI that’s got everyone all fired up, saying the firm is best positioned to benefit from the AI software breakout following the headline grabbing emergence of ChatGPT and Microsoft Bing’s AI.

The CEO said “AI is at an inflection point”, setting up the tech and the company for broad adoption “reaching into every industry.”

“From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.”

And that’ll drive businesses to snap up Nvidia chips which are looking good for developing machine learning software, and its graphics processors are built to train and run said software.

Huang added that that Nvidia’s new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, “is in full production.”

With AI activity – as Huang himself says – going through the roof, the stock is back up 54% in 2023 after Wednesday’s earnings report.

“Generative AI’s versatility and capability has triggered a sense of urgency at enterprises around the world to develop and deploy AI strategies,” he told analysts (to tell everyone).

“We are set to help customers take advantage of breakthroughs in generative AI and large language models.”

“Gaming is recovering from the post-pandemic downturn, with gamers enthusiastically embracing the new Ada architecture GPUs with AI neural rendering,” he added, for good measure.

During Q4 2023, NVIDIA returned to shareholders US$1.15 billion in share repurchases and cash dividends, bringing the return in the fiscal year to (rubs glasses) US$10.44 billion.

NVIDIA will pay its next quarterly cash dividend of $0.04 per share.

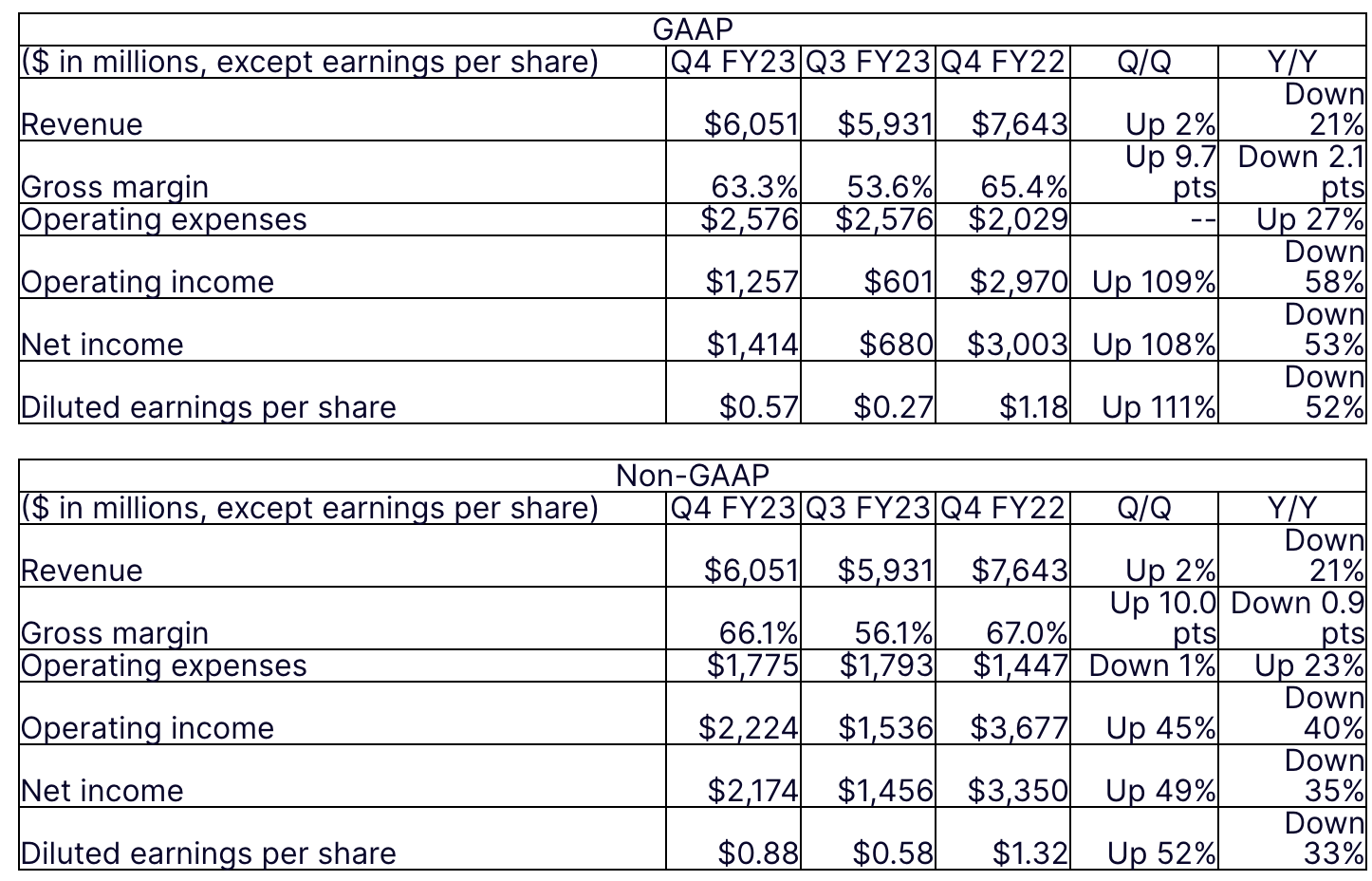

Q4 Fiscal 2023 Summary

Tougher times for chippies

With a market cap now of US$524 billion (4.16% of the Nasdaq), Nvidia is currently the number #4 Nasdaq name by market cap, ahead of Alphabet (GOOGL), Tesla (TSLA), Meta (META), Broadcom (BCOM)and Pepsico (PEP). We think.

