Bitcoin shrugs off volatile price dumps to climb to over $14k

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Bitcoin’s (BTC) value has gained 4.05 per cent this week, gaining nearly $1000 over Wednesday and Thursday.

The world’s largest digital asset made this overall gain despite volatile price dumps during the week.

The digital asset hit a seven-day high of $14,599 on May 21, only to fall to $13,857 later that day. Prices recovered over the next 48 hours before plummeting a further 4.9 per cent on Sunday to $13,449.

BTC’s value climbed back to $13,900 on Wednesday and continued into Thursday night to prop BTC up to its current price of $14,419.

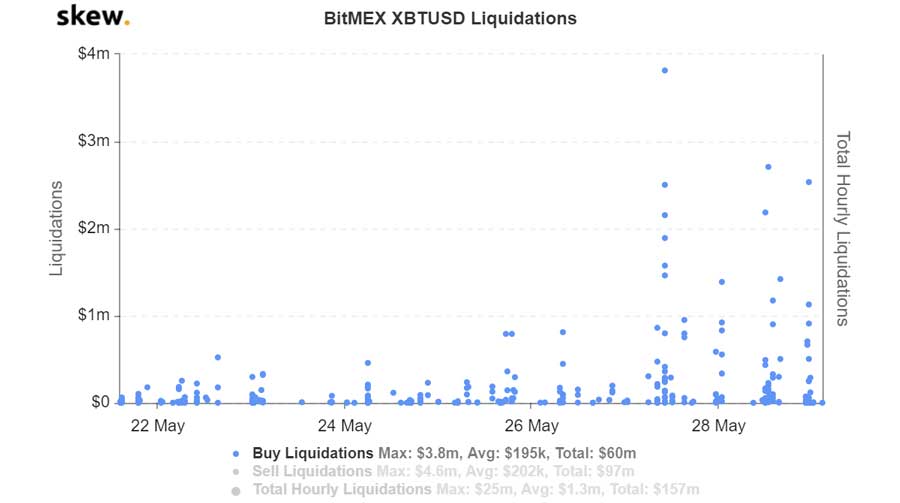

Large price movements on spot markets can be the result of activity on BTC derivative exchanges.

Offshore derivative exchanges, such as BitMEX, allow traders to long and short BTC. However, positions can be automatically liquidated by the exchange when prices move unfavourably in one direction.

Many short positions were liquidated on BitMEX when BTC’s value increased from Wednesday to Thursday. This encouraged traders to buy, resulting in the price increase on BTC Markets.

As BitMEX has a large total open interest of $US610m ($917m), activity on the exchange influences BTC’s price directly.

Open interest on the Chicago Mercantile Exchange’s (CME) BTC options market has hit a new all-time high of $US184m this week. Dutch derivatives exchange Deribit recorded a total open interest of $US1bn for the third time this month on its BTC options market.

Put:call ratios are used to gauge the mood of a market. BTC’s put:call ratio averaged 0.59 this week. This indicates bullish sentiment, as more options contracts speculating that BTC’s price will increase in the future are being bought. Any ratio under 0.7 is considered bullish.

Enjin announces Minecraft integration

Enjin Coin (ENJ), the native token of computer gaming start-up Enjin, gained a staggering 30 per cent this week.

The Singapore-based company recently announced the launch of its EnjinCraft software.

EnjinCraft integrates blockchain technology into the highly popular computer game Minecraft. It will allow the 480 million Minecraft players to use and trade blockchain game items, among other features.

ENJ has gained 191 per cent in value since it was first listed at 11.99c on BTC Markets in January. One EJN token is now worth 31.25c.

Decentralised finance

Decentralised finance, DeFi for short, is a blooming sector within the blockchain industry.

DeFi is any universally accessible financial market that operates over a blockchain network. These networks are considered decentralised as they don’t operate through one central touchpoint, such as a bank, but over a peer-to-peer network.

Universal Market Access (UMA), one such DeFi project, announced last week the creation of its ETH/BTC ‘priceless’ synthetic token.

UMA’s new asset will allow traders to speculate on and trade the price of ETH relative to the value of BTC.

For example, if ETH is worth $200 and BTC is worth $10,000, one ETH/BTC would be worth 2c. If ETH moves up to $300 and BTC stays steady at $10,000, then one ETH/BTC would be worth 3c.

What makes the token synthetic is that no ETH or BTC is needed to create it. Traders collateralise or fund their ETH/BTC tokens using the stablecoin DAI.

DAI is a digital asset whose price follows the value of the US dollar and generally fluctuates around $US1, meaning its price is kept stable.

The ETH/BTC synthetic token is ‘priceless’ as it does not require a price information for ETH or BTC for each transaction. UMA allows its users to liquidate any position they see to be under-collateralised, or underfunded.

As the blockchain industry develops, the products available to us are becoming more unique and diverse. UMA’s synthetic ETH/BTC token is proof of this.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.