It’s also the fifth largest name on the MSCI World (0.88%) ahead of Elon (TSLA), Exxon (XOM)and Taiwan Semiconductors (TSMC).

Like its peers, Nvidia is shipping fewer GPUs to retailers and partners instead of slashing prices. The executive speak is something like “lower sell-in to partners to help align channel inventory levels with current demand expectations.”

Nvidia also faced disruptions in China due to COVID-19 and President Joe Biden jamming its close ties with buyers, makers and markets.

But as Francois d’Hautefeuille, co-founder & president of Evariste Quant Research, said earlier this week, Nvidia is a “fabless” type company (sans factories), which is to say it designs its chips and then gets companies like TSMC (see below) to bust them out.

The other sector majors are all in the same boat as the Santa Clara-based chipmaker – there’s just not much in the way of demand for new consumer electronics while The Fed fights high inflation with higher interest rates, and while China’s reopening is hesitating at the cusp.

One of the reasons this company gets the spotlight, however, is that it’s got a good many moving parts and they’re all moving in a good direction.

Nvidia’s budding data centres and its side hustle automotive businesses both continued their ascent over the quarter.

Record revenue came out of auto ($294 million) and data centres just need to keep growing, which they did.

Nvidia’s graphics business, and particularly its gaming arm, took a step backward – down 46% as demand remains weather beaten.

PC makers planetwide are getting clocked by tanking demand for computers. Gartner says the sector wide drop in shipments of almost 29% is the largest quarterly shipment decline since they began tracking the PC market in the mid-1990s.

AMD says it’s a slump that won’t last forever, but added that client processor and gaming revenue would continue to slide into the first half of 2023.

NVIDIA Corp NVDA

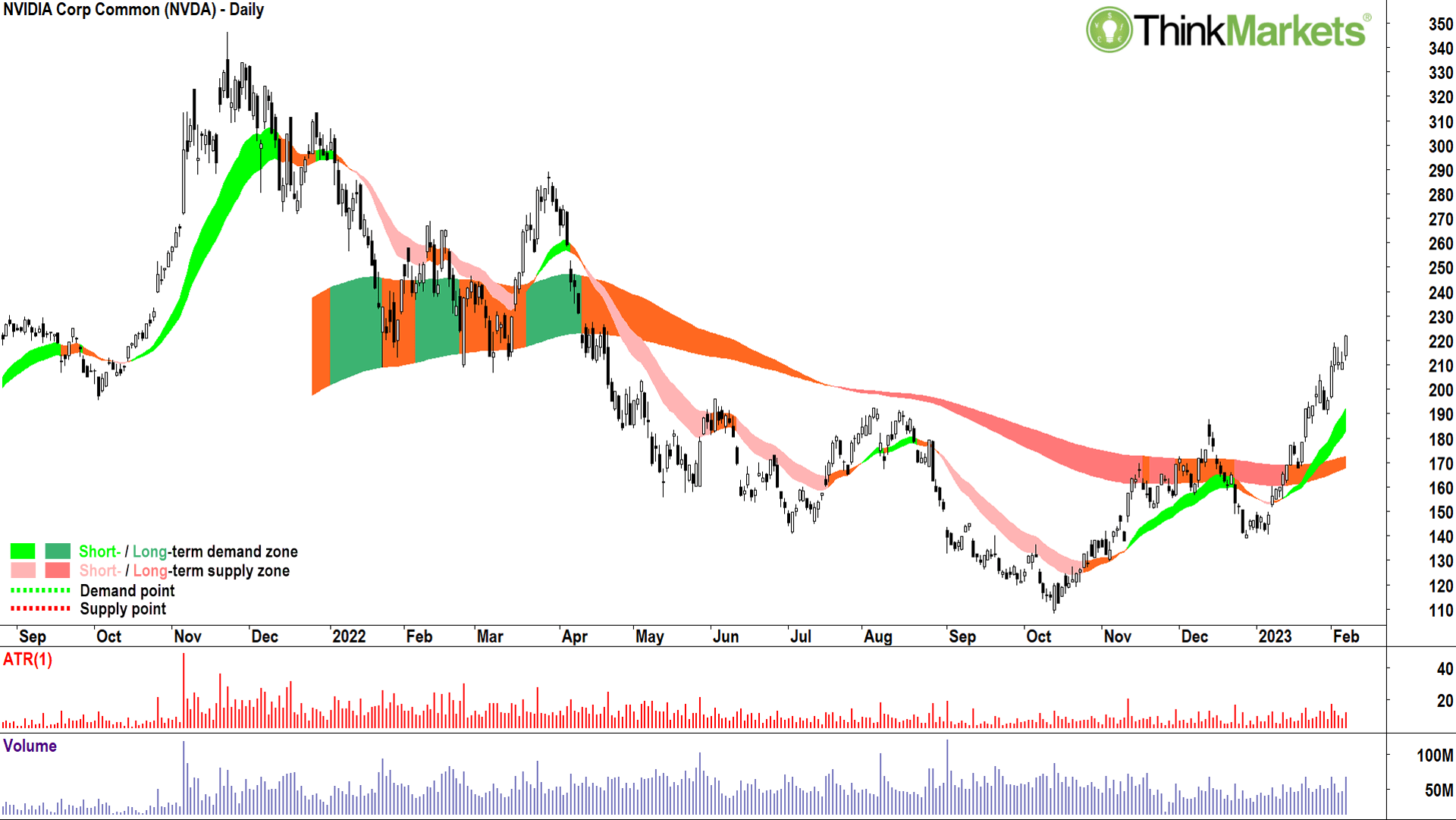

At the beginning of this month, Carl The Candlestick Capolingua showed us that his candles for NVDA were ‘almost exclusively of the demand-side variety.’

If you’re reading this on a PC, he said, chances there is a NVIDIA graphics processing unit (GPU) allowing it to happen.

“NVDA topped out at $346.47 a share on 22 November 2021. That’s no coincidence, it was the day Jerome Powell was reappointed as chairman of the Federal Reserve, and then in his acceptance speech, flipped from ultra-dove to ultra-hawk. The rest is history, as they say, and so was the prevailing bull market!

“NVDA has doubled from its $108.13 bear market low, but it’s showing excellent short-term momentum to continue to move higher. The candles are almost exclusively of the demand-side variety, i.e., white bodied and or with lower shadows, and the price action is firmly set to higher peaks and higher troughs.

“Ordinarily, I’d prefer to buy when the price is closer to my short-term uptrend ribbon, I use it as a kind of ‘value zone’. But in this case, the candles and price action are so strong, I’m happy to add some risk now knowing there could be a correction back to the short-term uptrend ribbon at some stage.

View: Bullish until a close below the 31 January low of $189.50. ”

NVIDIA’s outlook Q1 2024:

- Revenue is expected to be US$6.50 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 64.1% and 66.5%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately US$2.53 billion and US$1.78 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately US$50 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 13%, plus or minus 1%, excluding any discrete items.

Q4 FY23 Highlights

NVIDIA achieved progress since its previous earnings announcement in these areas:

Data Centres

- Fourth-quarter revenue was $3.62 billion, up 11% from a year ago and down 6% from the previous quarter. Fiscal-year revenue rose 41% to a record $15.01 billion.

- Announced a partnership with Deutsche Bank to extend the use of AI in the financial-services sector.

- Launched, together with Dell Technologies, 15 next-generation Dell PowerEdge systems available with NVIDIA® acceleration, enabling enterprises to use AI to efficiently transform their business.

- Announced that NVIDIA A100 Tensor Core GPUs showed unrivalled throughput and top latency in the latest STAC-ML benchmarks for financial services.

Gaming

- Fourth-quarter revenue was $1.83 billion, down 46% from a year ago and up 16% from the previous quarter. Fiscal-year revenue was down 27% to $9.07 billion.

- Unveiled the GeForce RTX™ 40 Series for laptops, providing the company’s largest-ever generational leap in performance and power efficiency.

- Launched the GeForce RTX 4070 Ti, which is faster than the GeForce RTX 3090 Ti, featuring NVIDIA Ada Lovelace architecture and NVIDIA DLSS 3 technology.

- Announced that DLSS 3 is available on, or coming soon to, more than 50 games and apps — including Cyberpunk 2077, Portal with RTX and Marvel’s Spider-Man: Miles Morales.

- Launched the GeForce NOW™ Ultimate membership tier, delivering GeForce RTX 4080-class performance with NVIDIA Reflex, full ray tracing and DLSS 3.

- Signed a 10-year agreement with Microsoft to bring the Xbox PC game lineup, including Minecraft, Halo and Flight Simulator, to GeForce NOW. Following the close of Microsoft’s Activision acquisition, GeForce NOW will add titles like Call of Duty and Overwatch.

Professional Visualisation

- Fourth-quarter revenue was $226 million, down 65% from a year ago and up 13% from the previous quarter. Fiscal-year revenue was down 27% to $1.54 billion.

- Enhanced NVIDIA Omniverse™ Enterprise’s capabilities to help teams build connected 3D pipelines and develop large-scale 3D works through increased performance, generational leaps in real-time RTX ray and path tracing, and streamlined workflows.

- Announced a collaboration with Lockheed Martin to build a digital twin of global weather conditions, enabling the U.S. National Oceanic and Atmospheric Administration to better monitor global environmental conditions, including extreme weather events.

- Shared news Mercedes-Benz is taking the next step to digitalize its production process, using NVIDIA Omniverse to design and plan manufacturing and assembly facilities.

Automotive and Embedded

- Fourth-quarter revenue was a record $294 million, up 135% from a year ago and up 17% from the previous quarter. Fiscal-year revenue rose 60% to a record $903 million.

- Announced a strategic partnership with Foxconn to develop automated and autonomous vehicle platforms based on NVIDIA DRIVE Orin™ and DRIVE Hyperion™.

- Released major updates to the NVIDIA Isaac Sim™ robotics simulation tool, including AI capabilities and cloud access, enabling the building and testing of virtual robots in realistic environments.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.